Amid growing interest in tech stocks, access to large companies like Alphabet Inc. is still limited by exchange hours, capital requirements, and traditional brokerage processes. Tokenized stocks like GOOGLX have emerged as a more flexible alternative, offering an on-chain representation of Alphabet’s Class A shares with more open, anytime trading access. This article briefly discusses Alphabet, how GOOGLX differs from GOOG, how it works, its recent performance, and the potential benefits and risks to understand.

Article Summary

- 🧩 Alphabet has two main share classes, GOOG and GOOGL-the only difference is the voting rights.

- 🔗 GOOGLX is a tokenized version of Alphabet Class A shares that follows GOOGL prices in real time. 🔗

- ⏱️ GOOGLX trading is flexible, can be 24 hours and bought fractionally with USDT.

- ⚠️ GOOGLX does not pay voting rights or dividends, and its price may deviate due to liquidity.

- 📈 Alphabet’s fundamentals are strong, demonstrated by its large market cap and consistent buyback trend.

Alphabet Inc: The Tech Company Behind GOOG and GOOGL

Alphabet Inc. is a multinational technology company that houses Google LLC and strategic business units in internet, cloud computing, digital advertising, and advanced technology research. The company operates services used by billions of people, including the Google search engine, Android, Chrome, and various products supporting the global digital ecosystem.

In addition to the digital advertising business, which is the main source of revenue, Alphabet is also developing Google Cloud as an important growth pillar, especially through infrastructure services and artificial intelligence-based technologies. This diversification has allowed Alphabet to maintain a dominant position in three major sectors: AI, cloud computing, and advertising.

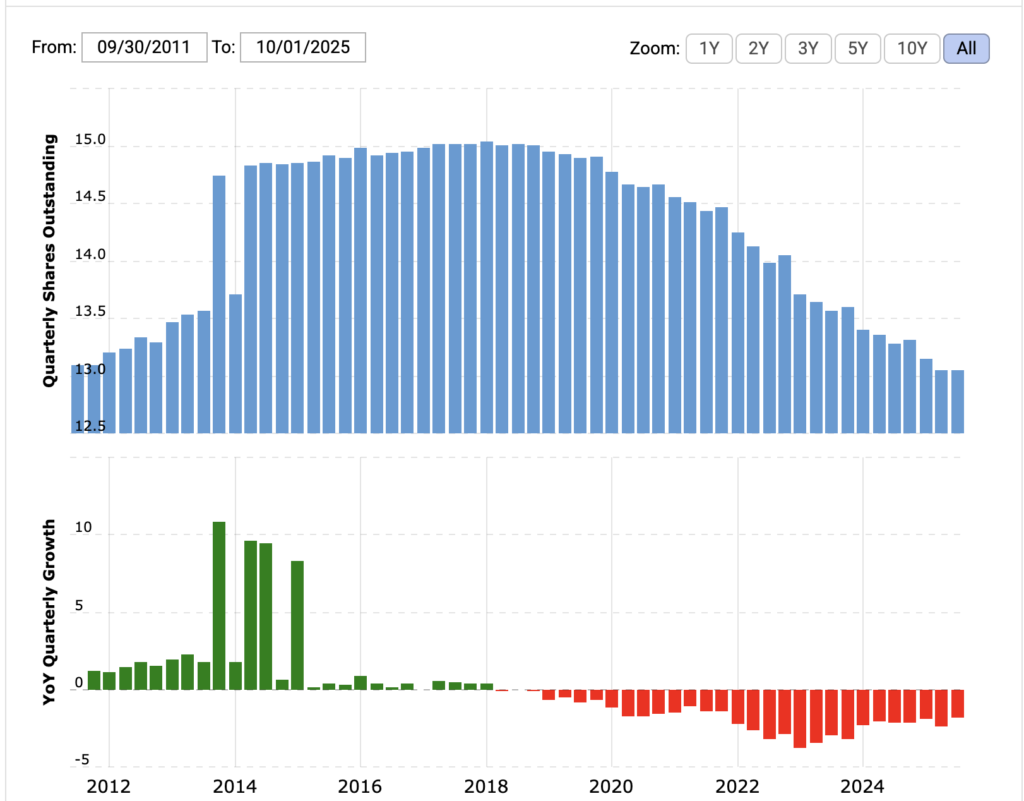

Development of Alphabet’s Share Count 2011 – 2025

The chart shows that the number of Alphabet shares outstanding increased from around 13 billion in 2011 and reached a peak of close to 15 billion in 2018-2019. After that period, the trend reversed to consistently decline until around 13 billion in 2025, reflecting the massive buyback program the company undertook to strengthen the value per share.

