The current competition in the layer-1 blockchain sector is not as hot as it was during the bull market in 2021. Ethereum proved to remain the dominant player in this sector. As the bear market has shown, better technology doesn’t guarantee network adoption, and many L1 users are declining. However, some L1s are not built to compete with Ethereum. Kujira is one L1 that offers different features than Ethereum and has a unique value proposition. So, what is Kujira? What is the function of the KUJI token? This article will explain it in detail.

Article Summary

- 👹 Kujira is an L1 built on top of Cosmos that offers various DeFi applications. Every DeFi app on Kujira has gone through a voting process by the Kujira governance to maintain its quality.

- ⚙️ Kujira offers features such as Native Token Generation, On-Chain Scheduler, semi-permissioned blockchain, and Kujira independent oracles. All these features make it easy to create and use applications on Kujira.

- ⚛️ Kujira has an ecosystem of DeFi applications such as ORCA, FIN, BOW, BLUE, GHOST, and POD, each with different functions.

- 💰 KUJI is a non-inflationary token thoroughly integrated into the Kujira ecosystem. KUJI staking provides rewards from app revenue, creating a sustainable capital flywheel system and providing benefits to token holders.

What is Kujira (KUJI)?

Kujira is a layer 1 blockchain built on the Cosmos network to facilitate decentralized financial activities. Kujira provides the infrastructure for development teams and users to transact in a secure and easy-to-use DeFi ecosystem. Currently, there are already eight applications in the Kujira DeFi ecosystem.

In addition, Kujira is a semi-permissioned blockchain because every new application must go through an approval process from Kujira’s governance system. Kujira does this to ensure every application on its platform is of high quality and in line with Kujira’s vision.

The word "Kujira" is Japanese for whale. Kujira's vision is "everyone can be a whale" as Kujira wants to democratize access to various types of financial activities for users.

Kujira itself is built using the Cosmos SDK, Tendermint BFT consensus, and integrated with Cosmos interchain communication (IBC). However, the creation of L1 Kujira only began after the downfall of Terra which had a significant impact on Kujira.

What happened with Terra forced the Kujira Team to create its L1 and realize its vision. Kujira wants to be a super apps platform with an ecosystem of apps that can fulfill all the needs of its users.

How does Kujira work?

Kujira operates using various frameworks provided by Cosmos such as modules in the Cosmos SDK, the Tendermint BFT consensus mechanism, and the IBC interoperability protocol. However, Kujira still makes modifications specific to DeFi. For example, Kujira changed the Cosmos SDK module to provide the ideal speed for FIN perpetual DEX.

The four main features of the Kujira blockchain are:

- Native Token Generation: Crypto developers no longer need to handle two entry points into their smart contracts. Every token created on Kujira automatically has the Cosmos token standard. Then, aspects such as liquidation and revenue from the platform (with more to come) will be automatically linked to the KUJI staker.

- On-Chain Scheduler: The development team can send automated instructions to execute specific transactions (e.g. every 2 blocks). This transactions scheduler reduces the need for bots and thus reduces the cost of operating the protocol.

- Semi-Permissioned: Unlike most L1 projects, not all teams can develop applications on Kujira. All projects must go through the Kujira governance process before continuing to build on Kujira. This process ensures the quality of projects that enter Kujira and prevents fraud that is rampant in many L1s.

- Kujira Oracle: The Kujira team builds its own price oracle to avoid relying on external data feeds such as Chainlink or Pyth Network. Then, the data is published by all Kujira validators and will be verified by 3 external parties to maintain its accuracy and security over time.

The above features show how Kujira is different from most other L1s. Kujira doesn’t bring cutting-edge innovations or the most sophisticated technology. Instead, Kujira focuses on small changes that have a big impact on its ecosystem.

Finally, an important aspect of how Kujira works is the connection with the Cosmos ecosystem through the IBC (Inter-Blockchain Communication) protocol. All applications in Kujira are connected to the Cosmos ecosystem. For example, you can stake all blockchains in Cosmos using the Kujira POD app.

