Signal Trading Summary:

- Storj (STORJ)

- Entry [Long] : $0.1532-$0.1680

- Stop Loss [SL] : $0.1518

- Take Profit [TP] :

- TP1: $0.1888

- TP2: $0.2140

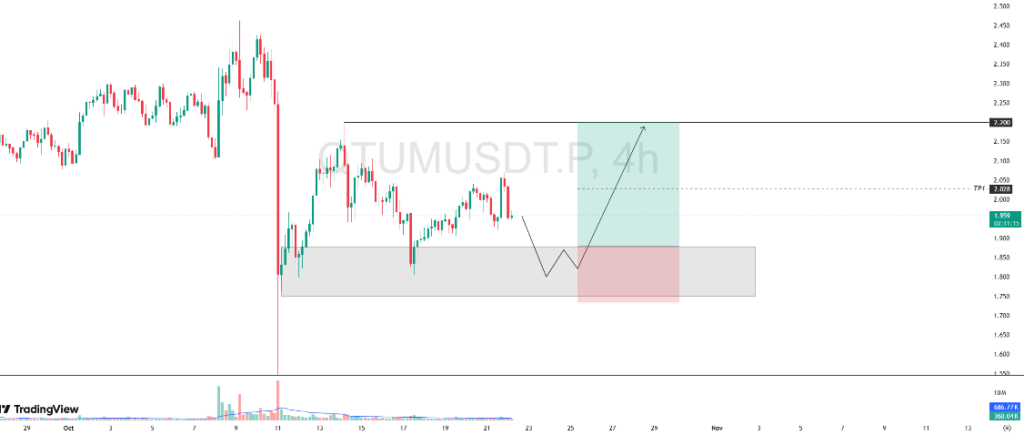

- Qtum (QTUM)

- Entry [Long] : $1.750-$1.877

- Stop Loss [SL] : $1.734

- Take Profit [TP] :

- TP1: $2.028

- TP2: $2.200

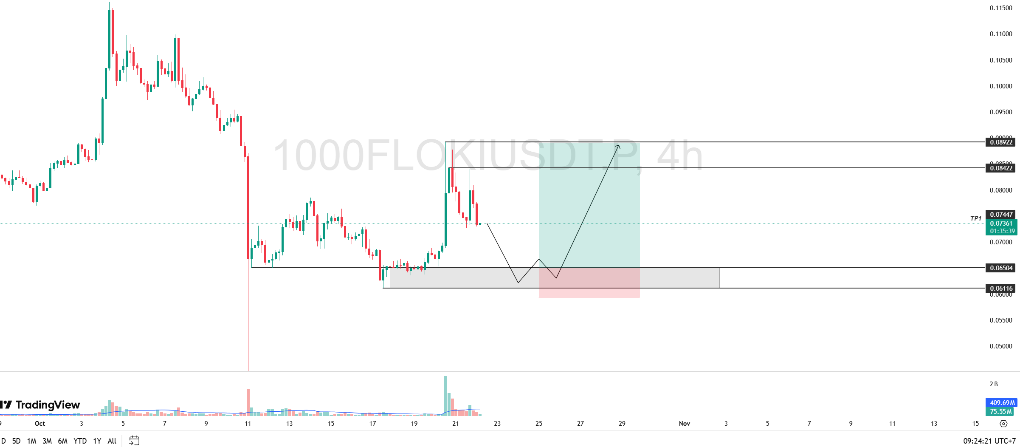

- Floki (FLOKI)

- Entry [Long] : $0.00006116 – $0.00006504

- Stop Loss [SL] : $0.00005935

- Take Profit [TP] :

- TP1: $0.00007447

- TP2: $0.00008422-$0.00008922

1. Storj (STORJ)

STORJ ‘s price movement showed a strong rejection at the $0.2140 resistance area, which was the upper limit of the previous recovery trend. Selling pressure at this level triggered a price correction that is still ongoing today.

Technically, this decline has the potential to continue until it reaches the demand zone in the range of $0.1532-$0.1680, which is a potential accumulation area.

If the price manages to form a bullish reversal candle accompanied by an increase in trading volume, then the area can be an attractive entry point for short to medium term long positions.

STORJ Potential Buy/Long Setup:

Entry [Long]: $0.1532-$0.1680

Stop Loss [SL]: $0.1518

Take Profit [TP]: TP1: $0.1888, TP2: $0.2140

2. Qtum (QTUM)

QTUM prices showed strength after retesting the demand area in the range of $1,750-$1,877, signaling that there is still strong buying pressure in the zone.

However, the current rebound movement started to face resistance after the appearance of two consecutive red candles with an impulsive character, signaling short-term selling pressure.

If the price weakness continues, the demand area could again become a potential accumulation zone. Buying is ideal when the price shows signs of a bullish reversal, such as the formation of a confirming green candle accompanied by an increase in trading volume.

QTUM Potential Buy/Long Setup:

Entry [Long]: $1.750-$1.877

Stop Loss [SL]: $1.734

Take Profit [TP]: TP1: $2,028, TP2: $2,200

3. FLOKI (FLOKI)

FLOKI price is currently undergoing a correction phase after previously registering an impulsive rise on October 20th. This correction is a natural market response after a strong rally, signaling a consolidation phase before a potential trend continuation.

Technically, selling pressure still has the potential to continue until the price reaches a potential support zone in the range of $0.00006116 – $0.00006504. The area is an important point to monitor for a possible rebound, especially if a bullish reversal candle appears accompanied by an increase in trading volume.

If a bounce occurs in this area, it could be an attractive opportunity to open a short-term long position.

Potential Buy/Long FLOKI Setup:

Entry [Long]: $0.00006116 – $0.00006504

Stop Loss [SL]: $0.00005935

Take Profit [TP]: TP1: $0.00007447, TP2: $0.00008422-$0.00008922

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

*Disclaimer: Pintu Futures activities (trading futures contracts on crypto assets) are carried out by PT Porto Komoditi Berjangka, a Futures Brokerage company licensed and supervised by Bappebti and is a member of CFX and KKI. Trading futures contracts on crypto assets has high risks, one of which is the risk that Leverage can provide greater profits and losses.