Apple Inc. is one of the most valuable Big Tech companies in the world, continuing to prop up global stock markets. As of the end of December 2025, its shares stood at around $271, up more than 8% since the beginning of the year, driven by the iPhone ecosystem, Apple Silicon, and service businesses such as the App Store, iCloud, and Apple Pay. Now, through tokenization like AAPLX, investors can access Apple’s stock price exposure on-chain, fractionally and 24/7 without a traditional broker. In this article, we will discuss how AAPLX works, its performance, how it differs from regular apple stocks, and how to buy AAPLX on Pintu!

Article Summary

- 🍏 Apple (AAPL) is one of the most valuable Big Tech companies with a market cap of around US$4 trillion and TTM revenue of over US$435 billion.

- 🔗 AAPLX is a tokenized stock that represents a 1:1 exposure to Apple’s stock price on the blockchain without voting rights and direct dividends.

- ⚙️ The AAPLX model enables fractional ownership, near 24/7 trading, and integration with crypto ecosystems and DeFi.

- 📊 Fundamentally, Apple shows strong long-term growth despite P/E and P/S valuations being at premium levels in recent years.

- ⚖️ AAPLX investments have the advantages of flexible access and on-chain transparency, but still carry regulatory, liquidity and issuer-dependent risks.

History of Apple Inc.

Apple Inc. was founded on April 1, 1976 by Steve Jobs, Steve Wozniak, and Ronald Wayne under the name Apple Computer Company in Cupertino, California. Its first product, the Apple I, was marketed to the computer hobbyist community and became the initial foundation of the company’s business. In 1977, the Apple II was launched and became one of the first commercially successful personal computers. This success prompted Apple to conduct an IPO on December 12, 1980 with an initial price of US$22 per share.

In 1984, Apple introduced the Macintosh which popularized the graphical interface (GUI) and the use of the mouse in personal computers. Although innovative, the company faced stiff competition from IBM-based PCs as well as internal management conflicts. Steve Jobs then left Apple in 1985. The company’s performance declined until the acquisition of NeXT in 1996 which brought Jobs back and began a phase of strategic restructuring.

In the 2000s, Apple transformed into an integrated consumer technology company. The launch of the iPod (2001), iTunes Store (2003), and iPhone (2007) transformed the global music and telecommunications industries. In 2007, the company name was officially changed to Apple Inc. to reflect its business diversification. Subsequently, Apple developed an ecosystem of devices and services such as iPad, Apple Watch, App Store, iCloud, and Apple Pay.

What is AAPLX?

AAPLX is a tokenized Apple stock token designed to represent 1:1 exposure to Apple Inc.’s stock price on the blockchain. The token allows investors to access Apple’s stock price movements without having to open a traditional brokerage account, and can be traded via crypto infrastructure. AAPLX is generally issued in token standards such as ERC-20 or other networks compatible with the DeFi ecosystem. However, ownership of AAPLX does not grant voting rights or direct dividend rights like Apple shareholders.

How Tokenized Apple Stocks Work

Tokenized Apple shares work by issuing digital tokens on the blockchain that represent the price exposure of Apple (AAPL) shares in the traditional market. In a typical model, each token is backed 1:1 by Apple shares held by a regulated custodian, and then tokens are minted according to the number of shares held.

This structure allows fractional ownership as well as trading through crypto platforms without having to open a stock brokerage account. All transactions and holdings are recorded on-chain so they can be publicly verified.

In addition toasset-backed models, there are synthetic structures that track stock prices through derivative mechanisms without directly owning physical shares. Tokenized stock can generally be traded almost 24/7 in the crypto ecosystem, unlike conventional stocks that follow official exchange hours. Despite following AAPL’s price movements, token holders typically do not receive voting rights or direct dividends like regular shareholders.