Kujira Application Ecosystem

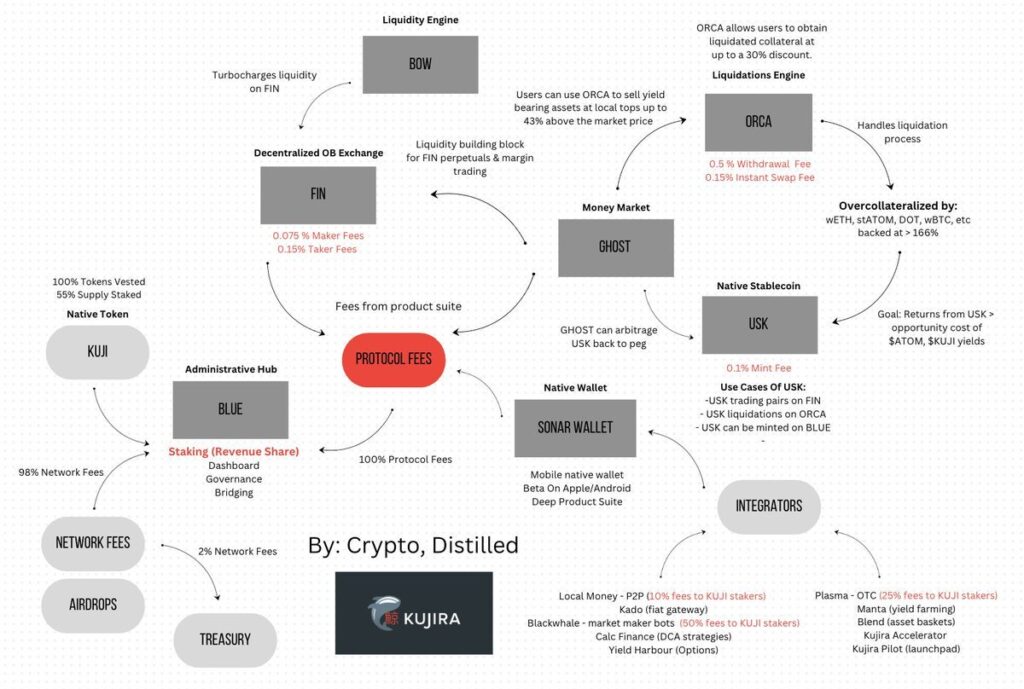

- ORCA: Orca is Kujira’s very first app for acquiring liquidated assets. You can get an asset at a discount of up to 30% by placing a bid for an asset that is about to be liquidated. With this, liquidated assets can re-enter the Kujira ecosystem, instead of being picked up by bots and sold immediately.

- FIN: FIN is the first DEX with an order book system in Cosmos. FIN utilizes arbitrage bots and market makers to provide deep liquidity for each asset. In emergencies, FIN utilizes the BOW application as a liquidity provider.

- BOW: BOW is an application that provides additional liquidity to FIN. The BOW liquidity provider will then get a portion of the transaction fee from FIN. In addition, the price range of BOW corresponds to the orders on the FIN application. This makes BOW liquidity pools more efficient than most DEXs. Users can also stake into liquidity pools that are incentivized by certain projects.

- BLUE: BLUE acts as the center of the Kujira ecosystem, displaying KUJI token data, governance systems, IBC bridges, swaps, and USK minting. You can do almost all activities on BLUE.

- GHOST: GHOST is Kujira’s money market where you can borrow and provide loans for various assets in Kujira.

- POD: POD is a KUJI staking application specifically designed to equalize validator voting rights. Users are encouraged to delegate to validators with small voting rights to support network decentralization. In addition, you can also stake all Cosmos blockchains connected to IBC on POD.

- USK stablecoin: Kujira is creating an overcollateralized stablecoin USK. USK utilizes various collateral such as KUJI, ATOM, etc. The USK collateralization rate must reach 166% of the minted USK value to prevent liquidation and maintain stability. In case of liquidation, users can purchase collateralized assets at a discount through ORCA.

