Rebranding in Web3 projects is more than just changing names or logos. It’s often used as a strategic move to increase adoption, attract new liquidity, or introduce technological innovations. However, not all rebranding efforts succeed—some gain traction and attention, while others are met with indifference or criticism. So, what makes a rebranding succeed or fail? This article explores the answer.

Article Summary

- 🔍 This article analyzes the rebranding strategies of three major Web3 projects: Sonic, Sky (MakerDAO), and Polygon (POL).

- 💡 Successful rebranding often involves technological innovation, relevant incentives, and a compelling narrative that resonates with users.

- ⚠️ Rebranding can fail when it’s overly technical and lacks immediate, tangible benefits for end users, as seen in the case of POL.

Case Study: Rebranding Sonic, MakerDAO, and Polygon

Recently, more and more Web3 projects have undergone rebranding. This move is not merely about changing names or visuals, but part of a broader strategy to capture market attention and enhance user experience.

This trend reflects a shift in industry focus. While Web3 projects previously concentrated on building infrastructure, the spotlight is now turning toward user-friendly applications, such as Phantom and Solflare in the Solana ecosystem, as well as Sui Wallet—which rebranded to Slush—within the SUI ecosystem. To stay relevant, major projects like Fantom, MakerDAO, and Polygon have also embraced rebranding, adopting new approaches and narratives that are more aligned with the evolving needs of their communities and users.

1. Fantom to Sonic

Fantom, a prominent Layer-1 project during the previous market cycle, underwent a rebranding to Sonic in August 2024. This rebrand brought about significant changes, ranging from improved transaction speeds to a shift in ecosystem strategy. One of the most notable developments was the return of Andre Cronje, Fantom’s former lead developer, who had previously stepped away from the Decentralized Finance (DeFi) space. His renewed involvement in Sonic sparked both excitement and controversy within the community.

Sonic Rebranding Strategy:

1. Implementation of 3 new technology pillars

- SonicVM: A new virtual machine that is more efficient than the EVM but still compatible, enabling faster execution of smart contracts.

- SonicDB: A large-scale data storage system with low latency and low operational costs.

- Sonic Gateway: A cross-chain integration bridge that simplifies the migration of decentralized applications (dApps) and the onboarding of users from other networks, thereby attracting new liquidity into the Sonic network.

2. Focus on user-friendly interface and experience

Sonic simplifies its UI/UX with a more intuitive and user-friendly flow, while also providing a solid infrastructure for developers to build dApps.

3. Airdrop Program

Sonic launched a large-scale incentive program through a points and airdrop system. Users can earn rewards through three types of points:

- Passive Points (simply by holding certain assets).

- Activity Points (by providing liquidity).

- App Gems (by interacting with dApps within the Sonic ecosystem).

The total airdrop allocation reached 190.5 million $S coins, making it one of the largest incentive programs among current Layer-1 projects. In addition, Sonic also launched the Innovator Program worth 200 million $S to support developers, builders, and new projects that want to build infrastructure or applications on the Sonic network.

4. Attractive incentive mechanism for developers

Through the Fee Monetization (FeeM) mechanism, 90% of user transaction fees will be directly allocated to dApp developers, offering real incentives to continue building and growing the Sonic ecosystem.

Market Response and Ecosystem Metrics After Rebranding

According to data from TradingView, the price of $S experienced a correction following the launch of the Sonic mainnet. However, within the next two months, $S recovered and recorded a significant increase of up to 213.6%.

In May 2025, Sonic recorded a total of 9.5 million monthly transactions. Although this represented a slight decline compared to the previous month, it was still significantly higher than in December 2024, when the Sonic mainnet was first launched. On the other hand, the number of monthly active addresses reached 91,300, marking the highest level since Sonic’s official launch and a strong indicator that user participation on the network continues to grow.

