Tokenization is the latest innovation in the financial sector. Previously, assets such as property, bonds, and other valuable collections were not accessible to everyone due to their high costs. However, blockchain technology is unlocking a new era of fractional ownership through tokenization, allowing anyone to own portions of these expensive assets. This article dives deep into tokenization, explaining what it is and how it works.

Article Summary

- 🪙 Tokenization is the process whereby ownership rights of an asset are represented as digital tokens and stored on a blockchain. These tokens act like digital certificates of ownership and represent almost any value object.

- 🏠 Tokenization can be applied to real assets (RWAs) such as stocks, bonds, deposits, fiat currencies, property, and so on. It can also be done on digital assets and in-game items.

- ✨ Benefits of tokenization include increasing asset liquidity and accessibility, fair market prices, reduced management and transaction costs, and transparency.

- 🔥 Asset tokenization has a promising future as more traditional financial institutions create tokenized products. However, it faces unclear regulatory issues and big data storage problems.

What is Tokenization?

Tokenization is the process whereby ownership rights of an asset are represented as digital tokens and stored on a blockchain. These tokens act like digital certificates of ownership and can be applied to any asset with value, including physical, digital, fungible, and non-fungible assets.

Through tokenization, the underlying asset can be divided into smaller ownership fragments. By purchasing these fragments, the buyer receives tokens representing their ownership. Since these assets are stored on a blockchain, owners can maintain custody over them.

Tokenized tokens are different from native tokens on a blockchain network. Native tokens like BTC, ETH, and SOL are fully digital and serve as speculative investment assets, stores of value, and utility tokens in their respective ecosystems.

Tokenized tokens, on the other hand, bridge the traditional financial world with blockchain. It also increases the liquidity of the underlying assets and makes them more accessible.

Difference between Tokenization and Securitization

Tokenization is similar in concept and process to securitization. Both convert assets into tokens whose proof of ownership can be traded. However, the difference lies in the assets used and the platform in which they are traded.

Tokenization can use various types of assets. In contrast, securitization can only use traditional financial assets such as loans and bonds. As for the platform, tokenization is stored and traded through the blockchain. Then, as securitization takes the form of securities, it is traded on the stock exchange.

Securitization is an established practice with a clear framework and regulations. In contrast, tokenization is relatively new, and its framework and regulations are still being developed.

How Tokenization Works

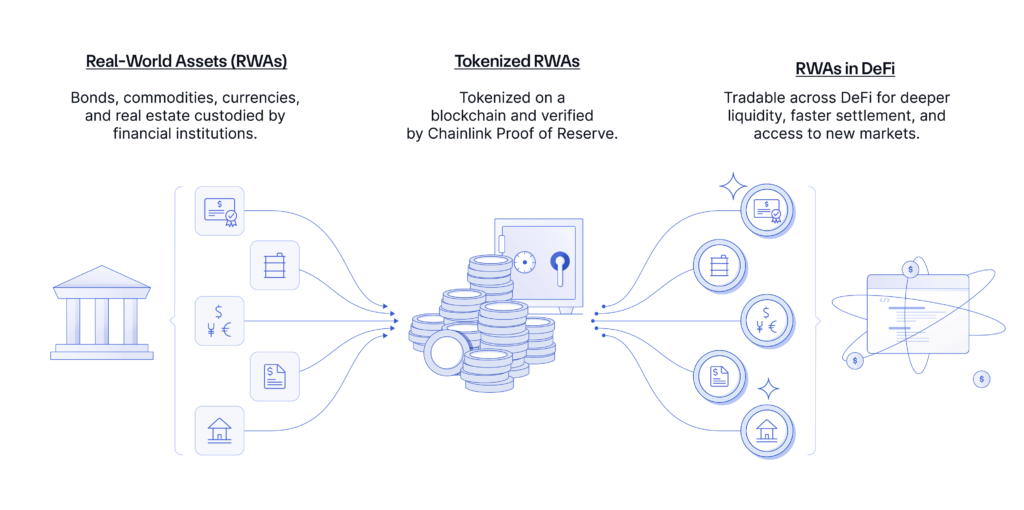

By consolidating the processes of creation, distribution, buying and selling, clearing, settlement, and storage into a single layer, tokenization enables an efficient financial system utilizing blockchain technology.

