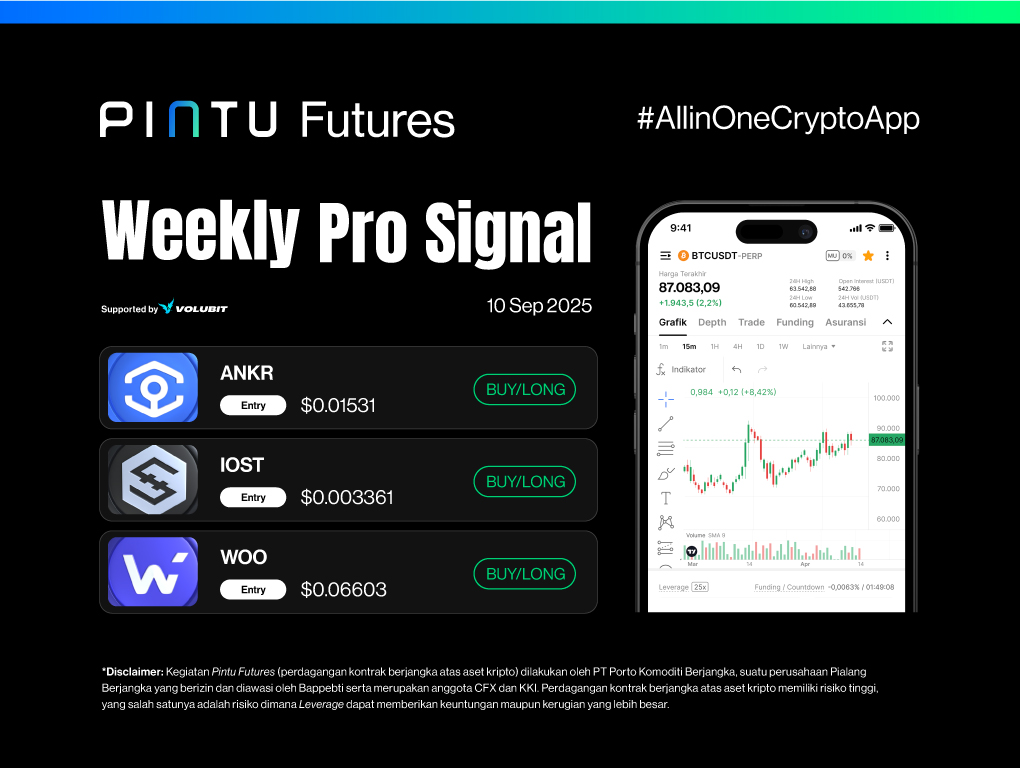

Signal Summary Futures Trading:

- Ankr (ANKR)

- Entry: $0.01531

- Stop Loss [SL]: $0.01473

- Take Profit [TP]:

- TP1: $0.01596

- TP2: $0.01634 – $0.01690

- IOST [IOST]

- Entry: $0.003361

- Stop Loss [SL]: $0.003227

- Take Profit [TP]:

- TP1: $0.003497 – $0.003560

- TP2: $0.003710

- WOO (WOO)

- Entry: $0.06603

- Stop Loss [SL]: $0.06387

- Take Profit [TP]:

- TP1: $0.06934

- TP2: $0.07199 – $0.07348

1. Ankr (ANKR)

The price of ANKR shows signs of recovery after the decline halted at a strong support area between $0.01432 – $0.01462. Buying pressure in this zone triggered a price reversal from a downtrend into an uptrend.

The bullish momentum became clearer after the price successfully broke out of the downtrend line on September 9 and surpassed the local resistance at $0.01486. This breakout has drawn increased market attention to ANKR.

As long as the price holds above the broken resistance level, the upward trend may continue. The short-term upside target lies within $0.01596 – $0.01634 as the next resistance, with the main upside target expected around $0.01690.

