Signal Trading Summary:

- Basic Attention Token [BAT]

- Entry [Long]: $0.2475

- Stop Loss [SL] : $0.2300

- Take Profit [TP] :

- TP1: $0.2652

- TP2: $0.2841-$0.2908

- SuperVerse [SUPER]

- Entry [Long] : $0.2707

- Stop Loss [SL] : $0.2418

- Take Profit [TP] :

- TP1: $0.2990

- TP2: $0.3335

- Band [BAND]

- Entry [Long] : $0.4407

- Stop Loss [SL] : $0.4168

- Take Profit [TP] :

- TP1: $0.4653

- TP2: $0.5100

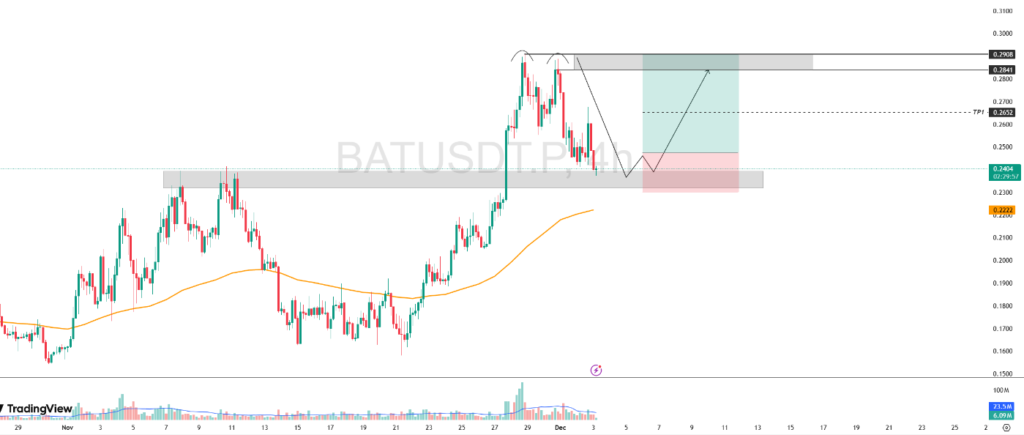

1. Basic Attention Token (BAT)

BAT’s bullish movement started to lose momentum after the formation of a double top pattern on November 29-30, which signaled the beginning of a correction. The selling pressure continued until the price entered the strong support zone at $0.2320-$0.2394.

This support area has the potential to hold the decline. The price reaction after touching the zone will determine the direction of the next movement. If it is able to rebound accompanied by confirmation through a bullish candlestick, then the uptrend is expected to continue with a target towards the previous high at $0.2908.

However, if the support fails to hold, then further weakness could occur with a projected drop towards $0.2222 as the next target.

Notes:

Wait for confirmation of reversal in the form of a strong green candle at the support zone before considering a buy.

Potential Buy/Long BAT Setup:

- Entry [Long]: $0.2475

- Stop Loss [SL]: $0.2300

- Take Profit [TP]:

- TP1: $0.2652

- TP2: $0.2841-$0.2908

2. SuperVerse (SUPER)

SUPER price showed significant strength after successfully breaking and holding above the 20-Day EMA at $0.2478, which now acts as dynamic support. This movement also increased the positive sentiment from market participants.

As long as the price remains moving above the $0.2460-$0.2478 support cluster, the bullish momentum is expected to continue. The current price structure favors a potential upside towards the primary target at $0.3332.

SUPER Buy/Long Potential Setup:

- Entry [Long]: $0.2707

- Stop Loss [SL]: $0.2418

- Take Profit [TP]:

- TP1: $0.2990

- TP2: $0.3335

3. Band (BAND)

BAND’s bullish momentum was put on hold after the price faced strong selling pressure at the $0.4988-$0.5101 resistance cluster. Rejection in that area triggered a correction that is still ongoing today.

This correction has the potential to continue towards the $0.4191-$0.4248 support cluster, which also serves as an RBS (resistance becomes support) area and coincides with the 20-Day EMA, making it an important defense zone.

The price reaction after entering the support zone will determine the direction of the next movement. If the price is able to rebound which is confirmed by a bullish candlestick, then BAND has the opportunity to re-test the resistance at $0.4988-$0.5101.

Conversely, if this support fails to hold, bearish pressure could potentially push prices lower.

Notes:

Wait for confirmation of reversal in the form of a strong green candle at the support zone before considering a buy.

Potential Buy/Long BAND Setup:

- Entry [Long]: $0.4407

- Stop Loss [SL]: $0.4168

- Take Profit [TP]:

- TP1: $0.4653

- TP2: $0.5100

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits or losses.