JPMorgan Chase Ondo Tokenized Stock (JPMon) is an innovative digital asset that brings traditional banking stocks into the blockchain ecosystem through tokenization. JPMon allows investors to gain exposure to JPMorgan’s prices and dividends through a global crypto protocol that operates 24 hours without the need for traditional brokers. In this article, we take an in-depth look at the history of JPMorgan Chase, how JPMon differs from traditional stocks, and how JPM stock has performed from 1996 – 2026!

Article Summary

- 🏦 As of early 2026, JPMorgan Chase leads the US banking market with $4 trillion+ in assets and a market capitalization of $840 billion.

- 🔗 JPMon is a tokenized stock that represents JPM’s share price on a 1:1 basis in the blockchain ecosystem.

- ⚙️ The JPMon mechanism supports 24/7 brokerless trading and is issued by Ondo Finance.

- 📊 Fundamentally, JPM stock remains bullish with $179.43 billion in revenue by 2025, although the P/E and P/S ratios are now above historical averages.

History of JPMorgan Chase

JPMorgan Chase began its history in 1799 with the Manhattan Company, but its modern identity was shaped by J.P. Morgan Sr. in the late 19th century as the architect of American finance. Its current strength is a result of the giant merger between J.P. Morgan & Co. (investment specialist) and Chase Manhattan Bank (commercial specialist) in 2000. This expansion was reinforced by strategic acquisitions during the 2008 crisis, such as the takeovers of Bear Stearns and Washington Mutual.

Under the leadership of Jamie Dimon, the bank now manages over $4 trillion in assets as of early 2026, making it the largest bank in the United States. The company’s focus has shifted towards future technologies, with billions of dollars of investments in generative AI and blockchain infrastructure for global transaction efficiency. As a market leader, JPMorgan Chase not only dominates retail and investment banking, but also serves as an anchor of global economic stability amidst the volatility of modern markets.

What is JPMon?

JPMon is an ERC-20 stock token that represents the economic value of JPMorgan Chase (JPM) shares in the blockchain ecosystem. It is typically issued by decentralized finance platforms such as Ondo Finance or other Real-World Assets providers. JPMon allows investors to gain exposure to JPMorgan’s price and dividends through a global crypto protocol that operates 24 hours without the need for traditional brokers.

JPMon is classified as a derivative instrument issued by a third-party entity with JPMorgan Chase (JPM) stock as theunderlying asset. It is fundamentally different from JPM Coin, which is JPMorgan Chase’s authorized blockchain technology-based payment infrastructure to facilitate the settlement of funds transactions between banking institutions.

JPM Traditional Shares vs Tokenized Asset JPMon Difference

| Features/Risk | JPM Shares (Traditional) | JPMon Token (Tokenized Asset) |

|---|---|---|

| Authorized Publisher | Published directly by JPMorgan Chase & Co. | Published by Ondo Finance. |

| Place of Transaction | New York Stock Exchange (NYSE) through Broker. | Crypto Exchange (DEX/CEX) or RWA Platform. |

| Trading Time | Monday-Friday, US market hours. | 24 Hours a day, 7 Days a week (Non-stop). |

| Shareholding | Legally registered as an authorized shareholder. | Indirect ownership (via smart-contract). |

| Voting Rights | Shareholders have voting rights at the GMS. | Usually do not have voting rights in the company. |

| Custodial Risk | Protected by SEC and SIPC (broker insurance) regulations. | It depends on the security of the Smart Contract and the crypto wallet. |

| Dividend Distribution | Directly into the customer’s fund account. | It is usually automatically reinvested into the token value. |

JPMorgan Chase Business Segments

JPMorgan Chase operates its business through four major segments that are highly integrated. This structure allows them to dominate the market from individual banking services to cross-border corporate transactions. Here is a breakdown of its major business segments as of 2026:

1. Consumer & Community Banking (CCB)

It is the public face of JPMorgan through the Chase brand. This segment serves more than 80 million consumers and 6 million small businesses in the United States.

- Services: Checking/savings accounts, credit cards (such as Chase Sapphire), mortgages, and vehicle financing.

- Digital Focus: Currently focusing on AI banking apps that provide personalized financial advice to retail customers.

2. Corporate & Investment Bank (CIB)

This segment is a global money machine that serves large corporations, governments, and financial institutions around the world.

