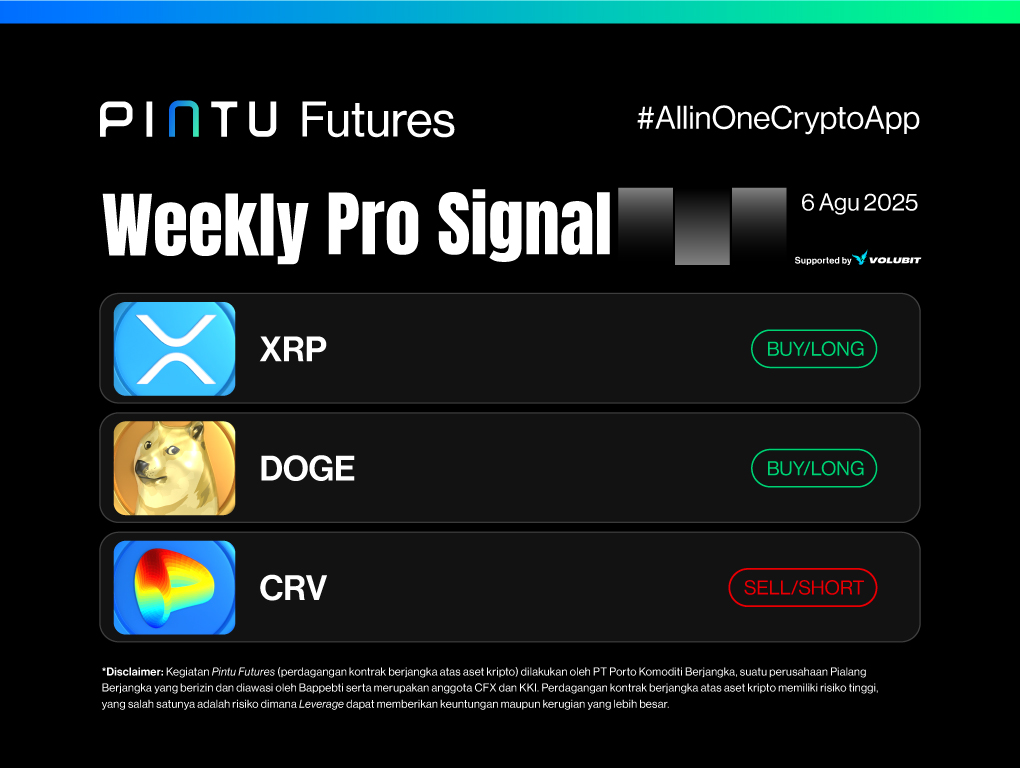

Signal Summary Futures Trading:

- RIPPLE (XRP)

- Entry : $2.9176, $2.8729

- Stop Loss [SL] : $2.8091

- Target Profit [TP] :

- TP1: $3.1

- TP2: $3.25

- DOGECOIN (DOGE)

- Entry : $0.19767, $0.19717

- Stop Loss [SL] : $0.1933

- Target Profit [TP] :

- TP1: $0.211

- TP2: $0.2236

- CURVE FINANCE (CRV)

- Entry : $0.9479, or once the $0.8596 level is breached.

- Stop Loss [SL] : $0.984, or $0.891

- Target Profit [TP] :

- TP1: $0.79

- TP2: $0.737

RIPPLE (XRP) – Layer-1 Category

After experiencing a significant rally starting Sunday, August 3, 2025, which pushed XRP up by 13.9% to $3.1 on Tuesday, August 5, 2025, the token has since corrected by 6.09%.

Currently, XRP is hovering near the Fibonacci golden pocket zone, a common area for retracement before potential continuation. Assuming that the surge starting last Sunday marks the beginning of a new uptrend, the ongoing correction could present an opportunity to enter a long/buy position, particularly in this golden pocket area, targeting the full resistance level at $3.25.

Potential XRP Buy/Long Setup:

- Entry: $2.9176, $2.8729

- Stop Loss [SL]: $2.8091

- Take Profit [TP]: TP1: $3.1, TP2: $3.25

DOGECOIN (DOGE) – Memecoin Category

Following a strong rally since Sunday, August 3, 2025, which drove DOGE up by 12% to $0.211 on Tuesday, August 5, 2025, the coin has since corrected by 7.13%.

DOGE is now positioned at the Fibonacci 0.618 golden ratio, a key zone where upward continuation often occurs after a pullback. The Relative Strength Index (RSI) has exited the oversold zone, suggesting that DOGE may resume its upward momentum. This correction could therefore be a potential opportunity to enter a long/buy position in the golden pocket, aiming for the next resistance at $0.2236.

Potential DOGE Buy/Long Setup:

- Entry: $0.19767, $0.19717

- Stop Loss (SL): $0.1933

- Take Profit (TP): TP1: $0.211, TP2: $0.2236

CURVE FINANCE (CRV) – DeFi Category

CRV appears to have broken its bullish structure after the $0.948 low was breached on Friday, August 1, 2025.

Traders can take advantage of a potential retest of that level to enter a short/sell position, targeting a decline toward the support-turned-resistance zone at $0.737.

Potential CRV Sell/Short Setup:

- Entry: $0.9479, or after $0.8596 is broken

- Stop Loss (SL): $0.984 or $0.891

- Take Profit (TP): TP1: $0.79, TP2: $0.737

Important Notes:

Always implement strict risk management and capital control. For leveraged positions, consider limiting risk per trade to 1% of your total capital.

*Disclaimer: Pintu Futures activities (trading crypto asset futures contracts) are conducted by PT Porto Komoditi Berjangka, a licensed Futures Brokerage Company supervised by Bappebti and a member of CFX and KKI. Trading crypto asset futures contracts carries high risk, including the possibility that leverage can amplify both potential gains and potential losses.