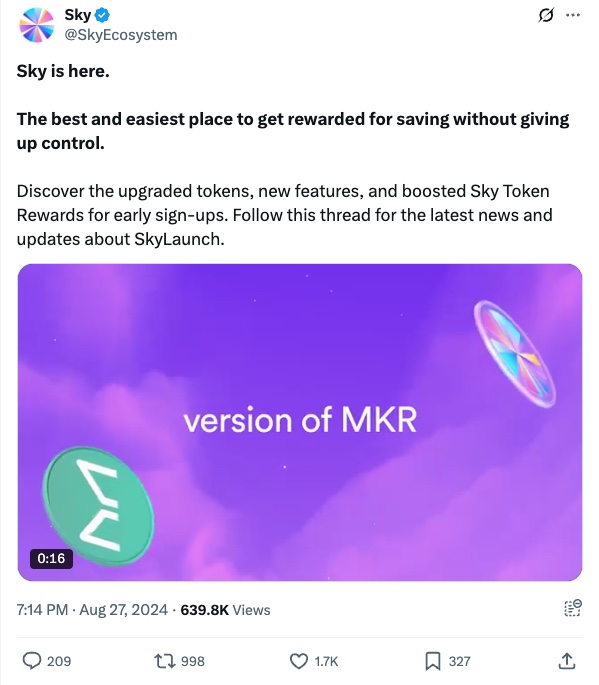

2. MakerDAO to Sky

MakerDAO, one of the pioneers in DeFi, officially rebranded to Sky on September 18, 2024. This move was considered ambitious, as it carried a bold vision to scale its stablecoin ecosystem to $100 billion, aiming to compete directly with Tether. The rebranding was not limited to a change in identity—it also introduced new products, revised tokenomics, and a more aggressive growth strategy.

Sky is no longer just a DeFi application like MakerDAO once was. It is now being developed as a standalone, modular, and scalable ecosystem. With its new subDAO-based structure, each component—from stablecoins and governance to incentives—can operate autonomously while remaining fully integrated.

Sky Rebranding Strategy:

Under the rebranding initiative called “Endgame,” Maker introduced two core tokens within the ecosystem:

- $SKY, a new governance token that replaces $MKR (at a conversion rate of 1 MKR = 24,000 SKY), marking a redenomination of the token structure.

- $USDS (Sky Dollar), a new stablecoin pegged 1:1 with DAI, offering an alternative stablecoin within Sky’s new ecosystem framework.

The $SKY token is used within a new governance model based on subDAOs (called Stars). It is important to note that conversion to $SKY and $USDS is optional. This means users can continue using the legacy tokens ($MKR and $DAI), while the new tokens are intended for engagement within the growing Sky ecosystem.

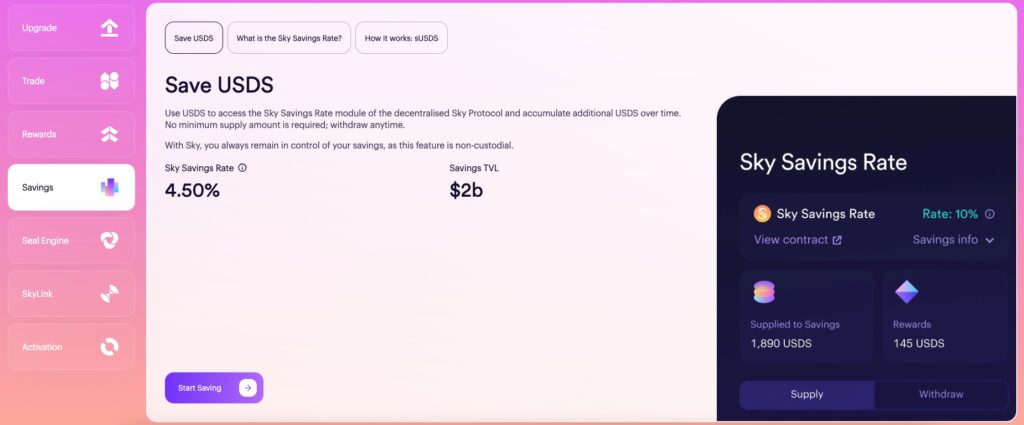

By converting to $SKY and $USDS, users gain access to new products such as Sky Savings Rate and Sky Token Rewards.