The tokenization process involves several complex steps. Here is the simplified version how the tokenization process works:

- Select the asset to be tokenized. The first step is to determine the asset, which can be stocks, commodities, currencies, securities, property, and various other assets.

- Define the token type. After choosing the asset, determine what token to create, such as fungible or non-fungible tokens. In addition, the token type (ERC-20, ERC-721, etc.), token allocation amount, governance token minting mechanism, and other parameters are also determined at this stage.

- Choose a blockchain to issue tokens. The selection should be customized according to the required criteria. Various criteria can be considered, such as the type of permitted or public blockchain.

- Select an auditor to verify off-chain assets. Tokenized assets must have the same amount in the real world. Auditors need to verify this to provide investors with a guarantee of trust.

- Issuing tokens. After the whole process is conducted, the tokenized assets will be issued as tokens and can be traded. Trading is typically done on DeFi for deeper liquidity, faster settlement, and broader access.

Asset Tokenization Example

The following are some examples of asset tokenization based on the type:

1. Real World Asset (RWA) Tokenization

RWA tokenization is the most widely used type of tokenization. In this type, real-world assets such as currencies, stocks, bonds, commodities, property, credit, and so on are tokenized and then stored on the blockchain. Owning an RWA token is the same as owning a partial asset in the real world.

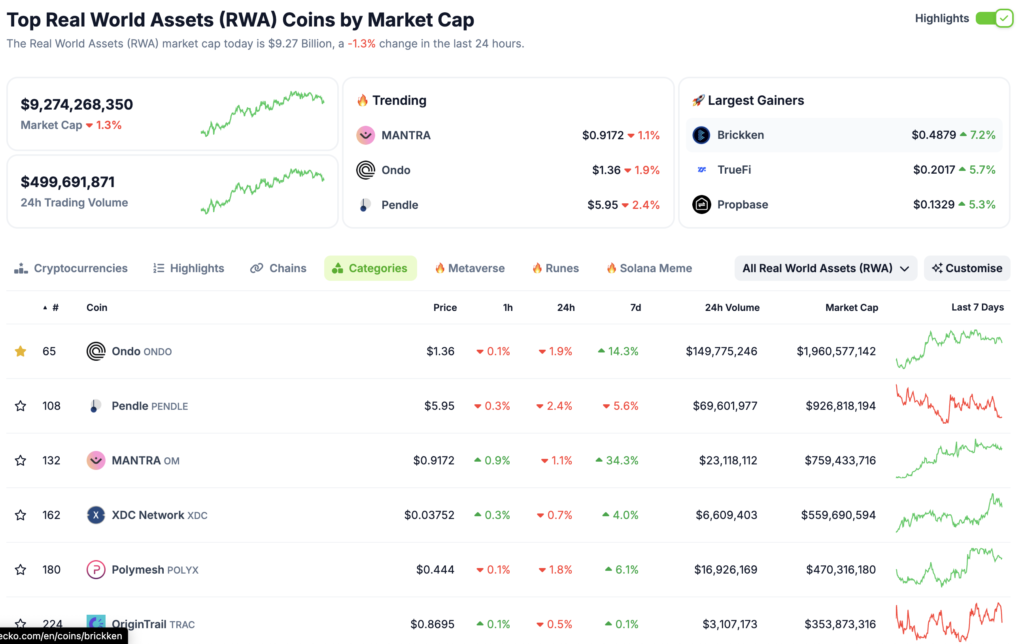

Ondo Finance is the protocol with the largest Total Value Locked (TVL) in the RWA sector. One of the real-world assets tokenized by Ondo Finance is US Treasuries. It is tokenized into OUSG. For investors who own OUSG, it means that they own US Treasuries.

In addition to Ondo Finance, other protocols that are doing RWA tokenization are Centrifuge, Clearpool, MakerDAO, Goldfinch, Maple Finance, TrueFi, and many more. The following article explains the development of the RWA ecosystem.

