Narrative trading is one of the most popular ways of making profits in the crypto market. It is a way of trading that utilizes a happening narrative. No doubt, narratives have a significant role in influencing the price movements of crypto assets. So how to do narrative trading, and how to do it? Keep reading to learn more.

Article Summary

- 📜 Narrative trading is a trading technique based on a series of events that form a narrative where the narrative affects price movements in the crypto market.

- 🔬 A person who trades based on a narrative is called a crypto narrative trader. They will buy assets that fit the narrative and sell them when it starts to fade.

- 🪙 Three groups of tokens will fit into a narrative within each narrative trading. The three groups are market leader tokens, mid-cap tokens, and new tokens created as the narrative emerges.

- 🗝️ The way to do narrative trading is always to be aware of the latest information and events, utilize on-chain data, accumulate as early as possible, and quickly take profits when the narrative begins to fade.

What is Narrative Trading in Crypto Market?

In trading, the narrative always plays a significant role in influencing market movements. It becomes one of the benchmarks for traders to evaluate opportunities and risks. In simple terms, narrative can be defined as connected events that become a “story.” Thus, narrative trading can be defined as trading based on a narrative that is happening.

The narrative is important because it has a role in shaping public perception and influencing market movements. It can provide a framework for traders to understand the potential and risks of a particular crypto sector.

Meanwhile, narratives can come in both positive and negative forms. If it is negative, it can lead to falling asset prices and sell-offs. Meanwhile, if the tone is positive, the narrative can lift the price of an asset and encourage accumulation.

An example is the Artificial Intelligence (AI) narrative in the crypto market. At that time, OpenAI’s ChatGPT was the talk of the town. This triggered the creation of an AI narrative in the crypto market and made AI-related blockchain projects suddenly desirable. The prices of FET, AGIX, and OCEAN tokens then experienced a significant increase thanks to this narrative.

In addition to developing a trading strategy, another crucial step is to mitigate risk. Here’s Pintu Academy’s article on crypto asset risk management

How to Become a Crypto Narrative Trader

A crypto narrative trader is someone who makes trading decisions based on the narrative that is happening in the crypto market. The narrative can be created from anything, but the most important thing is that many people must believe it. Otherwise, it won’t have a significant impact on the market.

So, when a new narrative is forming, a narrative trader will immediately open a position by buying tokens that fit the narrative. By the time the narrative is established, and many other traders are riding the wave, the narrative trader has already made a profit. Later, when the narrative shows signs of fading, the narrative trader will immediately sell his assets.

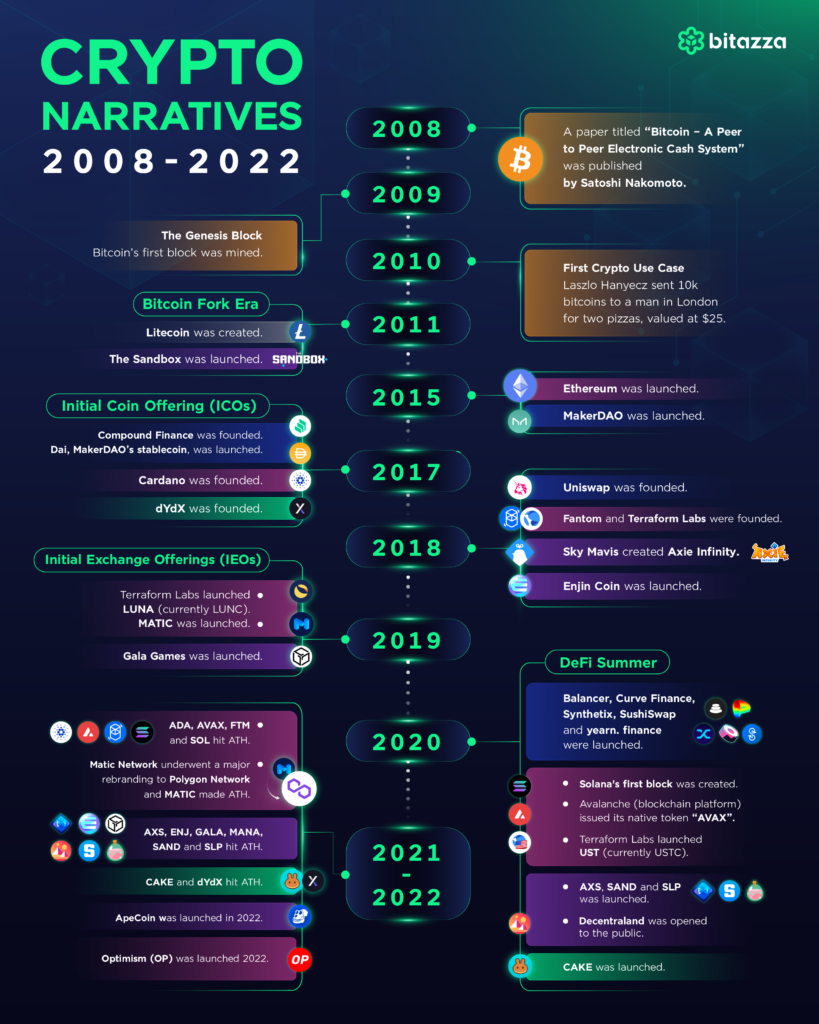

Crypto Narrative in the Past Year

Since crypto and blockchain are highly dynamic industries, narrative trading is important in influencing market conditions and trader behavior. Capitalizing on momentum with narrative trading can be one way to profit in the crypto market.

