Have you ever imagined owning a blue chip NFT like CryptoPunks by only spending around 10 US dollars? Apparently, it’s possible thanks to fractional NFTs (F-NFTs). The concept of fractional NFTs allows CryptoPunks NFT owners to divide their ownership into pieces and sell them as tradable fractional NFTs. In this article, we will dive deeper into what fractional NFTs are and their various exciting uses.

Article Summary

- 🖼️ Fractional NFTs (F-NFTs) are a form of NFT that allows owners to divide their NFT into small tradable pieces.

- 🪙 The fractionalization process involves dividing a standard NFT (typically using ERC-721 or ERC-1155) into smaller fractions in the form of ERC-20 tokens via smart contracts.

- ✨ Fractional NFTs allow retail investors to invest in blue chips NFTs that are unaffordable to small investors

- 🤑 F-NFTs open up opportunities within various sectors. Players, investors, and collectors can own shares of virtual assets, game characters, real property, artwork, and more.

What is Fractional NFT?

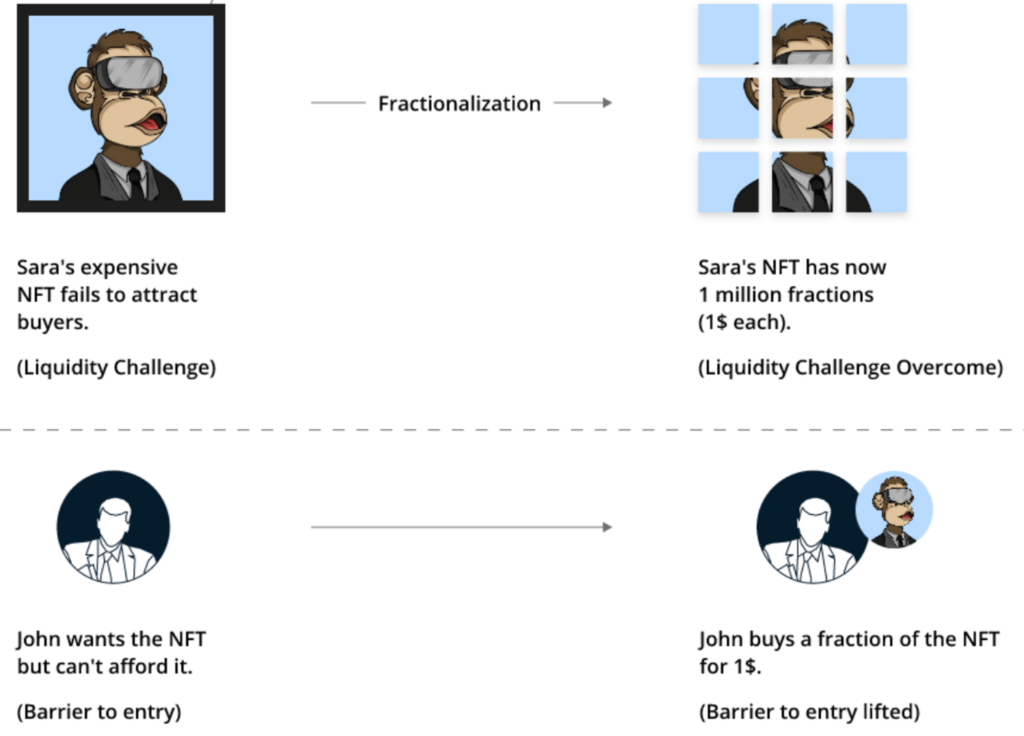

Fractional NFTs (F-NFTs) are a form of NFT that allows owners to divide their NFT into small tradable pieces.