- Investment Banking: Underwriting of IPOs, bonds, and mergers and acquisitions (M&A) consulting.

- Market Services: Asset trading (stocks, forex, commodities) and custodial services for institutional investors.

3. Asset & Wealth Management (AWM)

With assets under management (AUM) in the trillions of dollars, this segment focuses on long-term wealth management.

- Wealth Management: Exclusive services forultra high net worth individuals, including through the acquisition of First Republic.

- J.P. Morgan Asset Management: Management of pension funds, mutual funds and alternative investment strategies for institutional clients.

4. Commercial Banking (CB)

This segment is in the middle position, catering to medium to large-scale enterprises as well as commercial real estate developers.

- Services: Corporate lending, cash management and operational payment solutions.

- Specialization: They have specialized teams for specific industry sectors, such as technology, healthcare, and green energy.

Notes: JPMorgan also has a "Corporate" unit that manages corporate treasury and strategic investments in technology (such as their blockchain division, Onyx).

JPM Stock Performance from 1996 – 2026

Here is how JPM stock has performed from 1996 – 2026, ranging from market cap growth, earnings trends to its P/E and P/S ratio:

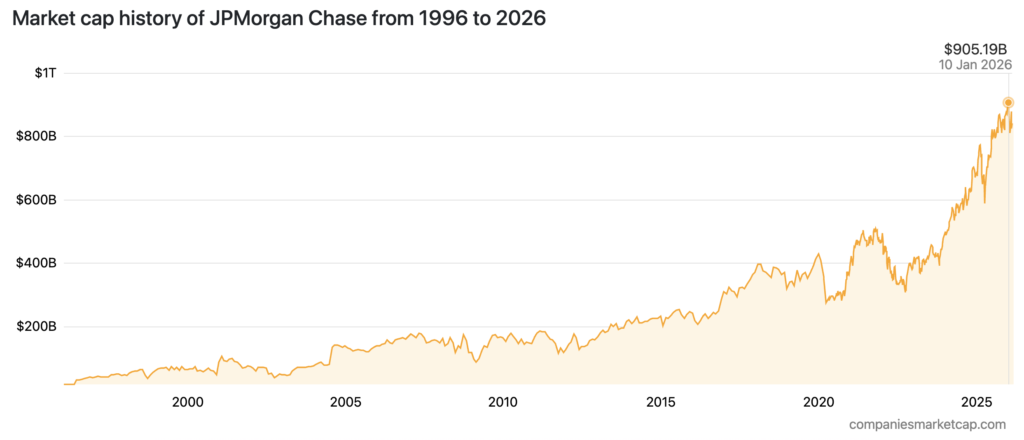

JPMorgan Chase Market Capitalization Growth (1996-2026)

This chart shows the growth trend of JPMorgan Chase’s (JPM) market capitalization over three decades, from 1996 to February 2026. Overall, the company’s valuation is moving in a long-term bullish trend, with significant spikes beginning after 2020. As of February 2026, JPM peaked at $840.58 Billion USD, making it the 15th most valuable company in the world.

Despite showing massive growth, the journey has seen some fluctuations, such as sharp corrections around 2008 (financial crisis) and 2020. However, the post-2023 recovery looks very aggressive, where the chart shows an exponential rise breaking the $800 Billion barrier. This reflects strong market dominance and high investor confidence in the bank’s stability.

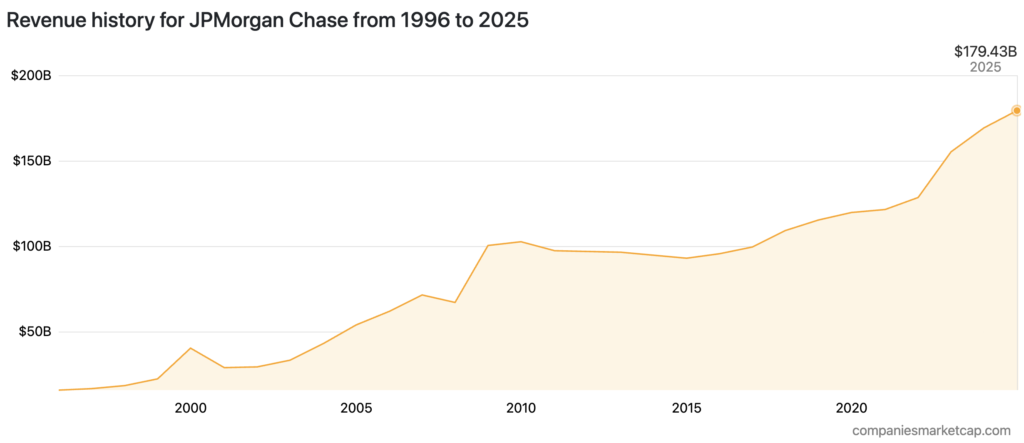

JPMorgan Chase Revenue Trends (1996-2025)

