Robinhood is a modern, app-based investment platform that is revolutionizing the way people invest in the financial markets. Since its launch in 2013, Robinhood has grown rapidly and become one of the major players in the fintech space, especially among the younger generation who want convenience, speed, and flexibility in managing their portfolio. In this article, we take a closer look at Robinhood’s (HOODX) profile and share price performance.

Article Summary:

🪜 Robinhood was founded in 2013 by two entrepreneurs, Baiju Bhatt and Vladimir Tenev, who met while studying at Stanford University.

📊 Listing on NASDAQ, Robinhood launches IPO in 2021.

💰 Robinhood’s share price is in the range of $117-$120 by mid-December 2025.

🖥️ HOODX is a tokenized form of stock that is backed 1:1 by Robinhood’s native stock.

Robinhood Profile

Robinhood Markets, Inc. is a publicly listed financial technology(fintech) company founded in 2013 and based in Menlo Park, California, the heart of the Silicon Valley region. A few years after its founding, Robinhood launched its initial public offering (IPO) in July 2021 and since then its shares have been traded on the NASDAQ exchange.

Through the Robinhood platform, users can conveniently invest in various instruments such as stocks, ETFs, options, gold, and cryptocurrencies. In addition to the ease of investing, Robinhood also offers additional features that support users’ financial needs, such as fractional share trading, regular investments, instant withdrawals, and access to margin investments. Some other services include retirement programs, 24-hour trading, and different types of accounts and investment contracts.

Robinhood also provides various learning and education solutions, including:

- Snacks: an easy-to-understand summary of business news for a new generation of investors;

- Learn: a collection of online guides, feature tutorials and financial dictionaries;

- Newsfeeds: access to free and premium news from sites like Barron’s, Reuters, and Dow Jones.

Furthermore, Robinhood features Robinhood credit cards, cash cards, expense accounts, and digital wallets. The company operates a digital currency marketplace that allows individuals and companies from around the world to buy and sell Bitcoin, Litecoin, Ethereum, Ripple, and Bitcoin cash.

History of Robinhood

Robinhood was founded in 2013 by two entrepreneurs, Baiju Bhatt and Vladimir Tenev, who met while studying at Stanford University in California. After graduation, they moved to New York and founded two fintech companies that provided software to hedge funds. There, they realized that large brokerage firms paid almost nothing to execute transactions, yet still charged retail investors commissions.

That’s how the idea for Robinhood came about, a commission-free investment platform that provides fairer market access for everyone, not just the big players. The name “Robinhood” was inspired by a legendary British character known for standing up for the little guy.

Some important milestones in Robinhood’s journey include:

- 2014: The Robinhood app officially launched on the Apple App Store, with over 1 million people already on the waiting list before the launch.

- 2015: Robinhood won the Apple Design Award, a prestigious award from Apple for innovative and user-friendly app design.

- 2019: Robinhood’s valuation jumped to $7.6 billion, backed by nearly $1 billion in funding from venture investors.

- After 2019: Robinhood’s success sparked major changes in the industry, prompting major brokerage firms like TD Ameritrade, Merrill Lynch, Wells Fargo, and Charles Schwab to remove commission fees in their services.

To stay ahead of the curve, Robinhood continues to develop new features, including small share purchases (fractional shares). Robinhood has also been one of the pioneers in giving retail investors access to cryptocurrency investments through Robinhood Crypto.

Robinhood provides three main account types: Robinhood Cash, Robinhood Instant, and Robinhood Gold. The first two account types can be used for free, while Robinhood Gold offers additional features for an affordable monthly fee.

Robinhood Pros

1. Commission Free Trade

One of Robinhood’s key advantages is its no-commission trading feature. Unlike traditional brokers who usually charge a fee every time a user makes a transaction, Robinhood allows users to buy and sell stocks, ETFs, options, and cryptocurrencies at no additional cost.

2. Easy to Use Application

The Robinhood app is designed to be easy to access and use, especially for new users. The interface is simple and intuitive, allowing users to quickly search for information and make transactions. The app also provides real-time price data and the latest market news, helping users make more informed investment decisions.

