What if you decided to go all-in on a high-risk asset like meme tokens in pursuit of rapid profits? While the potential for substantial gains exists, it also comes with significant risks, including the threat of rug pulls or pump-and-dump schemes. Hence, investors may seek investment strategies that align with their risk tolerance and objectives. One such strategy to contemplate is the Barbell Strategy, which allocates funds to two types of assets that differ in risk. In this article, we’ll delve deeper into the Barbell Strategy and its application in cryptocurrency asset investment.

Article Summary

- ⚖️ Barbell strategy is an investment approach that balances potential gains and risks by allocating funds to two types of assets that differ in risk: safe assets (low risk) and high-risk assets while avoiding assets in the middle.

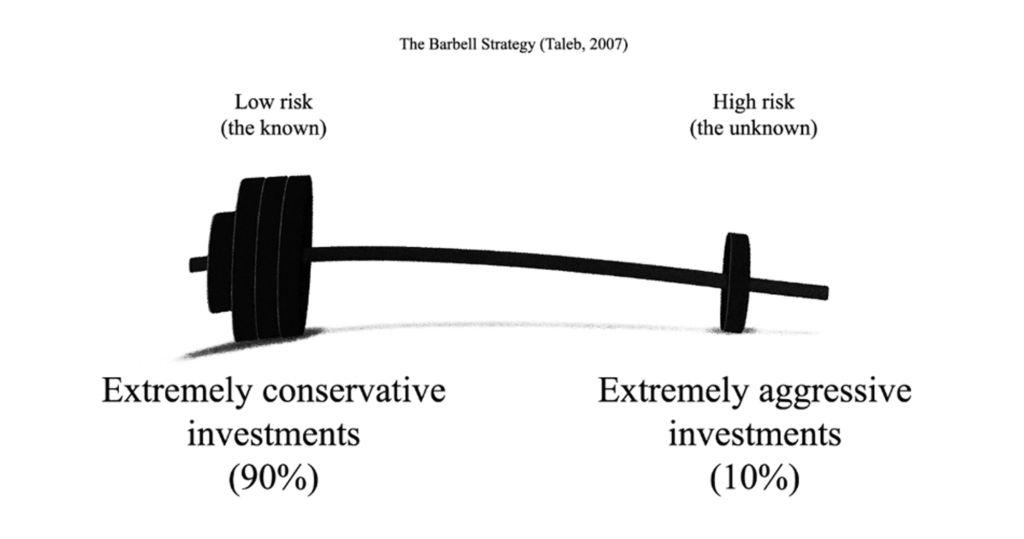

- 🏋️ The concept is called the “Barbell Strategy” because it is similar to a barbell with two heavy weights at both ends. Those two weights are two very different asset classes regarding risk and potential returns.

- 🪙 This approach involves combining large market capitalization assets (blue-chip crypto assets), which are relatively secure, with smaller market capitalization assets that show higher volatility

- 📊 This strategy diversifies the portfolio by combining assets with different risks. However, there is still inherent risk in volatile assets like crypto. In addition, this strategy also requires careful monitoring to see market trends.

What is the Barbell Strategy?

Barbell strategy is an investment concept that balances potential returns and risks by investing in two different risky assets, a low-risk (safe) asset, and a high-risk asset, and avoiding the middle-risk asset.

Barbell strategy was introduced by Nassim Nicholas Taleb, a philosophical thinker, financial advisor, and statistician. In traditional financial systems, the barbell strategy is usually applied by combining government bonds and stocks.

It is named "Barbell Strategy" because the idea behind it describes a balancing concept similar to a barbell consisting of two extreme weights at both end of the stick. In the investment world, those two weights are two very different asset classes regarding risk and potential returns: safe assets (low risk) and high-risk assets.

In the crypto world, this strategy can be applied by combining blue chip assets with a big market cap with smaller market cap assets that are more volatile.

For safe-haven crypto assets, investors can hold liquid and less volatile blue-chip crypto assets such as Bitcoin and Ethereum. Then, for higher-risk assets, investors can hold other altcoins such as meme tokens, newly released project tokens, or tokens with high volatility. High-volatility assets can be further diversified with perpetual assets.

The barbell strategy aims to balance potentially high growth and protection against the large volatility in the crypto market.

Investors allocate a large portion of their portfolio to more stable assets (such as Bitcoin) to protect the value of their underlying capital. On the other hand, they take risks with a small portion of assets, such as meme tokens, to make high and fast profits.

Advantages of Barbell Strategy

Portfolio diversification and risk reduction are two potential benefits of the barbell strategy. With this strategy, you can diversify your risk by combining two different assets. By having a safe asset and a speculative asset, you can reduce the overall risk of your portfolio. If the speculative asset suffers a loss, the safe asset may be able to offset the loss.

