In a crypto market that appears to be moving sideways, derivative trading emerges as an attractive alternative for users to make quick but high-risk profits. Those who enjoy speculating on the volatile prices of crypto assets typically turn to centralized exchanges (CEX) as their preferred option. However, within the DeFi space, there exists a platform that streamlines derivative trading, offering affordability, security, and speed, namely dYdX. In this article, let’s explore dYdX and what you can do.

Article Summary

- dYdX is a decentralized exchange (DEX) for derivatives trading (perpetual and margin), spot trading, and lending services.

- Unlike the Automated Market Maker (AMM) as used by Uniswap, dYdX utilizes a centralized order book model. This model combines the security and transparency typically associated with DEX with speed and ease of use, similar to a CEX.

- DYDX tokens play an essential role in the dYdX ecosystem. DYDX token holders can earn rewards through applicable programs within the dYdX platform.

- dYdX is preparing for a major update called dYdX V4. In this update, dYdX will have its blockchain, dYdX Chain. This blockchain is built using Cosmos SDK and Tendermint Proof-of-Stake consensus protocol.

What is dYdX?

dYdX is a decentralized exchange (DEX) that allows users to do derivative trading (perpetual and margin), spot trading, and lending. The platform is designed for professional users to access financial services without relying on intermediaries or traditional financial institutions.

dYdX utilizes a centralized order book model, in contrast to the Automated Market Maker (AMM) used by Uniswap. This approach provides convenience for users who are used to trading on traditional exchanges. The dYdX model integrates the security and transparency elements commonly associated with DEX with the speed and ease of use similar to a CEX.

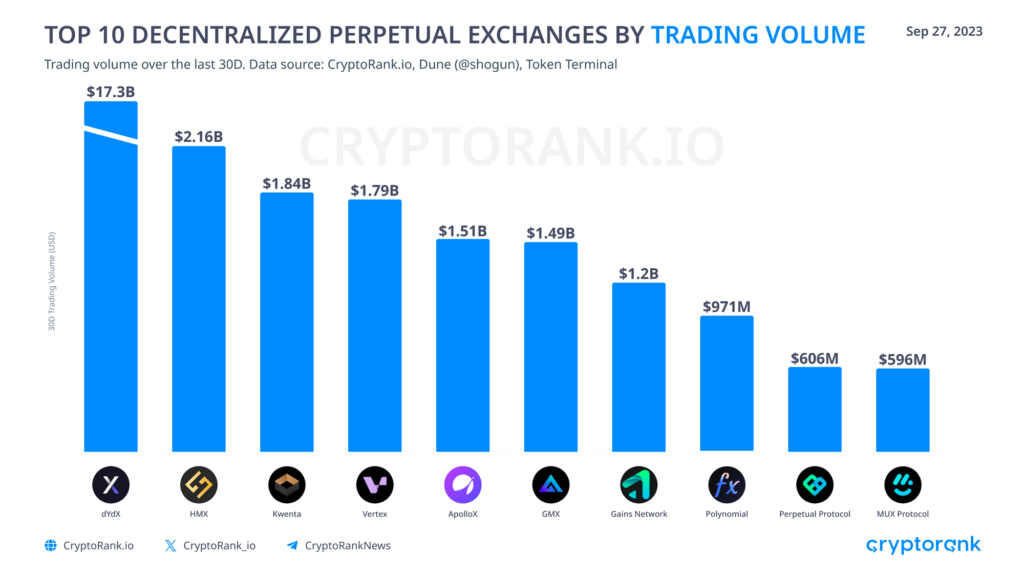

Data from CryptoRank shows that dYdX was the largest perpetual DEX by trading volume in September 2023, with a total of 17.3 billion US dollars.

The substantial increase in trading volume was primarily attributed to the significant system update that dYdX underwent in 2021, known as dYdX V3. The key updates included:

- Shifting the dYdX network from the Ethereum mainnet to Ethereum’s layer 2 solution, StarkWare. This transition significantly enhanced scalability and facilitated faster and more cost-effective transaction processing.

