Circle (CRCL) is a digital financial infrastructure company at the center of the global blockchain-based payments ecosystem through the management of the stablecoin USD Coin (USDC).

Since its inception, Circle has focused on developing transparent and scalable payment technology so that USDC can be widely used by businesses, institutions, and cross-network applications.

With a business model based onreserve income and expansion into major blockchains, Circle is evolving into a strategic player in the integration of traditional finance, crypto, and the modern digital economy.

Article Summary

🏛️ Circle (CRCL): Circle is a digital financial infrastructure company that manages the stablecoin USD Coin (USDC). With a focus on reserve transparency, regular audits, and regulatory compliance, Circle is building the foundation of blockchain-based global payments and becoming one of the most influential actors in the crypto industry.

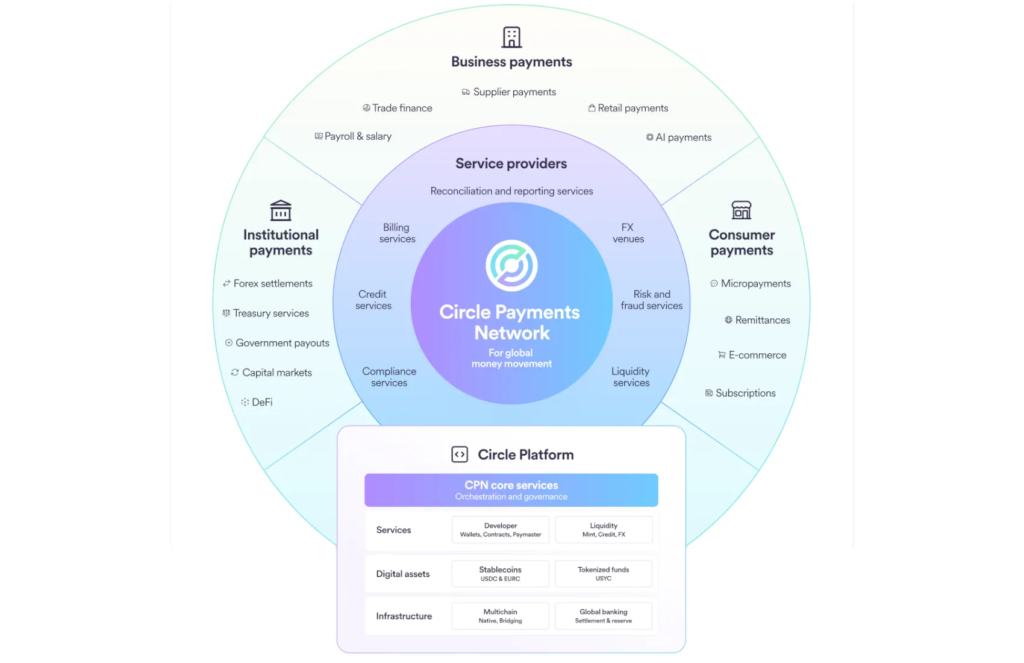

💰 B usiness Model: Circle’s primary source of revenue comes from reserve income generated from US government cash and debt securities backing USDC. In addition, Circle earns revenue from payment APIs, enterprise solutions, and Web3 services such as programmable wallets that accelerate USDC adoption across multiple business sectors.

🌐 The role of USDC: USDC is utilized for international trade payments, cross-border payroll, remittances, and corporate settlements at lower fees than traditional bank methods. USDC’s support on major networks such as Ethereum, Solana, Base, and Polygon helps expand its use globally.

🚀 CircleRoadmap: Circle continues to expand USDC support across multiple blockchains, strengthen backup security, integrate payments for the AI ecosystem, and build a global treasury infrastructure. These efforts confirm Circle’s role as a key pillar in the evolution of blockchain-based digital payments.

What is Circle and its History

Circle is a United States-based fintech company that developed USD Coin (USDC), one of the largest stablecoins in the crypto market. Founded in 2013 by Jeremy Allaire and Sean Neville, Circle initially focused on digital payments before eventually developing an enterprise-grade stablecoin backed entirely by cash assets and short-term US government securities.

Circle became the center of global payment infrastructure as USDC was designed to maintain a 1:1 value against the US dollar. With a transparent governance model, regular audits, and monthly reserve reports, Circle is growing into a major player accelerating the integration of traditional finance and blockchain.

What are Circle’s Main Products?

Circle’s main products include:

- USDC Stablecoin – used across hundreds of blockchain protocols, exchanges, and networks.

- Circle Mint – a service for businesses to print and redeem USDC directly.

- Circle Wallets & Developer APIs – payment services and infrastructure for cross-border transactions, funds transfer, and treasury management.

