Signal Trading Summary:

1. TRON (TRX)

- Entry: IDR 4.642 ($0.2787)

- Cut Loss (CL): IDR 4.474 ($0.2686)

- Target Profit [TP]:

- TP1 = IDR 4.837 ($0.2904)

- TP2 = IDR 5.017 ($0.3012)

2. Solana (SOL)

- Entry: IDR 2,173,333 ($130.46)

- Cut Loss (CL): IDR 1,985,519 ($119.18)

- Target Profit [TP]:

- TP1 = IDR 2,412,223 ($144.80)

- TP2 = TP2: IDR 2,842,858 ($170.65)

3. Avail (AVAIL)

- Entry: IDR 121 ($0.007277)

- Cut Loss (CL): IDR 96.62 ($0.005800)

- Target Profit [TP]:

- TP1 = IDR 146.95 ($0.008821)

- TP2 = IDR 169 – IDR 180 ($0.010150 – $0.010845)

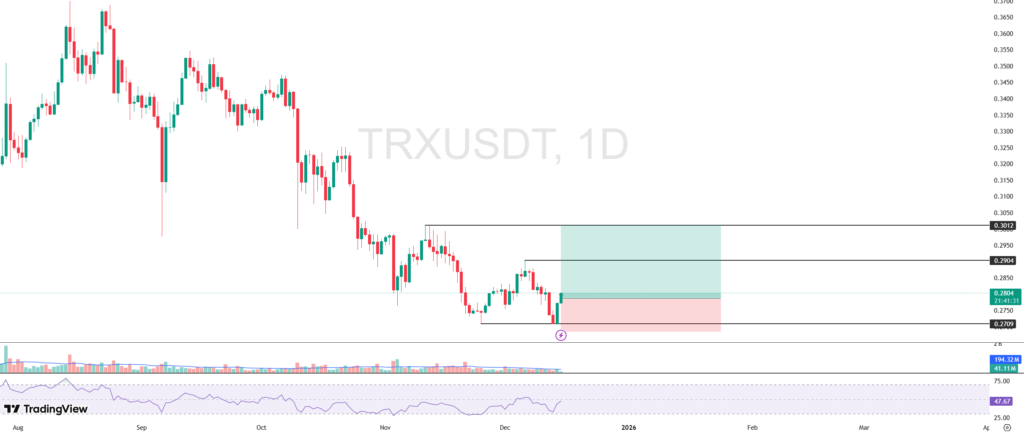

1. TRON (TRX)

TRX’s price movement showed signs of recovery after selling pressure was successfully contained in a crucial support area that coincided with the lowest closing level on November 25, at IDR 4,512 ($0.2709). This zone proved to be a strong accumulation area, characterized by increased buying pressure that was able to reverse the price direction from the correction phase to rebound.

From a technical perspective, the formation of a bullish engulfing pattern at the close of this morning’s daily candle indicates a potential shift in market sentiment towards a more positive direction. This pattern has historically often been an early signal of continued strengthening, especially when followed by increased volume.

As long as the price of TRX is able to stay above the support area, the opportunity for continued gains is still open. The nearest upside target is projected to be the resistance area at the level of IDR 4,837 ($0.2904), which is the highest price on December 6. If the bullish momentum continues, then the main upside target is at the level of IDR 5,017 ($0.3012).

TRX Buy Potential Setup:

Entry: IDR 4.642 ($0.2787)

Cut Loss [CL]: IDR 4.474 ($0.2686)

Take Profit [TP]:

- TP1 = IDR 4,837 ($0.2904)

- TP2 = IDR 5,017 ($0.3012)

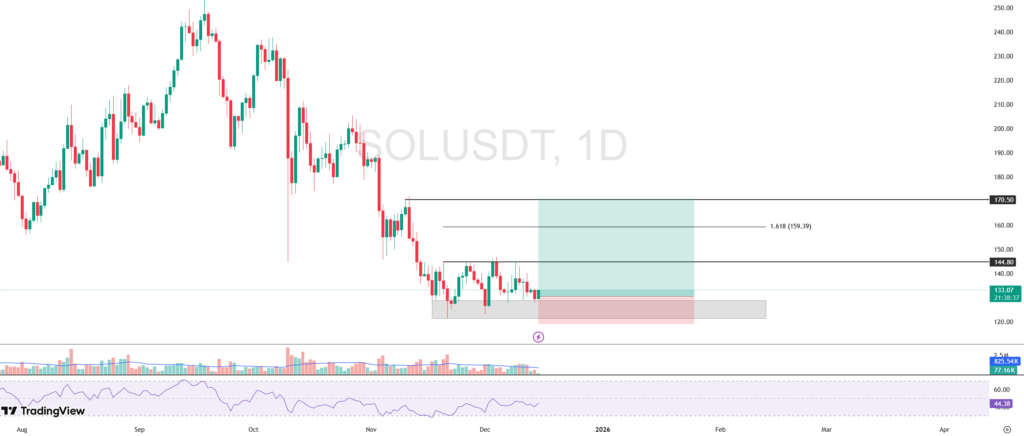

2. Solana (SOL)

SOL’s current price movement is still in a consolidation phase (sideways), reflecting a temporary balance between buying and selling pressure. Selling pressure is seen to increase every time the price approaches the resistance area at IDR 2,412,223 ($144.80), triggering a short-term correction.

On the downside, the crucial support area is in the range of IDR 2,021,569 – IDR 2,143,680 ($121.35 – $128.68). This zone has so far acted as a solid stronghold, proving to be able to withstand selling pressure and open up opportunities for price reversal to the rebound phase.

As long as the SOL price is able to survive and move stably above the support area, the technical price structure is still maintained. This condition opens up opportunities for SOL to retest the nearest resistance area. If there is a valid breakout accompanied by increased volume, then the potential for further gains towards higher targets will be increasingly open.

SOL Potential Buy Setup:

Entry: IDR 2,173,333 ($130.46)

Cut Loss [CL]: IDR1,985,519 ($119.18)

Take Profit [TP]:

- TP1 = IDR 2,412,223 ($144.80)

- TP2 =IDR 2,842,858 ($170.65)

3. Avail (AVAIL)

AVAIL’s price movement is showing recovery signals after selling pressure was successfully contained at a crucial support area that coincides with the lowest closing level on December 2, at IDR 103 ($0.006210). This area acts as a fairly solid support, characterized by the entry of significant buying pressure.

From a technical perspective, the increased buying interest is reflected through the formation of a bullish engulfing pattern at the close of the daily candle this morning. This pattern indicates a potential reversal from the correction phase to the rebound phase.

As long as the price of AVAIL is able to stay above the support area, the opportunity for further strengthening is still open. The pace of the rebound is projected to lead to a resistance cluster in the range of IDR 169 – IDR 180 ($0.010150 – $0.010810) as the main target. Before reaching this target, the minor resistance area has the potential to become a short-term price reaction area.

AVAIL Potential Buy Setup:

Entry: IDR 121 ($0.007277)

Cut Loss [CL]: IDR 96.62 ($0.005800)

Take Profit [TP]:

- TP1 = IDR 146.95 ($0.008821)

- TP2 = IDR 169 – IDR 180 ($0.010150-$0.010845)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, it is best to use a risk per transaction of: 1% of total capital