- DYDX token launch, which functions as a governance and utility token within the dYdX platform.

dYdX still uses Ethereum’s layer 2 network, StarkWare, to accommodate high transactions loads. However, as the dYdX system evolves, the platform has announced plans to develop its blockchain using the Cosmos SDK and update dYdX V4. dYdX founder, Antonio Juliano, said the update will take place in October 2023.

Apart from dYdX, there is the GMX platform that facilitates derivative trading. You can read more about it here.

Who is the Founder of dYdX?

dYdX was founded by Antonio Juliano, a Princeton University graduate with a background in computer science. He graduated in 2015 and joined Coinbase as a software engineer. At Coinbase, he delved into the crypto world and became interested in Ethereum and its technology.

In 2017, Antonio built dYdX and then managed to get an initial funding of 2 million US dollars from Andreessen Horowitz, Polychain, and several other investors.

In 2018, several names joined dYdX. They are Brendan (now chief of architect), Zhuoxun (head of operations, has left and founded Magic Eden), and Bryce (software engineer).

Since its establishment, dYdX has operated on the Ethereum mainnet to support margin trading and lending. Then, in April 2021, dYdX made a network shift to StarkWare, and in August, dYdX introduced perpetual trading products. Since then, dYdX’s transaction volume has steadily increased to over 100 billion US dollars as of October 2021.

Features on dYdX

- Perpetual trading

In perpetual trading, users can open long or short positions similar to futures contract trading and leverage up to 25x.

However, unlike futures contracts, perpetual contracts have no specified expiration date. Therefore, users can hold their positions indefinitely. dYdX supports 36 crypto assets on perpetual trading, such as Ethereum (ETH), Bitcoin (BTC), Solana (SOL), and Cardano (ADA).

- Margin trading

Users can borrow funds from other users to buy more assets. There are two types of margin trading on dYdX: isolated margin and cross margin. So far, dYdX margin trading only supports three assets: ETH, DAI, and USDC. The trading pairs are ETH-DAI, ETH-USDC, and DAI-USDC, and users can utilize leverage of up to 5x.

- Spot trading

dYdX supports spot trading just like on CEXs. Users can buy and sell crypto assets by executing market orders, limit orders, or stop orders. The dYdX spot trading platform supports the same three trading pairs as margin trading.

- Lending and borrowing

dYdX users can deposit or lend their assets into a lending pool and earn rewards. In addition, users can also borrow funds from the pool to use for other platform services.

How Does dYdX Work?

As a DEX, dYdX offers its main product, which is perpetual swaps (perps) or perpetual trading. Perps are similar to futures contracts as they allow users to speculate on the future price movements of crypto assets. The main difference is that perpetual swaps do not have an expiration date.

From a technical perspective, dYdX is a hybrid DEX that combines centralized and decentralized systems. The centralized components are the order book and matching engine, while the decentralized components are the smart contracts in the system.

Therefore, dYdX differs from other DEXs, such as Uniswap and Pancakeswap, which use the Automated Market Maker (AMM) model. dYdX uses a centralized order book commonly used in centralized exchanges (CEX).

Antonio Juliano said the order book is well-established and more efficient than AMMs. He also said the order book requires less funding to achieve the same liquidity as the AMM.

However, with the system update in dYdX V4, dYdX will make it a fully decentralized exchange using a decentralized order book.

dYdX Chain – dYdX V4

Basically, V4 will bring three main changes: decentralizing the order book and matching engine, allowing the addition of permissionless trading pairs, and distributing trading fee revenue to DYDX token holders.

- Decentralized Order Book

To facilitate users’ transactions and move towards a fully decentralized exchange, dYdX will launch its blockchain, the dYdX Chain. dYdX Chain is developed using Cosmos SDK and Tendermint Proof-of-Stake consensus protocol.

dYdX V4 will have a fully decentralized, off-chain order book and matching engine that can handle much higher throughput than previous blockchains.

