Did you know that tokens can represent ownership of real-life assets, such as property or a house? Thanks to Real-World Asset (RWA) tokenization, it is now possible to connect real-world asset ownership with the digital world. So, what exactly is RWA, and what are the potentials and projects related to RWA? This article will answer all these questions.

Article Summary

- 🏘️ RWA (Real-World Asset) is a tangible asset that can be tokenized and potentially used as collateral in DeFi. Examples of tangible assets are bonds, real estate, money, commodities, etc.

- ⛓️ RWA tokenization involves several complex steps, but the ultimate goal is to bridge the physical and digital worlds through blockchain technology.

- 💵 Franklin Templeton (BENJI) issues nearly 50% of all tokenized US Treasuries on Stellar, while Ondo Finance (OUSG) issues half of them on Ethereum

- 🪄 Some protocols and projects supporting RWA tokenization in the DeFi ecosystem include Maple Finance, Centrifuge, Goldfinch, and Rio Network.

What is Real-World Asset (RWA)?

Real-World Asset refers to a tangible asset that can be tokenized and potentially used as collateral in DeFi. Examples of tangible assets are bonds, real estate, money, commodities, etc.

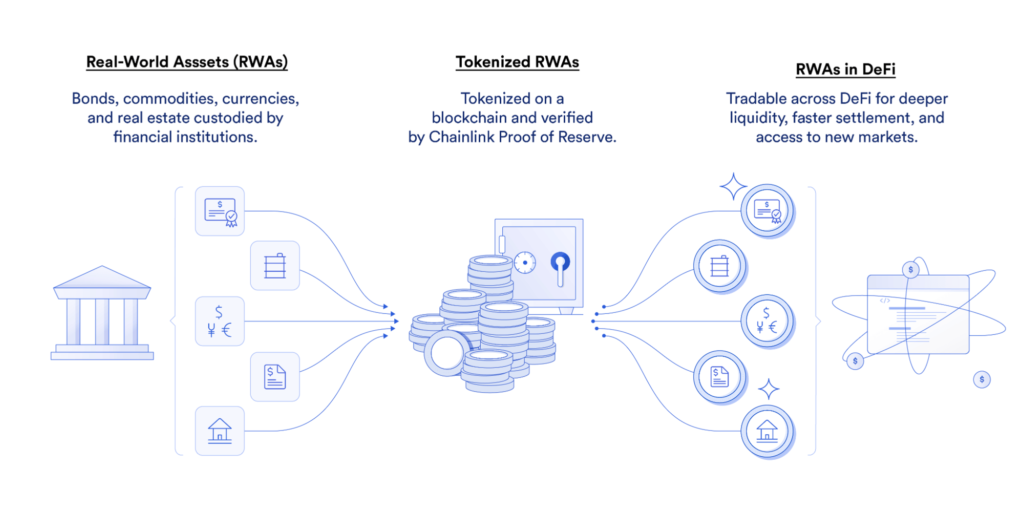

When we refer to RWA, we are talking about the tokenization of tangible assets. Through RWA tokenization, smart contracts manage and represent physical assets with tokens, facilitating on-chain trading.

Traditionally, investing in real assets like property or gold was restricted to certain individuals due to high entry barriers and minimum investment requirements. However, with RWA tokenization, these assets become accessible to everyone, regardless of their capital.

RWAs offer opportunities for investors with limited capital to participate in real-world asset markets that were once out of reach. This increased accessibility not only benefits individual investors but also enhances the overall liquidity and openness of the market.

Moreover, RWA tokenization can potentially eliminate geographical barriers, allowing assets to be traded and moved globally.

A token in RWA can function like a digital certificate of ownership representing almost any value object, including physical and digital assets.

How Does Real-World Asset (RWA) Tokenization Work?

How Real-World Asset tokenization works involves several complex steps. However, the ultimate goal is to connect the physical and digital worlds through blockchain technology.

The RWA tokenization process involves selecting the token type, choosing a blockchain for token issuance, appointing a third-party auditor to verify the asset off-chain, issuing the asset, and finalizing the token allocation.

Advantages of Real-World Asset (RWA)

- Liquidity: RWA tokenization increases the liquidity of real-world assets. Typically illiquid assets, such as real estate or artwork, become more tradable and accessible to investors with small capital. It opens up new opportunities in the financial markets.

- Accessibility: RWA tokenization allows investors with small capital to invest in real-world assets that were previously only accessible to investors with large funds. It provides an opportunity for more people to participate in real-world asset markets.

- Transparency: Blockchain technology enables transparency in ownership and transactions of real-world assets represented by tokens, allowing all relevant parties to monitor them. This increased transparency fosters trust and enhances security among asset holders and other stakeholders.

- Use in DeFi: RWA tokenization has enabled real-world assets to be used as collateral in DeFi platforms. It allows more types of businesses and individuals to access decentralized financial services.

Read also: DeFi Red Flags and How to Stay Safe in DeFi.