The annualized growth (YoY) portion shows a shift from share expansion in 2012-2014 to a sustained structural decline since 2018. The intense negative growth in the 2020-2025 period shows Alphabet’s focus on reducing the number of outstanding shares.

GOOG vs. GOOGL: Why Are There Two Classes of Alphabet Stock?

Alphabet Inc. has two classes of public stock, GOOG and GOOGL. Both represent ownership in the same company, but have different voting rights. This two-class structure was created to keep the founders and management in control of the strategic direction of the company even though its shares are widely traded in the public market.

Why Companies Use Multiple Share Classes

Some companies choose to have more than one class of shares to maintain internal control. When a company IPOs or issues new shares, the founder’s ownership may be diluted. By creating share classes with different voting rights, founders can retain control even if they sell some of their shares. Alphabet is one of the most recognizable examples of this structure.

GOOG and GOOGL difference

| Aspects | GOOGL (Class A) | GOOG (Class C) |

|---|---|---|

| Voting Rights | There is voting right | Do not have voting rights |

| For Investors | Suitable for those who still want the right to vote | Suitable for investors who do not prioritize voting rights |

| Ticker Symbol | GOOGL | GOOG |

Relevance of Alphabet Share Class and On-Chain Access via GOOGLX

Alphabet also has Class B shares that are not publicly traded and are owned by the founders, such as Larry Page and Sergey Brin. This class has much greater voting rights, so while the economic ownership is not dominant, control of the company remains in their hands. This makes voting rights on GOOGL less influential on the company’s strategic decisions.

For most investors, the difference between GOOG and GOOGL is insignificant as they represent the same economic value and move almost in tandem. The choice is usually based on a more attractive price or a preference for voting rights with limited effect.

With Alphabet’s steady performance and continued interest from global investors, access to its shares through traditional markets can be challenging for some users. Through tokenized shares like GOOGLX, investors can gain exposure to Alphabet’s value movements on-chain without the need to purchase physical shares directly.

What is Alphabet Tokenized Stock (GOOGLX)?

GOOGLX is a tokenized version of Alphabet’s Class A shares traded on the Solana (SPL) and Ethereum (ERC-20) networks. The token gives crypto users easy access to stock exposure with 24/7 trading and fractional purchases, while not granting direct ownership rights.

The GOOGLX price is pegged to the market value of Alphabet’s shares and is backed by real shares held by regulated custodial institutions. This tokenization model combines traditional financial infrastructure with the flexibility of cryptocurrencies, making it an alternative for investors looking to gain global stock exposure on-chain.

How GOOGLX Works

GOOGLX links Alphabet’s stock price to a digital token through blockchain technology. The token is created so that its value follows the movement of Alphabet shares in real time. The original GOOGL shares are held by a regulated custodian to maintain price matching. As such, GOOGLX reflects the performance of Alphabet stock in general.

GOOGLX transactions run on the Solana and Ethereum networks which are known for being fast and secure. This mechanism allows trading to take place at any time without the constraints of traditional market hours. Occasionally, small price differences may arise due to crypto market volatility. However, the design ensures that GOOGLX moves in line with Alphabet’s share price.

