Have you ever imagined buying a smartphone, only to have the manufacturer give you crypto assets worth more than the price of the smartphone? This is exactly the case with Seeker, which recently launched the $SKR token and is giving it away to its users. In this article, we will discuss what Seeker is, its history, $SKR tokenomics, advantages and disadvantages, and the potential and risks of $SKR tokens as an investment.

Article Summary

- 🔎 Definition of Seeker: Seeker is a crypto smartphone developed by Solana Mobile with the aim of simplifying onchain activities, including transactions, asset storage, and interaction with decentralized applications (dApps) in the Solana ecosystem.

- 🎯 Market Interest in Seeker: Seeker recorded preorder sales of around 150,000 units, far surpassing the achievements of its predecessor, Saga.

- ⚙️ Seeker Key Features: Seeker comes with a number of significant enhancements, including Seed Vault as hardware security for private key storage and transaction verification, the latest version of Solana dApp Store as a Web3 application distribution center, and Seeker ID, a Solana domain-based identity integrated with the device.

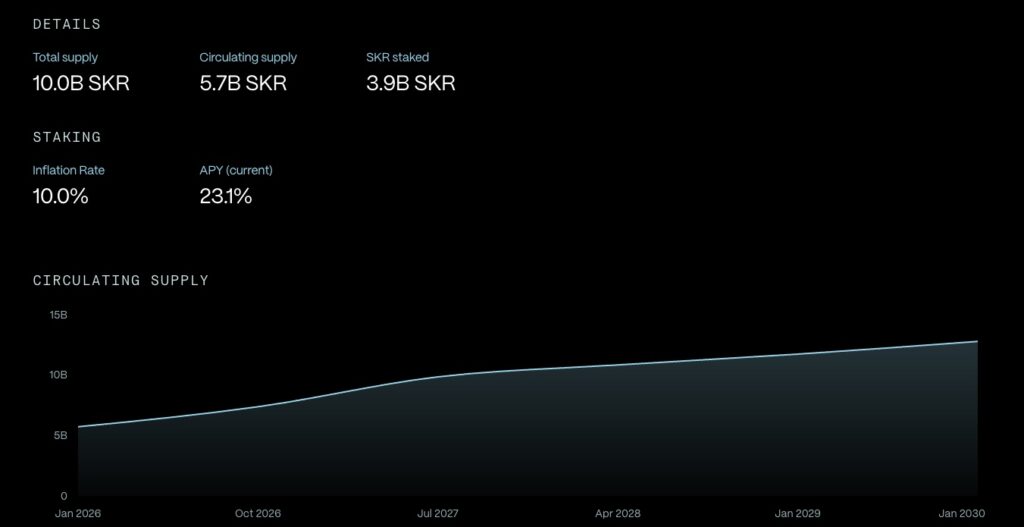

- 👀 The role of the SKR Token and its Tokenomics: $SKR is the native token in the Seeker ecosystem with a total supply of 10 billion tokens. It serves as an incentive mechanism for users and developers, while supporting the growth and governance of the Seeker ecosystem.

What is a Seeker?

Seeker is an Android-based crypto smartphone powered by the Solana network decentralized application (dApp). Unlike typical Android smartphones, Seeker is specifically designed to meet the needs of managing crypto assets and interacting with the Web3 ecosystem seamlessly, without losing the basic functions of a smartphone for daily needs. Thus, this gives Seeker an advantage over ordinary smartphones.