- Programmable Wallets – a Web3 solution that allows businesses to integrate crypto into applications without having to manage their own blockchain infrastructure.

In addition, Circle develops various compliance, risk management, and blockchain settlementtools for global enterprises.

Why is Circle so valuable?

There are three main reasons why the Circle can be so valuable:

- USDC’s dominance as an institutional-scale stablecoin. USDC is used by banks, fintechs, DeFi protocols, and global payment companies. USDC has a market capitalization of around $78.28 billion, far below Tether (USDT) at $185.74 billion, making Tether more than twice as large. However, Circle as the issuer of USDC remains Tether’s main competitor, especially in the institutional stablecoin segment used by banks, fintechs, global payment companies, and DeFi protocols.

- Reserve-based business model (reserve income). Circle generates income from interest on reserve assets backing USDC, primarily US Treasuries.

- The growing utility of USDC in cross-border payments. USDC postage is much lower than traditional bank transfers, especially for corporate settlements and large volumes.

These factors make Circle essential in the crypto sector, global payments, and even AI-fintech integrations that require high-speed payment rails.

Circle Business Model

Circle’s business model centers on providing digital payment infrastructure that relies on USDC reserve transparency, reserve-based income, and API services for global businesses.

This structure allows Circle to generate a steady stream of revenue while expanding the use of USDC as a modern payment standard across multiple sectors.

*1. Reserve Income (*Main Income)

Circle generates the majority of its revenue from reserve income, which is interest earned on US Treasuries and cash backing USDC. The larger the USDC capitalization, the larger Circle’s reserve income.

2. Revenue from Infrastructure Products

Circle’s additional revenue comes from:

- API service fee

- enterprise payment solutions

- corporate-specific digital curency service

- bank and fintech partnership

This business model creates a relatively stable margin, based on the volume of USDC in circulation.

Use of USDC for Global Payments

USDC is used for:

- international trade payments,

- remote worker payroll,

- inter-companysettlement,

- remittances,

- on-chain payments in global e-commerce.

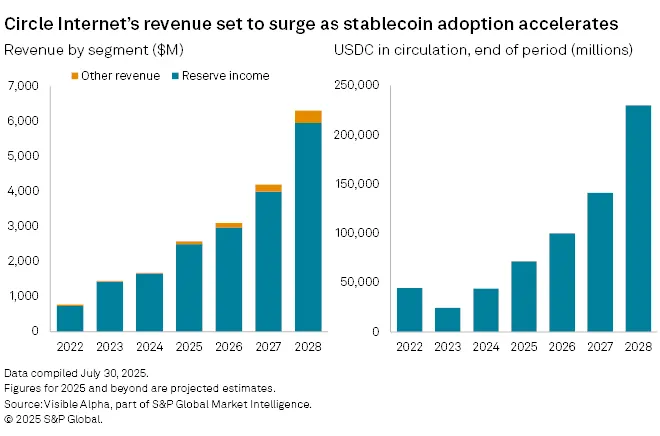

The cost of sending USDC on networks such as Solana or Base can be under IDR 100, much cheaper than international bank transfers which can reach IDR 50,000-IDR 400,000 per transaction. Adoption of Circle Internet Group (CRCL) and its stablecoin USD Coin (USDC) has increased significantly, driving a surge in company revenue.

A recent report by S&P Global showed that USDC circulation more than doubled in one year, reaching approximately US$73.7 billion in the third quarter of 2025. This growth was followed by an increase in revenue for Circle – total revenue and reserve income jumped to US$740 million, up about 66% over the previous period.

Analysts expect stablecoin adoption to continue to strengthen as regulations become clearer and global demand for fast and liquid payment solutions grows. According to projections, Circle’s revenue is expected to reach US$2.6 billion by 2025 if the increase in USDC adoption continues.

How does Circle Maintain USDC Reserves?

Circle publishes monthly independently audited reserve reports. The composition of its reserves usually consists of:

- cash deposits,

- short-termtreasury bills,

- money market instruments are highly liquid.