3. Fractional Stock Investment

Robinhood also offers the feature of investing in fractional shares. This means that users can buy a fraction of a stock or ETF, even if they don’t have the funds to buy a full share. For example, if the price of a share is $1,000, a user can still invest just $100 and own 1/10th of the share.

4. Diverse Investment Options

Robinhood offers a wide selection of investment assets such as stocks, ETFs, options and cryptocurrencies. With these options, users can customize their investments according to their own goals and risk tolerance levels. Robinhood also provides a list of preferred stocks and ETFs to help users discover new investment opportunities.

5. Learning and Educational Resources

To support its users, Robinhood also provides various educational materials. Within the app are articles, videos and a glossary of investment terms designed to help users understand basic concepts and investment strategies.

Difference between HOODX vs Robinhood Stocks

Getting to know HOODX

HOODX is a tokenized form of stock, a blockchain-based digital asset that represents Class A shares of Robinhood Markets, Inc. Each HOODX digital token is backed 1:1 by real Robinhood shares held by third-party custodian Backed Finance.

Robinhood tokenized stocks like HOODX are designed for investors who want to gain price exposure to Robinhood Markets, Inc. (HOOD) without having to go through traditional stock market infrastructure. Instead of buying HOOD shares through a brokerage account, investors can follow Robinhood’s stock movements through blockchain-based tokens traded on crypto platforms.

By purchasing HOODX, traders gain indirect access to Robinhood shares that are traded in the public markets. However, it is important to note that owning these tokens does not mean that one actually owns the original shares. As such, HOODX token holders do not get the rights of regular shareholders, such as voting rights in shareholder meetings or receiving dividends.

So, what are the differences between HOODX and Robinhood’s traditional stocks?

Basic Differences: Tokenized Stocks (HOODX) Vs Traditional Stocks (HOOD)

- Traditional shares are like physical property ownership certificates-kept and processed through the conventional financial system involving brokers, stock exchanges and clearing houses.

- Tokenized shares are digital versions of those shares stored on the blockchain, providing a new form of ownership and a more efficient way of transacting.

Ownership and Trading Process: From Broker Account to Crypto Wallet

- Traditional shares are recorded in a centralized system and require a turnaround time of 1-2 business days.

- Tokenized shares are directly recorded on the blockchain and self-managed through crypto wallets, with automatic execution through smart contracts-faster processing and no middlemen.

Market Access and Trading Efficiency: 24/7 vs. Specific Trading Hours

- Traditional stock markets are limited by operating hours and business days.

- Tokenized stocks can be traded 24 hours a day, 7 days a week, providing much higher flexibility and liquidity for global investors.

Investment Thresholds and Fees: Fractional Ownership vs One Share

- Traditional stocks are usually purchased by the full share; access to expensive stocks can be prohibitive for small investors.

- Tokenized shares support fractional purchases, allowing anyone to start investing with little capital. Transaction costs are also potentially lower due to automated processes and without many intermediaries.

Regulation and Security: New Technologies vs Mature Systems

- Traditional stock markets have well-established regulations and strong legal protections.

- Tokenized stocks, while technologically secure thanks to cryptography and blockchain, still fall under an evolving regulatory framework. Investors need to clearly understand their rights and risks when investing in these assets.

Risks of Buying Robinhood Shares

Here are some of the risks of buying Robinhood shares:

Regulatory Pressure Could Disrupt Robinhood’s Main Business Model

Currently, Robinhood still relies heavily on the payment for order flow (PFOF) model and transaction-based revenue, two aspects that continue to be under the spotlight of regulators. If there is a change in the rules, it could have a major impact on their core business.

Robinhood’s business is still highly dependent on market cycles

Robinhood’s performance improved with the rising market, high volume of options trading, and the rise of the crypto market. While this drives growth, it also shows that Robinhood is highly dependent on trading activity.

Competition in the Fintech and Broker World is Getting Tighter

Robinhood may have been a pioneer in mobile app-based investing, but now many competitors have emerged. Traditional brokers like Charles Schwab and Fidelity have updated their apps, removed commission fees, and added fractional share purchase features, making the competition even fiercer.