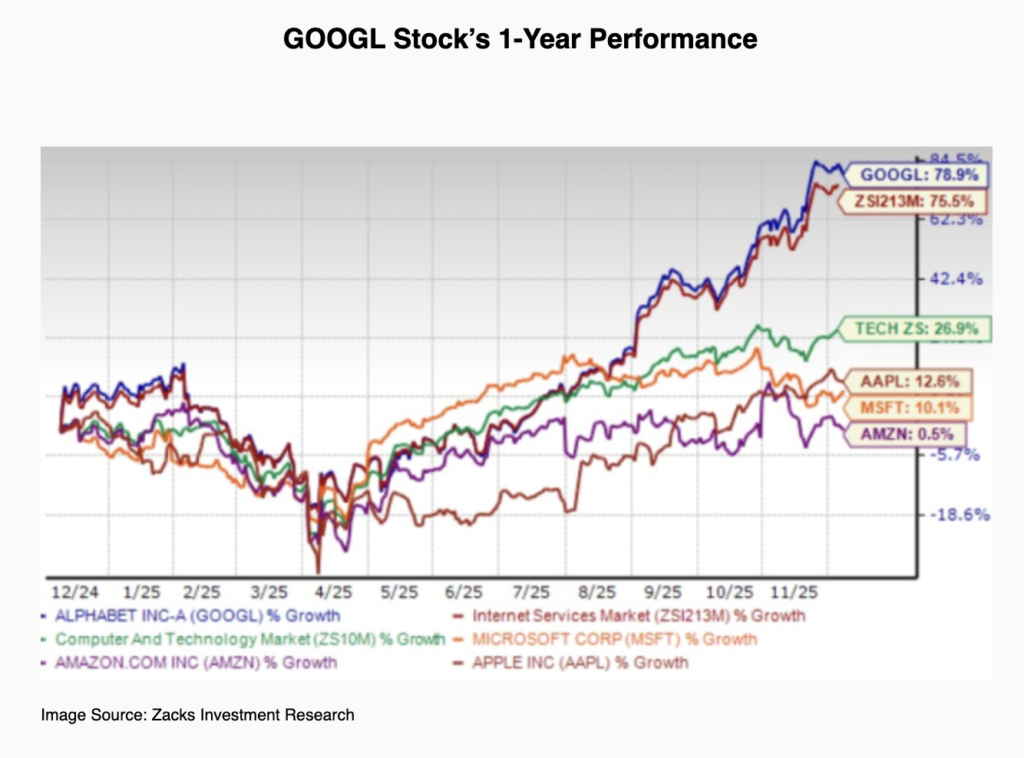

GOOGL’s One-Year Stock Performance Compared to Major Tech Issuers

The chart above shows that Alphabet Inc. (GOOGL) stock grew by about 78.9% in one year, making it the highest among its comparators. The significant gains started to be seen in the middle of the year and got stronger after September.

Compared to Apple, Microsoft, and Amazon, GOOGL’s performance was much more dominant. AAPL grew 12.6%, MSFT 10.1%, and AMZN only 0.5% over the same period. This difference reflects Alphabet’s strong momentum, driven by the expansion of AI services, the growth of Google Cloud, and operational efficiency. In the past year, Alphabet has emerged as one of the growth leaders in the technology sector.