The Potential of KUJI as an Investment

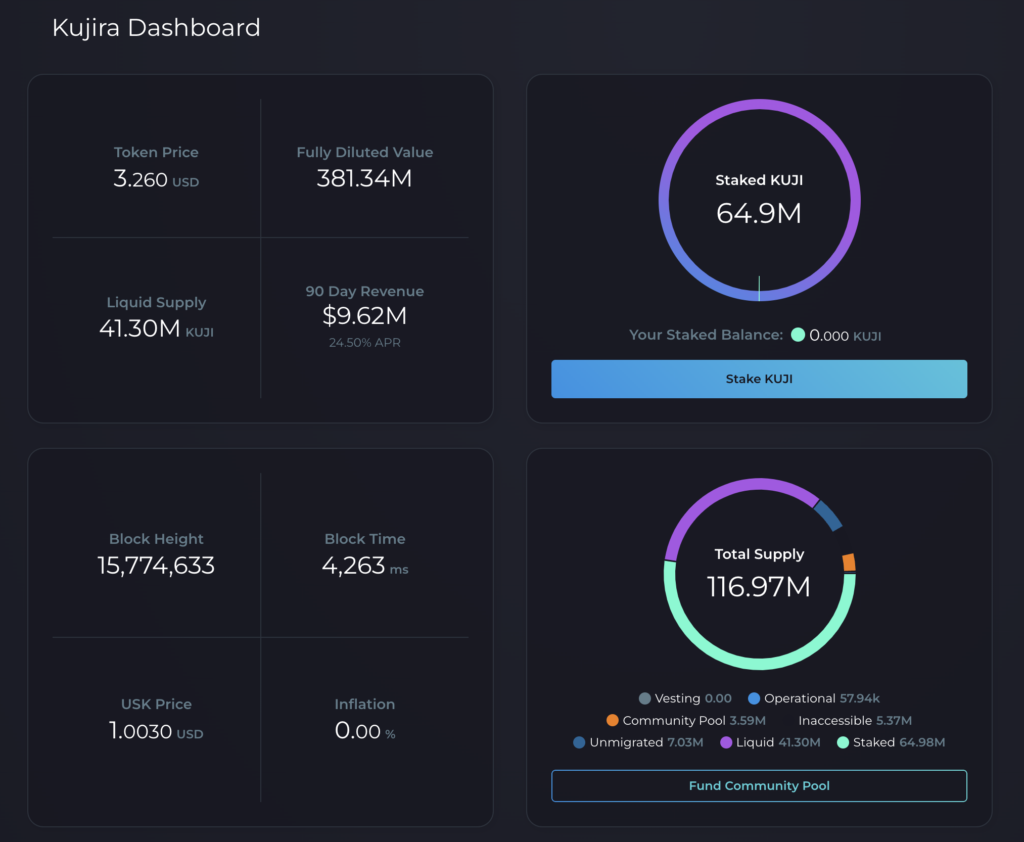

KUJI is the native asset of the Kujira ecosystem. KUJI is fully integrated into the KUJIRA ecosystem, from token staking, and governance, to tokens that collect protocol revenue. The supply of KUJI circulating in the market has reached 100%. This means that KUJI is a non-inflationary token as no more tokens are coming out as emissions.

Kujira is the only major cryptocurrency project that does not rely on token emission to incentivize rewards to its users. This is a policy that demonstrates Kujira's confidence in its products as the operation of the Kujira network depends on the revenue from all its products.

If no more KUJI tokens are released to the market, how does Kujira incentivize users and validators? This is what sets KUJI apart from other PoS (Proof-of-stake) network tokens. Kujira rotates almost all revenue from the apps in its ecosystem into KUJI stakers.

So, all the yield that users get comes from revenue from all Kujira apps. As pictured above, this process creates a sustainable system because rewards for users are not artificially created through token emission (which creates token value inflation). The amount of rewards is a real-time reflection of Kujira’s revenue.

KUJI plays an important role in the Kujira ecosystem and the fact that KUJI’s supply is already 100% makes KUJI have good tokenomics value. As in the image above, more than 50% of KUJI is locked in the staking system (Kujira investor tokens are also here).

Currently, Kujira has the 5th largest TVL in the Cosmos ecosystem. If you buy KUJI, that means you believe in the growth of the Cosmos ecosystem and the products within Kujira. In addition to buying tokens, you can participate in KUJI staking to earn additional profits and help secure the network.

Conclusion

Kujira is a layer-1 blockchain built on the Cosmos network. Kujira offers a DeFi ecosystem with diverse applications, adopting a semi-permission approach to ensure the high quality and security of its applications. The Kujira team focused on small but impactful changes, including the development of the KUJI token. The KUJI token is thoroughly integrated within the Kujira ecosystem, offering a non-inflationary token economy and sustainable turnover.

References

- “Kujira Empowers Everyone”, Kujira Docs, accessed on 28 November 2023.

- Beau Chaseling, “What is Kujira? Decentralisation meets Sustainable Fintech“, Zero Cap, accessed on 28 November 2023.

- Cryptowrit3r.x, “What is $KUJI? Kujira — the Blockchain for Real Yield“, Coinmonks Medium, accessed on 29 November 2023.

- Jaker Pahor, “Hottest project on Cosmos?“, Substack, accessed on 29 November 2023.

- @cryptostreahub, “Two protocols recently launched & received a lot of hype”, Twitter, accessed on 30 November 2023.