Crypto prices are known to be highly volatile and difficult to predict. For this reason, traders need to prepare precautionary measures to protect both their capital and profits. One way to do this is by using Take Profit, Stop Loss, Price Protection, or even a combination of all three. This article will explain what Price Protection is, why it is important, and how to use it effectively.

Article Summary

- Price Protection is a feature that ensures Market Orders are executed within a fair price range, protecting traders from excessive slippage.

- Slippage occurs due to the difference between the expected price and the actual execution price, generally caused by large order sizes, high volatility, or low liquidity.

What is Price Protection?

Price Protection is a feature that safeguards the execution of Market Orders so that they occur within a fair price range, minimizing the risk of excessive slippage.

Slippage, or the price difference that occurs when executing a transaction with a Market Order, is a common phenomenon on every exchange. This difference typically arises due to factors such as liquidity, extreme market volatility, or the size of the order.

Market Orders are often used by traders because they allow positions to be opened or closed instantly based on the best bid/ask available in the Order Book.

<strong>For Example:</strong> <p> Ari wants to open a long position of 3 BTC using a Market Order. In this case, Ari is referred to as the Taker because he is taking the sell orders listed in the Order Book. </p> <p>In the Order Book, sellers placed the following orders:</p> <ul> <li>1 BTC at $115,500</li> <li>1 BTC at $116,000</li> <li>1 BTC at $116,735</li> </ul> <p> When Ari executes the Market Order, the system will “sweep” through all three orders to fulfill the 3 BTC requirement. </p> <p>As a result, the average entry price for Ari’s long position = <strong>$116,078</strong></p> <p><strong>Conclusion of the example:</strong></p> <ul> <li>Last Price (Before order execution): $116,735</li> <li>Best Ask: $115,500</li> <li>Mark Price: $115,100</li> <li>Average Long Entry Price: $115,710</li> <li>Slippage: (116,078 − 115,500) ÷ 115,500 = 0.5%</li> </ul>

From the example above, using a Market Order results in the transaction being executed at a higher price compared to the previous Best Ask.

It is important to note that the Last Price and the Mark Price can differ. The Last Price refers to the most recent transaction price in the market, while the Mark Price is a reference price calculated from the average prices across several major exchanges. The Mark Price is used for calculating PnL as well as for liquidation purposes.

It should also be emphasized that slippage is calculated based on the difference between the expected price (before the order is executed) and the actual execution price.

One of the factors that affects the magnitude of slippage is the size of the order. The larger the order being executed, the higher the risk of slippage.

This occurs because the available asset volume in the Order Book could be limited and distributed across different price levels. As a result, large orders may “sweep through” multiple price levels at once, creating a gap between the execution price and the expected price.

How Price Protection Works

In essence, Price Protection available on crypto exchanges is designed to protect traders from having their orders executed at prices that are too far from a fair market value.

Here’s how Price Protection works on Market Orders:

1.Slippage Protection

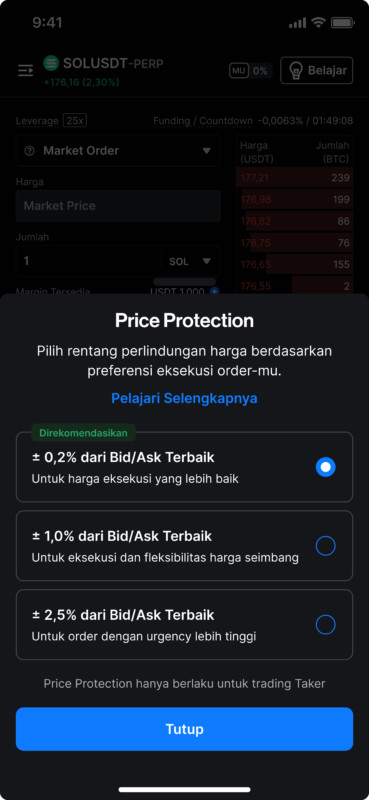

- Exchanges usually apply a slippage tolerance limit. Some set a fixed threshold (e.g., 5%–15%), while others give traders the flexibility to adjust their own maximum slippage. On Pintu Futures, users can choose the slippage limit according to user needs, such as 0.2%, 1%, or 2.5%.

- If the execution of a Market Order exceeds the maximum slippage limit, that portion of the order will not be executed.

2.Reference Price (Best Bid/Ask)

- Price Protection on Market Orders works based on the best bid/ask in the order book. The tolerance limit (for example, 0.2%, 1%, or 2.5%) is calculated from the lowest selling price (best ask) for a Market Buy, or the highest buying price (best bid) for a Market Sell.

- With this limit in place, traders are protected from extreme price spikes caused by a thin Order Book or abnormal price movements far from the last traded price.

Pintu Futures now offers the Price Protection feature for Market Orders. With this feature, users can trade more safely and be protected from the risk of excessive slippage. Try it now on Pintu Futures.

