For some traders, a short squeeze can be a golden opportunity to gain profits. However, for some traders, a short squeeze can be a catastrophe that leads to losses. Then, what is a short squeeze? How can you take advantage of it or avoid it? Find out more in this article.

Article Summary

- 📈 A short squeeze occurs when the price of crypto sharply rises, forcing short sellers to exit their positions to avoid bigger losses.

- 🔁 The short seller exits their position by buying the crypto. However, this purchasing action can create a snowball effect. It pushes the price even higher and attracts new buyers and investors.

- 🤑 Traders can profit from short squeezes by taking long positions in highly shorted assets at the right time. To avoid the risks associated with short squeezes, it’s advised to trade on high liquidity exchanges, use moderate leverage, and monitor short interest ratios

About Short Selling

Before understanding the short squeeze, it is essential to understand the concept of short selling (shorting). Shorting means selling an asset in the hopes of rebuying it later at a lower price. Shorters profit from the difference between the selling price and the lower buying price.

The profit calculation simulation is quite simple. Take the initial selling price (the higher price point) and then subtract from the buying-back price (the lower price point).

For example, a trader can borrow 1 ETH at US$3.500 and sell it immediately. BTC subsequently drops to US$2.500, and the trader decides to buy it back to return it to the lender. His profit will then be US$1.000 minus any transaction/exchange fees.

The risk of short selling comes when the asset price increases because they start to amass an unrealized loss. As the price goes up, short sellers may be forced to close their positions. In addition, the risk can also be higher when short-sellers utilize the leverages feature.

What is Short Squeeze?

Short squeeze is a term that refers to the sharp rise in crypto prices due to many short sellers being forced out of their positions. Short sellers close their positions either due to the use of stop-losses or liquidation (for margin and futures). Often, they also close their positions manually to avoid further losses.

Short sellers will close their positions by going long. However, a short squeeze can often have a snowball effect. When a group of short sellers closes their positions, the asset price will start to rise. The more the price increases, the more short sellers are forced to close their positions. The continuous buying action will further push the price up.

As you can see, the effect starts to snowball. To exacerbate the situation, sharp price increases over a short period of time attract other buyers who hope to go long and make a profit. The entry of these participants further elevates the asset’s price.

The combination of short-sellers closing positions and the influx of new investors and traders causes prices to rise sharply in a short squeeze. As such, a short squeeze is typically accompanied by an equivalent spike in trading volume.

The opposite of a short squeeze is a long squeeze. It is a term that refers to the same effect when long positions are trapped by selling pressure. The result is that prices experience a sharp decline.

How does a Short Squeeze Happen?

As mentioned, a short squeeze occurs when short sellers have to close their positions, either due to stop loss, liquidation, or manually closing their positions. When the price of the asset they are short moves up instead, the short sellers are forced to buy the asset at a higher price than before.

The cause of a short squeeze can come from anything, from new updates on a blockchain to pure market speculation. The most important factor is an imbalance between demand and supply. A significant spike in demand can cause a substantial increase in price.

Short squeezes can occur in all financial markets that allow traders to short. On the other hand, if the financial market does not have the opportunity for shorting, it can create a significant price bubble. This is because there is no way to risk the price of the asset going down, and as a result, the price will rise for an extended period.

Example of a Short Squeeze

The majority of large-capitalization cryptos have experienced a short squeeze at least once. The practice is relatively commonplace, but most are disguised as regular price action. It is more prevalent in bearish markets due to the high ratio of short sellers to longs.

One example of a short squeeze occurred with the Celsius (CEL) token. In July 2022, Celcius filed for bankruptcy. This should have been a negative sentiment as Celcius’ fundamentals were deteriorating. Seeing an opportunity for a downtrend, traders then took shorting positions.

The price of the CEL token skyrocketed from $0.77 to $4.30 within a month of the bankruptcy announcement. However, given the poor fundamentals, the CEL price plummeted again soon after. The short squeeze led to massive liquidation for short sellers.

The stock market is also inseparable from the short squeeze. In mid-2019, Tesla announced that it would produce electric vehicles. Many market participants bet that Tesla would fail and its shares would fall. It turned out that Tesla shares actually rose by more than 400%, which led to the liquidation of more than $40 billion throughout 2020.

