Article Summary

- Bounce (AUCTION)

- Entry: IDR119,625 ($7.72)

- Cut Loss [CL]: IDR102,062 ($6.16)

- Take Profit [TP]:

- TP1 = IDR152,928 ($9.23)

- TP2 = IDR174,799-Rp185,237 ($10.55-$11.18)

- TrueFi (TRU)

- Entry: IDR377 ($0.0228)

- Cut Loss (CL): IDR296 ($0.0179)

- Take Profit (TP):

- TP1 = IDR462 ($0.0279)

- TP2 = IDR561-Rp599 ($0.0339-$0.0362)

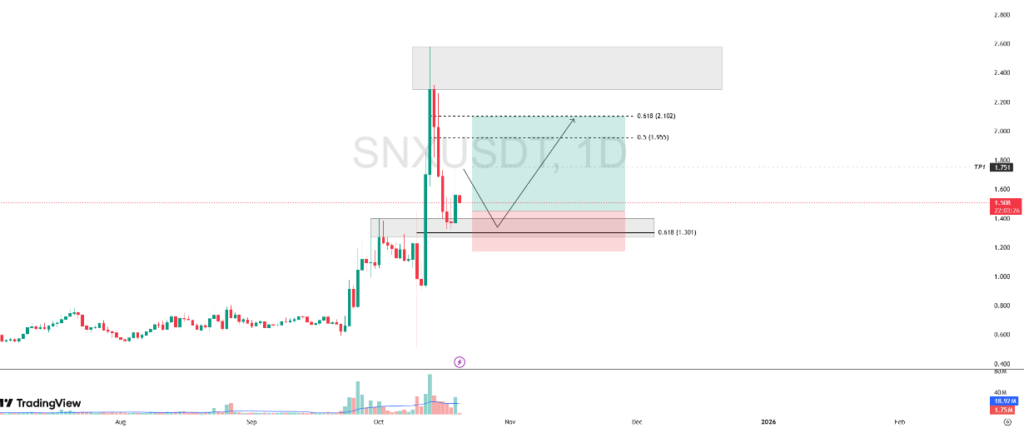

- Synthetix (SNX)

- Entry: IDR24,057 ($1,452)

- Cut Loss (CL): IDR19,451 ($1,174)

- Take Profit (TP):

- TP1 = IDR29,011 ($1,751)

- TP2 = IDR32,391-Rp34,827 ($1,955-$2,102)

1.Bounce Token (AUCTION)

Tags: DeFi

AUCTION showed a solid recovery after the market correction on October 10. Strong buying action drove the price to close the daily candle with a significant gain of +19.14%, accompanied by a surge in trading volume above the 20-day moving average – an indication of increased market interest in this asset.

As long as the price holds above the weekly closing area of IDR119,625 ($7.22), the uptrend has the potential to continue. Stability above this level confirms strong buyer support, opening up opportunities towards the next resistance area at IDR174,799-Rp185,237 ($10.55-$11.18).

Potential Buy AUCTION Setup:

Entry: IDR119,625 ($7.72)

Cut Loss (CL): IDR102,062 ($6.16)

Take Profit (TP): TP1 = IDR152,928 ($9.23)

TP2 = IDR174,799-Rp185,237 ($10.55-$11.18)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

2. TrueFi (TRU)

Tags: DeFi

TRU (TrueFi) started showing positive momentum after retesting a strong support area, which coincided with a block order in the range of Rp275-Rp323 ($0.0166-$0.0195). The price reaction from the area resulted in an impulsive daily candle close with a gain of +23.24%, signaling a significant return of buying pressure.

As long as the price is able to stay above the immediate support area, TRU technical structure has the potential to continue the recovery phase towards the resistance zone of IDR561-Rp599 ($0.0339-$0.0362). This level is an important area to test the strength of buyers in maintaining the short-term trend.

TRU Potential Buy Setup:

Entry: IDR377 ($0.0228)

Cut Loss (CL): IDR296 ($0.0179)

Take Profit (TP): TP1 = IDR462 ($0.0279)

TP2 = IDR561-Rp599 ($0.0339-$0.0362)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.

3. Synthetix (SNX)

Tags: DeFi

SNX has again caught the attention of market participants after recording a quick rebound after the market crash on October 10. The price increase that occurred in the last few days was supported by significantly increased trading volume, indicating accumulation by market participants.

The RBS (Resistance Become Support) area in the range of IDR21,042-Rp23,179 ($1,270-$1,399) proved to be an important defense zone, successfully resisting the selling pressure that emerged in the October 14-18 period. The positive reaction in this area triggered a price reversal from a downtrend to an uptrend.

As long as the price stays above the RBS area, the opportunity for SNX to continue the upward trend remains open. The potential for further strengthening leads to the key resistance zone of IDR32,391-Rp34,827 ($1,955-$2,102), which is the short-medium term price target.

SNX Potential Buy Setup:

Entry: IDR24,057 ($1,452)

Cut Loss (CL): IDR19,451 ($1,174)

Take Profit (TP): TP1 = IDR29,011 ($1.751)

TP2 = IDR32,391-Rp34,827 ($1,955-$2,102)

Important Notes:

Always apply risk management and capital management with discipline. For trading, especially those using leverage, we recommend using a risk per transaction of: 1% of total capital.