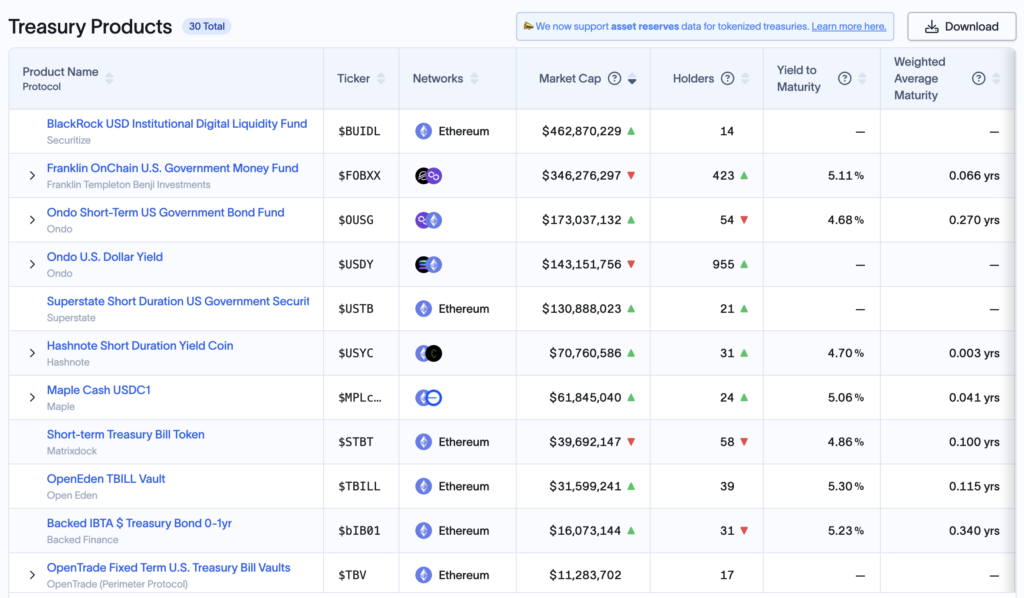

The practice of RWA tokenization is not exclusive to the crypto industry. The traditional financial sector is also doing the same. For example, Franklin Templeton launched the Franklin OnChain U.S. Government Money Fund in October 2023. It is a tokenized product of government debt securities and deposits. It is also the first registered mutual fund on the blockchain.

Similar initiatives have been carried out by other securities companies and investment managers, such as JP Morgan through the Tokenized Collateral Network (TKN), City Treasury through Citi Token Services, and many others.

2. Digital Asset Tokenization

Tokenization of digital assets on blockchain networks is commonly used for Web3 purposes. It can represent rights in DAO governance rights and cross-chain assets. By owning a governance token, its owner can participate in the network’s management.

Because they’re entirely digital, tokenized assets stored on a blockchain enable the owner to hold the asset outright rather than owning a claim on the underlying asset.

Any protocol that uses DAOs for its governance will tokenize digital assets. Often, these tokens have other utilities, such as means of payment in the network ecosystem. For example, Ondo Finance has an ONDO token that serves as a governance token. ONDO holders have the opportunity to manage the Ondo DAO.