Tokenized US Treasuries as Real-World Assets (RWA)

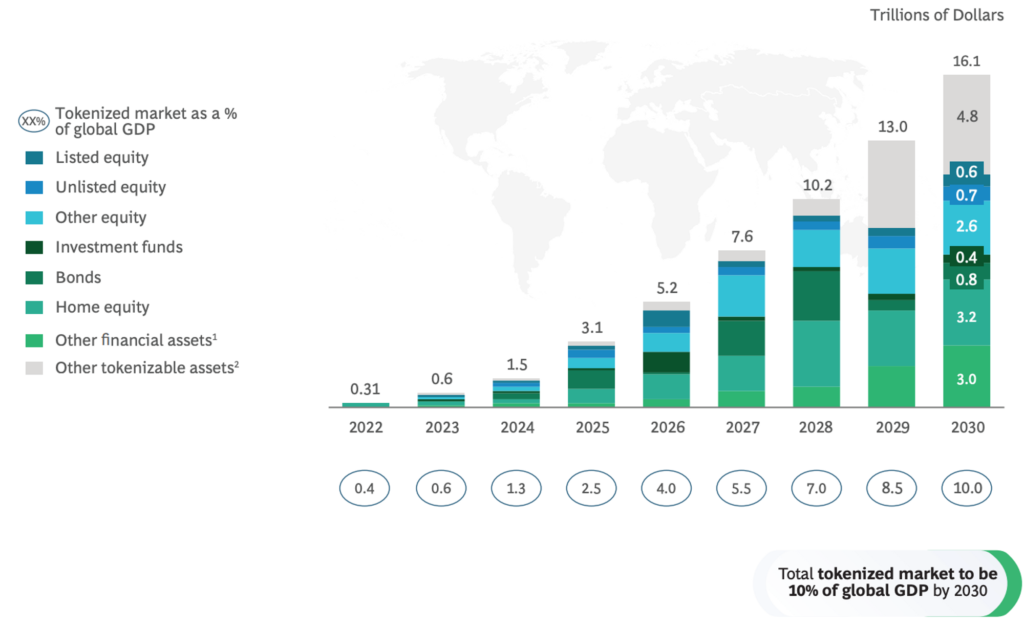

Over the past 15 months, demand for US Treasury yields has increased significantly due to the Fed’s interest rate hikes. Interest rates increased from 0.25% in March 2022 to 5.25% (July 2023).

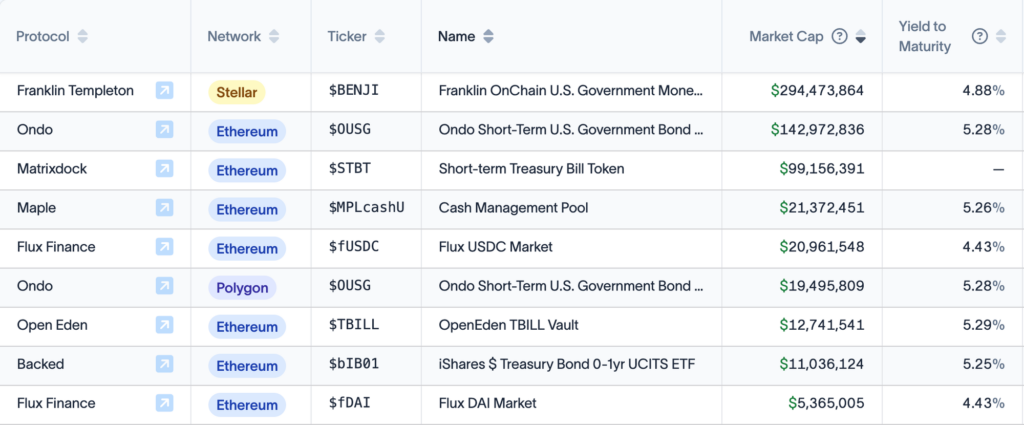

As an attractive low-risk alternative, crypto lending protocols offer around a 3% yield on stablecoins. It has led to the emergence of several protocols that bring these off-chain yields into the blockchain network, such as Franklin Templeton (an international asset management company) and Ondo Finance (a DeFi startup).

Franklin Templeton (BENJI) issues nearly 50% of all tokenized US Treasuries on Stellar, while Ondo Finance (OUSG) issues half of them on Ethereum.

Digital Asset's blockchain startup has attracted attention from major corporations such as Goldman Sachs, Microsoft, and Deloitte, all of which are focused on tokenizing digital assets through their partnerships. In addition, Germany's top tech company Siemens has also issued a 64 million US dollars digital bond on a public blockchain in February 2023.

Read also: What is Bitcoin ETF?

Real-World Asset (RWA) in DeFi

Real-World Asset is considered stable and can be alternative collateral in DeFi. It enables access to decentralized financial services for various types of businesses. The potential uses of RWA in the DeFi sector are as follows:

- Stablecoins: Stablecoins backed by RWA have more excellent value stability because their value is directly linked to physical, real-world assets. It helps reduce volatility and provides confidence to users, thus encouraging wider adoption and use of stablecoins in various DeFi use cases.

