Amid the growing need for fast and responsive on-chain applications, many blockchains are still limited by high fees and slow latency. MegaETH is emerging as a much-talked-about innovation, offering a new approach to real-time execution within the Ethereum ecosystem. This article will take a deeper dive into what MegaETH is, what its technology and architecture looks like, MEGA tokenomics, and its impact on the Ethereum ecosystem!

Article Summary

- MegaETH delivers real-time execution with block times of 10-20 ms and >100,000 TPS.

- 🧠 Unique architecture with sequencer, full node, and prover makes the network more efficient and scalable.

- 🔐 Stateless validation & dual-client ensures lightweight validation without compromising security.

- 💰 MEGA tokens are for staking, gas fees, governance, and ecosystem drivers.

- 📈 Major investor support and high public interest strengthens MegaETH’s position in the Ethereum ecosystem.

What is MegaETH?

MegaETH is a high-performance Layer-2 blockchain on top of Ethereum designed to deliver speed, scalability, and real-time responsiveness. Unlike traditional rollups that process transactions in batches, MegaETH offers block times in milliseconds and a capacity of over 100,000 TPS, making the dApps experience feel as fast as Web2 applications.

The network is fully compatible with EVM, so developers can run Ethereum smart contracts without major changes. Execution is accelerated by high-speed internal infrastructure, while transaction finality remains secured by Ethereum. This approach enables applications such as high-frequency trading, real-time games, and AI agents to operate directly on the blockchain.

Origin of the MegaETH Project

The MegaETH project was founded by experienced researchers and developers, including Yilong Li, Lei Yang, and Shuyao Kong. MegaETH has also received widespread attention from the blockchain research community, backed by major investors such as Dragonfly Capital.

The project even received appreciation from Vitalik Buterin, one of the founders of Ethereum. It is this strong technical foundation and industry support that has driven MegaETH’s development to date.

The Technology Behind MegaETH

MegaETH achieves real-time performance through an architecture specifically designed for high speed and capacity. Instead of relying entirely on Ethereum’s throughput, it builds an optimized execution layer that can process transactions much faster than conventional rollups.

- Blazing-Fast Block Times

MegaETH targets block times of 10-20 milliseconds, well below the standard rollup which is generally around 2 seconds. This speed makes applications such as fast trading, on-chain gaming, and autonomous agents capable of instant response.

- Parallel Transaction Execution

Unlike most chain EVMs that execute transactions one by one, MegaETH uses multi-threading-based parallel execution. By utilizing multiple CPU cores at once, throughput can surpass 100,000 TPS in internal testing.

- Off-Chain Data Availability Layer

To reduce the data load on Ethereum, MegaETH moves data availability to an external layer. This approach improves efficiency, but has also been criticized for making it resemble a new Layer-1 rather than a fully Ethereum-dependent rollup.

- Ethereum-Anchored Finality

Although execution and data storage are performed outside of the mainnet, MegaETH still sends critical state updates to Ethereum. Thus, the network maintains Ethereum’s security, similar to the optimistic rollup mechanism adapted to its own infrastructure.

- EVM Compatibility & Lower Fees

Full compatibility with EVM allows developers to use Ethereum smart contracts and tooling without major customization. For users, transaction fees are projected to be lower due to execution and batching efficiency.

MegaETH takes a strategy that prioritizes real-time performance, although it reduces some aspects of decentralization. This approach offers great benefits for applications that require high speeds, but its sustainability and security at scale are still aspects that need to be proven as it moves towards the mainnet.

MegaETH Node Architecture

MegaETH is a Layer 2 solution that increases Ethereum’s capacity by overcoming bottlenecks like the straggler problem. With latency under one millisecond and over 100,000 TPS, it approaches the performance of modern web applications and delivers a “real-time Ethereum” experience. Through a more efficient consensus mechanism, MegaETH speeds up transaction confirmation, making it suitable for fast execution needs such as trading and DeFi applications.