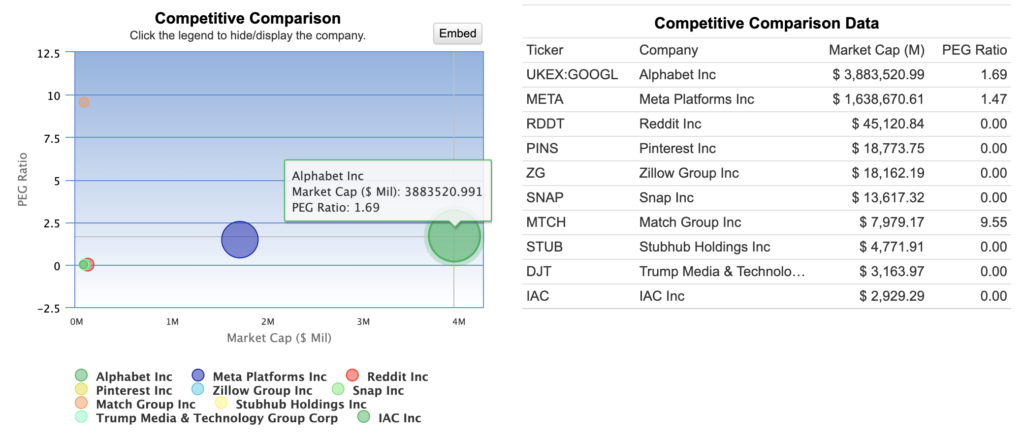

Alphabet’s PEG Ratio Comparison with Other Tech Companies

According to the data, GOOGL’s PEG Ratio comparison occupies a strong position through a PEG Ratio of 1.69 and a market capitalization of around US$3.88 trillion. This value shows a relatively balanced combination of earnings growth and valuation, and is slightly above Meta Platforms, which recorded a PEG Ratio of 1.47.

While many other companies on the list have a PEG Ratio close to zero or very high, GOOGL’s position emphasizes its fundamental stability and prospects which are more scalable than most of its competitors.

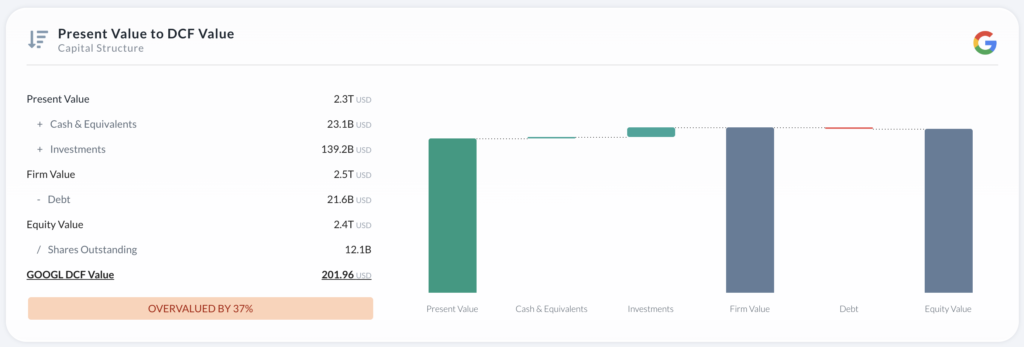

DCF Value GOOGL

According to Alpha Spread data, the Discounted Cash Flow (DCF) estimate for GOOGL shares shows that the company’s current value comes from projected future cash flows of around US$2.3 trillion, plus cash and cash equivalent holdings of US$23.1 billion, and investments worth US$139.2 billion.

These components result in a firm value of around US$2.5 trillion, which is then reduced by total debt of US$21.6 billion to obtain an equity value of around US$2.4 trillion. When the equity value is divided by the number of outstanding shares of 12.1 billion, GOOGL’s fair value based on the DCF model is around US$201.96 per share. Thus, the current market price is estimated to be about 37% overvalued compared to the intrinsic value according to this model.

Recent Performance of Alphabet Inc (GOOGL)

The latest data from Stock Analysis shows the strong performance of Alphabet Inc.’s (GOOGL) stock, which rose about 81.49% in one year, moving from a range of US$140 to US$317 with a consistent upward trend since mid-year. Fundamentally, Alphabet recorded revenues of US$385.48 billion, net income of US$124.25 billion, EPS of 10.14, and P/E of 31.29, reflecting a premium valuation with solid growth prospects. The annual price range of US$140.53-328.83 shows volatility but remains in a positive trend.

Gemini 3 Domination and Google’s TPU Technology Leap

Gemini 3, which Google released in late 2025 and is trained with Ironwood’s TPUv7, showed superior performance on various frontier AI benchmarks, even surpassing some recent versions of ChatGPT according to a DigiTimes report. This new generation of TPUs is also considered to offer cost efficiency and performance that challenges the dominance of Nvidia GPUs, thus strengthening Google’s position in large-scale AI model development.

Gemini 3 adoption increased rapidly after launch reaching 650 million users by October 2025, as Geeky Gadgets noted, making this model a key driver of Google’s AI services ecosystem. In December 2025, Geoffrey Hinton stated that Google was beginning to surpass OpenAI in the AI race, with Gemini 3 and its internal computing infrastructure being an indicator of the company’s significant progress.