Potential Buy Setup ANKR:

- Entry: $0.01531

- Stop Loss [SL]: $0.01473

- Take Profit [TP]: TP1: $0.01596, TP2: $0.01634 – $0.01690

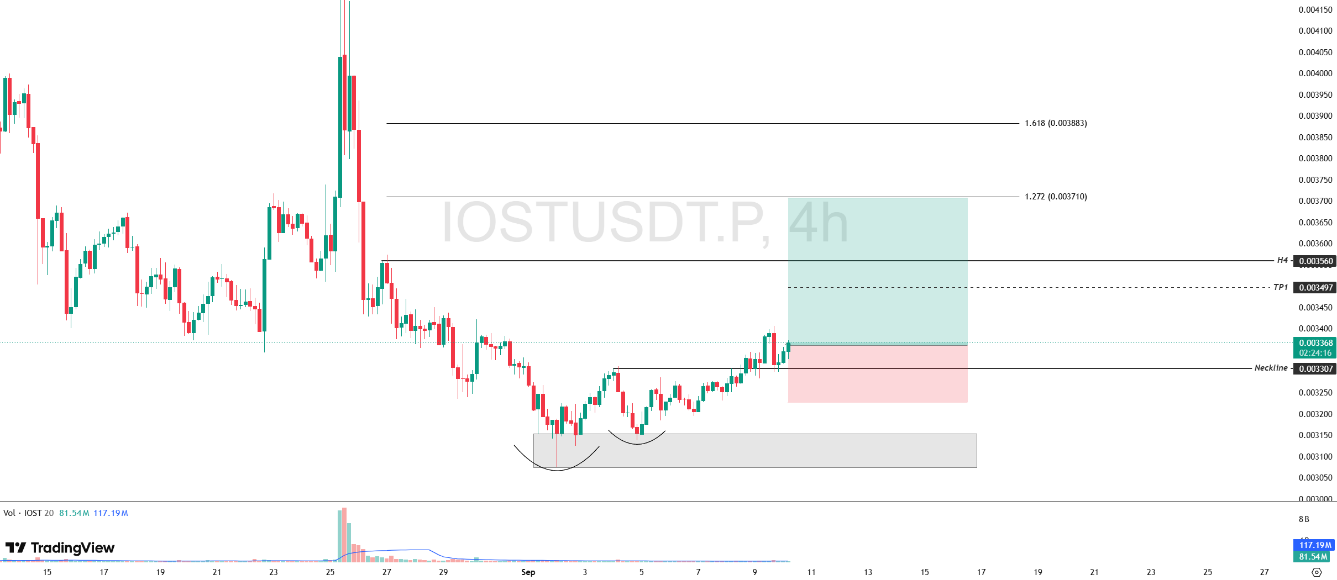

2. IOST (IOST)

The price movement of IOST signals a positive outlook after a double bottom pattern formed and confirmed through a neckline breakout on September 8. This technical pattern indicates potential continuation of the upward trend.

The level at $0.003307, which previously acted as the neckline, now serves as a key support to sustain the rebound momentum. As long as the price stays above this area, further upside potential remains intact.

The nearest upside target is at the $0.003560 resistance area, with the main target projected around $0.003710.

Potential Buy Setup IOST:

- Entry: $0.003361

- Stop Loss [SL]: $0.003227

- Take Profit [TP]: TP1: $0.003497 – $0.003560, TP2: $0.003710

3. WOO (WOO)

WOO’s price movement indicates an accumulation phase following the decline from August 14 to September 2. This consolidation zone, within $0.06408 – $0.06559, was broken on September 9, driving the price higher toward resistance at $0.06934.

However, the bullish momentum was briefly held back, causing the price to retest the accumulation zone.

As long as WOO maintains its position above this accumulation zone, the upside potential remains open, with an initial target at $0.06934 and a main target within the range of $0.07199 – $0.07348.

Potential Buy Setup WOO:

- Entry: $0.06603

- Stop Loss [SL]: $0.06387

- Take Profit [TP]: TP1: $0.06934, TP2: $0.07199 – $0.07348

Important Note:

Always apply strict risk management and capital allocation. For trading, especially with leverage, it is recommended to limit the risk per trade to 1% of total capital.

Disclaimer: Pintu Futures trading (crypto futures contracts) is conducted by PT Porto Komoditi Berjangka, a licensed Futures Broker regulated by Bappebti, and a member of CFX and KKI. Futures trading of crypto assets carries a high level of risk, including the potential for leverage to amplify both profits and losses.