Cryptocurrency is a new asset class born in 2009. The first crypto asset, Bitcoin, started the crypto industry as we know it today. Bitcoin eventually becomes the catalyst for many computer scientists in the world to create various other innovations. Ethereum, Solana, NFTs, and many of today’s crypto technologies all started with the small beginnings of the pseudonym Satoshi Nakamoto. Satoshi uploaded a whitepaper about an electronic P2P payment system. So, what is the story behind the rise of Bitcoin? How has Bitcoin’s history unfolded over the years? This article will explain everything.

Article Summary

- 💰 Bitcoin is the first cryptocurrency that Satoshi Nakamoto created as a decentralized digital currency. Satoshi wanted to create a digital transaction system that does not require a third party.

- 🔨 Bitcoin, the first digital currency, successfully solved the major problems of digital currencies such as the Byzantine Generals problem and Double Spending.

- 📊 Bitcoin has gone through many stages of development, from Bitcoin Pizza Day to major hacking cases like Mt. Gox and becoming the reserve asset class it is today.

- 💸 Over time, Bitcoin began to be recognized as “digital gold” and accepted in various countries, including being recognized as legal tender in El Salvador.

- ⚙️ Various innovations and upgrades have occurred in Bitcoin. Some of these include supporting smart contracts and NFT transactions through the Ordinals protocol.

What is Bitcoin?

Bitcoin is a decentralized digital currency that was created to be a digital medium of value exchange. Bitcoin was the first cryptocurrency created by someone under the pseudonym Satoshi Nakamoto. As the first crypto asset, Bitcoin catalyzed the advent of the crypto industry because of the innovation it brought.

Bitcoin itself was not born instantly. Satoshi Nakamoto’s innovations utilize previous iterations of digital currencies. Some of the digital currency efforts that formed the foundation of Bitcoin were BitGold (Nick Szabo), DigiCash (David Chaum), and Hal Finney’s Reusable Proof of Work (RPOW).

The main issue with digital currency is that it cannot solve the Byzantine General and double spending problems. However, Satoshi Nakamoto solves both of these problems with Bitcoin.

The Genesis of Bitcoin

On August 18, 2008, the domain name “Bitcoin.org” was registered by an unknown individual (allegedly Satoshi Nakamoto). Volunteers and the Bitcoin community now manage this site and is now an information hub about Bitcoin. This community of developers also focuses on developing the Bitcoin Core client and other Bitcoin projects.

Then, on October 31, 2008, the Bitcoin Whitepaper was released with the title “Bitcoin: A Peer-to-Peer Electronic Cash System” sent to a cryptography mailing list. This whitepaper describes Bitcoin as a digital currency system that facilitates P2P transactions without the need for a third party. As we know, Bitcoin uses blockchain and Proof of Work consensus mechanisms to create a decentralized network.

Who is Satoshi Nakamoto? The true identity of Satoshi Nakamoto, the creator of Bitcoin, has yet to be solved. Some people have claimed to be Satoshi but there is no concrete evidence such as access to Satoshi Nakamoto's wallet.

Satoshi Nakamoto mined the first block of Bitcoin (Genesis Block) and pinned the message “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This message refers to a headline in The Times about the UK government’s plan to save banks from bankruptcy.

The message Satoshi left behind is important because it reflects the motivation of Bitcoin: creating an alternative economic system that doesn’t require trust in centralized institutions like banks and governments. In addition, the first block of Bitcoin also mined the first 50 BTC.

History of the Development of Bitcoin Usability

Bitcoin Pizza Day and Bitcoin’s First Transaction

The first transaction on the Bitcoin network was Satoshi Nakamoto sending 10 BTC to Hal Finney. Hal Finney is one of the earliest contributors to the Bitcoin network and he was one of the few people that communicates with Satoshi Nakamoto. In addition, Finney is also part of several developers using Bitcoin.

On May 22, 2010, Laszlo Hanyecz bought two pizzas from Papa John’s using 10,000 BTC. Laszlo’s transaction became popular as Bitcoin Pizza Day because it was the first commercial Bitcoin transaction. At the time, the price of 1 BTC didn’t even reach $1.

In the early days of Bitcoin, Satoshi Nakamoto mined 1 million BTC and disappeared, taking all the Bitcoin he had with him. To this day, no one knows where Satoshi went and what his true identity is.