Even if the crypto market is not bullish, certain narratives can still lift the prices of various crypto assets. The following are some narratives that have managed to raise the price of crypto assets by hundreds of percent in the past year:

- 🤖 AI Booming. The launch of OpenAI’s ChatGPT gave rise to the Artificial Intelligence narrative. All AI-related tokens, such as FET, AGIX, and OCEAN, increased.

- 💧 The Start of LSD. Post The Merge, liquid staking gained popularity. LSD platform tokens such as LDO, RPL, and FXS rose.

- 🇨🇳 China narrative. Crypto projects from China suddenly saw an increase in demand. Tokens like Conflux and Alchemy Pay are on the rise.

- 🤡 Memecoin 2.0. In April, the PEPE token surprisingly skyrocketed 10,000% in a month. Other meme tokens such as AIDOGE, WOJAK, and TURBO also saw gains.

- 🚰 The rise of LSDFI. The development of the LSD sector eventually gave rise to a new industry, which is LSDFI. LSDFI project tokens such as PENDLE, LBR, and TENET saw an increase.

- 📄 The rise of Bitcoin ETFs. Blackrock and other large institutions surprisingly listed a Bitcoin ETF. Inevitably, tokens like BTC, BCH, and STX went up.

Want to know what narratives are likely to happen in the rest of the year? Pintu Academy has prepared its predictions in the following article.

How to do Narrative Trading

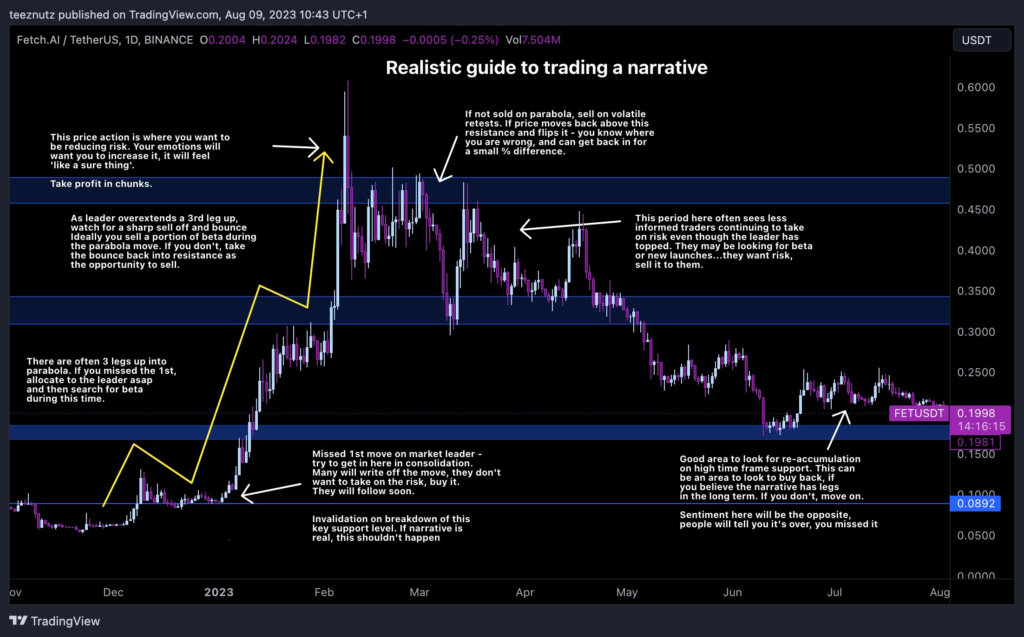

In narrative trading, there are generally three groups of tokens within a sector that fits within a narrative. The first group is market leader tokens (big cap). As the name implies, this group contains tokens that are leaders in their sector. It has a large market capitalization and liquidity and has strong fundamentals.

The second group is tokens with much smaller market capitalization and liquidity (mid-cap). Fundamentally, it does not have as good value as the first group. Then, the third group is new tokens created when the narrative is or has been formed (small cap). They are present as an effort to capture the momentum and opportunity created by a narrative. Tokens in this group have small market capitalization and liquidity, are very volatile and have the most risk.

For those who want to do narrative trading, buying tokens from the first group is the best option. The reason is that whales and other big money will enter this group of tokens when the narrative is formed. The increase in token prices from the first group will also trigger price increases in other groups.

The second group is usually the choice of traders who ‘miss’ to buy tokens from the first group. Although it does not have the fundamentals and liquidity of the tokens from the first group, it will still experience a price increase because it is perceived to have a link to the narrative at play. Then, traders who want additional profits can buy tokens from the third group. However, this type of token has the most risk (rug pull), very little liquidity, and is very volatile.