This chart displays JPMorgan Chase’s (JPM) revenue trajectory over nearly three decades, showing consistent growth from 1996 to 2025. The company reaches a new milestone with revenues reaching $179.43 Billion USD in 2025 (TTM). This figure reflects a sustained rise from previous years, where revenues were recorded at $155.29 Billion in 2023 and increased to $169.42 Billion in 2024.

The data visualization shows a very significant acceleration of income after 2020, where the curve rises more sharply than the stable period between 2010 and 2018. Despite minor fluctuations during the early 2000s, the long-term trend remains upward. This indicates strong business expansion and the company’s ability to massively increase revenue generation in the past five years.

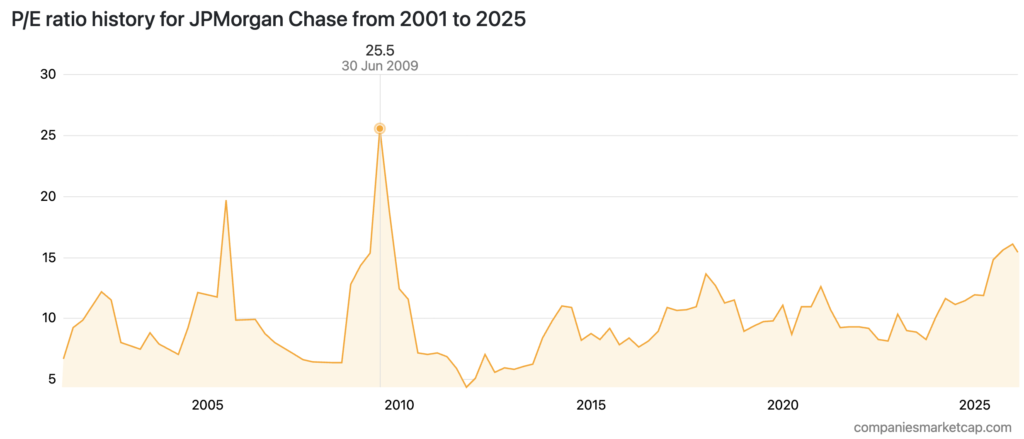

P/E and P/S Ratio of JPMogran Chase 2001 – 2025

The chart shows the fluctuation of JPMorgan Chase’s (JPM) P/E ratio from 2001 to February 2026, where the current figure stands at 15.4, a significant increase from the year-end 2024 figure of 11.9. Historically, this ratio experienced extreme spikes close to 25 during the 2008-2009 financial crisis, but has stabilized in the 5 to 15 range over the past decade.