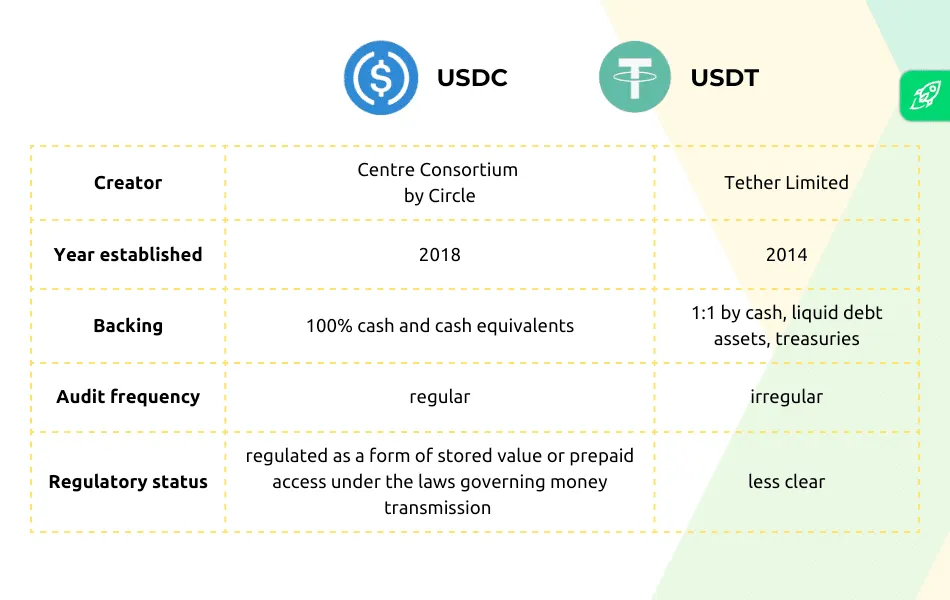

The goal is to keep the value of USDC stable while reducing risk-an important aspect in the USDC vs USDT comparison for businesses that require high transparency.

USDC vs USDT Difference for Business

According to the changelly website, USDC was developed by Circle with a clearer regulatory framework, 100% cash and cash equivalent-based reserves, and regular audit frequency to ensure full transparency. This approach makes USDC more aligned with the needs of businesses that prioritize compliance and clarity of reporting.

USDT, issued by Tether Limited, on the other hand, has a larger market capitalization, but its reserve composition is more diverse and its level of transparency is often the subject of discussion in the community. The fact that audits are not consistently scheduled has led some industry players to view the compliance aspect as unclear.

In business practice, USDC tends to be chosen for payment and treasury flows due to compliance with regulatory standards, while USDT is predominantly used in the trading market thanks to its very high liquidity.

Stablecoin Risks and Mitigations

Relevant risks include:

- regulatory risk,

- risk reserve management,

- technology risk (the blockchain network used),

- secondary market risk in the event of depegging.

Circle’s mitigations include regular audits, transparent reporting, reserve diversification, working with regulators, and the development of CCTP protocols to reduce liquidity fragmentation.

Circle Cooperation

The Circle Alliance Program is a global network that connects organizations-from startups to large institutions-that want to leverage USD Coin’s (USDC) stablecoin and digital payments infrastructure.

Through this program, partners gain direct access to Circle’s product, engineering, and compliance teams, enabling rapid integration of blockchain services and collaboration on payments and digital finance innovations.

The following are examples of relevant Circle brand partnerships that are frequently mentioned in industry reports and Circle Alliance programs:

1. Shopify

Circle is working with Shopify to enable merchants to accept USDC payments directly through on-chain payment integration. This partnership expands the adoption of stablecoins in the e-commerce sector and makes cross-border settlement easier.

2. Stripe

Stripe is adding support for stablecoin payments, including USDC on select networks, so businesses can accept crypto payments instantly with the option of automatic conversion to fiat. This collaboration strengthens USDC’s position as a global payment rail.

3. Visa

Circle partnered with Visa on a digital settlement program, where Visa uses USDC to settle cross-border transactions with select banking and fintech partners. This partnership increases the utility of USDC in traditional payment systems.

Circle Performance After IPO (CRCL)

Circle’s post-IPO performance (CRCL) is in the spotlight as the company enters a new growth phase supported by the expansion of USDC usage and increased demand for digital payment infrastructure.

1. Sales Data & Dominance in AI Sector

According to Circle’s operational report, USDC adoption in the AI sector is increasing as AI companies require fast, automated and programmable payment infrastructure. Data shows that micro-payment transactions between AI agents have reached 28 million transactions per month, while machine-to-machine transactions grew by around 31.4% QoQ.

In addition, the use of USDC-based payment APIs recorded demand of more than US$95 million per month (≈ Rp1.58 trillion using an exchange rate of Rp16,643 per USD). This surge reinforces USDC’s dominance and expands Circle’s position as a financial infrastructure provider for the AI economy.

2. Revenue Circle Growth

The latest data shows that Circle recorded TTM revenue of US$2.41 billion, up from US$1.67 billion (2024) and US$1.45 billion (2023), reflecting strong growth post-IPO. This increase was mainly supported by reserve income, which is greater when US interest rates are at high levels.

