Amid the growing popularity of cryptocurrency adoption over the past few years, one of the most attention-grabbing inventions in the crypto world is Decentralized Finance, or DeFi. DeFi is a blockchain-based financial application ecosystem that can operate without a central authority such as bank or other financial institution.

Today, almost every financial service such as loans, saving plans, insurance, and the stock market is still managed by centralized systems. This means, we must have a bank account or access to a centralized financial institution to be able to use financial products and services. In reality, a lot of people in Indonesia are still unbanked and do not have access to financial services. Financial inclusion or equal access to financial services has been proven to help people break out of poverty and boost economic growth.

The invention of Bitcoin and blockchain technology enables people to transfer digital assets to the other side of the world without any involvement of a bank or central authority. What if blockchain technology allows us to decentralize the financial system as a whole and not only be limited to sending and receiving cryptocurrency? This is when Decentralized Finance or DeFi comes into the picture.

How does DeFi work?

At first, it can be a bit difficult to wrap our heads around the idea of DeFi. But to put it simply, the invention of DeFi expands the use of blockchain from simple transfer to more complex financial use cases.

The invention of various Defi applications was started with the discovery of the Ethereum blockchain with its smart contract technology. Smart contracts, in essence, are computer programs written on top of the Ethereum blockchain. When a certain condition stated in the program is met, the smart contract automatically executes the commands that have been programmed, whether it is to transfer tokens between Ethereum addresses or perform other types of transactions.

With its smart contracts, Ethereum blockchain enables more complex levels of programming, giving developers the freedom to experiment with their code and create applications known as Decentralized Applications (DApps). DeFi is DApps focused on making traditional financial services decentralized.

Whereas previously financial services depended on institutions such as banks acting as intermediaries, with DeFi, all transaction processes were carried out by codes written in smart contracts. DeFi application code is generally transparent and open-source, where all users can verify the application code themselves. Thus, users can have complete control over their funds. Many DeFi applications are available today with services ranging from depositing crypto assets and earning interest, taking loans, and so on.

How is DeFi being used today?

To understand more on how the technology works, here are a few examples of how DeFi are already being used today:

Decentralize exchanges (DEX)

Decentralized exchanges (DEXs) are applications that facilitate the exchange of one token for another using smart contract. Two of the most popular DEXs built on the Ethereum blockchain are Uniswap and Sushiswap. With DEXs, you can exchange ETH for ERC-20 tokens or vice versa, as well as exchange between ERC-20 tokens.

DEX also exists on non-Ethereum blockchains, for example, PancakeSwap. This app is built on blockchain Binance Smart Chain with BNB (Binance Coin) as the currency. Just like the Uniswap protocol, PancakeSwap allows its users to exchange crypto assets.

Check out crypto price today in this link!

Borrow and Lend

Two DeFi applications that are also widely used today are AAVE and Compound, Ethereum blockchain-based lending applications. With AAVE and Compound, you can deposit crypto assets to earn interest, as well as borrow crypto assets for investment or other purposes. To use both applications, you only need an Ethereum wallet and some funds in the form of ETH or ERC-20 tokens. With AAVE or Compound, anyone can lend and borrow assets without a bank or other financial institution.

Asset Management

One DeFi application that is currently widely used is Yearn Finance. Launched in early 2020, Yearn Finance is an Ethereum blockchain-based yield aggregator app, which is useful for generating returns or interest from crypto assets invested by users. Users can deposit an asset into Yearn Finance vaults, and each of these vaults uses various strategies to generate interest on the deposited assets.

How to start using DeFi

First, you must have an Ethereum wallet that can interact with dApps. One of the most commonly used wallets is MetaMask.

Second, you must have enough ETH in your wallet to be able to make transactions on the DeFi protocol you want to use. Currently, most of the DeFi protocols are built on top of the Ethereum blockchain, so you have to buy ETH or ERC-20 coins to use them. However, as explained above, there are already many choices of DeFi applications that are built on the Binance Smart Chain blockchain and uses BNB as its currency.

Last but not least, don’t forget to learn about the application you want to use before you buy the token and make transactions in the chosen application. Once you’re ready, you can start to buy the crypto asset of your choice at Pintu.

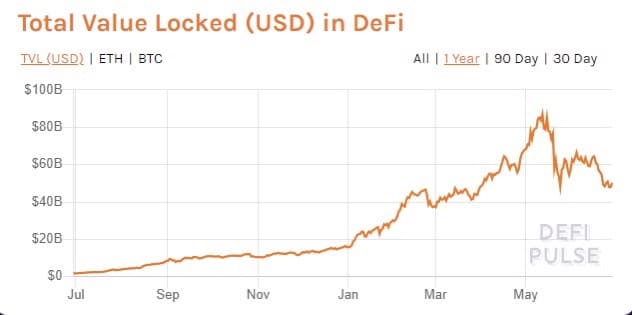

DeFi’s growth over the years

DeFi first began its popularity in 2017, however, by June 2020 the amount of funds on the DeFi smart contract has already reached 1 billion US dollars. In just one month, the amount skyrocketed to 2 billion US dollars. By the end of July, the amount of money in DeFi ecosystem had reached 3 billion US dollars. As of June 2021, the amount of funds in DeFi smart contracts has touched more than 50 billion US dollars.

Why DeFi matters?

The main advantage of the invention of DeFi is the ease of access for everyone to use any financial service. The traditional financial system relies on intermediary institutions such as banks that aims at gaining profit. This causes financial services to not always be accessible to all levels of society, especially low-income people. With DeFi, the cost of using financial services is significantly reduced, and ultimately opens the door for all levels of society to take advantage of financial services.

The invention of DeFi applications basically drives the realization of financial inclusion, or conditions that allow everyone to have access to financial products or services. Financial inclusion is important as it has been proven to help people move out of poverty, reduce social inequality and encourage economic growth.

Summary

- DeFi is an umbrella term for a variety of blockchain-based financial applications that do not rely on a central authority, such as banks or other financial institutions.

- DeFi runs with blockchain and cryptocurrency as its core technologies, mostly with Ethereum as its platform. Through the use of Ethereum, everyone can write automated code, also known as smart contract, including to manage any financial service they want to create, enabling developers to create far more sophisticated functionality other than simply sending and receiving cryptocurrency.

- With DeFi, the cost of using financial services is significantly reduced, and ultimately opens the door for all levels of society to use financial products and services.

Reference:

Antonopoulos, A. M. (2021). Mastering Ethereum. Stanford University Press.

Defi pulse: The defi leaderboard: Stats, charts and guides. DeFi Pulse – The Decentralized Finance Leaderboard. (n.d.). https://defipulse.com/.