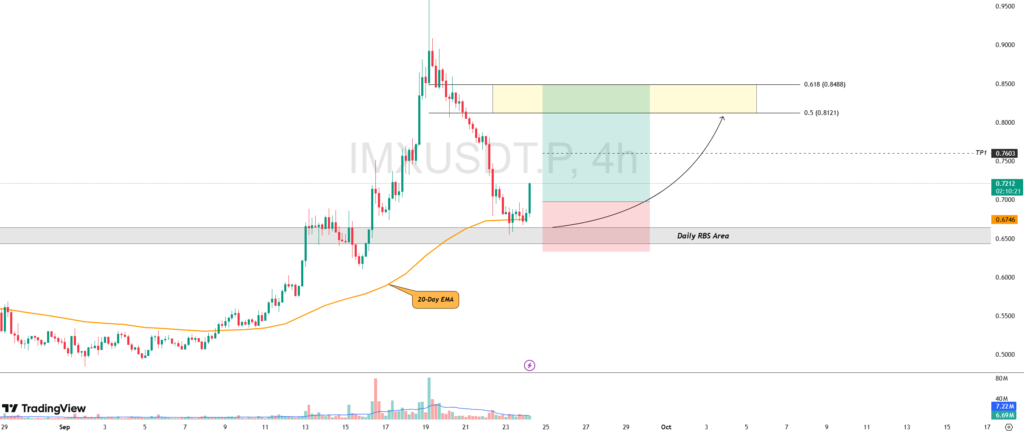

Signal Summary Futures Trading:

- Astar (ASTR)

- Entry : $0.023013

- Stop Loss [SL] : $0.022087

- Take Profit [TP] :

- TP1: $0.023990

- TP2: $0.025429

- Immutable X (IMX)

- Entry : $0.6976

- Stop Loss [SL] : $0.6334

- Take Profit [TP] :

- TP1: $0.7603

- TP2: $0.8121-$0.8488

- Open Campus [EDU]

- Entry : $0.1422

- Stop Loss [SL] : $0.1285

- Take Profit [TP] :