AAPL Stock Performance from 2021 – 2026

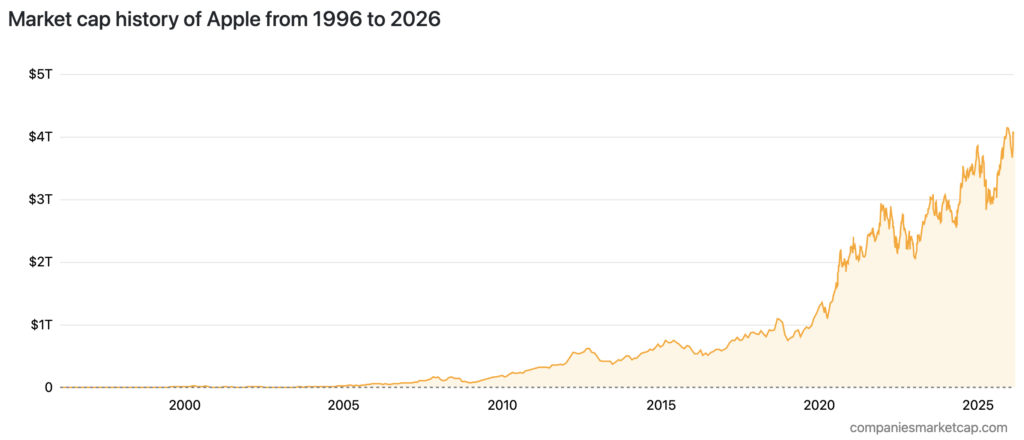

Apple (AAPL) Market cap 1996 – 2026

The chart shows the development of Apple’s (AAPL) market capitalization from 1996 to early 2026 with a very significant upward trend in the last two decades. In the late 1990s to early 2000s, Apple’s market value was still relatively small and flat, before starting to increase gradually after the mid-2000s with the launch of key products such as the iPhone.

The rise became sharper after 2019, when Apple’s market capitalization broke $1 trillion, then surpassed $2 trillion in 2020 and continued to rise to above $3 trillion in the 2023-2025 period. By December 2025, Apple’s market capitalization had reached around $4.14 trillion, and by February 2026 it was around $4.049 trillion, making it one of the most valuable companies in the world.

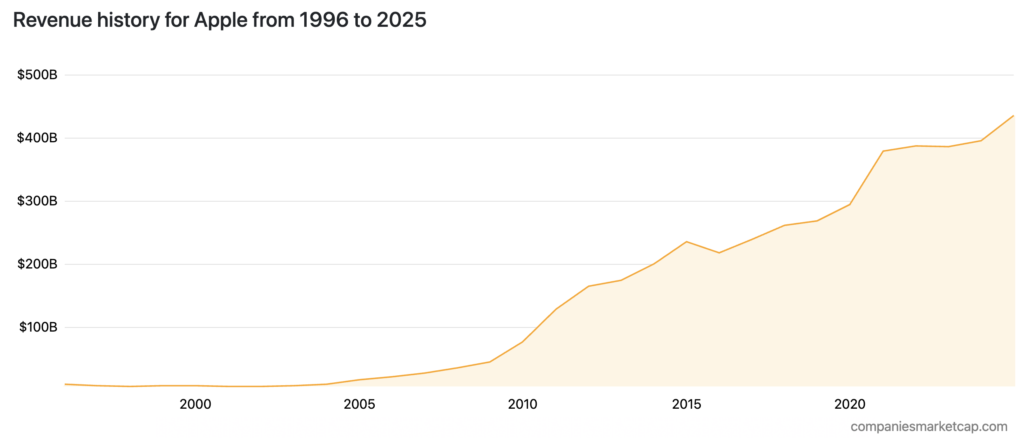

Apple Revenue 1996 – 2025

The chart shows Apple’s revenue development from 1996 to 2025 with a very strong long-term upward trend. In the late 1990s to early 2000s, Apple’s revenue was relatively low and grew gradually, before increasing significantly after 2010 as the iPhone and its product ecosystem expanded.