Silk Road and Mt. Gox Hack

In February 2011, the digital black market Silk Road was created. Users could use Silk Road to buy various goods anonymously. Unfortunately, Silk Road is widely associated with illegal and criminal activities such as buying and selling drugs. In addition, US authorities finally arrest the creator of Silk Road, Ross William Ulbricht. During its two years of operation, Silk Road processed approximately 9.5 million BTC.

The Mt.Gox crypto exchange launched around the same time as the Silk Road. In June 2011, the first hack of Bitcoin occurred. Hackers successfully steal 2,000 BTC (equivalent to $30,000 dollars at the time) from Mt. Gox. At its peak, Mt. Gox processed about 70% of all Bitcoin transactions that took place.

Unfortunately, Mt. Gox suffered another hack, which became the largest theft in Bitcoin history. In 2014, lightning struck twice as hackers steal Approximately 850,000 BTC (equivalent to $460 million dollars) from Mt. Gox in 2014. Although Mt. Gox stopped assets withdrawal, it was too late as the attackers had already taken Bitcoin from Mt. Gox users.

Incidents like Mt. Gox can happen because there was no hardware wallet technology like Ledger and Trezor back then. The Bitcoin wallet address of Mt. Gox Bitcoin wallet address was stored in a place connected to the internet so that an attacker could retrieve the private keys and access all of Mt. Gox’s BTC.

Acceptance of BTC as an Asset Across Countries

In October 2013, Robocoin and Bitcoiniacs teamed up to deliver the first Bitcoin ATM in Vancouver, Canada. Users could send and trade Bitcoin directly using their fiat money. In the same year, various government also starts talking about Bitcoin. In Kenya, the initiative to connect Bitcoin to the M-Pesa payment system began. Meanwhile, Thailand’s Department of Foreign Exchange Administration declared Bitcoin illegal because it lacked a legal umbrella.

However, there were many positive signals of Bitcoin adoption in 2014. Many large business enterprises accepted Bitcoin as a payment currency. Zynga, Dell, Newegg, and Microsoft gave their users the option to pay using BTC. A year later, the total number of businesses providing Bitcoin payment options reached around 160,000. In addition, there were already 771 Bitcoin ATMs by September 2016.

On January 14, 2016, Joseph Poon and Thaddeus Dryja release the whitepaper for a Bitcoin Lightning Network. Lightning Network processes Bitcoin transactions off-chain. Lightning Network speeds up Bitcoin transactions and improves network scalability. In addition, it also reduces the computational load for the Bitcoin network.

Bitcoin As A Reserve Currency

Over time, more and more countries have begun to accept Bitcoin and other cryptocurrencies. In the period 2017-end 2019, the price of Bitcoin managed to increase by about 700%. Then, if we compare it to the price of 1 BTC in early 2014 which was around $800, BTC increased by more than 1000% within 5 years (end-2019 price is around $8,000 dollars). Such a rapid appreciation in value in such a short period has made more and more people interested in investing in BTC. It has also attracted various institutional investors as well as countries to consider the legality of Bitcoin.

In early 2018, Japan's largest OTC (Over-The-Counter) exchange, CoinCheck, suffered a $530 million dollar hack. This early era of massive BTC adoption is still riddled with hacks.

During this era, many echoed that Bitcoin was “digital gold”. Several large investment firms such as Andreessen Horowitz (a16z), Microstrategy, and Fidelity began to explore investing in Bitcoin and other crypto projects.

In addition, more and more countries have begun to facilitate the regulation of Bitcoin and other cryptocurrencies and open crypto trading to retail investors. Japan, Australia, and Singapore are some of the countries that have been proactively facilitating the crypto industry since around 2017-2018.

On June 9, 2021, El Salvador officially legalized Bitcoin as a legal tender or legal payment currency in the country. El Salvador became the first country to adopt Bitcoin. El Salvador’s policy is a turning point for BTC to move from just an asset for speculation and become an asset with potential as a reserve/savings.

New Era of Bitcoin: Inscription and Bitcoin L2

In January 2018, the mainnet blockchain RSK (Rootstock) was successfully launched on top of the Bitcoin network. RSK aims to bring smart contract functionality to the Bitcoin ecosystem and allow developers to create decentralized applications (DApps) on Bitcoin. In addition, RSK is also compatible with the Ethereum virtual machine (EVM) so that developers can use Ethereum’s Solidity programming language and migrate to Bitcoin.

