In the world of crypto futures, risk management typically focuses on avoiding liquidation. However, there is a mechanism that affects even the most successful traders: Auto-Deleveraging (ADL). So, what is ADL? How does it work, and how can you reduce the chance of getting ADL? This article will dive deep into Auto-Deleveraging.

Key Takeaways

- 🔒 ADL is a Last-Resort Safety Mechanism: Auto-Deleveraging (ADL) is a risk-management tool that exchanges use to protect solvency. It activates only when the “Insurance Fund” is depleted, forcibly closing the positions of profitable traders to cover the losses of bankrupt traders.

- 🛡️ Protection Against Systemic Failure: While frustrating for winning traders, ADL is essential to ensure the platform’s sustainability and solvency.

- 🧠 Targeting Criteria and Avoidance: ADL priority is calculated based on profitability (Unrealized PnL%) and leverage. To reduce the chance of being targeted, traders should take partial profits (resetting their PnL ranking), lower their effective leverage, or add margin.

- 🧨 Liquidity and Volatility as Triggers: ADL is most likely to occur during “Black Swan” events or in low-liquidity altcoin pairs. So, the massive $20 billion liquidation event on October 10, 2025, is a prime example of how extreme volatility and thin order books forced exchanges to trigger ADL.

What is Auto-Deleveraging (ADL)?

Imagine you are in a massive long position, significantly in profit. Suddenly, the exchange automatically closes your position, not because you ran out of margin, but because someone else went bankrupt.

Auto-Deleveraging (ADL) is a risk-management tool that protects the platform’s solvency during extreme market volatility. Crypto exchanges use ADL as a last resort if their insurance fund can’t cover the extreme losses. In simple terms, ADL takes profits from winning traders to cover the losses of bankrupt traders and ensure the exchange’s solvency.

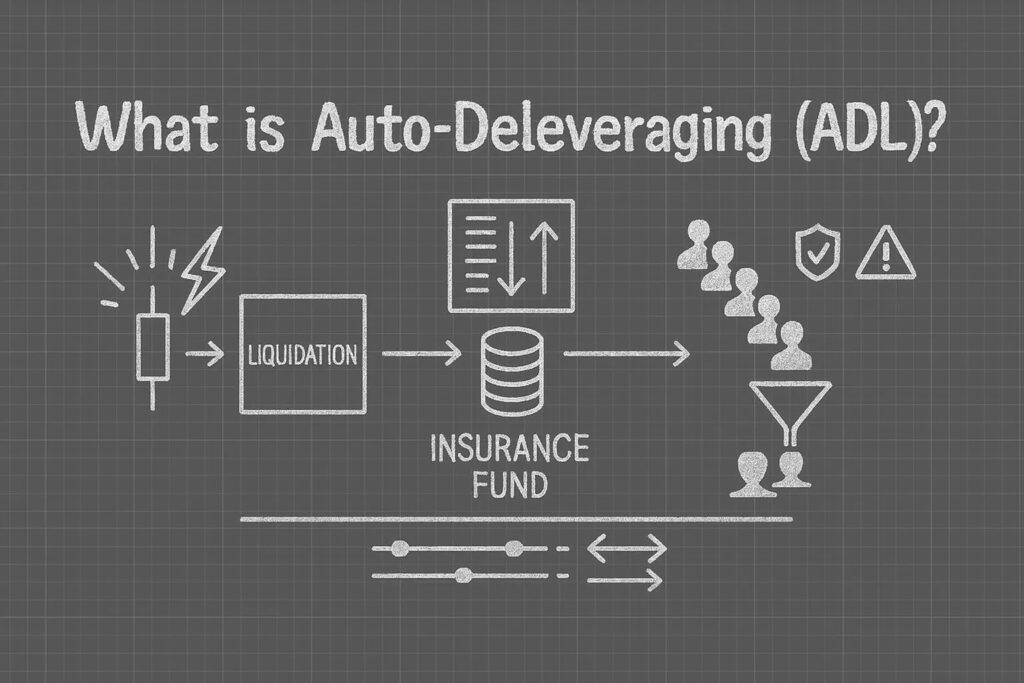

You can understand ADL as a last line of defense in a hierarchy of safety measures:

- Liquidation: If a trader’s margin falls below their maintenance margin, the exchange will forcibly close it.

