Amid the rapid growth of decentralized finance (DeFi), many traditional stablecoins remain burdened by classic challenges such as centralization, reliance on fiat currencies, and low capital efficiency.

Resolv emerges as an innovative solution to these issues, introducing the world’s first delta-neutral stablecoin protocol, naturally backed by Ethereum (ETH) and Bitcoin (BTC). This article explores what Resolv is, how it works, its core features, and the potential of RESOLV crypto.

Key Highlights

- Resolv is a DeFi protocol focused on delivering a secure stablecoin while also generating yields for its users.

- It maintains price stability by hedging futures contracts to build a market-neutral portfolio.

- The value of RESOLV crypto has increased following the passing of the GENIUS bill in the U.S., boosting market confidence in stablecoins.

What is Resolv?

Resolv is a decentralized finance (DeFi) protocol focused on providing a secure stablecoin solution that also generates yield. Its flagship product is USR, the world’s first delta-neutral stablecoin, directly backed by Ethereum (ETH) and Bitcoin (BTC) while maintaining a fixed value equivalent to 1 U.S. dollar.

Resolv operates on a dual-token system consisting of:

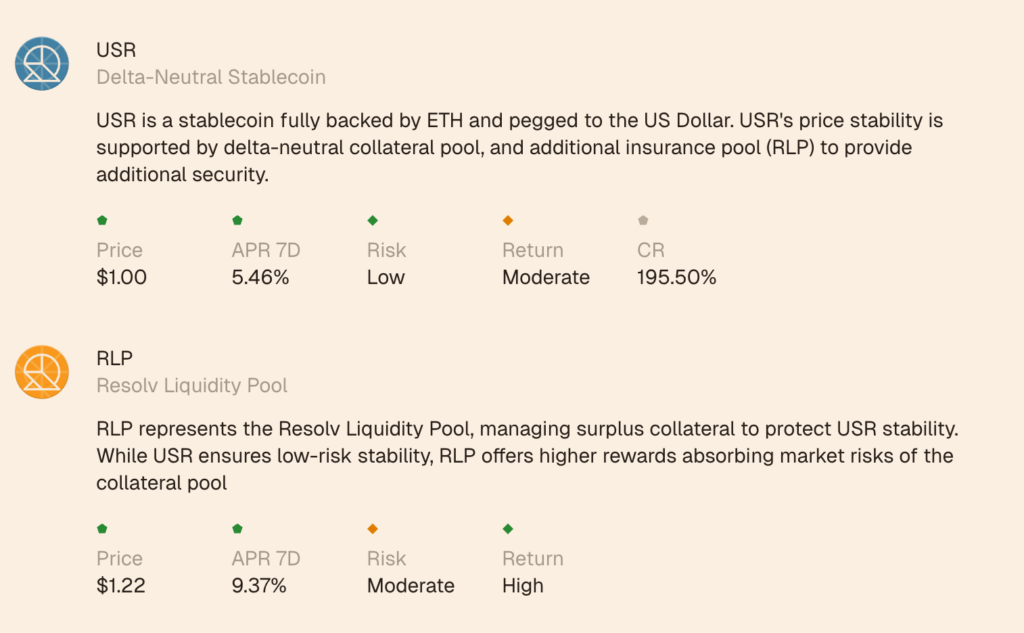

USR

USR is a stablecoin pegged to the U.S. dollar and backed by on-chain ETH, staked ETH (stETH), and BTC. Users can mint or redeem USR on a 1:1 basis with supported collateral.

Key characteristics of USR:

- Fully backed (100%+) by ETH and BTC reserves.

- Overcollateralized with an additional insurance layer using the RLP token.

- Can be staked to produce stUSR, a yield-bearing version of USR.

- Stability is maintained through arbitrage and redemption mechanisms.

Resolv Liquidity Pool (RLP)

The RLP acts as a secondary layer, functioning as both a buffer and an insurance mechanism for USR. It holds excess ETH and BTC collateral beyond what is required to directly back USR.

Core functions of RLP:

- Absorbs market risks and third-party risks from centralized exchanges.

- Protects the USR peg during periods of market volatility or stress.

- Offers higher yield potential as compensation for participants willing to take on these risks.

