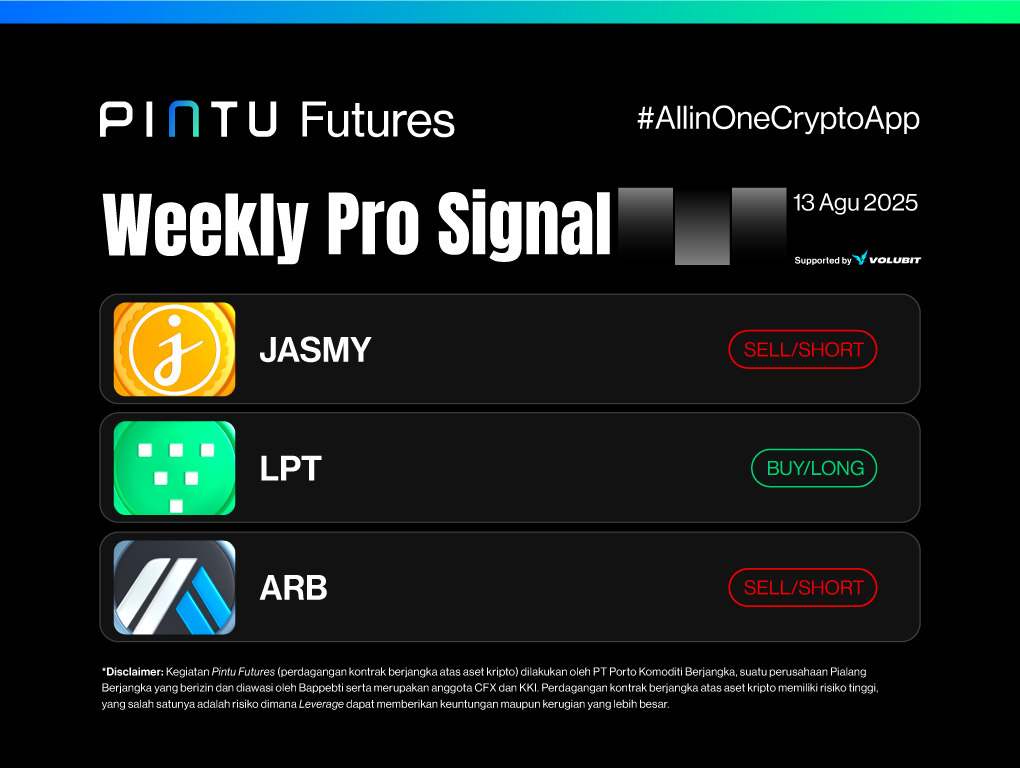

Signal Summary Futures Trading:

- Jasmycoin (JASMY)

- Entry: $0.019651

- Stop Loss [SL]: $0.020664

- Target Profit [TP]:

- TP1: $0.018622

- TP2: $0.017625

- Livepeer (LPT)

- Entry: $6.326-$6.509

- Stop Loss [SL]: $6.270

- Target Profit [TP]:

- TP1: $6.744

- TP2: $7.085

- Arbitrum (ARB)

- Entry: $0.4722

- Stop Loss [SL]: $0.5002

- Target Profit [TP]:

- TP1: $0.4445

- TP2: $0.4117

1. Jasmycoin (JASMY)

The bullish momentum for JASMY occurred after a breakout of the neckline from a double bottom pattern on August 8. The price of JASMY recorded a 20.22% increase from August 8 to August 13.

This upward trend has the potential to continue strengthening, with a target at the resistance area between $0.020035-$0.020590. Historically, JASMY faced rejection at this level on July 21 and 23, which led to price declines.

If the current upward movement faces rejection when it touches this area, JASMY could experience a correction, with a potential retrace target at $0.017944.

Potential Sell Setup for JASMY:

- Entry: $0.019651

- Stop Loss [SL]: $0.020664

- Target Profit [TP]: TP1: $0.018622, TP2: $0.017625

2. Livepeer (LPT)

LPT’s price movement successfully rebounded after forming a double bottom pattern between August 2-6, followed by a breakout of the neckline on August 8 as confirmation.

The upward movement stalled when it reached the $7.085 level on August 10, which is currently acting as a resistance level. A breakout attempt on August 11 failed to break through this level, resulting in a price decline.

The support cluster, consisting of the golden pocket from the Fibonacci retracement and the neckline of the double bottom pattern between $6.509-$6.326, is now a key buy zone to watch.

Potential Buy Setup for LPT:

- Entry: $6.326-$6.509

- Stop Loss [SL]: $6.270

- Target Profit [TP]: TP1: $6.744, TP2: $7.085

3. Arbitrum (ARB)

ARB experienced a significant rally, with a price increase of 34.63% between August 2-10. However, this upward momentum stalled when it retested the resistance area at $0.4838-$0.4966.

High selling pressure in that area led to a price decline from August 10-12. Currently, ARB has rebounded but has yet to reach the resistance area.

In the longer term, ARB’s price movement is expected to correct towards the $0.4314 level, which serves as its nearest support.

Potential Sell Setup for ARB:

- Entry: $0.4722

- Stop Loss [SL]: $0.5002

- Target Profit [TP]: TP1: $0.4445, TP2: $0.4117

Important Notes:

Always apply disciplined risk management and capital management. For leveraged trading, it is advisable to risk no more than 1% of total capital per trade.

*Disclaimer: Pintu Futures (cryptocurrency futures trading) is conducted by PT Porto Komoditi Berjangka, a licensed Futures Broker and supervised by Bappebti, and is a member of CFX and KKI. Cryptocurrency futures trading carries high risk, including the risk that leverage can lead to both greater profits and losses.