Why Is Price Protection Important?

Price Protection helps minimize the risk of slippage, especially in Market Orders, which are the most vulnerable to price deviations.

3 Main Factors That Can Affect the Magnitude of Slippage:

1.Large Order Size

The larger the transaction volume executed with a market order, the more price levels in the order book will be consumed. As a result, the average execution price can shift significantly from the initial price displayed on the screen.

2.Extreme Market Volatility

When the market moves rapidly, prices can jump or drop within seconds. These sudden swings often cause the execution price to differ greatly from the price traders initially expected.

3.Low Liquidity Conditions

If an asset is illiquid, it means there are only a limited number of bid/ask orders in the order book. This condition widens the gap between price levels, which can cause executed orders to deviate significantly from the last traded price.

3 Advantages of Price Protection

- A fairer gap between the last price and the execution price.

- Minimizes abnormal transaction executions, such as sudden price spikes.

- Provides better control over order execution in terms of precision, speed, and flexibility.

How to Use Price Protection on Pintu Futures

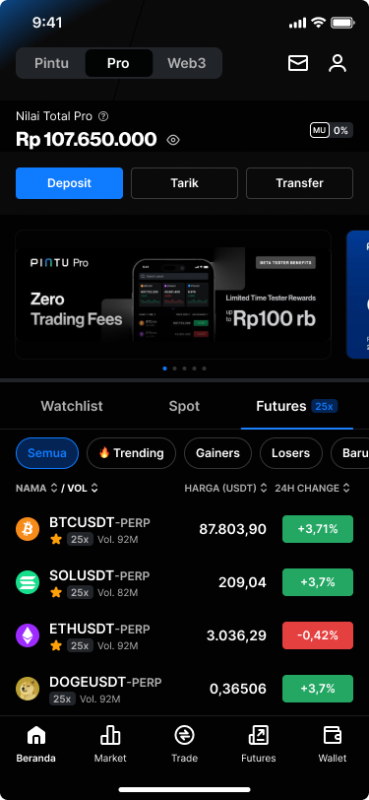

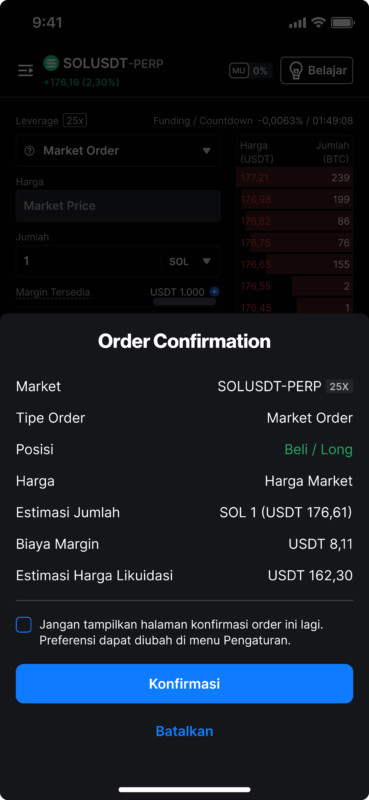

1.Open the Pintu app and tap the Futures menu

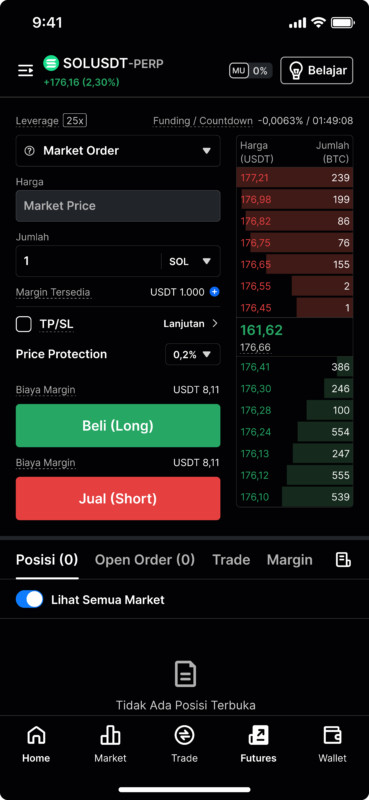

2.Select the asset you want to buy/long, enter the order size, and enable ‘Price Protection’

3.Choose your preferred slippage tolerance

4.Review the details and tap Confirm to proceed

Done! You have successfully placed an order using Price Protection on Pintu Futures.

Conclusion

Slippage is a natural risk in crypto trading, especially when using Market Orders. However, with Price Protection, traders can limit the impact of slippage, making trade outcomes more consistent with their trading plans.

On Pintu Futures, this feature provides users with the flexibility to choose their preferred level of slippage tolerance.

By using Price Protection wisely, traders can trade more safely, keep slippage risk under control, and protect their capital from extreme price movements.