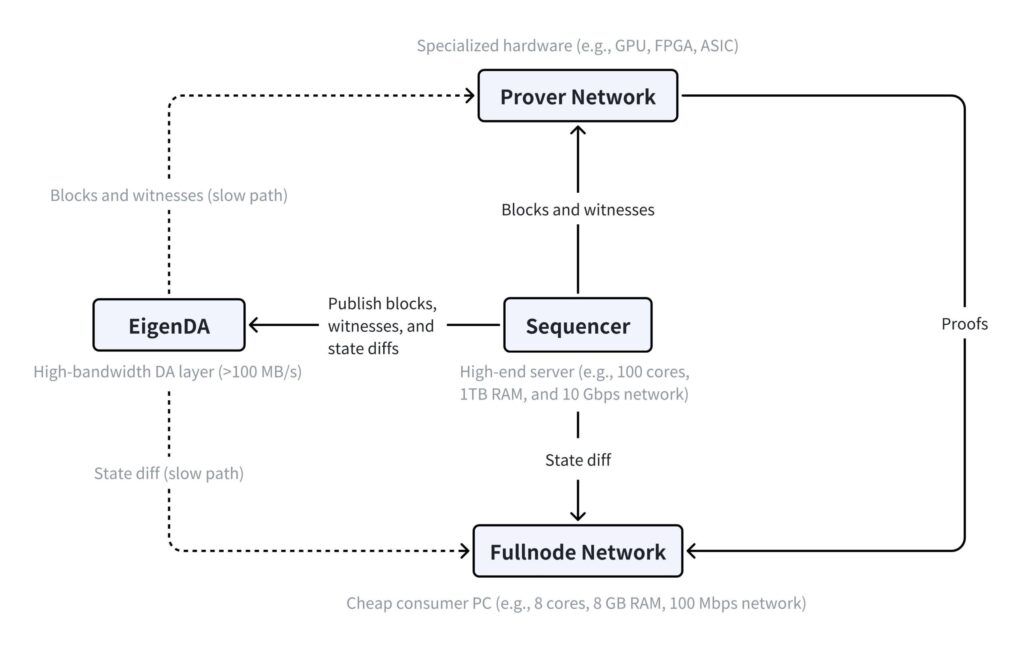

To achieve this efficiency, MegaETH divides network functions into three types of nodes:

- Sequencer: Sequences and executes transactions. Only one sequencer is active to keep the process simple and fast.

- Full Node: Applies the executed transaction without the need to recalculate, as it is already backed by a proof from the prover.

- Prover: Validates blocks independently, allowing them to work out of sequence and reducing the computational load of the network.

This specialization model makes the hardware requirements of each node different. Sequencers require high-performance servers, while full nodes can run on lighter devices. This separation of responsibilities allows for more optimized resource management and much more efficient transaction processing.

MegaETH (Layer-2) vs. Ethereum (Layer-1)

A comparison between MegaETH (Layer 2) and Ethereum (Layer 1) helps clarify the differences in their purpose, technical design, and ability to handle the needs of modern applications. The following table summarizes the key differences in a concise manner for easier understanding.

| Features | MegaETH (L2) | Ethereum (L1) |

|---|---|---|

| Key Objectives | High execution and throughput: provides a super-fast and low-cost environment for large-scale applications. | Security and decentralization: being a highly secure and censorship-resistant global settlement layer. |

| Speed & Cost | Built for ultra-low latency (block time < 1 second) and minimal transaction costs, suitable for high-frequency applications. | Block time is slower (±12 seconds) and costs are higher, making it less suitable for certain applications. |

| Model Validation | Using Stateless Validation and Dual-Client Validation; the heavy lifting is done by the sequencer, while the lightweight nodes only verify the proofs. | Using traditional stateful validation; each validator must process all transactions and store the entire blockchain state. |