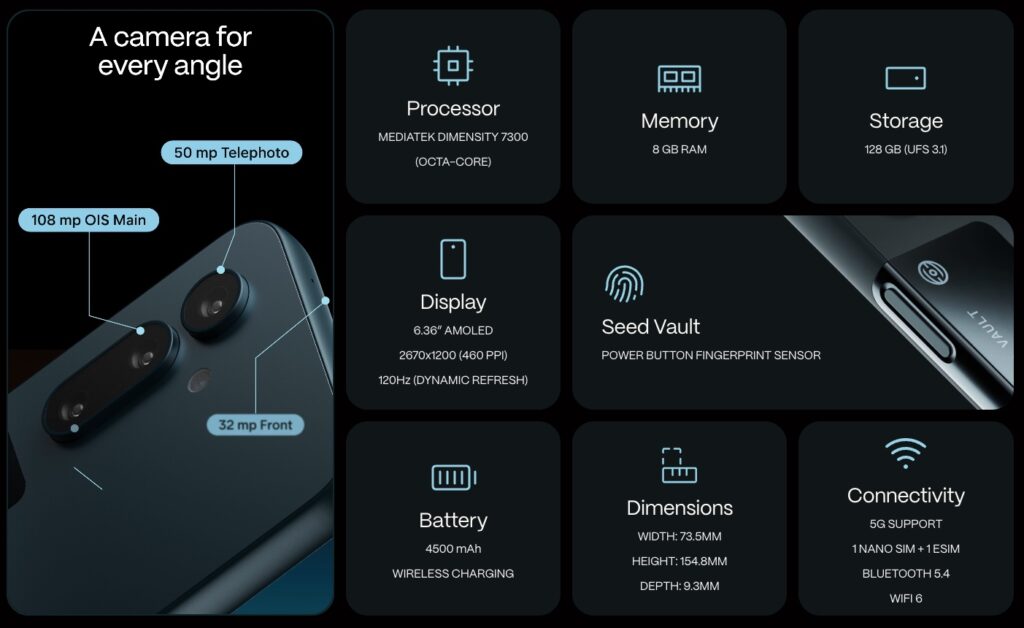

Seeker Key Features

- Seed Vault Wallet: Seed Vault is a crypto wallet feature that is built-in directly to the device, serving to store private keys and enable the approval process of onchain transactions using biometric authentication.

- New Solana dApp Store: Similar to the Apple App Store or Google Play Store, the Solana dApp Store features a decentralized collection of apps built on the Solana network that users can download and use.

- Seeker ID: A Solana domain address that users can claim and use as an identity to send and receive crypto assets, as an alternative to long wallet addresses.

In addition, Seeker uses TEEPIN (Trusted Execution Environment Platform Infrastructure Network) as a security infrastructure that ensures coordination between hardware and software to keep the device secure.

A Brief History of Solana Mobile and The Launch of Seeker

Solana Mobile, the smartphone manufacturer, had first launched a crypto smartphone under the Saga brand in May 2023. This launch coincided with the bearish crypto market conditions, which is thought to have affected the sales results of Saga, which were recorded at only around 20,000 units.

Saga only stayed on the market for about two years before production was discontinued. As a result, Saga users had to accept that Solana Mobile would no longer provide continued support, both in terms of app development and security updates.

In August 2024, Solana Mobile released Seeker and immediately received a high response of interest from the market. This is reflected in the preorder sales of 150,000 units, which are available for global delivery, including Indonesia.

Both Saga and Seeker users benefited through airdrops of varying values and types of crypto assets. One of them at that time, Saga users who used the Bonk application through the device had the opportunity to claim up to 30 million $BONK which was worth more than $250.

Learn more about Bonk at Pintu Academy: Bonk Full Explanation

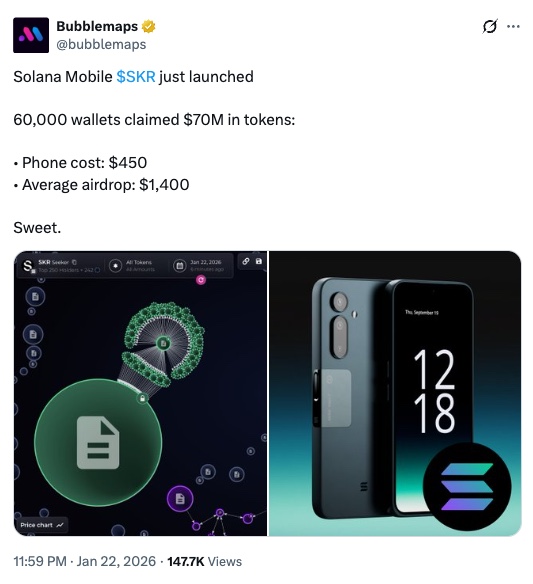

Meanwhile, Seeker implemented an airdrop scheme through the distribution of $SKR tokens to Seeker Season 1 participants. The program assessed device usage activity as well as developer contributions in building dApps for the Solana dApp Store. The token allocation that users received varied from 40,000 to 125,000 $SKR, which at the peak was worth over USD 1,400.

What is Token Seeker (SKR)?

$SKR is the native token of the Solana Mobile ecosystem launched on January 21, 2026. This token is designed as an economic driver within the ecosystem.

Through $SKR, the Solana Mobile ecosystem becomes economically synchronized, where each party’s incentives and participation can align with the overall growth of the network. Here are the main functions of the $SKR token:

1.Incentives

App creators and active users can participate in various programs organized by Solana Mobile, one of which is Seeker Season. In the program, the $SKR token is used as a reward base for participants.

2.Governance

Token owners have the right to participate in voting mechanisms that determine the direction of ecosystem development, from setting standards for applications that can be listed to decisions related to protocol development. With this mechanism, token owners have a fair voice in the decision-making process.

Tokenomics Token SKR

$SKR has a total supply of 10 billion tokens. Below is the breakdown of the $SKR token distribution.