Potential Rewards and Risks of Investing in GOOGLX

Investing in GOOGLX offers a combination of crypto-asset flexibility and exposure to Alphabet’s valuation. However, like any tokenized instrument, it has advantages and risks that need to be understood.

Advantages

- GOOGLX’s 24-hour trading hours GOOGLX can be traded at any time without being tied to traditional stock market opening hours, allowing users to respond to price movements with more flexibility.

- Flexible transactions with USDT Users can buy and sell GOOGLX using USDT, eliminating the need to deposit USD through the banking system.

- Blockchain-based technical transparency The process of issuing and settling transactions takes place on the blockchain network, providing a higher level of transparency and trust than off-chain instruments.

Risk

- GOOGLXshares are not genuine shares and therefore do not give rights to dividends, voting or ownership of the company.

- Potential price deviation due toliquidity Under certain market conditions, the price of GOOGLX may deviate from Alphabet stock due to differences in demand and supply in the crypto market.

GOOGLX provides a new way to gain exposure to Alphabet’s valuation through an on-chain mechanism. It combines traditional stock price logic with the liquidity and accessibility of cryptocurrencies. For users who want to follow Alphabet’s value movements through blockchain channels, GOOGLX could be an option worth learning more about.

Google Plans to Launch ‘Project Aura’ in 2026

Google plans to launch AI-powered glasses in 2026 in an attempt to return to the smart glasses market after the failure of Google Glass in 2015. Two models are being prepared, namely a Gemini-based audio-only version and a version with information display directly on the lenses. The product is being developed with Samsung, Gentle Monster, and Warby Parker.

Google allocated around Rp2.49 trillion for the partnership with Warby Parker as part of the device’s development. The glasses will run on Android XR and are designed to provide navigation, translation and AI assistant responses in a more practical manner. The AI wearables market itself is growing fast, with global sales rising more than 250% by the first half of 2025 according to Counterpoint Research.

The launch of Google’s AI glasses in 2026 is an important development for Alphabet valuation monitors, including investors in tokenized stocks like GOOGLX. Since GOOGLX tracks Alphabet’s Class A share price, product innovation and business expansion can be directly reflected in its value movements. This development adds context for investors who utilize on-chain access to follow company dynamics.

How to Buy GOOGLX on the Pintu?

At Pintu, GOOGLX purchases can start as low as Rp11,000, allowing users to gain exposure to Alphabet’s valuation without a large capital outlay.

In addition to GOOGLX, Pintu also provides various other tokenized stocks such as AMZNX, AAPLX, QQQX, and other similar assets through the Market Tokenized Stocks page, allowing users to easily access various global stocks in on-chain form.

Here’s an easy way to buy GOOGLX on Pintu:

- Enter the Pintu homepage.

- Go to the Market page .

- Search and select Alphabet xStocks (GOOGX) crypto assets

- Enter the amount you wish to purchase, and follow the rest of the steps.

Conclusion

GOOGLX provides a blockchain-based alternative for users who want to gain exposure to Alphabet’s price movements without purchasing conventional shares. With 24-hour trading, the use of USDT, and a tokenization mechanism that tracks GOOGL’s valuation, this instrument offers a different way of accessing stock-based assets.

However, GOOGLX does not provide direct ownership rights such as dividends or voting rights, and its price movements can be affected by crypto market conditions. With these characteristics, GOOGLX can be considered as an option to understand or explore forms of on-chain exposure to equity-based assets.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- Gate.io. What Is GOOGLX? Exploring the On-Chain Evolution of Alphabet Stock. Accessed December 10, 2025

- Phemex. What is GOOGLX? Your 2025 Guide to Alphabet Tokenized Stock (xStock). Accessed December 10, 2025

- US News. GOOG vs. GOOGL: Why 2 Classes of Alphabet Stock?. Accessed December 10, 2025

- Coin Central. Alphabet (GOOGL) Stock: Google Plans 2026 Launch for AI-Powered Smart Glasses. Accessed December 10, 2025