The Fed’s decision not to ease monetary policy next year has the potential to hamper economic growth. Meanwhile, the crypto market was hit by negative sentiment due to several FUD news over the week.

Pintu’s trader team has collected various data from the crypto market in the past week, summarized in this Market Analysis. However, please note that all information in Market Analysis is for educational purposes, not financial advice.

Market Analysis Summary

- 📈 In its final meeting of the year, The Fed hiked its rates by 50 bps, the move is widely expected by the market.

- 🚨 A total 17 of 19 The Fed members forecast federal funds to exceed 5% next year. More aggressive Fed rate hikes will lessen the likelihood of a soft landing scenario for the economy.

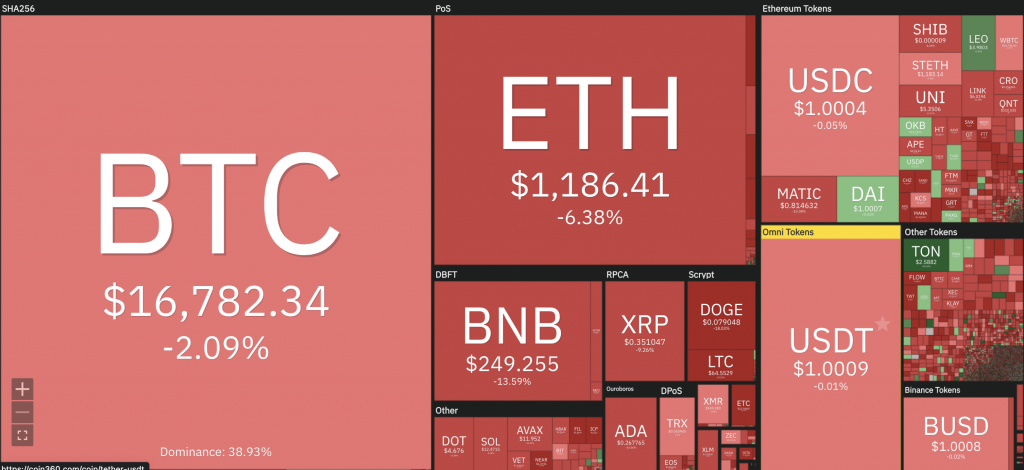

- 📉 Crypto market fell 3.6% in a week due to the FUD.

- ⚠️ BTC hits the 55 days EMA as resistance and falls back.

- 🔎 ETH has failed to move above the key resistance of 1,355, and head down to the current price range of 1,200