- Insurance Fund: If the exchange closes the position at a loss, the Insurance Fund pays the position (in full or partially).

- ADL (The Last Resort): If the Insurance Fund is empty, the ADL system automatically reduces the positions of profitable traders in the same asset to cover the loss. For example, if too many short positions in SOL are liquidated and the insurance fund is empty, ADL will kick in for the long traders in SOL.

Why is ADL Important?

While it sounds unfair to profitable traders, ADL is essential for the health of crypto exchanges for three reasons:

1. Prevent Widespread Losses

In the early days of crypto, some exchanges used a “clawback” system. If the exchange lost money on liquidations, they would take a percentage of profits from every winning trader on the platform. ADL is a mechanism for isolating incidents and preventing significant losses.

2. Ensures The Stability of Exchanges

If a trader goes bankrupt and owes the exchange $1 million, and the Insurance Fund is empty, the exchange would have to pay that $1 million. If this regularly happens, crypto exchanges could go bankrupt. ADL ensures the platform’s stability and sustainability. As explained, ADL is a last-resort measure to prevent the platform from going bankrupt and should not occur often.

3. Guarantees Settlement

For every winner in futures, there must be a loser. So, if the loser cannot pay (is bankrupt) and the exchange cannot pay (the insurance fund is empty), the winner cannot realize their profits. ADL guarantees settlement and ensures every trade can be closed, even at the expense of the winners not profiting as much.

How to Avoid ADL?

ADL is usually caused by a very unpredictable event in crypto that triggers extreme volatility. Exchanges typically have some sort of “ADL ranking” within their system to determine which positions to deleverage. ADL algorithms and ranking will target positions with the highest leverage and PnL. So, close or take partial profits on your positions when you know it is due to extreme volatility.

Additionally, you can lower your leverage directly or deposit more margin to lower your “effective leverage”. Another good rule of thumb is to avoid trading altcoins with low liquidity and volume. Low-liquidity assets are more likely to experience ADL due to thin order books and the small number of traders.

Difference Between Liquidation and ADL

| Liquidation | Auto-Deleveraging (ADL) | |

|---|---|---|

| Who it affects | Losing traders. | Winning traders. |

| Cause | Margin balance falls below maintenance margin. | The Insurance Fund is depleted due to massive volatility. |

| Outcome | Positions closed and margin lost. | Position closed early and margin returns. |

| Prevention | Add margin or lower leverage. | Use lower leverage or partially close position. |

Biggest ADL Case: The October 10th Liquidation Event

Source: @Coinvo on X.

Friday, October 10, 2025, became one of the most dramatic trading days in crypto. In less than 24 hours, more than $20 billion of leveraged positions were liquidated. Additionally, many traders are caught off guard as excessive price swings in altcoins trigger many ADLs, leading some exchanges to halt activity.

The liquidation event happened due to Donald Trump’s announcement regarding tariffs on China. This was the largest liquidation cascade ever, even bigger than those triggered by FTX and Terra. In addition, thin liquidity and volume in most altcoins are among the factors that lead to ADL kicking in.

Conclusion

IAuto-Deleveraging represents a necessary trade-off in the crypto futures market, prioritizing the exchange’s financial stability and settlement finality over individual potential gains. While the mechanism protects the ecosystem from bankruptcy during periods of historic volatility, it places the burden of risk management squarely on the trader. To navigate this, traders must actively manage their “effective leverage” and exposure to illiquid assets, ensuring they secure profits before the system forces an exit.

References

- “Inside the Largest Crypto Liquidation in History”, Newton Blog, accessed on December 1, 2025.

- Siamak Masnavi, “How Auto-Deleveraging Works on Crypto Perp Platforms and Why It Can Cut Winning Trades”, Coindesk, accessed on December 5, 2025.

- “What Is Auto-Deleveraging (ADL) and How Does It Work?”, Coinglass, accessed on December 5, 2025.