How to Identify a Short Squeeze

One of the noticeable signs before a short squeeze is short positions are more dominant than long positions. If there are more short positions than long positions, it means there is more liquidity to trigger a short squeeze.

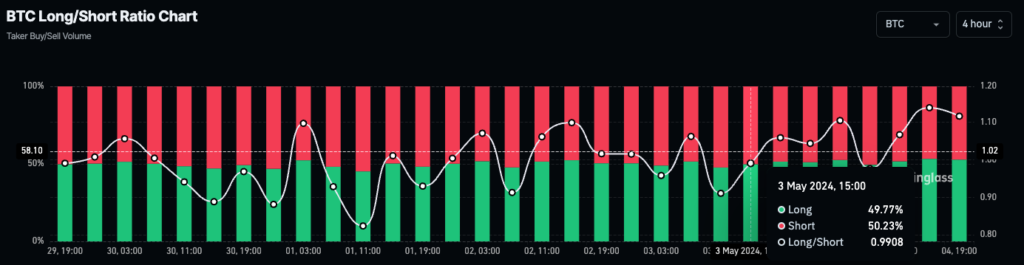

Identifying a short squeeze through market sentiment is often done using the long/short ratio. Here is an example of coinglass long/short ratio.

The ratio refers to the volume of active buying against the volume of active selling over a given time frame. It can reflect market sentiment in the short term. If the volume of active buying is high, it indicates a bullish sentiment. If the active selling volume is high, it indicates a bearish sentiment, as many traders are shorting.

How to Avoid Short Squeeze

A short squeeze is considered unsustainable. Many traders take profits at the first opportunity, which reduces the strength of the squeeze and makes it last longer.

Here are some tips on how to avoid a short squeeze:

- Choose exchanges with high liquidity. Short squeezes can be more efficiently executed and manipulated on exchanges with very little liquidity. By avoiding these exchanges, you can minimize your odds of being caught by the initial volume attack that triggers a cascade of liquidations.

- Don’t use high leverages. In some cases, a short squeeze can last only a few hours or days. By avoiding using high leverages, you can keep your position out of the liquidation zone when a short squeeze occurs.

- Watch out for shorting activity. Markets with a higher ratio of shorts to longs are more prone to short squeezes. Look at the short interest ratio (short interest / daily trading volume). The higher the number, the higher the risk of a short squeeze.

An increase or decrease in short interest can be a sign of a shift in market sentiment. For example, a 10% increase in short interest indicates that 1/10th of market participants have shorted the asset.

How to Trade a Short Squeeze

The sudden surge in prices creates a chance for maximum profit through a short squeeze. However, keep in mind that the risks are equally high. Therefore, they must have a clear understanding of how it operates, the reasons behind its occurrence, risk management techniques, and a well-defined trading strategy to capitalize on a short squeeze when it happens.

One way to trade is to look for cryptos with high short interest to look for potential short squeezes. But keep in mind, there is always a reason behind the high short interest in a crypto, such as an unfavorable fundamental outlook.

When the crypto does show signs of rising prices and has good momentum, traders can go long and hope for a short squeeze. In this strategy, the right entry point is needed, which is before or in the early phase when the short squeeze occurs. Then, sell it when the price has risen sharply

Be aware of the period that the short squeeze lasts. The longer it lasts, the greater the risk of it losing steam and turning back.

Meanwhile, for traders or investors who already own assets that are undergoing a short squeeze, the period is an opportunity to exit the position. Especially if the asset has been in a downward phase for a long time.

Conclusion

Short squeeze is a term for the sharp rise in crypto prices caused by many short sellers being forced to buy the asset at a higher price than before. The continuous buying action will further push the price up and attract other buyers who hope to go long and make a profit.

Thanks to its high potential profits, a short squeeze can be a promising trading strategy. However, with this high reward potential comes high risk. Timing a peak is no easy feat. Indicators such as the long/short ratio can be used as tools to identify short squeezes.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice

References

- Cory Mitchell, Short Squeeze: Definition, Causes, and Examples, Investopedia, accessed on 3 May 2024.

- Lou Whiteman, What is a Short Squeeze, The Motley Fool, accessed on 3 May 2024.

- Daniel Phillips, Crypto Short Squeezes: How They Work and Avoidance Strategies, CoinMarketCap, accessed on 3 May 2024.

- Reyna Gobel, How to Trade a Short Squeeze, Investopedia, accessed on 3 May 2024.