Sky Savings Rate allows users to earn variable interest by depositing USDS. The mechanism is fairly straightforward: when users deposit USDS into the ecosystem, they receive a new token called sUSDS. This token serves as proof of eligibility for earning interest. The value of $sUSDS gradually increases over time, reflecting the interest accrued through the current Sky Savings Rate. Notably, the interest is compounded automatically and does not require manual claiming.

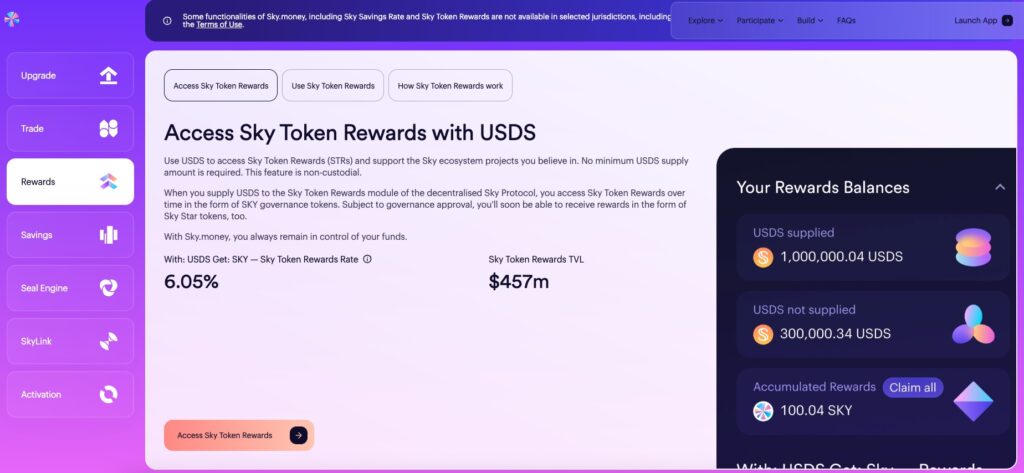

In the Sky Token Rewards product, there is no minimum requirement for the amount of USDS to be deposited. Users are free to supply any amount of USDS to start earning incentives in the form of $SKY tokens over time. The mechanism is simple and open—by supplying USDS, rewards will gradually accumulate. To receive the rewards, users must manually claim them through the dashboard.

All supplied funds and earned rewards are managed by non-custodial smart contracts, meaning that no third party has control over user assets. All processes are executed directly on the blockchain, ensuring a fully open level of security, transparency, and decentralization.

Market Response and Ecosystem Metrics After Rebranding

Over the past three months, the $SKY token has shown impressive performance in the market. Between February 6 and May 14, 2025, the price of $SKY surged by 125.05%.

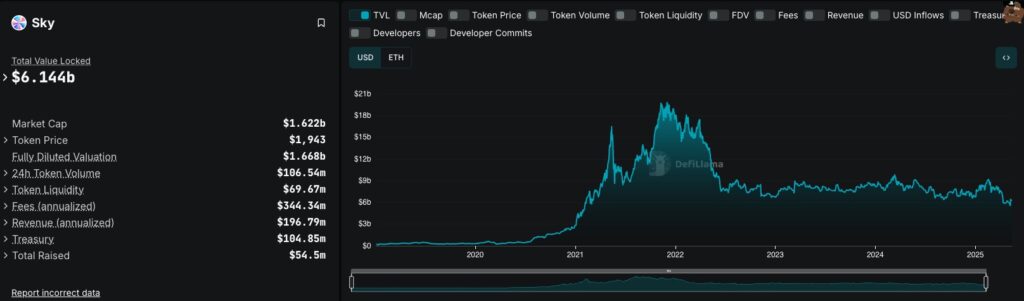

Although the rebranding of MakerDAO to Sky introduced numerous updates in terms of features and structure, the current Total Value Locked (TVL) has yet to show a significant increase. According to the latest data, Sky’s ecosystem TVL stands at $6.14 billion, a figure that still reflects a combination of MakerDAO’s legacy infrastructure and the new Sky framework.

This is understandable, as the migration from the old tokens ($MKR and $DAI) to the new ones ($SKY and $USDS) is still ongoing. Many users and DeFi protocols integrated with MakerDAO have yet to fully transition to the Sky ecosystem, meaning a large portion of liquidity and TVL activity remains tied to the previous structure.