Robinhood’s Performance in 2025

Robinhood Share Price in 2025

Robinhood (HOOD) recorded one of its strongest performances throughout 2025. As seen in the chart above, its share price hovered in the $117-$120 range in mid-December 2025, surging more than 200% since the beginning of the year. According to BingX’s report, this rise reflects investors’ growing confidence in Robinhood, both as a retail trading platform and as a fintech company increasingly integrated with the crypto world.

Some of the key factors behind HOOD’s stock surge this year include: increased revenue and profits, rising trading activity from retail investors, as well as successful expansion into new products such as crypto services, prediction markets, and tokenized assets.

In addition, Robinhood’s inclusion in the S&P 500 index by the end of 2025 also increased its visibility among institutional investors and attracted fund flows from passive mutual funds, which strengthened its stock rally.

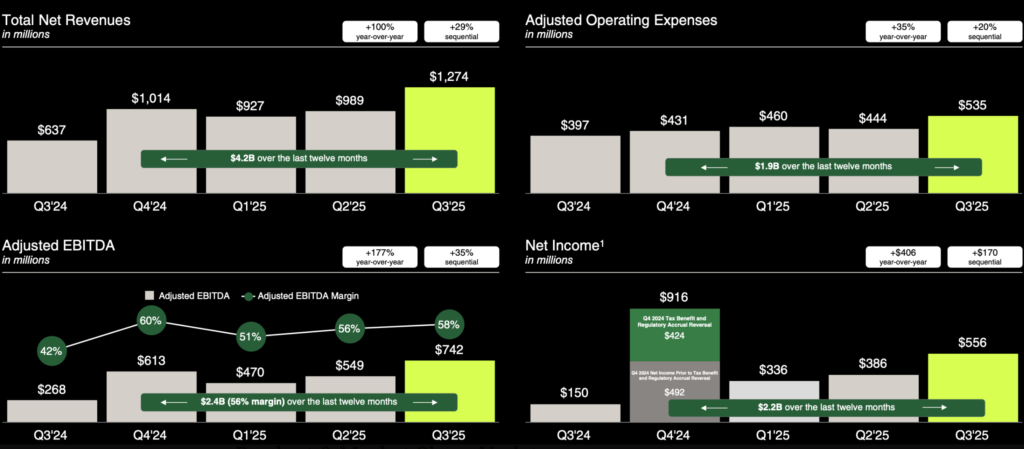

Robinhood Net Income in Q3 2025

According to the report, Robinhood’s net revenue in the third quarter of 2025 reached a record high of $1.27 billion-double that of the same period the previous year. This growth was driven by an even increase across multiple business lines.

Here are Robinhood’s key performance highlights in Q3 2025:

- Transaction-based revenue surged by 129% to $730 million.

- Cryptocurrency trading revenue skyrocketed over 300% to $268 million.

- Options trading revenue climbed 50% to $304 million.

- Equity trading revenue jumped 132% to $86 million.

- Net interest income grew by 66% to $456 million, driven by higher interest-earning assets and securities lending activity.

- Other revenues, primarily from Robinhood Gold subscriptions, totaled $88 million.

This strong performance also drove an increase in average revenue per user (ARPU) to $191, up 82% year-on-year, as customers became more active in using commerce and subscription services.

