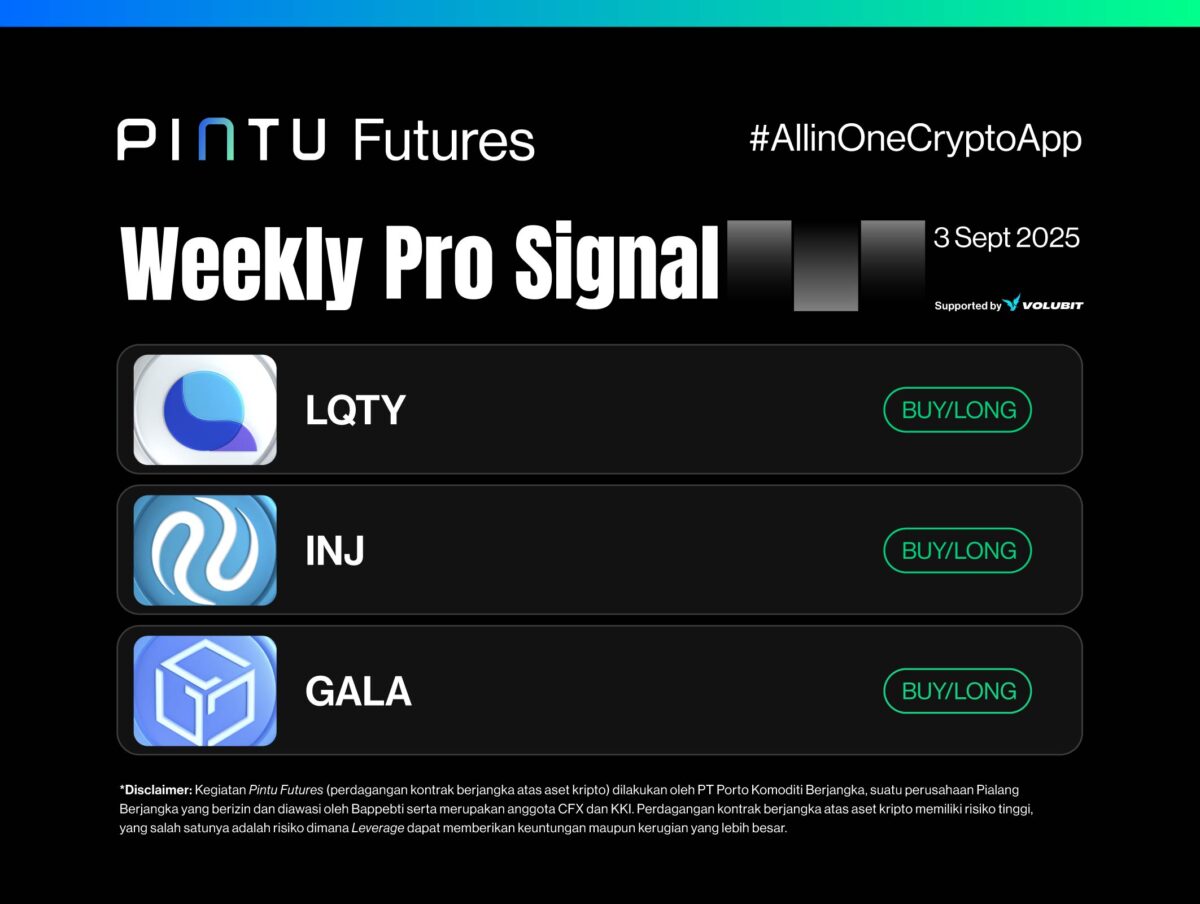

Signal Summary Futures Trading:

- Liquity (LQTY)

- Entry : $0.78-$0.8

- Stop Loss [SL] : $0.734

- Take Profit [TP] :

- TP1: $0.877

- TP2: $1.002

- Injective Protocol (INJ)

- Entry : $12.7-$13

- Stop Loss [SL] : $11.94

- Take Profit [TP] :

- TP1: $14.95 – TP2: $15.92

- Gala (GALA)

- Entry : $0.01572 – $0.016

- Stop Loss [SL] : $0.1533

- Take Profit [TP] :

- TP1: $0.01737

- TP2: $0.01893

1. Liquity (LQTY) – De-Fi Category

LQTY shows signs of a bullish reversal, with a bullish divergence formed on the RSI and the breakout of the bearish trendline in the 4-hour timeframe.

Additionally, confirmation that LQTY has broken out of its 21 EMA suggests that it could rise to $1.002, with potential resistance at the nearest level around $0.877.

Potential Buy/Long Setup for LQTY:

- Entry: $0.78-$0.8

- Stop Loss [SL]: $0.734

- Take Profit [TP]: TP1: $0.877, TP2: $1.002

Injective Protocol (INJ) – Layer-1 Category

Injective Protocol (INJ) has confirmed a strong bullish breakout, with a break above the 21 EMA on the 4-hour timeframe, along with strong indications that INJ will break out from the falling wedge pattern that has formed.

This bullish signal could drive INJ to $15.92 once the falling wedge pattern is confirmed as broken.

Potential Buy/Long Setup for INJ:

- Entry: $12.7-$13

- Stop Loss [SL]: $11.94

- Take Profit [TP]: TP1: $14.95 – TP2: $15.92

Gala (GALA) – Gaming and WEB-3 Category

GALA has shown a strong bounce from its support level at $0.016, along with a breakout from the 21 EMA on the 4-hour timeframe. These two indicators provide a strong bullish potential for GALA to rise to the nearest resistance at $0.01737. If this level is broken with strong momentum, GALA could potentially rise to $0.01893.

Potential Buy/Long Setup for GALA:

- Entry: $0.01572 – $0.016

- Stop Loss [SL]: $0.01533

- Take Profit [TP]: TP1: $0.01737, TP2: $0.01893

Important Note:

Always apply risk management and capital management discipline. For trading, especially when using leverage, it is recommended to risk only 1% of the total capital per trade.

Disclaimer: Pintu Futures trading (crypto asset futures contracts) is conducted by PT Porto Komoditi Berjangka, a Futures Broker company licensed and supervised by Bappebti, and is a member of CFX and KKI. Trading crypto asset futures contracts carries high risk, one of which is the risk where Leverage can amplify both gains and losses.