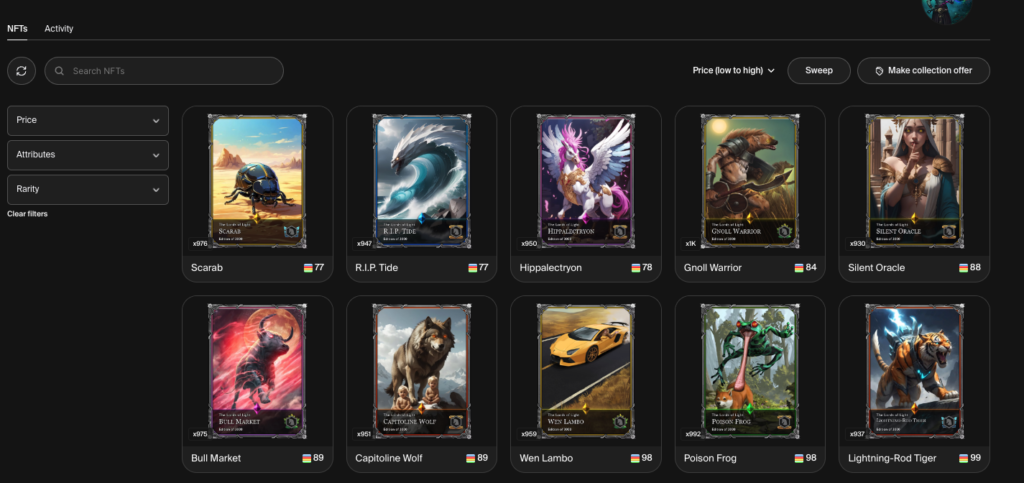

3. In-Game Asset Tokenization

The next assets that can be tokenized are in-game items within a GameFi project or metaverse. In-game items include weapons, costumes, props, in-game currency, and so on. While the previous two types turn assets into fungible tokens, tokenizing in-game assets turns them into Non-Fungible Tokens (NFTs).

The digitized nature of in-game assets allows the owner to hold the asset directly. Holding the NFT represents ownership of the asset in a game or metaverse. The owner can also still trade the in-game assets in the marketplace like assets in the real world.

Each GameFi protocol will have a native token used as a currency for buying and selling in-game assets. For example, every in-game asset from a game in the Beam ecosystem is traded with BEAM.

Benefit of Tokenized Assets

- 💪 Increased Liqudity. Through tokenization, the underlying asset can be broken down into smaller parts, allowing for fractional ownership. This, in turn, increases the asset’s liquidity and accessibility. The buying and selling process can also be done without intermediaries.

- 🏆 Fair price. Often, assets that cannot be liquidated at any time have a fixed market price. In some cases, sellers give discounts because they want to sell quickly, so assets are sold at off-market prices. Tokenization, which allows fractional ownership, prevents sellers from having to lower the price.

- 🤑 Lower management costs. Traditional asset ownership transfers require an intermediary to handle the paperwork. This process can be time-consuming, costly, and require trust. Tokenization allows the buying and selling of assets through a decentralized platform, automating the process of transferring ownership. This, in turn, reduces transaction costs.

- ⚡ Increased accessibility. Through tokenization, investors with little capital can still acquire fractional ownership of the token’s underlying assets. Without tokenization, these assets are only accessible to investors with large funds. Thus, tokenized assets provide broader investment opportunities to more investors.

- 🔍 Transparency. The use of blockchain allows investors and all parties to easily track the origin of ownership and transaction history of the asset. Not only that, all the data cannot be modified by anyone. This increases trust and security among asset holders and other stakeholders.

Disadvantages of Tokenized Assets

- 🚨 Unclear regulations. From a regulatory perspective, tokenized products are still in a grey area in some countries. The absence of clear rules creates uncertainty and is a risk that must be considered.

- 🗳️ Large storage log. Blockchain data logs can grow very large over time. If they become too large for storage and download, node loss can occur.

- 🔏 Data modification. A drawback of using blockchain is that there is no option to modify the data once the smart contract has been deployed. If there are errors or additions to the data, it is very difficult to change it.

The Future of Tokenization

Tokenization is one of the blockchain technology use cases with a bright future. So far, RWA tokenization has been successful in attracting investors and demonstrating its usefulness to them.

The most successful RWA tokenization product with the most widespread adoption is stablecoins. These are tokenized with (fiat) currency as the underlying. In terms of usability, they are the most important element in the crypto payment process. At the time of writing, the market cap of stablecoins has reached $162 billion.

Aside from stablecoins, commodity gold is another asset tokenization that is gaining traction. Pax Gold (PAXG) has the largest market cap, at $436 million. As a digital asset, PAXG and other gold tokenizations have the same use as gold in traditional financial markets: as a safe-haven asset

When the Iran-Israel geopolitical tension broke out on April 13, 2024, the PAXG price immediately rose 20% compared to the day before. At the same time, gold prices in traditional financial markets also rose on the same day. This means that the fundamental principle of gold as a hedge asset also applies to gold tokenized assets.

As mentioned earlier, the number of fund managers involved in developing RWA tokenization products is also key to the future of tokenization. They play a crucial role in on-ramp and onboarding traditional investors into crypto and blockchain.