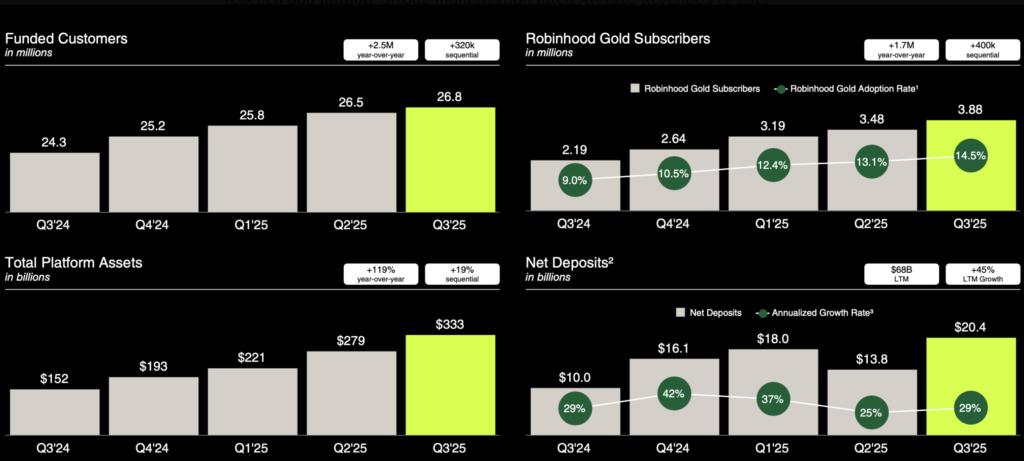

User and Asset Growth at Robinhood in Q3 2025

Robinhood recorded a significant increase in the number of users and total assets under management throughout 2025:

- Funded accounts grew to 26.8 million, marking a 10% increase year-over-year.

- Total investment accounts reached 27.9 million, reflecting strong user base growth.

- Total assets on the platform soared 119% year-over-year to $333 billion, driven by:

- Record net deposits of $20.4 billion in Q3, representing a 29% annual growth,

- Market value gains in both equity and cryptocurrency holdings.

Crypto exposure increased as the market rebounded , while Robinhood Retirement accounts now hold $24.2 billion in funds, growing 144% YoY.

Robinhood Gold (premium service) subscribers almost doubled to 3.9 million users, contributing to asset growth through:

- Cash sweep balance reached a record $35.4 billion (+44% YoY),

- Margin loans surged to $13.9 billion (+153% YoY).

This data shows that each user is getting more active and contributing more to the Robinhood ecosystem, both in terms of assets and engagement.

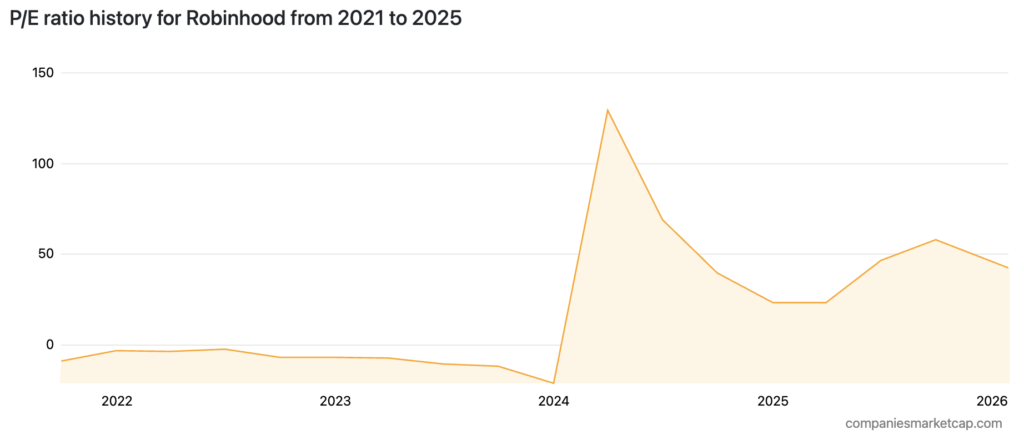

Robinhood Stock P/E Ratio Development to 2025

In the period from 2021 to 2023, Robinhood’s P/E ratio was relatively low and stable, and was even in the negative area, indicating unstable earnings performance or potential net losses. However, entering 2024, there was a sharp spike in the P/E ratio, peaking at over 150, which was most likely triggered by a significant increase in the share price before earnings growth could catch up. This indicates that the stock valuation has become very high relative to earnings at that time.

After reaching a peak, the P/E ratio begins to decline throughout 2025 as share prices adjust and/or earnings performance improves. Despite the decline, the figure remains above the level of previous years, reflecting a recovery in fundamentals and still strong growth expectations.

Robinhood’s (HOODX) Outlook Going Forward

Technical Analysis of Robinhood Stock (HOODX)

In a chart shared by Coin Republic website analyst Nambiampurath, Robinhood’s stock price is currently getting closer to its 200-day moving average-a technical level that has often been an important reference in the past. If the price stays above this line, the long-term trend usually remains positive. However, if the price falls below it, it is often followed by a deeper correction.