These two tokens serve distinct yet complementary roles by maintaining stability within the Resolv ecosystem while creating yield opportunities for DeFi participants.

How Resolv Works

Resolv maintains the price stability of its USR stablecoin by using a delta-neutral portfolio strategy—combining long positions in the spot market with short positions in perpetual futures contracts, specifically on Ether (ETH) and Bitcoin (BTC).

Unlike traditional stablecoins that rely on fiat reserves or overcollateralization, Resolv stabilizes its value through a hedging mechanism designed to create a market-neutral portfolio. This approach allows USR to maintain its $1 peg without needing fiat reserves, thanks to an automated arbitrage system.

<aside> 💡

Delta-neutral is a strategy that keeps a portfolio’s value stable regardless of price fluctuations in the underlying assets. This is achieved by offsetting exposure—such as holding BTC or ETH—through opposing positions like short futures, so that market swings have minimal impact on the portfolio’s total value.

</aside>

Here’s how it works:

- When a user deposits ETH or other accepted assets to mint USR, the protocol uses those funds to buy ETH and BTC in the spot market.

- At the same time, the protocol opens leveraged short positions in ETH and BTC perpetual futures markets.

- These opposing positions offset market risk, keeping Resolv’s portfolio stable in U.S. dollar value, even during sharp crypto price swings.

With this hedged collateral portfolio, the value of the backing assets is less volatile. In theory, Resolv’s stablecoin peg is easier to maintain compared to overcollateralized models.

Interestingly, Resolv is not the only protocol to adopt this method. Ethena (USDe) also uses a delta-neutral strategy with short perpetual futures as a hedge against market movements, though Ethena’s approach is more custodial and exchange-dependent.

Unlike Ethena (USDe), which uses a single-token model and relies solely on perpetual funding as its yield source, Resolv combines perp funding with staking, creating a more diversified and robust yield stream.

By contrast, protocols like USDC and DAI offer no native yield, while Lybra (eUSD) depends exclusively on ETH staking, which is more conservative and subject to lower volatility. Other protocols such as Angle, UXD, and Mero take a hybrid approach based on hedging and lending, but with more niche, less standardized strategies.

Another factor that sets Resolv apart is its risk tranching system, which divides risk between two types of users (conservative and aggressive). So the protocol can cater to different risk profiles more efficiently.

That said, a delta-neutral strategy is not without risks. Resolv mitigates these with an additional collateral buffer, targeting a 30% margin ratio with a 20% minimum threshold. This helps absorb potential losses from slippage, sudden market swings, or delays in rebalancing.

USR itself is an ERC-20 token. While minting is only possible on the Ethereum mainnet, USR can be bridged to other blockchains such as Base, Berachain, and BNB Chain, allowing users to deploy USR across multiple blockchain ecosystems.

Advantages of the Resolv Protocol and Benefits of Using Resolv

1. Innovative Dual-Token Economy

The Resolv Protocol operates on a unique dual-token system:

- USR serves as a stable token for everyday utility.

- RLP acts as an insurance layer that absorbs risk.

Users seeking to avoid crypto asset volatility can hold the stable USR, while those with higher risk tolerance can opt for RLP to earn greater yields. This creates a balanced ecosystem that caters to a wide range of investor profiles.

2. Staking System with Reward Multipliers

Resolv introduces a duration-based staking mechanism: the longer the RESOLV token is held, the higher the reward multiplier, up to 2x. This ensures voting power and rewards are directed toward long-term committed holders rather than short-term traders.

3. Institutional-Grade Risk Management

Resolv implements comprehensive risk management by placing assets with institutional custodians such as Fireblocks and Ceffu for off-exchange margin storage. This approach reduces third-party risk while enabling futures-hedging strategies to support its delta-neutral operations.

Benefits of Using Resolv

As a stablecoin protocol, Resolv offers several advantages that set it apart in the DeFi space:

- Market Neutrality Price fluctuations of ETH and BTC in the spot market are offset by opposing positions in perpetual futures, resulting in a stable net value.

- No Reliance on Fiat Currency There is no physical $1 directly backing Resolv tokens. Any fiat exposure exists only as exchange claims (when using CEXs), which are carefully managed to minimize third-party risk.