Growth became sharper in the 2010-2015 period when revenues surpassed $200 billion, despite a mild correction around 2016. Entering the 2020s, revenue surged again and reached approximately $435.61 billion (TTM) in 2025, up from approximately $395.76 billion in 2024, reflecting the continued expansion of Apple’s line of digital devices and services.

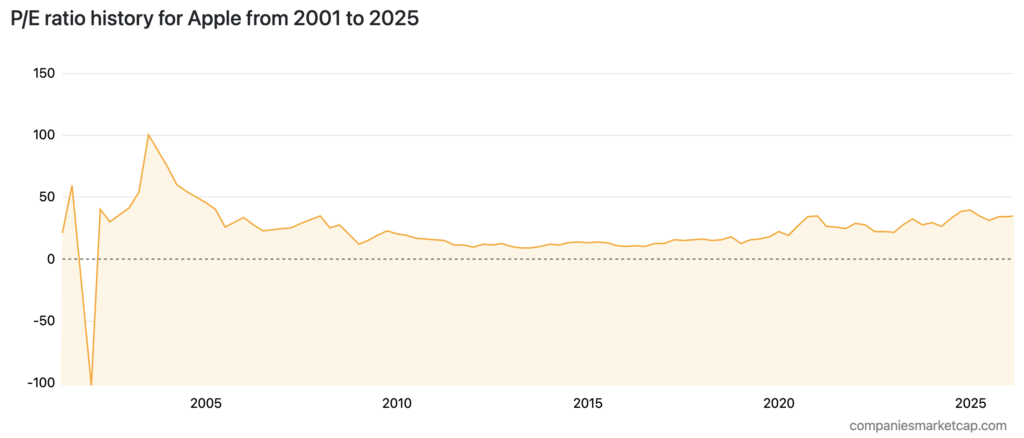

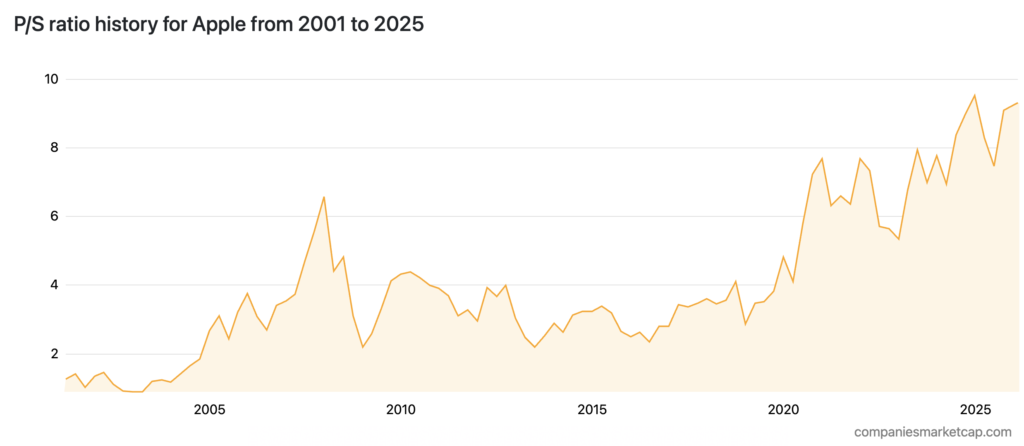

Apple’s P/E Ratio and P/S Ratio 2001 – 2025

The chart above shows the development of Apple’s Price-to-Earnings (P/E) ratio from 2001 to 2025, which tends to fluctuate but stabilize in the long run. In the early 2000s, the P/E ratio fluctuated sharply, including negative periods due to earnings pressure, before returning to a more reasonable range. Throughout the 2010s, P/E was relatively in the teens to 20s, reflecting more stable earnings growth. As of February 2026, the P/E ratio (TTM) stood at around 34.8, lower than the end of 2024 when it was close to 39.5.