MEGA Tokenomics

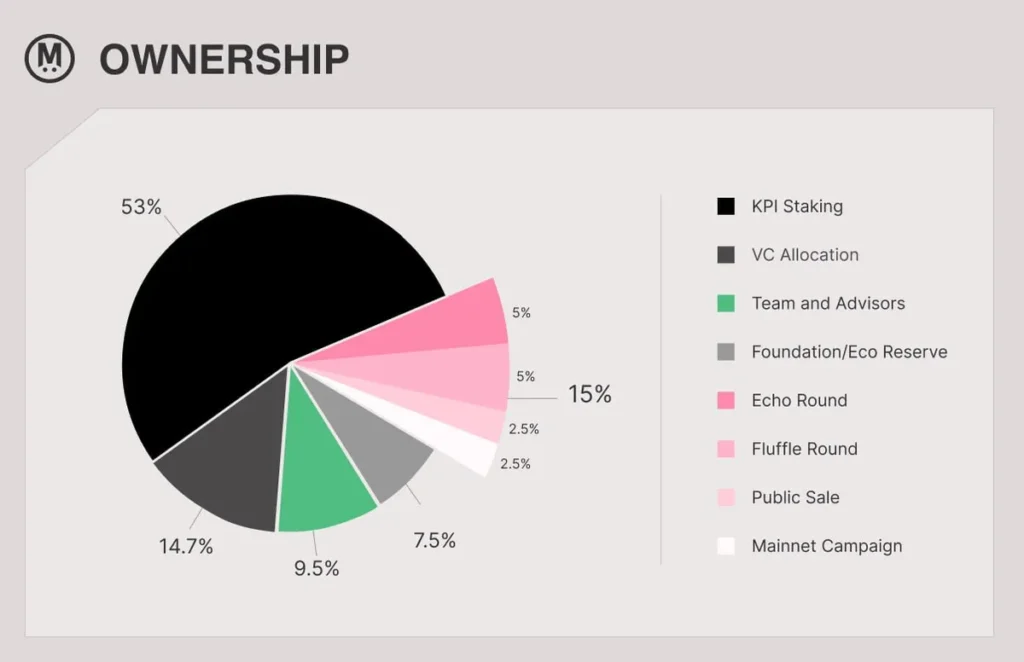

The MEGA token distribution in the figure shows a heavy focus on network incentives, with 53% allocated to KPI Staking to maintain security and ecosystem activity. Other allocations include VC Allocation (14.7%) as well as a portion for the team and advisors (9.5%), which supports project funding and development.

The remaining distribution is spread across ecosystem reserves (7.5%), community funding such as Echo and Fluffle Round (5% each), as well as the Public Sale and Mainnet Campaign (2.5% each). This structure reflects a strategy that balances community incentives, developer support, and the long-term growth of the MegaETH network.

MEGA’s Role in the Ecosystem

The MEGA token is a key element that supports the operations, security, and governance of the MegaETH network. Its functionality is designed to strengthen the high-performance Layer 2 ecosystem that MegaETH aims to build.

- Staking and Security

MEGA holders can stake to participate in network security and consensus mechanisms, including sequencer selection or validation services, while earning rewards.

- Transaction Fees

Although MegaETH is highly efficient, transactions still require fees to prevent spam and compensate network operators. MEGA is likely to be the gas payment token in this ecosystem.

- Governance

As the protocol evolves, MEGA will give its holders voting rights to determine network parameters, updates, and ecosystem fund allocation.

- Ecosystem Drivers

MEGA also serves as the primary token in various dApps on MegaETH-from DeFi, to NFT marketplaces, to gaming platforms-making it the center of value and activity on the network.

The Technology Behind MEGA: Solutions to Validation Challenges

MegaETH brings a new approach to the blockchain validation process, enabling ultra-fast performance without compromising on the decentralization aspect.

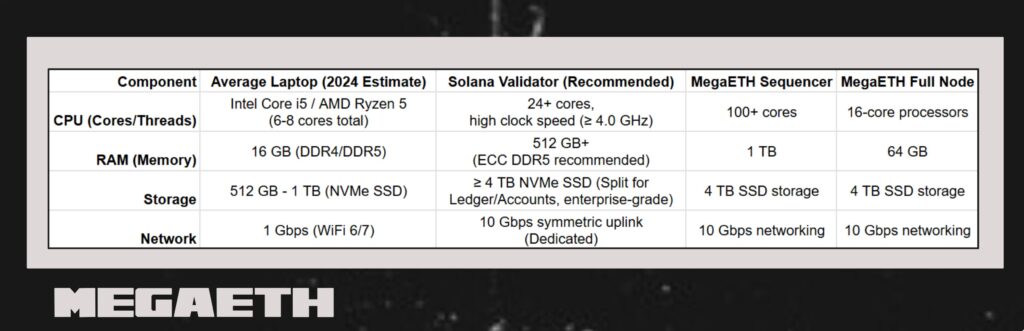

- Challenge: High Throughput Requires Heavy Hardware

To achieve extreme speeds, MegaETH sequencers use data center-grade machines (more than 100 cores, 1 TB RAM). Full nodes also require quite powerful devices. If the validation process also requires this kind of hardware, the network will become centralized. True decentralization demands that ordinary users can still verify network rules without special devices.

