The Solana ecosystem continues to grow massively. Jito has added to the variety of protocols available on the Solana network. Jito is a liquid staking protocol with the largest Total Value Locked (TVL) in Solana. It is also a pioneer in incorporating Maximal Extractable Value (MEV) into its reward structure. Curious about what Jito is and how it works? Check out the full review in the following article.

Article Summary

- 🌐 Jito is a liquid staking protocol built on the Solana network. It allows users to stake SOL and earn JitoSOL tokens in return. Users can use their JitoSol for various DeFi activities.

- 🔎 Jito also created the first MEV dashboard for Solana that aims to increase transparency and fair profit distribution.

- 🌟 Jito offers liquid staking and integrating borrowing/lending, and liquidity pool from other Solana’s protocols.

- 🚀 With the integration of MEV for rewards and the growing Solana ecosystem, Jito has promising potential in the future.

What is Jito?

Jito is a liquid staking protocol with a stake pool model built on the Solana network. When users deposit SOL tokens on Jito, they delegate their tokens to the stake pool. In return, they will earn a liquid stake token, Jito Staked SOL (JitoSOL).

Users can use JitoSOL for various activities in DeFi protocols. For example, for staking, lending and borrowing, and liquidity providers. The rewards obtained from these activities will be directly added to the value of the JitoSOL token. The process is similar to when users delegate their ETH to Lido Finance and get stETH in return.

For an explanation of how liquid staking works, you can learn more about it in the following article.

In addition, Jito also created the first MEV Dashboard for Solana. MEV, or Maximal Extractable Value, is the maximum value that a blockchain miner or validator can generate by including, excluding, or changing the order of transactions during the block production process. Jito can minimize the negative effects of MEV while distributing its benefits fairly and increasing transparency.

Jito’s innovation to MEV not only increases the potential revenue earned. It also increases liquidity and participation in on-chain governance for SOL holders. The integration puts Jito Network at the frontline of DeFi innovation on the Solana blockchain.

To understand how Jito works, you should first read about MEV and its explanation here.

History of Jito

Jito Labs is the team behind the creation of Jito. It was formed in 2021 by Lucas Bruder, an engineer who has worked in robotics and Tesla. However, after becoming interested in MEV, Bruder realized there was enormous potential to create an MEV system open to the public. Initially, MEV was a niche concept primarily employed by validators, but the Jito team hoped to create a streamlined system any investor could use.

In addition to Bruder, Anatoly Yakovenko, Co-Founder of Solana Labs, is also funding and involved in Jito. Solana Ventures and various other investors participated, and Jito Labs received US$ 10 billion in funding. With this success, the Jito Foundation was launched as a DAO that manages Jito Labs.

How Does Jito Work?

Jito has a unique approach to staking. It has stake pools to make the network decentralized and improve its performance. These stake pools are made up of one or more validator nodes. In exchange for joining the stake pools, users will get JitoSOL.

In addition, Jito also generates additional yield for stakers. This yield is derived from MEV searchers. This can be achieved thanks to Jito’s three-part product suite, which is designed to enable more significant revenue for validators.

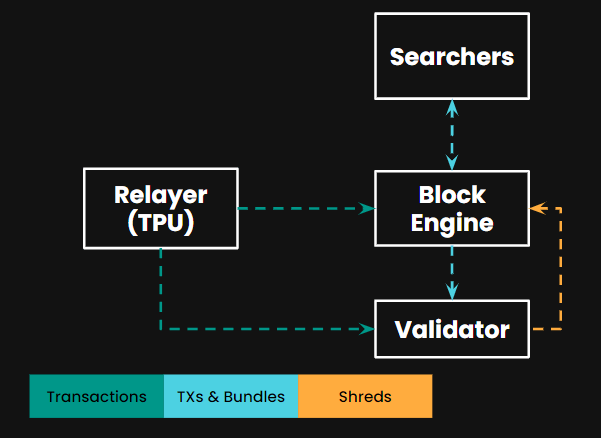

At the same time, it also eliminates unproductive network spam arising from MEV searchers. The three components are the Jito-Solana Validator Client, Jito Labs Block Engine, and Jito Relayer.

In this structure, Jito does an auction in every block, where MEV searchers bid for a sequence of transactions that they deem profitable. Then, the Jito Labs Block Engine runs simulations to determine the ideal combination of transactions that yields the highest rewards.

The final piece, the Jito Relayer, filters and verifies transactions on a separate server to reduce strain on validators. The transactions are then sent back to the Block Engine and validator.

All submissions sent by the MEV searcher then generate rewards for validators and stakers on the network. As a result, Jito stakers, and hence JitoSOL holders, will get a share of the related MEV auction results. Therefore, the rewards from staking SOL tokens in Jito can be more significant.

Want to become a validator? Check out the requirements and how it works here.

Jito Feature

Here are some of Jito features along with its DeFi ecosystem:

1. Staking

The main feature of Jito is Solana’s MEV-based staking service. Users lock JTO tokens and then get JitoSOL tokens. Jito will then use the locked tokens to earn rewards through its MEV products. Users will accrue value through JitoSOL as long as they hold it. However, they can also use the tokens in DeFi protocols. So, users can still use their capital while staking their Solana network tokens.

2. Borrowing/Lending Protocol

Jito Network also offers borrowing and lending protocols through Jito’s DeFi services. Various lending protocols such as Mango, MarginFi, Solend, Drift, and Kamino can be an option in Jito’s Defi Service.