The second chart shows Apple’s Price-to-Sales (P/S) ratio from 2001 to 2025 with a structural upward trend in the last decade. In the early 2000s, the P/S was in the low range of about 1-2 times sales, then increased as the iPhone and services business expanded. After 2020, it rose significantly and stayed at a high level, reflecting the market’s increasingly premium valuation of Apple’s earnings. As of February 2026, the P/S ratio (TTM) stood at around 9.30, slightly above the end-2025 level of 9.23.

AAPLX Pros and Risks

AAPLX as a tokenized Apple stock offers a new way to gain exposure to AAPL’s price movements through the blockchain ecosystem. This instrument presents a number of advantages such as more flexible access and fractional ownership, but comes with structural, regulatory and volatility risks of the crypto market that investors need to understand before investing.

Pros

Here are some of the advantages of investing in AAPLX:

| Aspects | Brief Explanation |

|---|---|

| Flexible Global Access | Provide AAPL price exposure through crypto platforms with more flexible access than US stock exchange hours. |

| Fractional Ownership | Can buy in small amounts without having to buy a full share. |

| No Traditional Brokers | Access through crypto wallets and exchanges without a conventional securities account. |

| On-Chain Transparency | Transactions are recorded on the public blockchain and can be verified. |

| DeFi Integration | Can be used in the crypto ecosystem such as trading or certain DeFi strategies. |

Risk

On the other hand, this instrument also has structural limitations and risks, namely:

| Aspects | Brief Explanation |

|---|---|

| Without Shareholder Rights | No direct voting rights or dividends from Apple. |

| Regulatory Risk | Depending on the rule of law in each country. |

| Publisher Dependency | The value of the token depends on the compliance and custody of the issuer. |

| Variable Liquidity | Volumes and spreads differ between platforms. |

| Crypto Market Risk | Remain exposed to volatility and potential price deviations in the crypto market. |

Difference between AAPLX and Apple Common Stock

| Aspects | AAPLX (Tokenized Apple Stock) | Apple Common Stock (AAPL) |

|---|---|---|

| Asset Form | A digital token on the blockchain that represents exposure to Apple’s stock price and is typically backed 1:1 by the underlying stock or instrument through a custodian. | The official stock of Apple Inc. that is listed and traded on exchanges such as NASDAQ. |

| Storage Area | Stored in a crypto wallet (on-chain). | Deposited in a securities account through an authorized broker. |

| Trading Hours | They can generally be traded almost 24/7 on crypto platforms, depending on exchange policies. | Traded only during US stock exchange hours (Monday-Friday, NASDAQ market hours). |

| Fractional Ownership | Supports small purchases flexibly. | Some brokers support fractional shares, but it depends on the policies of each platform. |

| Shareholder Rights | No voting rights or direct dividends from Apple. | Voting rights and dividends according to company policy. |

| Regulation | Being in the area of crypto regulation and digital securitization varies from country to country. | Strictly regulated by capital market authorities such as the SEC in the United States. |

| Ecosystem Integration | Can be used in certain crypto and DeFi ecosystems, depending on the platform. | Not directly integrated with the DeFi protocol without intermediaries. |

| Additional Risks | Depending on the token issuer, custodian, as well as the liquidity risk of the crypto market. | The main risks come from company performance and stock market volatility. |

Apple Stock Performance vs Other Tech Stocks According to Crypto Expert at X

- Apple (AAPL) Second in Big 4 Tech Revenue $1.86 Trillion

According to Charlie Bilello at X, the combined revenue of Amazon, Apple (AAPL), Google, and Microsoft in the last 12 months totaled about US$1.86 trillion. Amazon led with about US$717 billion, followed by Apple in second place with about US$436 billion. Google and Microsoft recorded around US$403 billion and US$305 billion respectively. In total, this figure is said to be greater than the GDP of almost all countries in the world except the 13 largest countries.