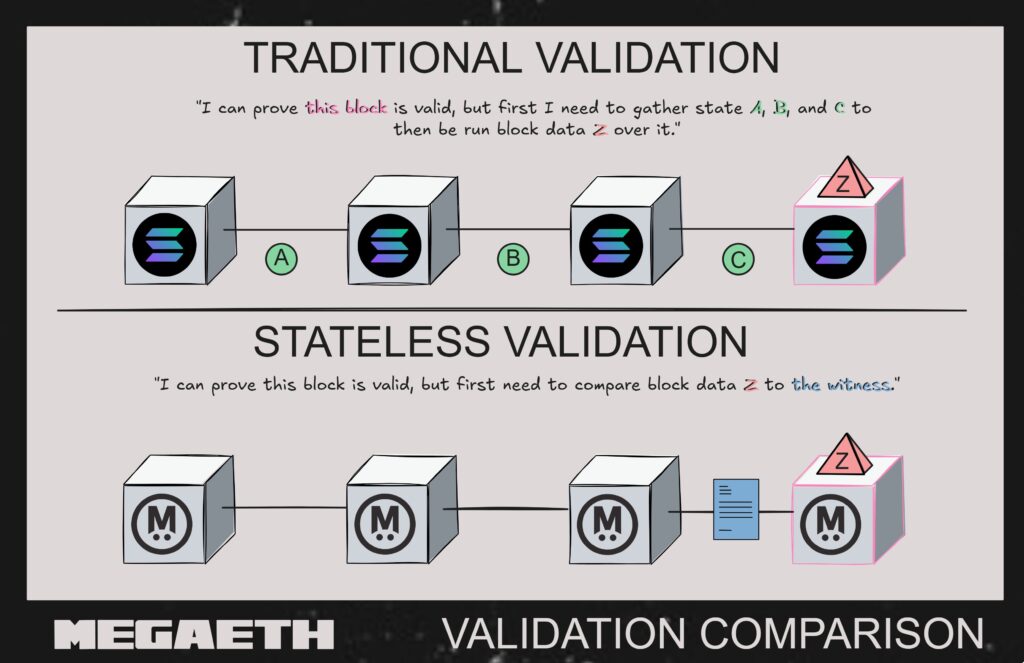

- Solution: Stateless Validation

MegaETH’s key innovation is stateless validation, which moves the burden of validation from large storage and computation to a proof-based verification model. Validators don’t need to store the entire blockchain state, just verify each block against the previous state. Like checking a route, the validator only needs relevant pieces of the map, not the entire map.

The process works as follows:

- Witness: The sequencer provides a witness, which is a cryptographic proof containing only the state data required to execute a transaction in a block.

- Data Authentication: The validator uses the witness to calculate the root state. If the result is the same as the previous root state, the data is considered valid.

- Execution: The validator executes the transaction with the verified data.

- Final Verification: The validator calculates the new root state and ensures the result is the same as the sequencer submitted.

With this method, the validator does not need to store the blockchain state and only checks a small portion of the block. Hardware requirements are minimal: 2 CPU cores, 1 GB RAM, no permanent storage.

Additional Security: Dual-Client Validation with Pi Squared

MegaETH strengthens its security with a second validation system from Pi Squared. Through the LLVM-K compiler, Pi Squared transforms the mathematical specification of EVM (KEVM) into high-performance execution code.

Both validators-MegaETH and Pi Squared-receive the same witness, run the verification independently, and then calculate the root state. A block is considered valid only if both systems produce identical root states. This two-client approach creates a high level of security because any manipulation attempt must fool two different, mathematically precise implementations.

MEGA Public Sale: Market Enthusiasm and Token Allocation Details

The public sale of MEGA tokens opened on October 27-30, 2025 through a UK auction on the Sonar by Echo platform. A total of 500 million MEGA-equivalent to 5% of the total supply of 10 billion-was offered with an initial price of US$0.0001 per token and a maximum cap of US$0.0999. Individual contribution ranges were set between US$2,650 and US$186,282, with a one-year lock-up option providing a 10% discount for certain investors.