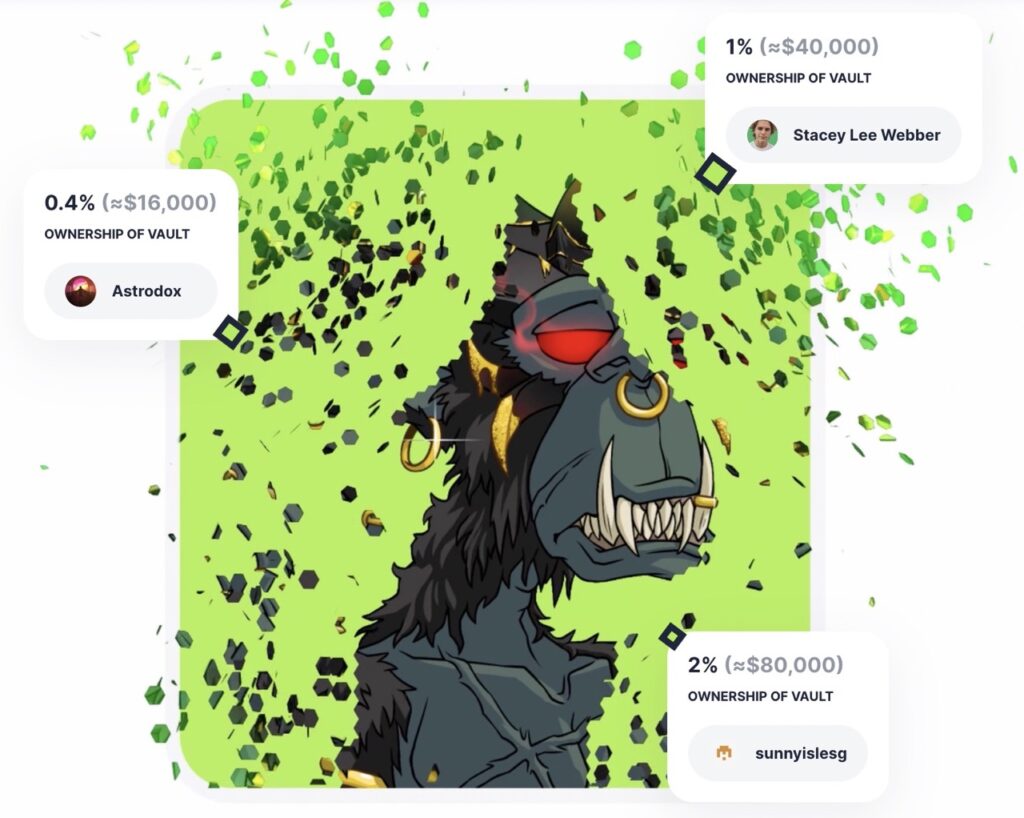

In other words, an NFT owner can divide his NFT into small pieces or “fractions.” It allows several users to invest in the same NFT using percentage ownership.

Blue chip NFTs, such as BAYC, Cryptopunks, DeGods, and others, are expensive. With fractional NFTs, users can own a fraction of those NFTs at a cheaper price. As such, fractional NFTs make it easier for retail investors or individuals to participate in blue chip NFTs investments.

You can also find other forms of NFT in this article.

How Does Fractional NFT Work?