Another potential benefit is that you can reinvest the profits from speculative assets. The profits may be higher than holding safe assets, allowing you to receive higher returns.

Disadvantages of Barbell Strategy

One of the main disadvantages of the barbell strategy is the inherent risk of speculative assets. These assets are more volatile and risky. So you could potentially lose a lot of money if the speculative assets you’re holding drop in value or fail.

Also, this strategy does not guarantee profits. While having safe assets in your portfolio can provide capital protection, you may only sometimes get the returns you expect from speculative assets.

Therefore, you need to monitor your portfolio and make decisions about asset re-allocation regularly. Of course, it takes time and a deep understanding of the crypto market.

How to Implement the Barbell Strategy

1. Identify Safe Assets

Choose crypto assets considered safe and stable, such as Bitcoin (BTC) and Ethereum (ETH), as they have a large market capitalization and are more stable than other assets. You can choose to focus on one asset or invest in both.

2. Identify Speculative Assets

Choose crypto assets that are more speculative or high-risk. These can be crypto assets with smaller market capitalizations or just emerging. Examples of speculative assets include altcoins, newly released project tokens, or high-volatility tokens. Ensure you analyze to avoid scams or pump-and-dump projects. Also, ensure the assets you hold have clear potential and use cases.

3. Determine the Ratio of the Two Assets

Decide how much allocation you want to give to each asset class, such as 90:10, 80:20, or 70:30. For example, you allocate 80% of your portfolio to safe assets like BTC and ETH, and the remaining 20% to speculative assets.

4. Portfolio Evaluation

You need to evaluate your portfolio regularly. For example, if speculative assets have gained significant value, you may need to realize profits or allocate more to safe assets. On the other hand, good market conditions can make you more aggressive.

Example of Implementing Barbell Strategy on Crypto Assets

Ari has IDR 10 million of investment capital and he applies the barbell strategy. Ari allocates the funds with a ratio of 80:20, which means Ari invests IDR 8 million in BTC and ETH, and the remaining IDR 2 million is used to buy high-volatility tokens such as PEPE, FLOKI, BONK, and others.

Of the 20% allocation to high-risk assets, Ari chooses to allocate half, which is 10% of the total capital, to perpetual assets. He opens a long or short position on the BTC/USD trading pair on the DEX perpetual, dYdX.

Thus, Ari’s portfolio may look as follows:

| Safe assets* (80%) | Speculative assets* (20%) |

|---|---|

| BTC: 5 million | PEPE: 1 million |

| ETH: 3 million | Perpetual assets: 1 million |

With this strategy, Ari can balance between high growth opportunities on speculative assets and protection against crypto market volatility faced with safe assets.

Barbell Strategy for Crypto Natives

As Bankless explains, the best barbell strategy for the future is to invest in digital real estate (Bitcoin) and physical real estate (property), known as scarcity games. Scarcity games are money games with fixed supply assets that aim to accumulate as much as possible.

According to Michael Saylor of Microstrategy, Bitcoin is digital real estate in limited supply. BTC has a fixed amount of 21 million BTC, which means only 0.0025 BTC per person can own it on the planet. No individual or entity can create more BTC.

Furthermore, there are about 15 billion acres of habitable land on the planet, which equals about 2.3 acres per individual. However, real estate that has actual value is much more limited. Different from Bitcoin, the amount is difficult to verify with certainty. The key concept in real estate is “location, location, location”. Therefore, the valuable land in the world is very limited.

Thus, a potential barbell strategy could combine real estate or property ownership as a safe asset and crypto assets as high-risk assets with value based on their scarcity. It should be noted that this strategy is only sometimes suitable for everyone as it requires a deep understanding of the property market and the crypto world.

Conclusion

In the ever-evolving world of investing, the barbell strategy is an approach that can be considered to balance portfolio growth and risk protection.

Investors can create a portfolio that fits their profile by combining blue chip assets like Bitcoin with high-risk assets, such as meme tokens or other speculative assets. However, it is important to remember that risks are associated with high-risk assets, and this strategy may not be suitable for all investors.

References

- Sarah Jansen, Bringing the barbell strategy to life in the crypto space, Cointelegraph, diakses 20 Oktober 2023.

- Ryan Sean Adams, The Crypto Barbell Strategy, Bankless, diakses 20 Oktober 2023.

- Ryan Sean Adams, The Best Barbell Strategy for Crypto Natives, Bankless, diakses 20 Oktober 2023.

- Perry Guarracino, Barbell Strategy: Weighing the Benefits and Risks, diakses 20 Oktober 2023.