Circle Investor Relations also mentioned that reserve income could potentially reach billions of dollars per year if USDC’s capitalization returns to above US$50 billion, in line with USDC’s supply which is currently around US$78 billion. Circle Investor Relations noted that reserve income could reach billions of dollars per year if USDC capitalization returns to its peak above $50 billion.

Circle Stock Analysis (CRCL)

Circle (CRCL) stock analysis positions the company as an issuer whose performance is highly correlated with USDC adoption, interest rate dynamics, and global stablecoin regulatory developments.

With its status as a digital financial infrastructure provider, CRCL is an interesting stock to analyze through various modern valuation methods.

1. DCF Based Valuation

In the hypothetical DCF model, the value of CRCL shares is highly sensitive to the following variables:

- USDC capitalization,

- US interest rates,

- growth in API usage,

- expansion into the global AI and payments market.

The DCF suggests a high valuation if USDC regains significant dominance in the stablecoin market and maintains the pace of annual transaction volume growth.

2. Valuation Based on EPS

Based on data from StockAnalysis.com, Circle’s EPS (CRCL) shows significant volatility with a value of -0 . 53 in 2025 after previously being at 0.30 in 2024. This decline reflects the post-IPO heavy investment phase, during which Circle ramped up infrastructure spending and USDC expansion. However, the 2026 projection shows a strong recovery with a positive EPS of 1.02, or an increase of over +292% YoY, driven by reserve income growth, increased USDC transaction volume, and operational efficiency.

The combination of positive EPS projections and revenue growth – including +63.94% in 2025 and +19.43% in 2026 – puts CRCL as a growth stock that analysts are closely monitoring. Although Circle has a history of negative EPS in 2020-2023, structural changes in the business model as well as the expansion of USDC usage make medium-term profitability more realistic. With 23 analysts following CRCL, EPS is a key metric in assessing the company’s valuation.

Technical Analysis of CRCL Based on Trader X

Based on technical analysis from a trader on the X platform named @bullrunalpha, he considers that CRCL is in a technical “air pocket”, which is an empty zone of liquidity that has the potential to fill up quickly towards USD 135-160. He highlighted that the previous high of USD 299 still opens room for an increase if market momentum strengthens.

The chart shows weakening selling pressure, increasing volume, as well as recovering MACD signals. The trader marked the USD 159 area as a key resistance. This analysis confirms that CRCL’s movement is highly sensitive to stablecoin sentiment and USDC activity which is often an early indicator of market interest in Circle stock.

Circle’s Roadmap After IPO

According to Circle statements and industry analysts, CRCL’ s roadmap includes:

- USDC expansion to more blockchain networks,

- expanding its role as AI payment infrastructure,

- global treasury rails for multinational companies,

- enhanced backup and audit security programs,

- Deeper integration of programmable wallets for enterprise businesses.

These steps strengthen Circle’s position as the backbone of global blockchain-based payments.

Conclusion

Circle (CRCL) is emerging as one of the key players in the transformation of digital financial infrastructure through its strategic role in the development and management of USDC. The reserve income-based business model, expansion of the blockchain network, as well as increasing adoption in cross-border payments indicate a strong foundation for growth.

However, regulatory dynamics and macro conditions remain factors to consider in assessing the company’s long-term prospects. With the combination of USDC’s expanding utility and continued product innovation, Circle is in a significant position to shape the future direction of the blockchain-based economy.

You can also start investing and buying USDT and USDC coins on Pintu app. Through Pintu, you can buy USDT and USDC and other crypto assets in a safe and easy way. Download Pintu cryptocurrency app on Play Store and App Store!

Reference:

- changelly. USDC vs. USDT: Which of the two main stablecoins is a better choice? Accessed December 4, 2025.

- Circle. USDC Transparency & Reserve Reports. Accessed December 4, 2025.

- Circle. Circle Alliance Program. Accessed December 4, 2025.

- Circle. Operational and Ecosystem Update. Accessed on December 8, 2025.

- CoinMarketCap. USD Coin (USDC) Market Data. Accessed December 4, 2025.

- FXC Intelligence. Circle’s cross-border payments plan: Insights from its first earnings call. Accessed December 09, 2025

- S&P Global. Circle Internet’s revenue set to surge as stablecoin adoption accelerates. Accessed December 4, 2025.

- Shopify. Stablecoins Are Ready for Global Commerce: Accept USDC on Base With Shopify Payments. Accessed December 4, 2025.

- StockAnalysis.com. Circle (CRCL) Earnings & Revenue Forecast. Accessed December 05, 2025