- TP1: $0.1561

- TP2: $0.1767-$0.1857

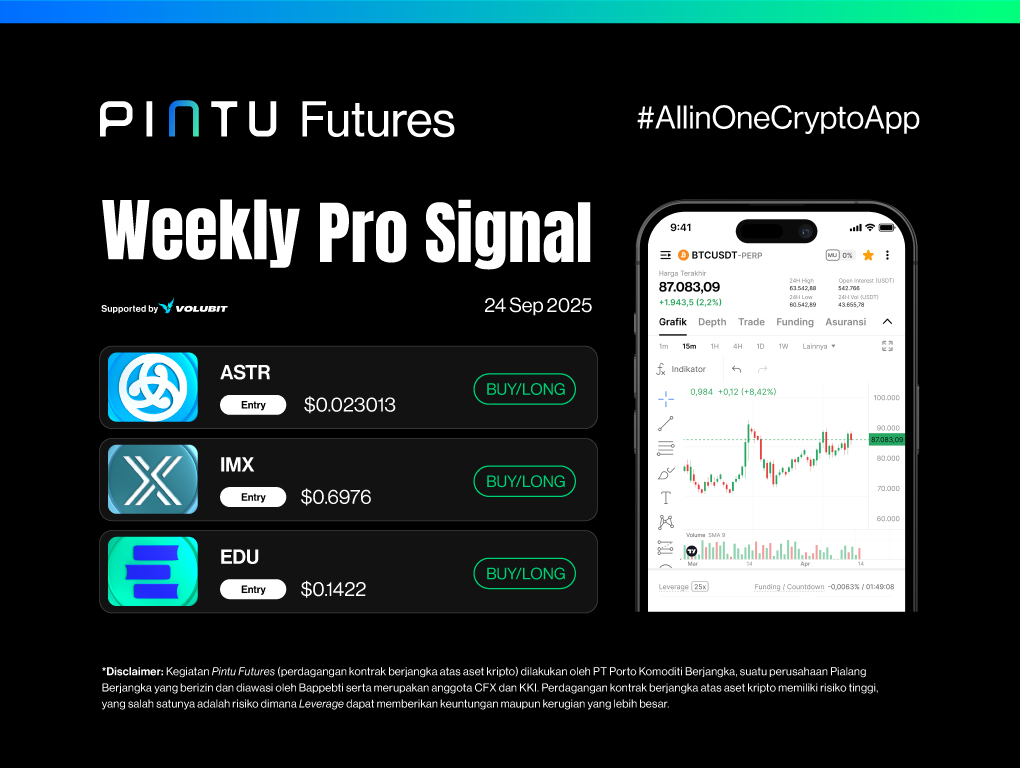

1. Astar (ASTR)

The current price of ASTR is still moving sideways within a consolidation phase, with resistance at $0.025429 and support at $0.022371. The decline on September 22–23 halted at the support level of the consolidation area, followed by a rebound due to increasing buying pressure.

The rebound of ASTR is expected to continue, with an upside target toward the main resistance level at $0.025429, which marks the upper boundary of the consolidation zone.

Potential Buy/Long Setup for ASTR:

- Entry: $0.023013

- Stop Loss (SL): $0.022087

- Take Profit (TP): TP1: $0.023990, TP2: $0.025429

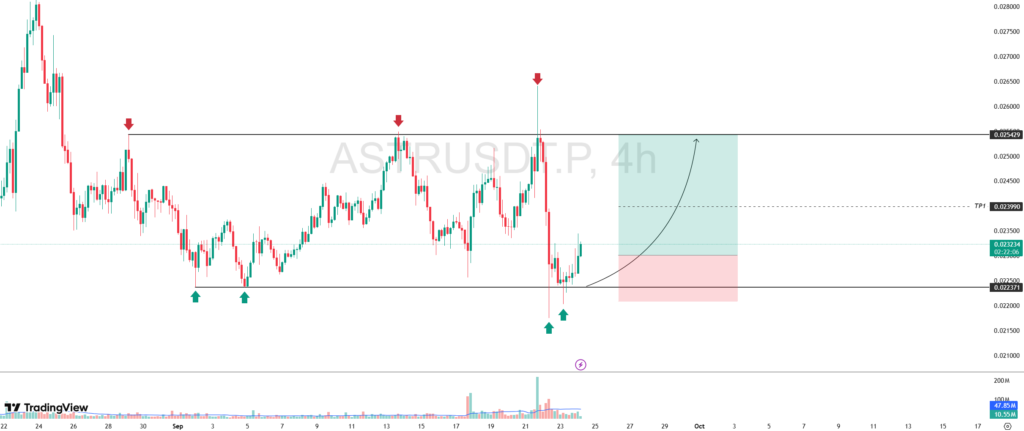

2. Immutable (IMX)

The decline in IMX’s price stopped at a cluster support area consisting of the 20-Day EMA and the RBS (resistance becomes support) zone around $0.6746–$0.6433. If the price successfully rebounds from this level, it may form a new higher low and strengthen the potential continuation of the upward trend.

IMX’s rebound is expected to gain momentum with an upside target toward the golden pocket of the Fibonacci Retracement, in the range of $0.8121–$0.8488.

Potential Buy/Long Setup for IMX:

- Entry: $0.6976

- Stop Loss [SL]: $0.6334

- Take Profit [TP]: TP1: $0.7603, TP2: $0.8121–$0.8488

3. Open Campus (EDU)

The bullish movement of EDU on September 20–21 halted at the peak level of $0.2150 before undergoing a correction. The price then found strong support within the demand zone of $0.1299–$0.1382.

As long as the price remains above this demand area, the opportunity for a rebound stays open. The initial rebound target is set at $0.1561, while the main target lies in the range of $0.1767–$0.1857.

Potential Buy/Long Setup for EDU:

- Entry: $0.1422

- Stop Loss [SL]: $0.1285

- Take Profit [TP]: TP1: $0.1561, TP2: $0.1767–$0.1857

Important Notes

Always apply disciplined risk management and capital allocation. For trading, especially when using leverage, it is advisable to limit risk per transaction to 1% of total capital.

Disclaimer: Pintu Futures activities (crypto futures contract trading) are conducted by PT Porto Komoditi Berjangka, a licensed Futures Broker regulated by Bappebti and a member of CFX and KKI. Futures trading in cryptocurrency carries high risk, one of which is that leverage can magnify both potential gains and losses.