In addition, Sky has actively conducted a buyback program for the $SKY token, with a total repurchase of 805.5 million $SKY valued at over $62 million at the time of writing. This reflects the team’s commitment to maintaining a healthy governance token value and distribution.

On another front, the Smart Burn Engine holds $17 million worth of liquidity on Uniswap, helping to support price stability in the secondary market. Interestingly, Sky also reports a surplus of $103.5 million, serving as a strategic liquidity buffer. This figure plays a critical role in sustaining protocol operations and serves as a resource to fund incentive programs, subDAO development, and potential ecosystem expansion in the future.

3. Polygon Matic to POL

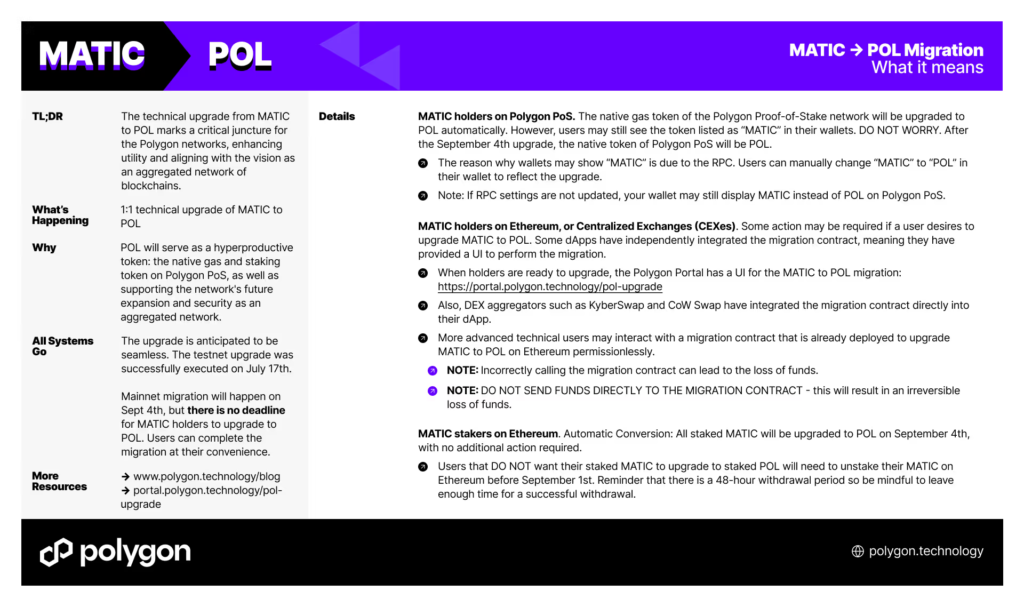

As part of the Polygon 2.0 development framework, Polygon introduced $POL as the new token replacing $MATIC. This rebranding is not merely a name change, but a broader transformation in the direction and structure of the ecosystem and network. The migration process from $MATIC to $POL is still ongoing, with a 1:1 conversion ratio.

POL Rebranding Strategy

The migration from $MATIC to $POL is part of Polygon’s strategy to strengthen its position as a competitive multichain infrastructure. The approach includes:

- Reducing friction, enhancing experience

$POL is designed to remain fully functional without requiring mandatory token ownership or staking. This ensures a lightweight, simple, and low-barrier experience for both users and developers. The goal is to open access as widely as possible for anyone who wants to build or transact within the Polygon ecosystem—without unnecessary complexity. - Broader utility of the token

$POL is designed to serve multiple roles simultaneously, including staking, validation across different chains, protocol governance, and incentive distribution. This concept allows a single token to be utilized across the entire Polygon network without requiring fragmented functionalities. - Infinite scalability and ecosystem support

Within the broader vision of Polygon 2.0, the $POL token is not merely a replacement for $MATIC—it is positioned as the core foundation for the exponential growth of the Polygon ecosystem. One of its main objectives is to enable infinite scalability, where a single validator network can support thousands of interconnected chains within one cohesive ecosystem.

