As crypto matures, investors and traders demand more from projects. Initially, most crypto projects don’t assign any utility to their tokens. ETH, SOL, and BNB serve only to be the medium of exchange in their respective networks. This was working for several years. However, in the past few years, investors realized that most tokens are useless. They don’t capture or hold any value from the network.

Projects knew this and developed plans such as buyback, burning tokens, and sharing their revenue with the holders. So, in this article, we will explore what token buyback is, why crypto projects buy back their tokens, and how you can benefit from this mechanism.

Key Takeaways

- The Shift Toward Value Capture: As the crypto market matures, investors are moving away from tokens with no utility and are demanding projects show real revenue, profits, and mechanisms that capture value from the network’s success.

- Three Primary Buyback Mechanisms: Projects generally utilize one of three methods: Buyback and Burn, Buyback and Hold, and Buyback and Distribute.

- Buybacks are not a Cure-All: A buyback mechanism often fails to influence price if it is used to “paper over the cracks” of a token that lacks fundamental utility or sustainable revenue.

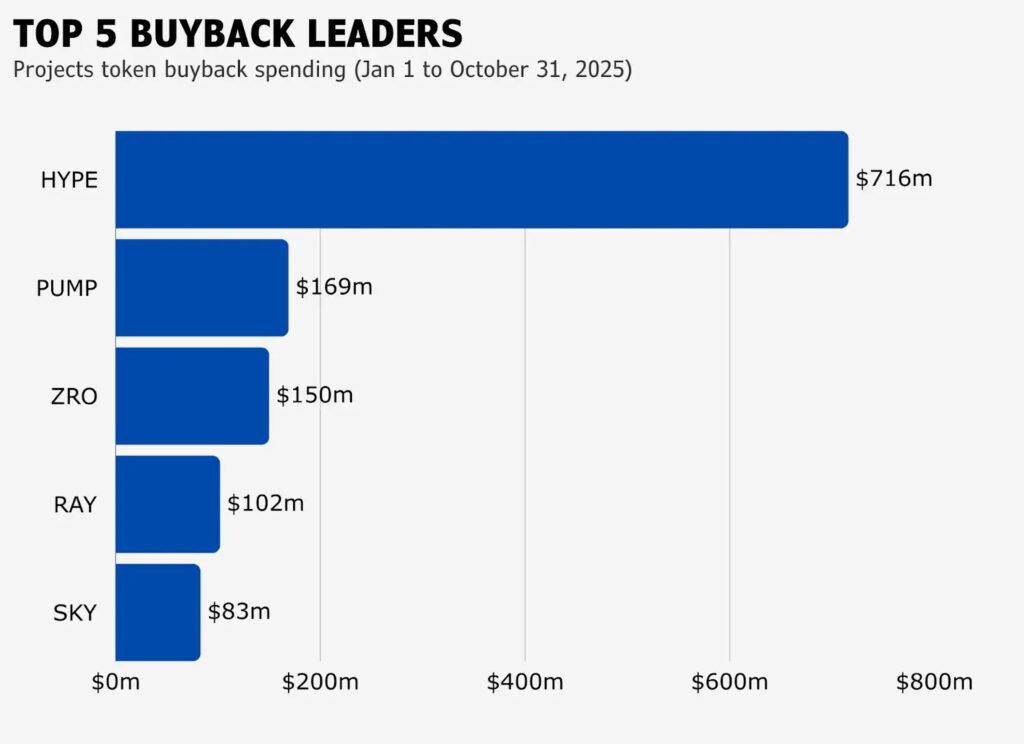

- Market Leaders in 2025/2026: Hyperliquid (HYPE) and Sky (SKY) have set the “gold standard” for successful buybacks, with Hyperliquid purchasing over $1 billion worth of HYPE using organic protocol revenue.

What is Token Buyback in Crypto?

A buyback is a popular mechanism in TradFi where the company buys back its shares from the market. This is done to reduce shares circulating in the market, which will reduce selling pressure from other market participants. This is the same in crypto. Projects buy back their tokens to reduce selling pressure from the market (with the assumption that the team won’t sell them).

The Token buyback mechanism varies for each project. Some projects, such as BNB, buyback and burn their tokens, permanently removing them from circulation. Others, like HYPE, store the tokens in a treasury for futures incentives and growth initiatives.

Token buyback has been one of the hottest topics in 2025. As the market matures, investors and traders are starting to look at revenues, profits, and the product itself. Naturally, the token becomes one of the key issues, as most projects don’t bother to add utility to their token.

The Hyperliquid buyback model has become one of the gold standards for projects. Hyperliquid, Jupiter, Pumpdotfun, and Sky have done some of the biggest token buybacks in 2025.

Why Do Projects Utilize Token Buyback?