In addition to their duties as validators, they will also run an order book in their memory and thus remain off-chain. Orders and cancelled transactions will propagate like other blockchain transactions through the network. The network will match orders in real-time, and the resulting trades will be confirmed on the chain periodically. This design allows for high throughput in the order book while maintaining a decentralization level.

- Addition of Permissionless Trading Pairs

In dYdX V3, the dYdX development team had already determined what trading pairs would be added to the exchange. However, dYdX v4 changed that. Anyone can add and remove trading pairs through on-chain governance.

While dYdX was previously slow to add trading pairs, the addition of permissionless trading pairs in V4 certainly makes dYdX an attractive platform for centralized perpetual platform users.

- Trading Fee Distribution

dYdX applies very low gas fees thanks to StarkWare’s L2 system. Then, when implementing V4 using the Cosmos system, users do not have to pay gas fees for unexecuted transactions. Users only pay fees for executed transactions similar to dYdX V3 and CEX with very low to zero fees.

With dYdX V4, all transaction fees are no longer given to centralized parties, including dYdX Trading Inc. Instead, they will be fully distributed to validators and DYDX token holders.

Fees scale down as user monthly trading volumes increase, but any platform trading volume below 100,000 US dollars is free.

DYDX Token

DYDX is the native token of the dYdX platform that serves as a governance and utility token. With a maximum supply of 1 billion tokens, as of October 2023, nearly 184 million DYDX tokens are actively circulating in the market. Currently, DYDX is in the 89th position of Coinmarketcap by the amount of its market cap.

For DYDX token holders, several benefits are available, including:

- Retroactive Mining Rewards: These rewards are distributed to long-term users of the dYdX Layer 2 protocol, with the reward amount depending on user activity. Please note that this program is not accessible to users in the United States.

- Trading Rewards: Every user is eligible for DYDX rewards that are tied to their trading activity and volume. The aim is to popularize the platform and increase market liquidity.

- Liquidity Provider (LP) Rewards: Users who deposit their assets in the dYdX pool will receive DYDX tokens as rewards. These rewards will be distributed to liquidity providers after 28 days.

- Discounted Trading Fee: DYDX holders can enjoy trading fee discounts of up to 50%, effectively reducing transaction costs for users holding DYDX tokens.

Conclusion

dYdX exchange is a DeFi platform that is getting a lot of attention for being one of the pioneers in derivative asset trading. The platform offers low-cost, leveraged, and permissionless crypto derivatives trading.

The upcoming transition to a new blockchain, dYdX Chain, and other updates outlined in the dYdX roadmap, referred to as dYdX V4, make this platform particularly interesting to monitor.

Buying DYDX on the Pintu App

You can invest in crypto assets, such as DYDX, BTC, ETH, SOL, etc., on Pintu without worrying about fraud. In addition, all crypto assets on Pintu have undergone a rigorous assessment process and prioritized the precautionary principle.

The Pintu app is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download the Pintu app on the Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on the Pintu app, you can learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

References

- Gabbie, dYdX: A leading DEX for perpetual trading, dYdX Academy, accessed 29 September 2023.

- Antonio Juliano, The History of dYdX (so far), Medium, accessed 29 September 2023.

- Tom Dunleavy, Analyzing DYDX Tokenomics, Messari, accessed 29 September 2023.

- Phemex Team, What is dYdX: An Order Book Decentralized Exchange (DEX), Phemex Academy, accessed 29 September 2023.

- Griffin Mcshane, What Is dYdX? Understanding the Decentralized Crypto Exchange, Coindesk, accessed 29 September 2023.

- Tyler McCracken, dYdX Review 2023: The #1 DEX for Perpetual Traders, Coin Bureau, accessed 2 Oktober 2023.