Users can deposit or borrow JTO, JitoSOL, and SOL through these protocols. Borrowers can get additional funds for trading or other activities. While lenders will get rewards.

3. Liquidity Pool

In Jito’s DeFi Service, Jito Network has also collaborated with several protocols such as Orca, Kamino, and Raydium to create a liquidity pool. This allows users to re-stake their JitoSOL tokens.

In return, they will earn interest by becoming liquidity providers. Nominally, the amount may be smaller than the reward from MEV. However, for some users, the amount is much more reliable than the reward from MEV.

JTO Tokenomics

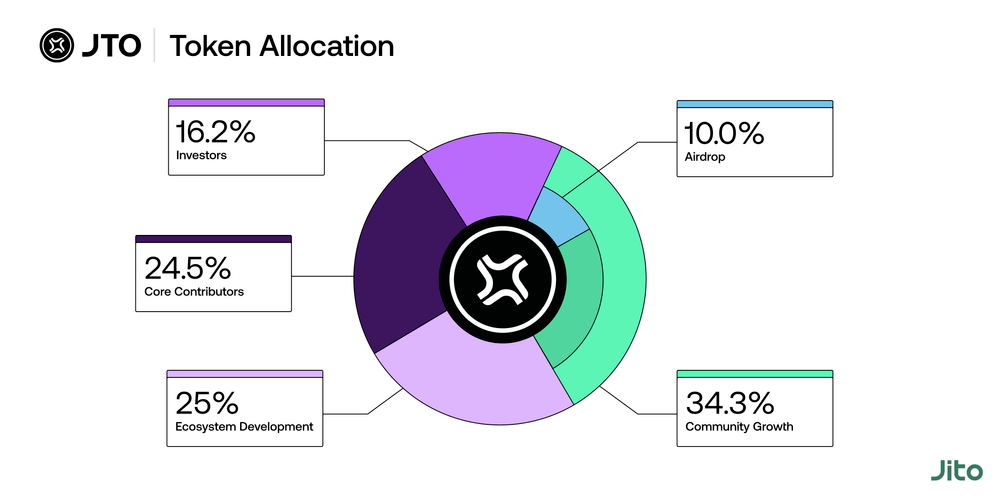

Jito Network has the JTO token as its native token. It serves as a governance token that allows community members to participate in the Jito DAO. The JTO token has a total supply of 1 billion tokens. Currently, only 115 million JTO tokens are in circulation.

Jito Labs allocates 25% of the overall supply to the development of the Jito ecosystem. Then, 24.5% and 16.2% were for core contributors and investors, respectively. Meanwhile, 34.3% is allocated for community growth, of which 10% has been distributed via airdrop on December 7, 2023.

When it was first launched, the JTO token was at US$ 1.79 and then immediately skyrocketed to its highest level of US$ 4.3. However, after that, the JTO token price gradually dropped and was US$ 2.64 when this article was written.

JTO Token as an Investment

From Jito’s official website, there are 82 validators in the Jito network. Then, the number of stakers in the stake pool is 112,951, with Total Value Locked (TVL) in the pool up to 6.32 million SOL.

So far, the number of Jito TVL is also on an upward trend. Based on Defi Llama data, Jito’s TVL on December 27, 2023, was at US$ 695.82 million. In early October 2023, the figure was still at US$ 51.23 million.

Compared to other liquid staking protocols, such as Lido Finance, Jito has a unique position. It is the first network to incorporate MEV into its reward structure. As a pioneer, this is Jito’s added value compared to other liquid staking protocols.

Another factor that makes Jito have great potential is the development of the Solana ecosystem. Many potential new protocols have recently grown and developed on the Solana network. This can trigger liquidity growth and the emergence of various new tokens. As a result, the market share for MEVs will continue to grow.

If the trends on the Solana network continue, we can expect a DeFi Summer, similar to what happened on the Ethereum network in 2022. Of course, this could be a positive catalyst for Jito and its liquid staking activities.

Are you interested in liquid staking protocols? Check out the technology and potential of the Lido DAO here.

Conclusion

Jito is a liquid staking protocol on the Solana network. It allows users to stake SOL tokens and receive Jito Staked SOL (JitoSOL) tokens in return. JitoSol tokens can be used for various DeFi activities, such as lending and liquidity provision. Jito also acts as the first MEV Dashboard for Solana, increasing transparency and fairness.

The main features offered by Jito include staking, borrowing/lending protocol, and liquidity pool. The JTO token serves for governance and participation in the Jito DAO. With its unique position in MEV integration and the growth potential of the Solana ecosystem, Jito has promising potential in the future.

How to Buy JTO Token on Pintu

After knowing what Jito is, you can start investing in JTO by buying it on the Pintu app. Here is how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for JTO.

- Click buy and fill in the amount you want.

- Now you have JTO!

In addition to JTO, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- Jito Docs, Introduction to Jito, accessed on 22 December 2023.

- Jito Blog, Jito Block Engine Expands Access to All Solana MEV Traders, accessed on 22 December 2023.

- Jito Blog, Announcing JTO: The Jito Governance Token, accessed on 22 December 2023.

- 0xKira, What is Jito? Liquid Staking Protocol on Solana, CoinMarketCap, accessed on 22 December 2023.