- Airdrops: 30% of the total supply is allocated to active users and builders, with no lock-up period.

- Growth + Partnerships: 25% is allocated for ecosystem growth and partnership needs. Of this allocation, 28% is immediately unlocked at token launch, while the rest will be released linearly over 18 months.

- Solana Mobile Team: 5% is allocated to the Solana Mobile team, with a vesting scheme of 12 months cliff, followed by a linear release of tokens over 36 months.

- Liquidity + Launch: 10% of the total supply is immediately unlocked on token launch day for liquidity needs, so that $SKR tokens can be traded in the market.

- Solana Labs: 10% allocated to Solana Labs, with a vesting scheme of 12 months cliff, then released linearly over 36 months.

- Community Treasury: 10% is allocated to the Community Treasury and opened at token launch, with a management mechanism through governance.

When analyzed from its allocation structure, the $SKR token can be categorized as community-centric, with around 40% of the total supply allocated to Airdrop and Community Treasury. This portion is open from token launch, with distribution and management mechanisms organized through governance.

Pros and Cons of SKR Token

Seeker has a relatively strong position as one of the pioneering crypto-phones, developed by Solana Mobile, a subsidiary of Solana, one of the largest layer-1 blockchains in the industry.

Based on DAU, Solana records the highest rate among other layer-1 blockchains, with approximately 5.4 million active addresses per day. This large onchain activity base gives Seeker an edge, especially in designing more effective user incentives and onboarding strategies.

The $SKR token acts as an incentive mechanism that encourages users to participate more actively, while providing an opportunity for developers to continue to bring relevant and interesting dApp innovations.

On the other hand, this mechanism has the potential to create opportunistic adoption, where mobile phone purchase decisions are driven more by incentives than by the usefulness of the device or ecosystem.

Potential and Risks of SKR Tokens as an Investment

Tokenomics $SKR showed a relatively large circulating supply, mainly due to 30% of Seeker’s airdrop allocation being fully unlocked from day one.

This contributed to selling pressure in the market, which was also reflected in the correction of $SKR’s market cap from around USD 300 million to around USD 113 million, a drop of more than 60% from its peak.

With a sizable amount of airdrop allocation that is 100% unlocked, this may pose a risk of further price decline if there is no significant token demand even though most of the tokens in circulation are staked, if we take the example of other projects such as JUP, Meteora, they also experienced a very significant correction after the airdrop.

With approximately 3.9 billion $SKR already staked, the staking mechanism plays an important role in absorbing circulating supply. In addition to offering a competitive APY, staking also gives holders the option to utilize their tokens, thereby reducing supply in the market and offsetting the 10% annual inflation rate.

On the other hand, the high level of staking in the early phase needs to be viewed with more caution. The large amount of tokens staked may not necessarily fully reflect long-term confidence in the fundamentals of Seeker or the $SKR token.

In many cases, early-stage staking participation is driven more by the still-high APY, especially when token distribution has just started.

The large allocation of 100% unlocked airdrops has the potential to create selling pressure and the risk of further price declines, especially if not accompanied by significant token demand. This condition remains relevant even though most of the tokens in circulation are in staking status. Referring to the experience of other projects such as JUP and Meteora, both also experienced significant price corrections after the airdrop distribution.

How to Invest in Crypto in Pintu

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up your Pintu balance using your preferred payment method.

- Go to the market page and search for your favorite asset!

- Click buy and fill in the amount you want.

- Now you have crypto assets!

Download Pintu crypto app on Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions, on Pintu app, you can also learn more about crypto through various Pintu Academy articles that are updated weekly!

Disclaimer: All articles from Pintu Academy are intended for educational purposes and do not constitute financial advice.

Conclusion

Seeker comes as a crypto smartphone designed to expand Web3 adoption, not only among crypto users but also the general public, primarily through incentive strategies such as Seeker airdrops. This approach is effective as an interest trigger, although it risks encouraging incentive-oriented adoption patterns. On the other hand, the $SKR token serves as the primary economic instrument in the Seeker ecosystem, with a tokenomics design that emphasizes community as their priority but comes with the challenge of a large initial supply in circulation. As such, the future value of $SKR will largely depend on how far it is able to deliver sustainable usability and keep users and builders engaged.

Reference

- Solana Mobile, “SKR Whitepaper“, accessed on January 27, 2026.

- Backpack, “What is Solana Phone?“, accessed on January 27, 2026.

- Solana Mobile Blog, “From Saga to Seeker: Solana’s Mobile’s Smartphone Revolution“, accessed on January 28, 2026.

- Kathleen Kinder, “Solana Ends Phone Support Saga After Two Years“, CoinLaw, accessed on January 28, 2026.