Investment instruments such as stocks and crypto assets operate based on the fundamental principle of supply and demand. Transactions involving these instruments highlight the concept that sellers aim to sell their assets at the highest available market price, while buyers strive to acquire them at the lowest possible price. This dynamic tension between buyers and sellers generates a pricing disparity known as the “spread.” This article will discuss about the concept of spread, and why it is important for crypto investors and traders to understand it. Read the full article below.

Article Summary

- 💰 Spread is the difference or gap between the buying price (bid) and the selling price (ask). This discrepancy arises during transactions between sellers and buyers on an exchange.

- ✍🏻 Several factors influence spreads, including market volatility, liquidity, supply and demand dynamics, and trading volume.

- 🏦 The bid-ask spread is the most common type of spread used in arbitrage trading strategies.

What Is Spread?

Spread is the difference or gap between the buying price (bid) and the selling price (ask). This difference occurs in transactions between sellers and buyers on the exchange. For example, if you want to buy one bitcoin (BTC) for $30,000, but the seller sets the bid price at $32,000, there is a spread of $2,000.

Additionally, the spread can also be calculated as a percentage of an asset using the following formula $1,000 spread / $32,000 x 100 = 6.25%. In the crypto industry, there are three types of spreads, namely the inter-exchange spread, the intra-exchange spread and the calendar spread.

Types of Spread

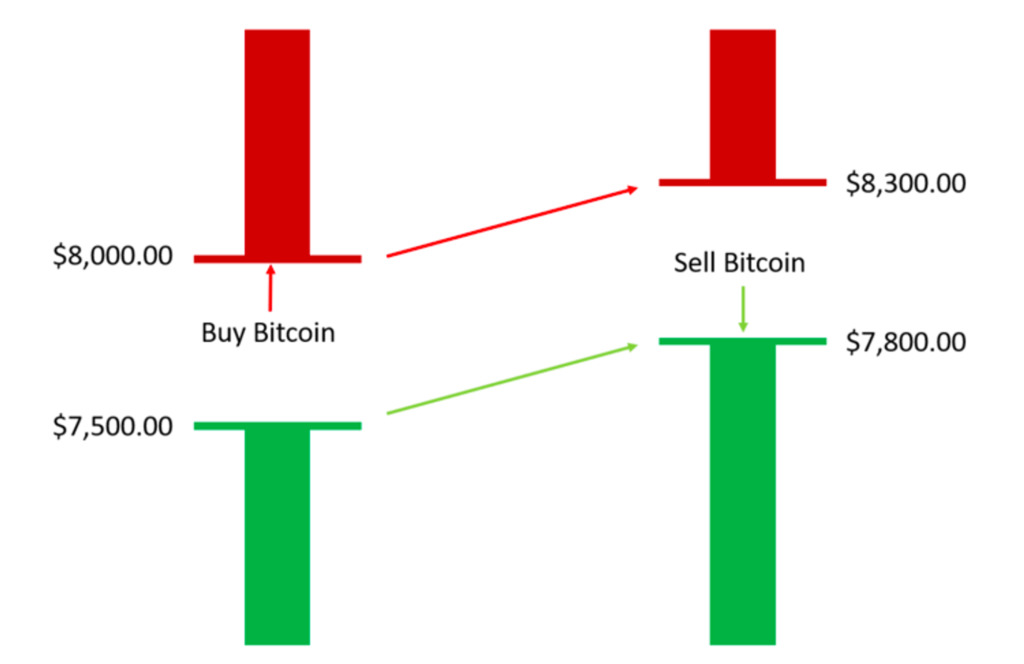

The bid-ask spread represents the disparity between the ask price (selling/offering) and the bid price (buying/buying) on an exchange. When buyers and sellers come to an agreement regarding their respective offered prices, a trade is executed. Spreads are commonly utilized in arbitrage trading strategies.

💡 Arbitrage is a trading strategy that aims to capitalize on price inconsistencies between two distinct markets. The entity engaging in arbitrage is referred to as an arbitrageur.