Macroeconomic Analysis

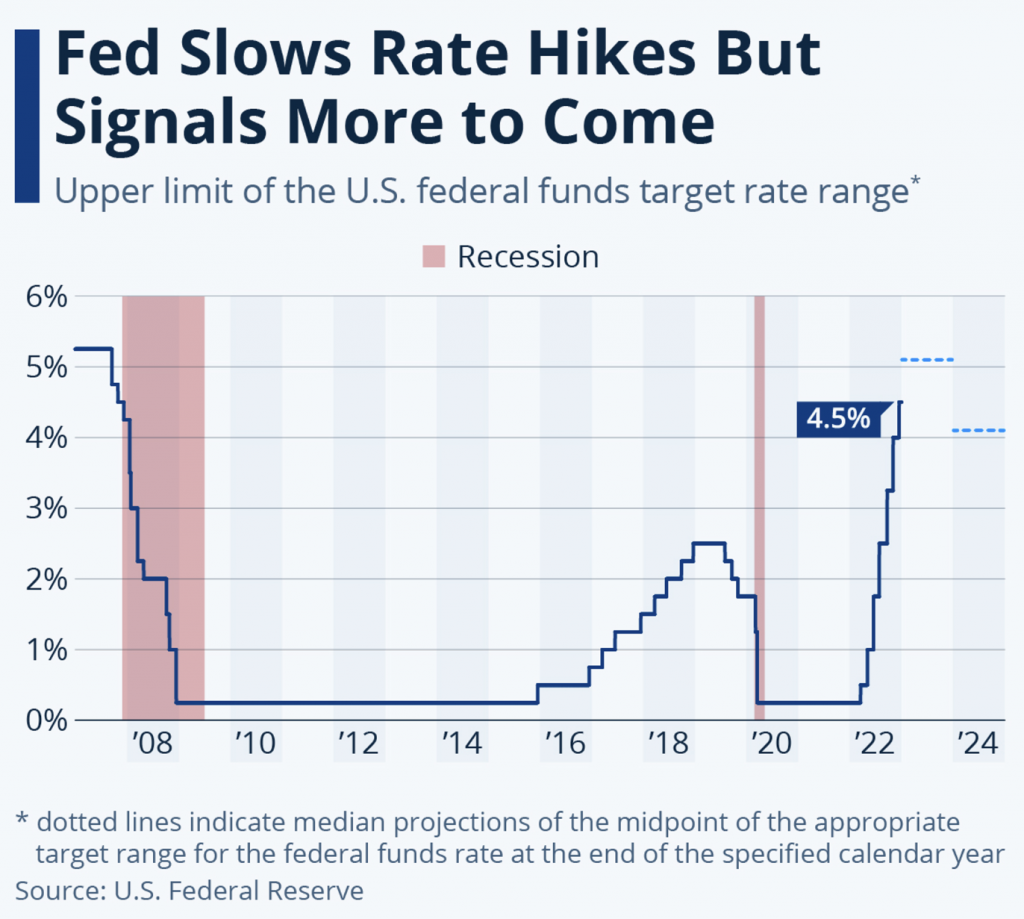

On Wednesday, in its final meeting of the year, The Federal Reserve hiked its rates by 50 bps. The move is widely expected by the market. This brings the Fed funds rate to a range of 4.25-4.5%. At the press conference, Jerome Powell said that the rates are restrictive, but not restrictive enough.

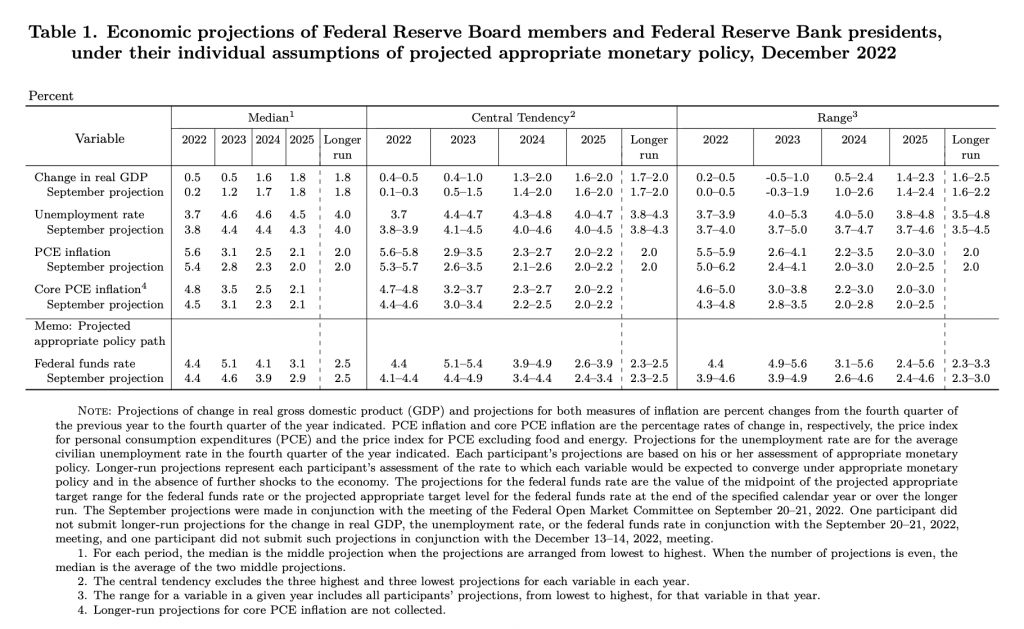

There was a “dot plot” showing the forecasts of the 19 members of the FOMC in the Summary of Economic Projections. A total of 17 members forecast federal funds to exceed 5% next year. The median forecast of the committee’s participants is now 5.1%, up from 4.6% in the September dot plot. At 5.1%, Fed are likely to pause to allow the tightening policy to seep into the economy.