This paves the way for the era of hyperblockchainization, where blockchain technology can operate across multiple sectors and industries in parallel—without facing scalability limitations. In addition, $POL also serves as a key mechanism for establishing sustainable funding within the ecosystem. Polygon recognizes that achieving long-term network maturity requires ongoing support for research, development, and community-driven initiatives.

Market Response and Ecosystem Metrics After Rebranding

Based on price chart data from January to May 2025, the $POL token experienced a significant decline. From the beginning of the year to mid-May, $POL dropped by approximately 51.8%, falling from around $0.48 to approximately $0.23.

This decline suggests that, despite the technical and structural updates brought by the rebranding from $MATIC to $POL, the market response has not been fully positive in the short term.

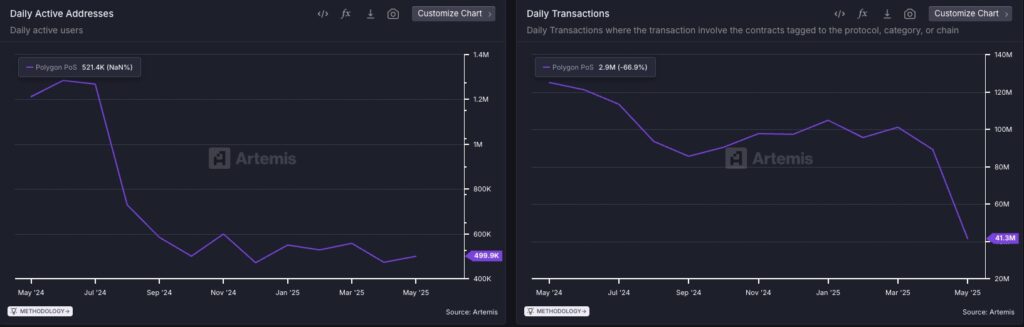

Data from Artemis shows that between May 2024 and May 2025, activity on the Polygon PoS network experienced a significant decline in both users and transactions.

In the left-hand chart, the number of daily active addresses dropped from approximately 1.3 million to 499,900 by May 2025. This decline reflects a noticeable decrease in user participation on the Polygon network over the past year.

Meanwhile, the right-hand chart shows that daily transactions fell sharply by 66.9%, from a peak of over 120 million to just 41.3 million transactions.

Key Success Factors in Rebranding

A successful rebranding goes beyond changing names or visuals—it’s about how a project delivers strategic improvements that are directly felt by the community and users. From the cases of Sonic and Sky, several key elements stand out as indicators of effective rebranding:

1. Relevant Technological Innovation

Sonic serves as a clear example of how rebranding can succeed when paired with meaningful technological upgrades. By introducing SonicVM, SonicDB, and Sonic Gateway, the project not only presented a refreshed identity but also delivered tangible solutions for both developers and users.

2. Attractive Incentives and New Products

Large-scale airdrops, point-based programs, and a monetization system for developers gave Sonic strong appeal in its early phase. These initiatives helped drive higher on-chain participation and a significant increase in active user numbers. Meanwhile, Sky introduced a subDAO-based governance structure along with two core products: Sky Savings Rate and Sky Token Rewards

3. A Strong Narrative and Clear Long-Term Vision

Both Sonic and Sky used the momentum of rebranding to reinforce their long-term visions. Sonic promoted a narrative centered on efficiency and ecosystem expansion, while Sky introduced its ambitious “Endgame” plan to build a globally scaled stablecoin system capable of competing with major players like Tether. This strong narrative has played a key role in building market trust and attracting community support.

Reasons Why Rebranding May Be Less Well-Received

Not all rebranding efforts go according to plan. In some cases, changes in identity are not met with a positive response from the market or the community. Polygon serves as an example that rebranding alone does not automatically lead to growth. Here are several reasons why a rebranding might receive limited interest:

1. Lack of Urgency in the Migration Process

Unlike other rebranding efforts that prompted swift action from communities and users, the migration from $MATIC to $POL is optional and not bound by a specific timeline. As a result, most users remain passive, seeing little compelling reason to make the switch. The absence of strong incentives or a sense of urgency has also contributed to the slow pace of the transition.