- Synthetic Tokens: Synthetic tokens can provide exposure to real-world asset prices without owning the physical asset. For example, tokens linked to the price of gold or a stock index can be created using RWA as a price reference. It provides accessibility and liquidity in gaining exposure to traditional markets.

- Lending Protocol: At this time, DeFi lending protocols usually rely on crypto asset lending. However, DeFi protocols focusing on RWAs serve borrowers with real-world asset collateral and offer more stable returns. It could attract more real-world asset owners to use decentralized financial services.

Real-World Asset (RWA) Project in the DeFi Ecosystem

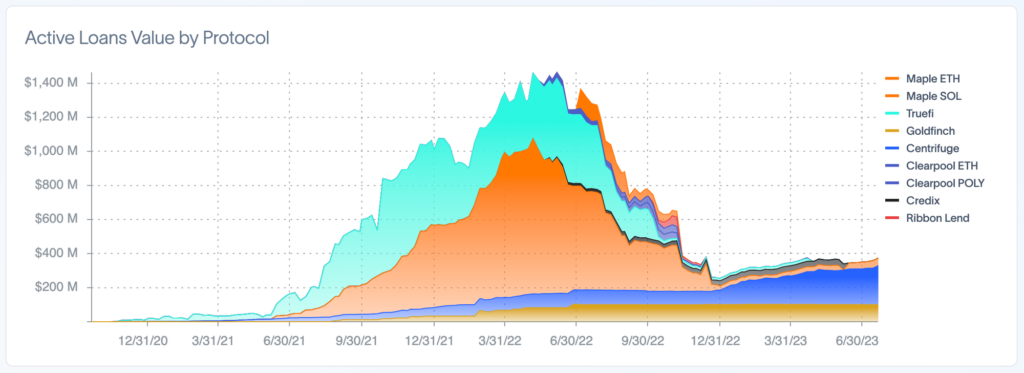

As the DeFi ecosystem continues to expand, an increasing number of new protocols and projects are emerging to support RWA tokenization. Data from rwa.xyz shows that the number of active loans on the Maple protocol reached more than 900 million US dollars as of May 7, 2022. Here are some protocols and projects that support RWA in DeFi:

Maple Finance (MPL)

Maple Finance is a DeFi protocol focusing on decentralized lending using RWA as collateral. This protocol focuses on institutional borrowers.

Data from DefiLlama, Maple RWA has a TVL of 31.03 million US dollars as of July 25, 2023. This amount places Maple RWA in 6th place by the TVL.

Centrifuge (CFG)

Centrifuge is a protocol that integrates real-world assets (RWAs) into the DeFi space. It creates a more open and accessible financial system.

This protocol also has high security. It applies strict legal standards, KYC checks, and technical audits to ensure user safety and reliability.

CFG token holders also have voting rights in developing the protocol, making it more democratic.

Goldfinch (GFI)

Goldfinch is a decentralized credit protocol that enables crypto asset lending without crypto asset collateral – with off-chain collateralized loans.

Its primary business is providing loans to companies. It targets borrowers such as debt funds and fintech companies and provides them with credit loans in USDC.

Realio Network (RIO)

Realio Network is a distributed network that modernizes storing, issuing, analyzing, and exchanging assets (tokens). It enables the issuance of tokens that comply with strict regulations and provides a complete infrastructure for the success of RWA tokenization.

Real-World Asset (RWA) Challenges

One of the main challenges in RWA is the regulatory issue. Real-world assets must comply with various financial regulations in multiple jurisdictions. The RWA tokenization process must pay attention to and comply with legal requirements, including KYC (Know Your Customer) and AML (Anti-Money Laundering) rules. It is to ensure compliance and safety in using such assets in the DeFi ecosystem.

Additionally, it is crucial to establish a clear linkage between tokens representing RWAs and the related physical assets in the real world. When real-world assets are tokenized, a well-defined mechanism is necessary to connect the token to its actual physical asset. Failure to establish these linkages properly may result in integrity and value concerns for RWA tokens.

Buying Real-World Asset (RWA) Tokens on Pintu App

After knowing what RWA is, you can invest in RWA tokens such as MKR, SNX, and others without worrying about fraud on Pintu. In addition, all crypto assets on Pintu have passed a rigorous assessment process and prioritize the principle of prudence.

Pintu application is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download Pintu app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

- Haylesdefi, RWA protocols have crossed $750M in combined TVL, Twitter, accessed 25 Juli 2023.

- LD Capital Team, A Review of RWA Lending Protocols, Linkedin, diakses 25 Juli 2023.

- Chase Devens, U.S. Treasuries Fuel Real World Asset Growth, Messari, accessed 25 Juli 2023.

- Enrico Rubboli, If DeFi Wants to Grow, It Has to Embrace Real-World Assets, Coindesk, accessed 25 Juli 2023.

- Chainlink Team, Asset Tokenization: What It Is and How It Works, Chainlink, accessed 25 Juli 2023.

- Bary Rahma, The Future of Finance: Tokenization of Real-World Assets, Be in Crypto, accessed 25 Juli 2023.