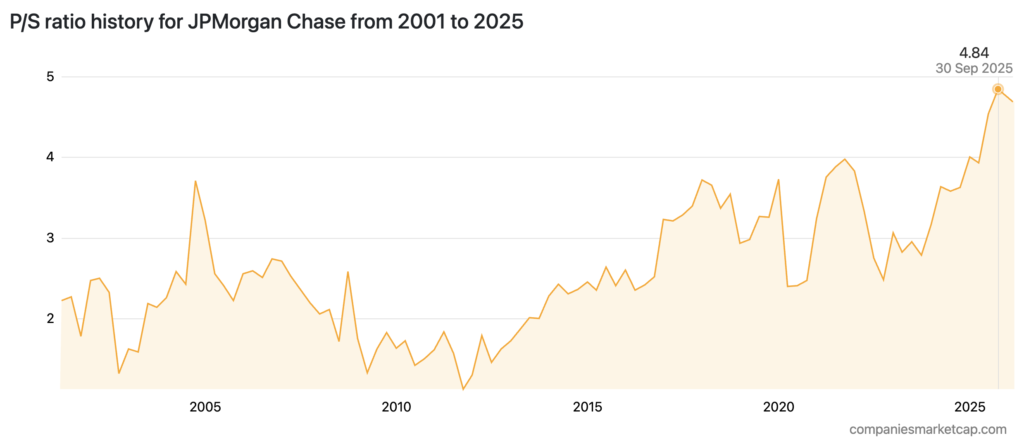

The historical chart of JPMorgan Chase’s (JPM) P/S ratio from 2001 to 2025 shows a long-term upward trend that peaked at 4.84 as of September 2025. Although the figure as of February 2026 has slightly corrected to 4.68, this ratio is still much higher than its historical average which was below 2.0 in the 2008-2012 period.

JPMorgan Chase Stock Performance According to Crypto Experts at X

- Chances of $JPM Rebounding at Crucial Support Levels

According to @Mr_Derivatives through his thread on X, J.P. Morgan Chase & Co. ($JPM) stock has the potential for a bounce play after its price corrected near two crucial technical support points. The chart shows the price movement testing the orange uptrend line and the 200dma as psychological support levels for investors. This condition is supported by the RSI indicator which is at a neutral level tending to be low (41.81).

- JPMorgan Stock Signals Saturation on the Weekly Chart

According to @ElliottForecast, JPM’s current share price movement is considered to have reached the saturation stage after experiencing a long rally since the lowest point in April. Based on the Elliott Wave analysis on the weekly chart, this upward trend is showing signs of price exhaustion and is expected to soon enter a correction phase in a three-wave structure (A-B-C). This technical decline is projected as a wave (2) cycle to seek a new equilibrium to support further price movement. The potential for continuation of this long-term positive trend remains valid as long as the price is able to hold above the invalidation level of $101.28.

- J.P. Morgan Predicts Gold Could Reach $8,000/oz

According to @oguzerkan through his thread on X, Ray Dalio suggests investors allocate 5-15% of the portfolio to gold as a protection against currency devaluation. This is reinforced by J.P. Morgan’s projection that gold prices could touch $8,000/oz if the average investor allocation reaches 4.5%. With debasement concerns still high, the upward trend in gold prices is not expected to stop anytime soon.

Tokenized Stock Regulation Like JPMon

Tokenized stocks like JPMon are viewed as digital securities instruments and generally remain subject to traditional securities rules despite being built on blockchain technology. In the United States, the Securities and Exchange Commission (SEC) asserts that blockchain-based securities must comply with federal securities laws, including registration and disclosure obligations when it comes to the underlying stock.

In Indonesia, the regulation of digital assets has undergone major changes with the adjustment of the legal framework by the Financial Services Authority (OJK). Since January 10, 2025, regulatory and supervisory authority over digital financial assets including crypto assets has been transferred from Bappebti to OJK based on Government Regulation No. 49 of 2024 and OJK Regulation No. 27 of 2024, which classifies crypto as digital financial assets and requires related activities to comply with OJK rules.

How to Buy JPMorgan Chase Ondo Tokenized Stock (JPMon) on Pintu?

At Pintu, JPMon purchases can start as low as Rp11,000, allowing users to gain exposure to JPMorgan Chase’s valuation without a large capital outlay.

In addition to JPMon Pintu also provides various other tokenized stocks such as TLTon, MAon, and other similar assets through the Market Tokenized Stocks page, allowing users to easily access various global stocks in on-chain form.

Here’s how to easily buy JPMon on Pintu:

- Enter the Pintu homepage.

- Go to the Market page .

- Search and select the JPMon crypto asset .

- Enter the amount you wish to purchase, and follow the rest of the steps.

Conclusion

As of early 2026, JPMorgan Chase solidified its dominance in the US banking market with fantastic assets exceeding $4 trillion and annual revenue reaching $179.43 billion. While fundamental indicators remain bullish, investors need to be mindful of P/E and P/S ratios that have now surpassed their historical averages. A modern solution is JPMon, which represents JPM shares on a 1:1 basis on the blockchain ecosystem to enable 24/7 trading without intermediaries. The technology also facilitates reinvestment through an auto-compounding dividend feature that is efficiently managed by smart contracts.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- BitTime. What Is JPMON and How to Buy JPMON on Bittime. Accessed February 19, 2026