2. Lack of Activation and Tangible Incentives

Unlike Sonic, which aggressively rolled out incentive programs and airdrops, Polygon has yet to introduce compelling reward mechanisms for early $POL adopters. In the early stages of a rebranding, incentives often play a crucial role in generating momentum—something that has been noticeably absent in Polygon’s transition.

3. Limited New Products, Overemphasis on Technical Aspects

One of the reasons why the $POL rebranding has attracted limited interest is the lack of new, user-facing products launched alongside it. Most of the changes have focused on the network’s technical and structural foundations. While these upgrades are important in the long term, their impact is less tangible for users and retail traders—who are often more drawn to new features or incentive programs. As a result, the transformation has not been strong enough to generate real excitement within the community and broader user base.

How to Buy Sonic, MKR, and POL on Pintu

After learning about the rebranding of projects like Sonic, MakerDAO, and Polygon, you can start investing in $S, $MKR, $POL, and many other cryptocurrencies through the Pintu app. Here’s how to buy $S, $MKR, and $POL on Pintu:

- Create a Pintu account and complete the identity verification process to start trading.

- On the homepage, tap the Deposit button and top up your balance using your preferred payment method.

- Head to the Markets section and search for Sonic, MakerDAO, and Polygon.

- Tap Buy and enter the amount you want to purchase.

- Congratulations—you now own Sonic, MakerDAO, and Polygon coins!

In addition to $S, $MKR, $POL you can also safely invest in other crypto assets like BTC, ETH, SOL on Pintu. All assets listed on Pintu undergo a rigorous evaluation process that prioritizes security and regulatory compliance.

The Pintu app is also compatible with popular digital wallets like MetaMask, making it easier to manage your crypto transactions. Download the Pintu app now from the Play Store or App Store. Your security is ensured—Pintu is officially regulated and supervised by Bappebti and Kominfo.

Beyond trading, Pintu also offers a comprehensive learning hub called Pintu Academy, where you can explore weekly articles to deepen your understanding of the crypto world.

Note: All content in Pintu Academy is intended for educational purposes only and should not be considered financial advice.

Conclusion

Rebranding in Web3 is not a quick fix to regain market attention. Instead, it should be a strategic move that delivers real impact across technology, products, and the community. From the cases of Sonic and Sky, we’ve seen how rebranding—when accompanied by new features, compelling incentives, and an improved user experience—can rebuild momentum and expand adoption.

On the other hand, the case of POL shows that an overly technical focus without delivering immediate value to users can make the transition feel underwhelming. In a highly competitive ecosystem, the projects that successfully align their new identity with the real needs of their community are the ones that will earn long-term attention, trust, and support.

References:

- James Hunt, “MakerDAO rebrands to Sky, DAI stablecoin optionally upgradeable to USDS” theblock.co, accessed Mei 13, 2025.

- Prashant Jha, “DeFi TVL breaches $100B, MakerDAO readies DAI ‘Endgame:’ Finance Redefined” cointelegraph.com, accessed Mei 13, 2025.

- Ash V. Khatibi, “From Fantom to Sonic — What You Need to Know”, Sonic Labs Blog, accessed Mei 13, 2025.

- Lavina, “Everything You Need To Know About the Sonic Launch” blocmates, accessed Mei 13, 2025.

- OneSafe Content Team, “Fantom’s Sonic Shift: A Desperate Bid for Liquidity?” OneSafe Blog, accessed Mei 13, 2025.

- “The Fantom Foundation’s Rebrand to Sonic: What Users Need to Know” Nansen, accessed Mei 13, 2025.

- Sonic Labs: Litepaper

- Sonic Labs: Fee Monetization

- Sonic Labs: Points

- Polygon Labs, “MATIC to POL Migration Is Now Live. Everything You Need to Know.” Polygon Technology, accessed Mei 13, 2025.

- Polygon Labs, “Unlocking Perpetual Growth: How POL Fuels Polygon’s Aggregated Blockchain Future” Polygon Technology, accessed Mei 14, 2025.

- Polygon Labs, “Polygon 2.0: Tokenomics” Polygon Technology, accessed Mei 15, 2025.

- Polygon Whitepaper, “POL: One token for all Polygon chains”, accessed Mei 15, 2025.