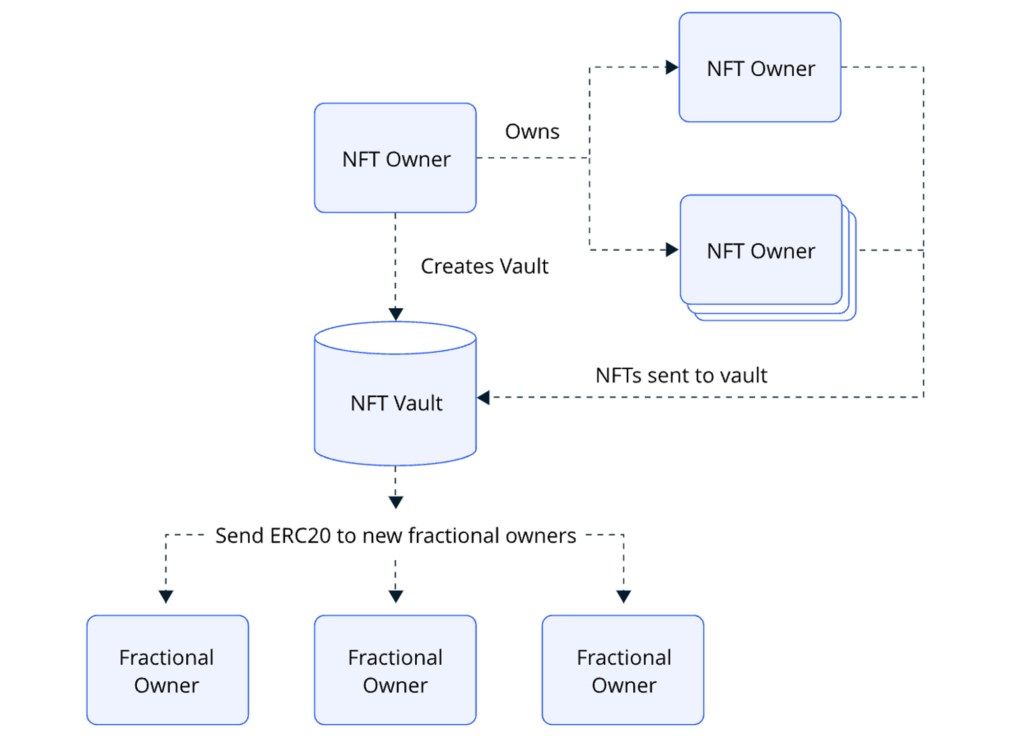

Before NFTs were fractionalized, they were locked in smart contracts. NFTs generally use the ERC-721 (also ERC-1155) token standard on the Ethereum blockchain. The fractionalization process involves dividing ERC-721 NFTs into smaller pieces in the form of ERC-20 tokens through smart contracts.

NFTs that are fractionalized will be ERC-20 tokens. For example, The Doge NFT, the fractional token is DOG, and the Mutant Cats NFT is FISH. The fractional NFT creator can specify the ticker of such tokens.

NFT owners can create fractional NFTs using fractional NFT creation platforms such as Fractional.art, Unic.ly, NFTX, and others.

Here’s how fractional NFTs are generally made:

- NFT Divide: Let’s say a person owns an NFT worth 100,000 US dollars. He wants several other people to invest in his NFT without buying the whole NFT.

- Fraction Creation: The NFT owner creates a fraction of the main NFT. For example, this main NFT worth 100,000 US dollars can be divided into 100 fractions, each representing ownership of 1% of the main NFT.

- Co-Investment: Other users can purchase one or more of these fractions. For example, a user can buy five fractions with an investment of 5,000 US dollars.

- Ownership and Dividends: Fraction owners share ownership of the main NFT and potential profits from its increase in value. If the main NFT increases in value to 200,000 US dollars, fraction owners will see their assets increase proportionally. Additionally, suppose the NFT generates revenue, such as royalties, from the sale of its digital reproductions. In that case, the revenue will be distributed to the fraction owners according to their proportion of ownership.

Use Cases of Fractional NFT

- Gaming and Entertainment: Players can invest in rare in-game items or virtual characters through F-NFT ownership. It opens up the opportunity to benefit from the rising value of in-game assets.

- Real Estate: Investors can own a fraction of real property through F-NFTs, easing access to real estate investments.

- Art and Collectibles: F-NFTs allow users to invest in expensive artwork or collectibles with F-NFT ownership.

- Music and Sports: Fans can invest in their favorite artists, athletes, or teams through F-NFTs, following their potential success.

- Metaverse and VR: F-NFTs create a digital economy within the metaverse, enabling ownership of virtual assets with real-world impact.