Nambiampurath – January 26, 2026

Currently, HOOD stock is very close to that level. If it is unable to hold, the next two support levels to watch are $101 and $95. These two numbers are not random; they are areas where Robinhood stock has previously found support before experiencing a big surge.

In terms of short-term technicals, the price structure also looks weak. The stock has not been able to break the downtrend line, and every time it tries to go up, it immediately gets selling pressure.

What does this mean? Sellers are still active, while buyers are still waiting for developments. To show more convincing strength, Robinhood’s share price needs to rise above $117 again. In fact, it can only be considered fully recovered if it manages to break $124. Otherwise, downside risks still remain.

Robinhood Stock Analysis According to Analysts at X

Based on charts and analysis shared by technical analyst at X, Donald Dean, Robinhood stock is currently showing a potential double bottom formation, a technical pattern that is often considered a signal of reversal from a downtrend to an uptrend.

According to him, if the double bottom formation is successful and the price breaks out of the descending wedge and passes through the high volume zone above $117, then there is potential for further strengthening. However, if the price fails to hold above the current support, the risk of further decline remains open. Investors and traders need to keep a close eye on price movements in this area, as the next direction is likely to be determined in the near future.

In addition, a chart shared by TheProfInvestor account on X, shows the importance of the 200-day moving average indicator in Robinhood’s (HOOD) stock price movement.

Since the beginning of 2024, Robinhood stock has experienced a sharp rise after it managed to break and hold above the 200-day MA line. This momentum was characterized by several large spikes:

- +160% from January to August 2024

- +307% from August 2024 to April 2025

- +354% from April to peak at the end of 2025

The 200-day MA line served as dynamic support during the uptrend, and now the price is approaching that level again around $102-$106. If this support holds, there is potential for a recovery. However, if it is broken, it could be a signal of trend weakness.

Investors are advised to also pay attention to the 200-week MA, as these two indicators can provide a strong picture of the medium to long-term direction of HOOD stock.

How to Buy HOODX Door

At Pintu, Robinhood is easy to invest in. HOODX purchases can start as low as Rp11,000, allowing users to gain exposure to Robinhood’s valuation without a lot of capital.

In addition to HOODX Pintu also provides various other tokenized stocks such as NVDAX, AAPLX, TSLAX, and other similar assets through the Market Tokenized Stocks page, allowing users to easily access various global stocks in on-chain form.

Here’s an easy way to buy HOODX on Pintu:

- Enter the Pintu homepage.

- Go to the Market page .

- Search and select the Robinhood xStocks (HOODX) crypto asset.

- Enter the amount you wish to purchase, and follow the rest of the steps.

Conclusion

Robinhood has grown rapidly since its founding in 2013, becoming a pioneer in app-based investing with a commission-free model. In 2025, the company recorded significant growth in revenue, number of users, and assets under management, driven by a surge in trading activity, expansion into crypto and tokenized assets, and an increase in premium service subscriptions.

Overall, Robinhood shows strong long-term growth prospects, but remains subject to regulatory risks, dependence on market cycles, and intensifying competition in the fintech industry.

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Reference:

- BingX. What are Robinhood Tokenized Stocks HOODX (xStocks) and HOODON (Ondo) and How to Buy? Accessed on January 28, 2026

- Dakota McCombs. Exploring the Benefits of Investing on Robinhood. Accessed on January 28, 2026

- Greene, Jim, MFA. Robinhood. Accessed on January 28, 2026

- Insights4vc. Q3 2025 Results: Robinhood vs Coinbase. Accessed on January 28, 2026

- Lawrence Nga. 3 Risks Investors Should Watch Before Buying Robinhood Stock Today

- OSL. Tokenized Stocks vs. Traditional Stocks: A Breakdown of the Core Differences. Accessed on January 28, 2026

- Rahul Nambiampurath. Robinhood Stock Price Pulls Back Ahead of Earnings With $95 in Focus. Accessed on January 28, 2026