Market enthusiasm was high, with total demand reaching around US$450 million from 14,491 participants, far exceeding the initial target of around US$50 million. A total of 819 wallets even hit the maximum contribution limit. This huge interest shows the strong confidence in MegaETH ahead of the mainnet launch, while strengthening MEGA’s position as an important asset in its ecosystem.

On November 19, 2025, through its X account, MegaETH officially announced the closure of MEGA’s public sale, in line with the high interest generated during the auction process. MegaETH announced that bids are now irrevocable, while US$2.3 million of forfeited tokens will be redistributed to participants still in the pool. The final allocation is scheduled to be released on Friday, bringing to a close the public sale phase that previously recorded huge demand ahead of the mainnet launch.

MegaETH Funding and Strategic Collaborations

| Category | Details | Description |

|---|---|---|

| Seed Funding | US$20 million (June 2024) led by Dragonfly Capital; investors include Vitalik Buterin, Figment Capital, Robot Ventures, Big Brain Holdings. | Initial funding for network development. |

| Community Funding “Echo Round” | Approximately US$10 million (December 2024) through the Echo platform; far exceeding the US$4.2 million target with the participation of ~3,200 investors from 94 countries. | Funding that engages the global community. |

| Stablecoin Collaboration | Launch of native stablecoin USDm with Ethena (September 2025) to fund sequencer fees through institutional reserve yields. | Strategic partnerships to build economic and low-cost mechanisms. |

| Ecosystem Program | The MegaMafia program accelerator hosts many projects (DeFi, gaming, AI) within the MegaETH network. | Acceleration of the ecosystem that supports real-time applications on the network. |

MegaETH’s Strategic Impact on the Ethereum Ecosystem

MegaETH has the potential to make a big impact on the Ethereum ecosystem. By offering lower transaction fees and much higher processing speeds, the network could attract more new users. An influx of additional users not only helps projects built on Ethereum, but also strengthens the stability and appeal of the network as a whole.

This performance boost also gives developers more incentive to design and release dApps on Ethereum. If more applications are born and used, the Ethereum ecosystem will develop more rapidly and its position as one of the main blockchain platforms will be further strengthened.

Amid competition from new blockchains, MegaETH’s ability to deliver fast and efficient features could be an important plus for Ethereum. These advantages help keep Ethereum relevant and a top choice for developers and users alike.

Start Crypto Investing at the Pintu

Now that you understand what MegaETH is and how it impacts the Ethereum ecosystem, you can start exploring the growing number of Ethereum and Layer-2 projects on the Pintu app. All in one secure, easy-to-use app that’s suitable for beginners and experienced investors alike.

Here’s how to buy crypto assets on Pintu:

- Enter the Pintu homepage.

- Go to the Market page.

- Search and select the crypto asset that you have analyzed before.

- Enter the amount you wish to purchase, and follow the rest of the steps.

Conclusion

MegaETH is emerging as one of the most ambitious innovations in the Ethereum ecosystem, offering high-speed transaction execution close to Web2 applications. With a specialized architecture-from block time in milliseconds, parallel execution, to stateless validation-MegaETHtargets a truly real-time on-chain experience without having to leave Ethereum security as a layer of finality.

These advantages open up space for new types of applications that were previously difficult to run on the blockchain, such as high-frequency trading, on-chain gaming, and agentic AI. Backed by strong funding, strategic collaborations, and great enthusiasm in MEGA’s public sale, MegaETH has the potential to be an important catalyst for the growth and competitiveness of the Ethereum ecosystem going forward.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- Coingecko. What Is MegaETH: The Ethereum L2 Backed by Vitalik Buterin. Accessed November 19, 2025

- Phemex. What Is MegaETH (MEGA)? A Guide to the Real-Time Blockchain. Accessed November 19, 2025

- Trust Wallet. MegaETH: A Beginner’s Guide. Accessed November 19, 2025

- MEXC Blog. MegaETH Airdrop: Everything You Need to Know to Participate and Maximize Rewards. Accessed November 19, 2025

- X. ENDGAME: How MegaETH bridges throughput and decentralization. Accessed November 19, 2025