Then, in January 2021 Muneeb Ali and Ryan Shea also launched a layer 2 technology built on the Bitcoin network called Stacks. Like RSK, Stacks also wants to bring smart contract functionality to Bitcoin. Stacks has its programming language Clarity with a unique consensus mechanism called Proof-of-Transfer (POX).

Read Pintu Academy article on what is Stacks and how it works.

Bitcoin also successfully implemented the biggest update since SegWit in 2017, the Taproot update. With Taproot, Bitcoin transactions are getting smaller in size and complex transaction fees are getting cheaper. This Taproot update eventually enabled a new use case for Bitcoin: NFTs.

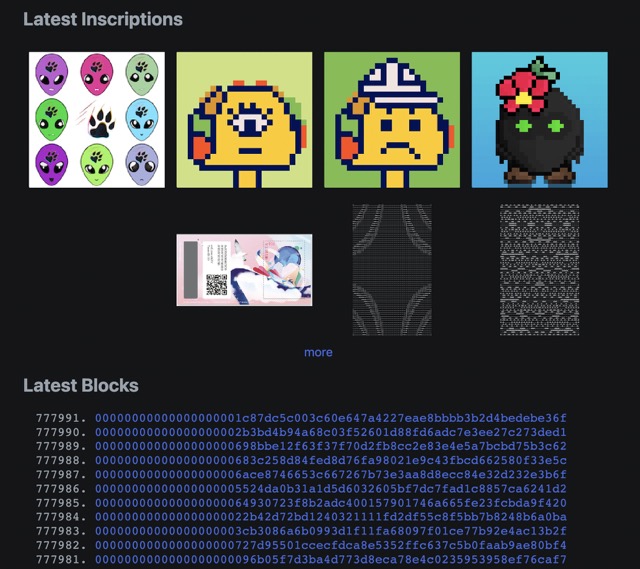

In 2023, Casey Rodarmor utilized Taproot and SegWit to enable the creation of an NFT in Bitcoin called Inscription. Inscriptions were made possible by Rodarmor’s Ordinals protocol which created a way to embed different types of content (such as text, videos, and images) into each Sats (the smallest unit of Bitcoin). As of August 18, 2023, there have been 24.4 million inscriptions created using Ordinals.

Read Pintu Academy’s article on what are Ordinals and why they are so popular.

Ordinals ushered in a new era of Bitcoin and expanded the functionality of Bitcoin beyond just a storage or investment asset. Now, NFTs can be created permanently in Bitcoin blocks.

Conclusion

Cryptocurrency is a new asset class introduced in 2009 with Bitcoin being the first crypto asset. Bitcoin, created by an individual or group under the pseudonym Satoshi Nakamoto, sparked a series of innovations in the crypto industry. Before Bitcoin, various attempts at digital currencies had existed but failed to overcome the problems of double spending and Byzantine Generals. While Satoshi Nakamoto’s identity remains a mystery, his contributions include mining the first block of Bitcoin and a hidden message of disillusionment with traditional financial institutions. Bitcoin’s history includes Bitcoin Pizza Day, associations with black markets like Silk Road, major hacks like Mt. Gox, to its recognition as an investment asset by various countries and large corporations. Today, with innovations like Taproot and platforms like RSK and Stacks, Bitcoin continues to evolve until it can support smart contracts and NFT functions.

How to Buy Bitcoin on the Pintu App

You can start investing in Bitcoin by buying BTC on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for Bitcoin (BTC).

- Click buy and fill in the amount you want.

- Now you are a BTC investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- “Trust Machines Bitcoin History Timeline”, Trust Machines, accessed on 15 August 2023.

- Kirsty Moreland, ”The History of Bitcoin and Cryptocurrencies: Explained”, Ledger, accessed on 15 August 2023.

- Usman W. Chohan, “A History of Bitcoin”, https://ssrn.com/abstract=3047875, accessed on 16 August 2023.

- Ekin Genç, “How Are Institutions and Companies Investing in Crypto?”, CoinDesk, accessed on 18 August 2023.