Examples of Popular Fractional NFT

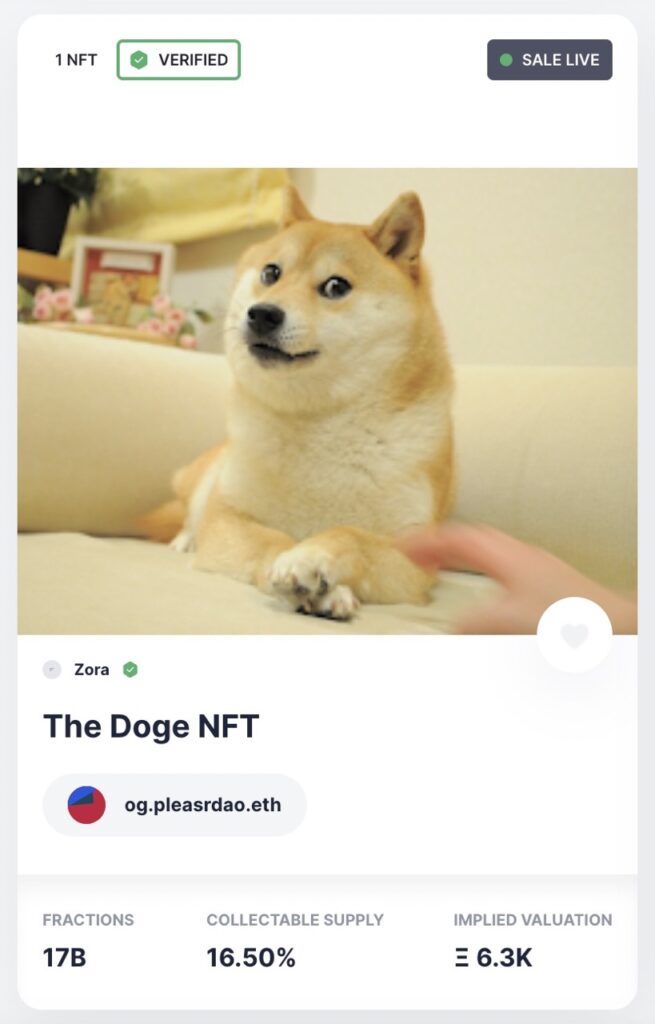

Doge Meme NFT

Doge NFT portrays Kabosu, a Shiba Inu who became a global meme. The story begins with his owner, Atsuko Sato, accidentally taking a picture of him. It inspired Dogecoin, a crypto asset with Kabosu’s facial symbol. In June 2021, Atsuko Sato sold this meme as an NFT to PleasrDAO for 4 million US dollars. PleasrDAO then fractionalized it into 17 billion with the ticker token DOG, allowing collectors to own a piece of this iconic NFT.

Newborn 1 & 3

Canadian musician Grimes’ NFTs, Newborn 1 & 3, which were valued at 6,400 US dollars, are now fractionalized on Otis for 10 US dollars per fraction.

CryptoPunks

There are only 10,000 CryptoPunks NFTs in existence, which is expensive enough for small investors to afford. However, with F-NFTs, small investors can partially own the NFTs.

In April 2021, 50 CryptoPunks were divided into 250 million uPUNK tokens on Unicly. Some CryptoPunks owners divide their NFTs into more than 8 million fractions. As a result, users can invest in CryptoPunks for only about 10 US dollars!

Regarding exclusive access to the NFT community and other benefits, such as voting rights, it depends on the NFT and the platform where the F-NFT is purchased.