The CEO of BlackRock, the investment manager with the largest assets under management, mentioned that asset tokenization has enormous potential. According to him, asset tokenization offers pricing efficiency in the capital market, shortens the value chain, saves management costs, and increases investor access.

BlackRock USD Institutional Digital Liquidity Fund ($BUIDL) is BlackRock's tokenized product. It tokenizes US deposits, money markets, and debt securities. BlackRock's $BUIDL Fund Outpaces Ondo Finan

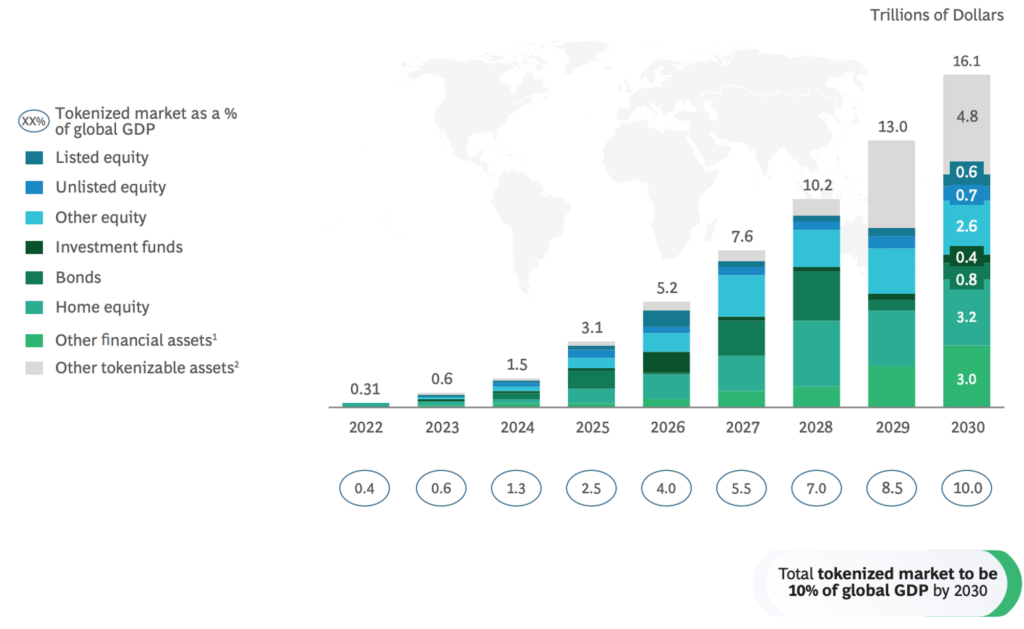

Furthermore, in their research, ADDX and Boston Consulting Group predict that the business opportunity in asset tokenization could grow by 50x to $16.1 trillion by 2030. It is not surprising that RWA tokenization is one of the fastest-growing sectors with all this potential.

Conclusion

Tokenization transforms ownership rights into digital tokens stored on a blockchain. This process involves several key steps, including asset selection, token type definition, blockchain choice, asset verification, and finally, token issuance.

There are three types of asset tokenization: RWA tokenization, digital asset tokenization, and in-game asset tokenization. The tokenization of RWA is advancing rapidly. This growth is largely driven by the strong involvement of traditional financial institutions in establishing RWA projects. The value of the RWA tokenization market is expected to reach $16 trillion by the year 2030.

The advantages of tokenization are increased asset liquidity, fair pricing, lower management costs, and broader investor access. However, it faces the challenges of unclear regulations and technical issues such as large data storage.

Buy Crypto Assets on Pintu

Looking to invest in crypto assets? No worries, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Chainlink, Asset Tokenization: What It Is and How It Works, accessed on 12 June 2024.

- Chainalysis Team, Asset Tokenization Explained: Benefits, Risks, and How It Can Work, Chainanlysis, accessed on 12 June 2024.

- Cristiano Ventricelli, The Promises and Perils of Private Asset Tokenization, CoinDesk, accessed on 12 June 2024.

- Zach Pandl, Public Blockchains and the Tokenization Revolution, Grayscale, accessed on 12 June 2024.