Projects use buybacks to convince the market that their tokens are valuable and worth holding. This can be seen with projects such as Pumpdotfun, where the PUMP token lacks significant utility. The team knows this, and so they allocate a percentage of their revenue to token buybacks. However, as the chart above illustrates, it isn’t really effective.

Buybacks don’t change the fact that the PUMP token doesn’t capture value from Pumpdotfun’s success. Contrast the PUMP chart above with Hyperliquid, where the buybacks only add to the fact that HYPE is a valuable token in the Hyperliquid ecosystem. When buyback is the only utility, it doesn’t add significant value.

Deep dive into Hyperliquid: What Is Hyperliquid (HYPE)? – Pintu Academy.

For investors, investing in projects with buybacks makes sense because selling pressure should be reduced compared to others. Additionally, projects confident with their buybacks should also signal a healthy profit and revenue stream for the team.

How Token Buyback Works

1. Buyback and Burn

Buyback and burn is the most aggressive approach in the buyback mechanism. Tokens are bought back from the market and then sent to a burning address, permanently removing them from supply. In terms of purely reducing sell pressure, this is the best one. However, this is essentially burning money. Radium and Sky (formerly MakerDAO) are the leaders in this mechanism. Ethereum and BNB also implement this mechanism, but do so in a less aggressive approach.

2. Buyback and Hold

In this mechanism, projects simply buy their tokens and hold them in a treasury. This does two things: removes selling pressure, and allocates funds for future needs. This is the most common buyback mechanism, as the token just sits in the project’s treasury. This opens up flexibility for the project to create a reserve for future initiatives, liquidity, or incentives.

Hyperliquid is the leader in this category. The Hyperliquid Assistance Fund is now the 4th largest holder of HYPE after consistently accumulating it.

3. Buyback and Distribute

The third mechanism takes a unique approach. Instead of just removing or burning the tokens, the project reinjects them into the ecosystem through staking rewards, governance incentives, or yield programs. Sky protocol employs this mechanism, where the surplus USDS revenue is split between burning SKY and redirecting SKY to stakers.

Deep dive into the Sky Protocol: MakerDAO Rebrands to Sky: How It Works and Features of USDS & SKY.

The buyback and distribute model is relatively risky compared to the other two. Buyback and burn simply creates scarcity and sell pressure. In buyback and hold, it reduces sell pressure while accumulating a reserve for the project. The buyback and distribute model will add additional benefits to token holders, but can backfire if inflation is not controlled or the numbers don’t match.

Top Token Buybacks

Source: Blocmates.

Hyperliquid is, without a doubt, the project with the biggest buyback in 2025. Per January 8, 2026, Hyperliquid has bought back HYPE worth $1 billion. PUMP comes in second with around $230 million. So, what about the performance of these projects? HYPE, ZRO, and SKY are the best performers since the October correction. RAY and PUMP are the worst ones, with around -70% for PUMP and -60% for RAY.

Overall, SKY and HYPE are the only ones truly successful in using buybacks in their ecosystem. Ultimately, the key point is not how buybacks are triggered, but where the tokens go once they leave the market. The market will always know which buyback builds value, instead of merely covering up weaknesses.

Why Buybacks Fail

Source: @flowslikeosmo.

As previously discussed, buybacks generally fail to impact the price when investors know that it is only papering over the cracks. This applies to tokens without meaningful utility, projects with no sustainable revenue, or buybacks that are small in dollar value. Essentially, investors know now if a buyback is just for the sake of having a buyback.

In equities, companies only buy back shares from the cash they generate. It makes sense for the company to reinvest the profits back into the company for growth. However, most companies with buybacks are mature ones with sustainable revenues and a working business model. No early-stage growth company does a buyback.

In contrast, most crypto projects do buybacks regardless of their product or revenue situation. They do this just to attract attention and hype. And this is why most buybacks will fail to influence the price.

As an investor, our job would be to look at the fundamentals beyond the buyback. Find out where the buyback money comes from and where the tokens flow to after the buyback. If we do this, we will end up with tokens such as HYPE, SKY, and SYRUP, where the buybacks are generated from the protocol’s revenue.

Conclusion

Ultimately, a token buyback is only as strong as the fundamentals of the project behind it. While the mechanism can effectively reduce selling pressure and signal a healthy revenue stream, it cannot compensate for a lack of genuine utility or a failing business model. Savvy investors must look beyond the “hype” of a buyback announcement to determine if the funds are generated from sustainable protocol revenue.

References

- Adrian, “Top Projects With Buybacks: 2025 Edition | Top Projects With Buybacks”, Blocmates, accessed on January 6, 2026.

- (1) fejau on X: “On token buybacks (and how to decide how much to do)”, X, accessed on January 7, 2026.

- (1) More Recently The Giver on X: “i am actually going to take this even one step further and say that buybacks in crypto should almost never be used in the early stages of a business”, X, accessed on January 8, 2026.