- Maintained Price Stability (Peg) USR can always be redeemed for $1 worth of ETH, ensuring that any deviation from its peg is quickly corrected through arbitrage activity.

- Insurance Layer via RLP RLP serves as a scalable protective layer to maintain the stability of USR.

- Sustainable Business Model The protocol’s treasury allocates assets into staking and earns additional funding fees from futures positions, creating a steady, sustainable revenue stream.

The Potential of RESOLV in the Crypto Space

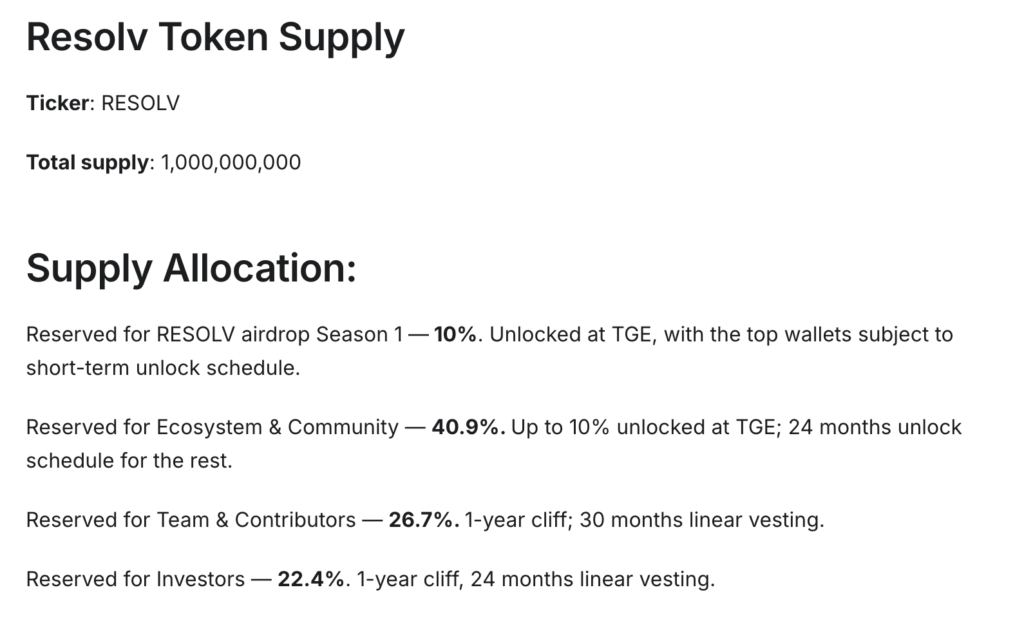

The RESOLV token serves as the primary utility and governance asset within the ecosystem. With a total supply of 1 billion tokens, RESOLV holders can participate in protocol governance, earn staking rewards, and benefit from ecosystem growth through its innovative staking multiplier system.

According to The Defiant (June 11, 2025), RESOLV made an impressive debut—its price surged roughly 25% on the first day of trading. As of August 7, 2025, the token has a market capitalization of $50 million and a fully diluted valuation of $173 million.

Resolv Labs designed the RESOLV token to:

- Distribute a share of protocol revenue to token holders.

- Enable voting on protocol decisions, including collateral management.

- Unlock access to higher yield tiers for holders.

By holding RESOLV, users gain governance rights to influence key protocol decisions, such as:

- Protocol Proposal Voting – Approving new integrations, adjusting metrics, or modifying existing systems.

- Community Alignment – Bridging the interests of DeFi protocols, liquidity providers, and long-term investors.

- Treasury Management – Supporting community-driven initiatives, such as bug bounty programs or other projects that enhance the platform’s activity.

RESOLV Token Distribution

- Ecosystem & Community: 40.9% – Allocated to support community initiatives and long-term protocol development.

- Team & Contributors: 26.7% – Reserved for the core team, with a 1-year cliff and 30-month linear vesting.

- Investors: 22.4% – Allocated to investors, with a 1-year cliff and 24-month linear vesting.

- RESOLV Airdrop Season 1: 10% – Fully unlocked at TGE for early community participants.

This distribution model emphasizes long-term incentives while ensuring a substantial share is dedicated to protocol growth, aligning the interests of both the team and the community.