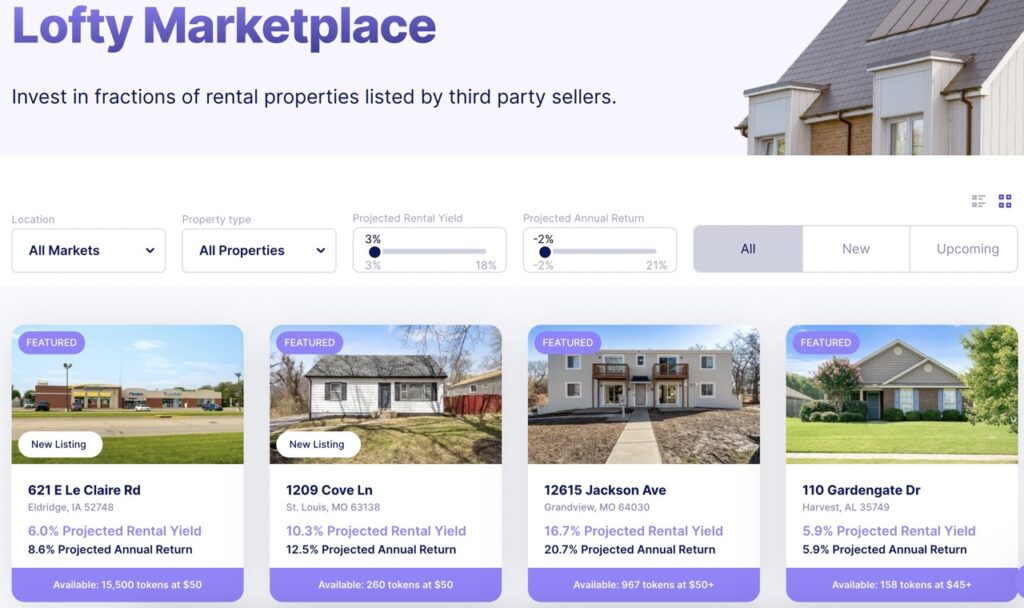

Lofty AI

Lofty AI is a platform that allows users to acquire small ownership of properties in the United States. Through this platform, investors can receive tokens as fractions of properties using Algorand blockchain technology.

Users can choose a property on the Lofty AI marketplace and purchase ownership of the property (F-NFT) with a minimum of 50 US dollars. Lofty AI is an alternative to traditional real estate investing, allowing individuals to invest without having to allocate a significant amount of funds.

Read also: RWA: Bridging Real-World Assets to the Digital World through Blockchain Technology.

Advantages of Fractional NFT

- Accessibility To Expensive Assets: F-NFTs allow individuals to invest in digital assets that may be too expensive to purchase. For example, a digital painting worth millions of dollars could be purchased by multiple investors by sharing ownership through fractions.

- Liquidity and Trade: With tradable F-NFTs, liquidity can increase as F-NFT tokens can be bought and sold on liquidity pool platforms such as Uniswap and Sushiswap. It opens up new opportunities for traders and investors.

- NFT Owner Incentives: NFT owners who divide their NFTs into fractions will receive curator fees from their chosen NFT platform.

- Connection with Physical Assets: F-NFTs connect the digital world with the real world by allowing owners to invest in physical assets represented by NFTs, such as real estate properties or physical collectibles.

Challenges of Fractional NFTs

If an NFT owner wants to reconstitute his NFT fractions, he can buy them all from the buyers. However, if he fails to reconstitute them, the solution is a buyout auction.

Before dividing his NFTs, the NFT owner has set a reserve price, which is the minimum price for the NFTs at auction. At the buyout auction, potential buyers must bid above this minimum price.

The current owner of the F-NFT can retain its ownership by bidding at a higher price. Otherwise, all the fractions will be merged back into a whole NFT and transferred to the NFT owner. It is quite complicated for NFT owners to reconstitute their NFT fractions.

In addition, another challenge is the issue of regulation. Quoted from Cointelegraph, US regulators may slow the adoption of F-NFTs. Since F-NFTs allow people to own a fraction of an asset, they could be classified as stocks by the United States Securities and Exchange Commission (SEC).

Conclusion

Fractional NFTs (F-NFTs) present the unique ability for NFT asset holders to fragment ownership into smaller, tradable units. This revolutionary approach not only renders investment in high-value assets more financially feasible but also opens opportunities to unexplored prospects.

Renowned NFTs like Doge NFTs and CryptoPunks have already undergone the fractionalization process, ushering in an era where everyday investors can engage with assets that once catered exclusively to those with substantial capital. Nevertheless, navigating challenges persists, particularly concerning the regulatory framework and the cohesive reassembly of these fractionated assets.

Buying Crypto Assets on Pintu

You can invest in crypto assets such as DOGE, BTC, ETH, and others without worrying about fraud on Pintu. In addition, all crypto assets on Pintu have passed a rigorous assessment process and prioritize the principle of prudence.

The Pintu application is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download the Pintu app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on the Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

References

- Akash Takyar, Fractional NFTs, Leeway Hertz, accessed 29 Agustus 2023.

- Anthony Clarke, Fractional NFTs and what they mean for investing in real-world assets, Cointelegraph, accessed 29 Agustus 2023.

- Ekin Genc, How Can You Share an NFT? Fractional NFTs Explained, Coindesk, accessed 29 Agustus 2023.

- Masterworks Team, What Are Fractional NFTs? (How They Work, Pros & Cons), Masterworks, accessed 30 Agustus 2023.

- Adele, Fractionalized NFTs: How to Invest In a Cryptopunk With Only $10, NFT Evening, accessed 30 Agustus 2023.