The chart above can be one of the references when you want to do narrative trading. A brief correction generally follows three significant rises. It is best to buy during the first and second phases of the rise, which is the ideal moment. The third phase can be identified through the appearance of tokens from the third group. In this phase, the price increase of tokens from the first and second groups starts to slow down. Therefore, this phase is the most appropriate time to take profits.

Basically, narrative trading is just trying to buy risk before others want it, due to new information that the market hasn't effectively repriced yet. Once the narrative is priced in and followed by FOMO from most investors, this is the time to sell.

Narrative Trading Tips

Here are some tips that you can do when you want to try narrative trading:

- 💡 Stay up-to-date. Always knowing what is happening in the crypto market is a requirement for anyone who wants to do narrative trading. Knowing the information from the beginning increases the chance of being the first mover.

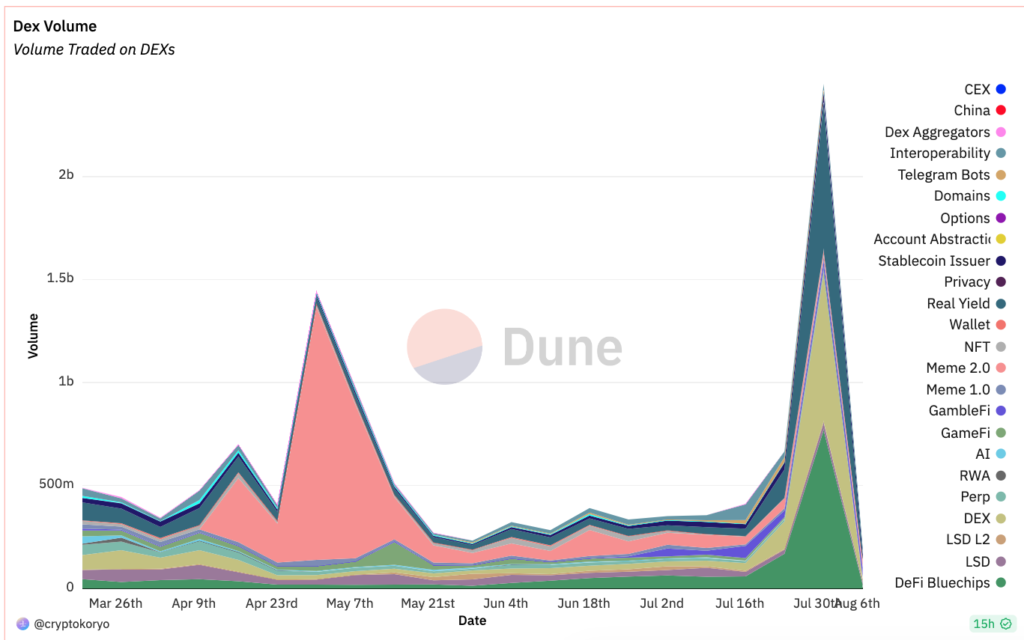

- ⛓️ Utilize the on-chain data platform. Whale and big money movements can be identified through Dune, whale tracker, block explorers, and on-chain data. Here is one of Dune’s dashboards that tracks the narrative in the crypto market.

- 🔜 Accumulate as soon as possible. Since there are generally only three price spikes in each narrative, getting in as quickly as possible is the best way to maximize profits.

- 🪙 Buy tokens from the first group. Tokens from this group will experience the first price increase when the narrative is formed. Also, risk management will be easier with great liquidity and less volatility than the second and third groups.

- 💰 Do not hesitate to take profit. Every price increase will eventually experience a correction. Especially if the movement is narrative-driven. Therefore, take profit immediately when it looks like the trend will end.

- 🔁 Always rotate. One thing is for sure about narratives; they don’t last long. Narratives in the crypto market will continually change. So, never stick to one narrative, and constantly rotate.

Besides Dune, here are five other crypto analysis platforms you can use!

Conclusion

Narrative trading has become one of the most promising trading methods, as narratives play an important role in influencing market movements. A narrative can be defined as a series of events that form a “story,” which can influence public perception and the price of crypto assets.

Narrative trading emphasizes the importance of being responsive to emerging narratives, buying relevant tokens, and selling them when the narratives start to fade. To be successful in narrative trading, traders must stay up-to-date with the latest information, utilize on-chain data, buy relevant market leader tokens, and not hesitate to take profits.

Buy Crypto Assets in Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily at Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

- Crypto Koryo, A single year, 10 narratives, and countless opportunities. Twitter, accessed on 10 August 2023.

- Teeznutz11, The Lifecycle of a Narrative Trade 101, Twitter, accessed on 10 August 2023.

- Daniel Phillips, What Is Narrative Trading in Crypto? CoinMarketCap, accessed on 10 August 2023.

- Josiah Makori, What Are Crypto Narratives? Top 10 Narratives for 2023, CoinGecko, accessed on 10 August 2023.