The bid-ask spread, primarily employed in arbitrage trading, encompasses the following forms:

- Inter-Exchange Spread: This spread signifies the difference in the price of the same crypto asset across various exchanges or trading platforms. Traders keen on arbitrage investment strategies find this value differential critical.

- Intra-Exchange Spread: This spread concerns the price variance of an asset within the same trading platform.

- The calendar spread: This spread is a type of intra-exchange spread found in the futures market. In calendar spreads, the difference reflects the price of contracts for the same underlying asset but with different expiration dates. For example, an investor buys a put option on a BTC asset with an agreed price of $20,000, expiring in six months, for a premium of $1,000. At the same time, the investor executes a put option with the same agreed price, expiring in three months, for a premium of $500. As a result, the net debit paid for the spread is $500.

Factors Influencing Spread

Several factors impact spreads within the crypto market:

- Market volatility: This is the most important factor affecting spreads in crypto. During periods of high volatility, spreads tend to widen due to turbulent market conditions, thus increasing risk for market participants such as entities or individuals that provide liquidity by being willing to buy and sell certain assets. The strategy to compensate for the increased risk is to widen the spread.

- Liquidity: Refers to the ease with which an asset can be bought or sold in the market without affecting the price. In a highly liquid market, where many buyers and sellers meet, it means that an asset can be traded without causing significant price changes. When a crypto asset is said to be highly liquid, its spread tends to be smaller because market makers find it easier to match buyers and sellers without taking significant risk.

- Supply & Demand: The principle of supply and demand also applies to spreads in crypto. When the demand for a certain crypto asset is high while its supply is low, the spread is usually wider. This occurs because sellers demand higher prices to increase the purchase price, while buyers may be less willing to buy or pay for the asset at a high price.

- Trading Volume: The volume of crypto trading on an exchange can affect the crypto spread. Typically, higher trading volume can result in a tighter spread due to increased liquidity, making it easier for market makers to match buyers and sellers.

Other factors that can influence the spread include global macroeconomic conditions, geopolitical events, and news regarding regulations affecting crypto.

Benefits of Spread in Crypto Trading

Spread trading provides arbitrage opportunities for investors and traders. This price difference can be exploited by buying assets at a lower price on one exchange and selling them at a higher differential price on another exchange. Arbitrage trading has been used by investors or traders who know how to take advantage of price differences.

In addition, understanding the spread can be beneficial to investors as it can be used to measure liquidity, identify market volatility, calculate costs incurred and compare asset values.

Conclusion

As a trader or investor, an understanding of the spread can offer its own advantages in trading and investing, especially as the spread can affect potential profitability, with a smaller spread allowing for quicker profits. Conversely, a larger spread requires a significant price movement to generate profits.

In addition, strategies that traders can use to minimize the spread include trading in high volumes, choosing liquid markets, and trading during busy hours. By effectively implementing these strategies, traders have the potential to increase their trading profits.

In conclusion, crypto spread is more than just a trading term, but refers to a concept that can bring success to crypto trading activities. By understanding the spread and knowing how to calculate it, one can certainly improve trading decisions and potentially achieve maximum profits.

Read more: 4 Crypto Trading Techniques You Need to Know

Buy Crypto Assets in PINTU

For those of you interested in trading or investing in crypto assets such as BTC and ETH, you can use the PINTU application. There’s no need to worry because the PINTU application is officially registered and supervised by the Commodity Futures Trading Regulatory Agency (Bappebti). All crypto assets available in the PINTU application have undergone a rigorous assessment process, prioritizing cautionary principles.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store!

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Redot, What Is the Market Spread in Crypto and What Is a Spread in Crypto Trading?, accessed on 27 September 2023.

- Swyftx, What is Market Spread in Cryptocurrency?, accessed on 27 September 2023.

- Woolypooly, Crypto Spread 101: Mastering the Key to Profitable Trading, accessed on 27 September 2023.

- Economictimes, What is ‘Bid-Ask Spread’, accessed on 27 September 2023.