Market Analysis and Potential of the RESOLV Token

Over the past month, RESOLV has posted a solid price performance with a 29.8% gain, currently trading around $0.1732. Within this period, the token saw a sharp rally toward $0.275, followed by a corrective pullback before stabilizing in the $0.15–$0.175 range.

As of August 7, 2025, RESOLV’s market capitalization stands at $50,316,577, with a daily trading volume of roughly $25 million. The protocol’s Total Value Locked (TVL) exceeds $516 million, reflecting strong capital commitment within the ecosystem.

For comparison, according to DeFiLlama (August 7, 2025), USR’s market cap is about $243.74 million, still modest relative to similar protocols:

- Ethena (USDe) – $9.612 billion

- Sky Dollar (USDS) – $5 billion

- Ripple USD (rUSD) – $612 million

- Usual USD (USD0) – $578.41 million

This comparison shows that despite Resolv’s sizeable TVL, USR’s market capitalization still has significant room for growth when measured against other stablecoins and comparable crypto protocols.

Interestingly, RESOLV’s price surge over the past month coincided with the passage of the GENIUS Act in the United States—legislation that has bolstered market confidence in the stablecoin ecosystem. The law establishes a clear regulatory framework, emphasizing 1:1 reserves, regular audits, and strict AML/CFT compliance, signaling the beginning of a more transparent regulatory era for stablecoins.

For a project like Resolv Protocol, which relies on the USR stablecoin and the broader RESOLV token ecosystem, the new regulatory environment could actually unlock several key opportunities:

- Boosting Market Confidence With regulations that promote transparency and security, stablecoins like USR will be more easily accepted by both institutional and retail investors. This, in turn, could indirectly drive adoption of the RESOLV token, which is deeply integrated into the stablecoin’s ecosystem.

- Expanding Global Reach If Resolv can meet international regulatory standards such as those outlined in the GENIUS Act, it will be easier for the project to operate across borders and forge partnerships with formal financial institutions.

- Enhancing Yield Potential for Holders As the regulated stablecoin ecosystem grows, staking and yield farming within the RLP (Resolv Liquidity Pool) could attract more liquidity. This would ultimately benefit RESOLV token holders, who earn rewards from participating in the ecosystem.

In a crypto market that is increasingly under regulatory oversight, RESOLV is well-positioned to become part of the next generation of stablecoins and utility tokens capable of competing on a global DeFi stage.

Conclusion

The Resolv Protocol introduces a fresh approach to the stablecoin space through its delta-neutral strategy, 1:1 capital efficiency, and a complementary dual-token ecosystem (USR & RLP).

With institutional-grade risk protections, the RLP insurance layer, and yield opportunities for RESOLV holders, the protocol aims to address one of DeFi’s biggest challenges—maintaining price stability amid the inherent volatility of crypto markets.

If stablecoin adoption continues to grow alongside supportive global regulations such as the GENIUS Act, Resolv has the potential to emerge as a major player in the next generation of stablecoin ecosystems.

References:

- Binance. What Is Resolv (RESOLV)? Accessed August 7, 2028

- MEXC. What is Resolv (RESOLV) Crypto? Complete Guide to USR Stablecoin Protocol Accessed August 7, 2025

- NFT Evening. What is Resolv (RESOLV)? The True-Delta Stablecoin Protocol Accessed August 7, 2025

- OSL. Understanding the Resolv (RESOLV) Protocol Accessed August 7, 2025

- Phemex. What Is Resolv (RESOLV Coin)? Airdrop, Token Utility & How to Trade Accessed August 7, 2025

- Resolv. Resolv Docs Accessed August 7, 2025

- Resolv Labs. RESOLV Token Explained: The Engine Behind Resolv Labs’ Yield Stablecoin Accessed August 7, 2025

- Siddhant Kejriwal. Reviewing Resolv Protocol: How Delta-Neutral Hedging Powers USR Accessed August 7, 2025

- The Defiant. Resolv Stablecoin Protocol’s Token Debuts at $300 Million Valuation Accessed August 7, 2025

- World Economic Forum. The GENIUS Act is designed to regulate stablecoins in the US, but how will it work? Accessed August 7, 2025