- Projected 2026 Big Tech CAPEX Spend on AI

According to @StockMKTNewz on X, Big Tech companies plan to increase capital expenditure (CAPEX) significantly by 2026 to support expansion in the field of artificial intelligence (AI). Amazon is projected to lead with an allocation of around $200 billion (+60% YoY), followed by Google $180 billion (+97%), Meta $125 billion (+73%), and Microsoft US$117.5 billion (+41%). Tesla also recorded the highest annual growth in percentage terms at +135% with total spending of around US$20 billion. This is followed by Apple (AAPL) which is expected to allocate around $13 billion for CAPEX by 2026 with an annual growth of +2%.

Tokenized Stock Regulation Like AAPLX

Tokenized stocks like AAPLX are viewed as digital securities instruments and generally remain subject to traditional securities rules despite being built on blockchain technology. In the United States, the Securities and Exchange Commission (SEC) asserts that blockchain-based securities must comply with federal securities laws, including registration and disclosure obligations if they relate to the underlying stock.

In Indonesia, the regulation of digital assets has undergone major changes with the adjustment of the legal framework by the Financial Services Authority (OJK). Since January 10, 2025, regulatory and supervisory authority over digital financial assets including crypto assets has been transferred from Bappebti to OJK based on Government Regulation No. 49 of 2024 and OJK Regulation No. 27 of 2024, which classifies crypto as digital financial assets and requires related activities to comply with OJK rules.

Other Examples of Tokenized Stock Besides AAPLX

Besides AAPLX, there are various other tokenized stocks that represent shares of global companies and popular ETFs in the form of blockchain-based digital assets. These instruments allow investors to gain exposure to specific stock prices through the crypto ecosystem with an on-chain mechanism . Some examples of tokenized stocks are:

| Ticker | Tokenized Stock Name | Brief Explanation |

|---|---|---|

| TSLAX | Tesla xStock | The token, which represents Tesla Inc. shares, enables Tesla’s price exposure through the blockchain. |

| SLVON | iShares Silver Trust (Ondo) | The token, which mirrors the iShares Silver Trust ETF, provides exposure to the silver market in a crypto format. |

| CRCLX | Circle xStock | A token that tracks the share price of Circle Internet Financial, the company behind the USDC stablecoin. |

| NVDAX | NVIDIA xStock | Tokens that reflect the shares of NVIDIA Corporation, one of the world’s largest semiconductor companies. |

| GOOGLX | Alphabet xStock | A token that tracks the share price of Alphabet Inc. parent company Google. |

How to Buy Apple (AAPLX) at the Pintu?

On Pintu, AAPLX purchases can start at a very affordable amount of Rp11,000, allowing users to gain exposure to Alphabet’s valuation without a large capital outlay.

In addition to AAPLX Pintu also provides various other tokenized stocks such as CRCLX, HOODX, QQQX, and other similar assets through the Market Tokenized Stocks page, allowing users to easily access various global stocks in on-chain form.

Here’s how to easily buy AAPLX on the Pintu:

- Enter the Pintu homepage.

- Go to the Market page .

- Search and select the crypto asset AAPLX.

- Enter the amount you wish to purchase, and follow the rest of the steps.

Conclusion

AAPLX provides a modern way to gain exposure to Apple stock through a flexible and fractional blockchain mechanism. With Apple’s strong fundamentals and position as one of the world’s largest technology companies, stock tokenization opens up new access for crypto investors. However, the differences in ownership rights, regulatory risks, and issuance structure still need to be understood before investing. A rational, risk-based approach is key to capitalizing on the opportunities of tokenized stocks like AAPLX.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- Bingx Academy. What Is Apple Tokenized Stock (AAPLX and AAPLON) and How to Buy. Accessed February 12, 2026

- Gate.io. AAPLx: Invest in Apple stocks via Web3 in 2025. Accessed February 12, 2026

- Binance Academy. What Are Tokenized Stocks? Accessed February 12, 2026