Only 2 out of the 19 officials forecasted below 5%, this is a hawkish surprise. Based on the latest Fed projections, the Fed is likely to maintain high rates for a long period of time rather than determining where it may end. Positively, the median forecast for 2024 and 2025 drops to 4.1% and 3.1%, respectively.

The economic projection forecasted that the Fed’s restrictive policy will cause real GDP growth to be just 0.5% next year and 1.6% the following year. Unemployment rate is expected to rise 3.7% to 4.6% by end of next year.

The Fed wants more evidence that inflation is cooling and on a sustained downward path before easing back on interest rate increases. More aggressive Fed rate hikes will lessen the likelihood of a soft landing scenario for the economy. Moreover, Fed reiterate that February hike will depend mostly on the incoming datas.

The 2 year Treasury fell to 4.24%, reflecting the market expectations that the funds rate is on a downward path starting next year. The 10Y & 2Y Treasury yield spread remained at -73bps.

The DXY rose right after Fed announced its hawkish press conference, it has risen 1.4% from its lowest before its annoucement.

Bitcoin Price Analysis

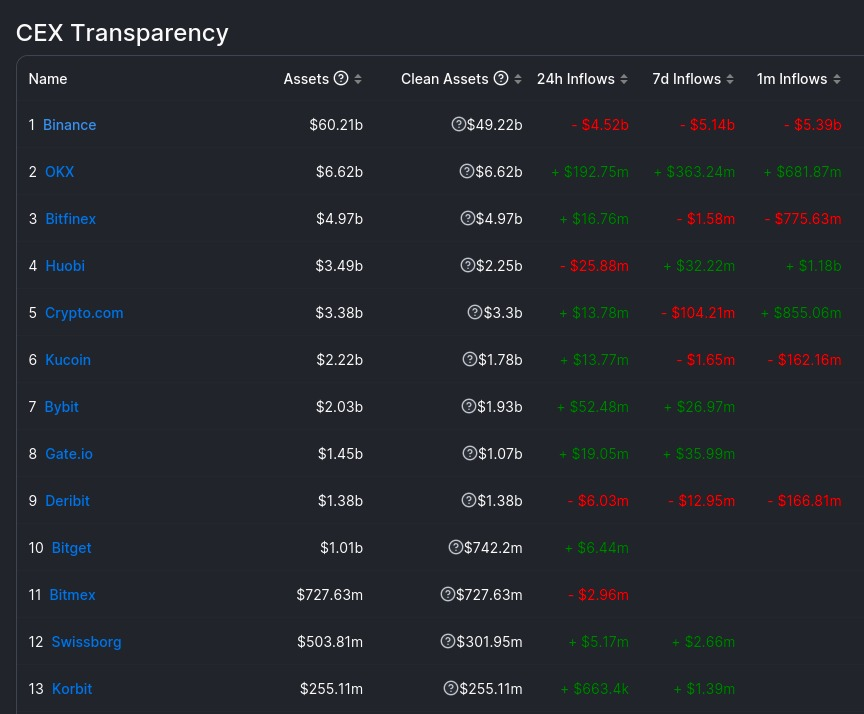

Over the week, we have seen a FUD over Binance not having 100% of its reserve fully backed. Moreover, there is a potential investigation for money laundering. Binance saw its daily largest withdrawal of nearly 4.5 billion USD in 24 hours.

Towards the end of the week, Mazars, the auditing firm working with Binance and other crypto exchanges on proof-of-reserves statements, has paused all work for crypto clients. This has caused the crypto market to fall by close to 4% in a day. BTC has retraced, from 18,500 midweek only to fall to 16,800 on Friday. On the daily chart, we can see that it hits the 55 days EMA as resistance and falls back.

Ethereum Price Analysis

ETH has failed to move above the key resistance of 1,355, we are then met with the bearish momentum and head down to the current price range of 1,200. Next support is at 1,150 and 1,070.

On-Chain Analysis

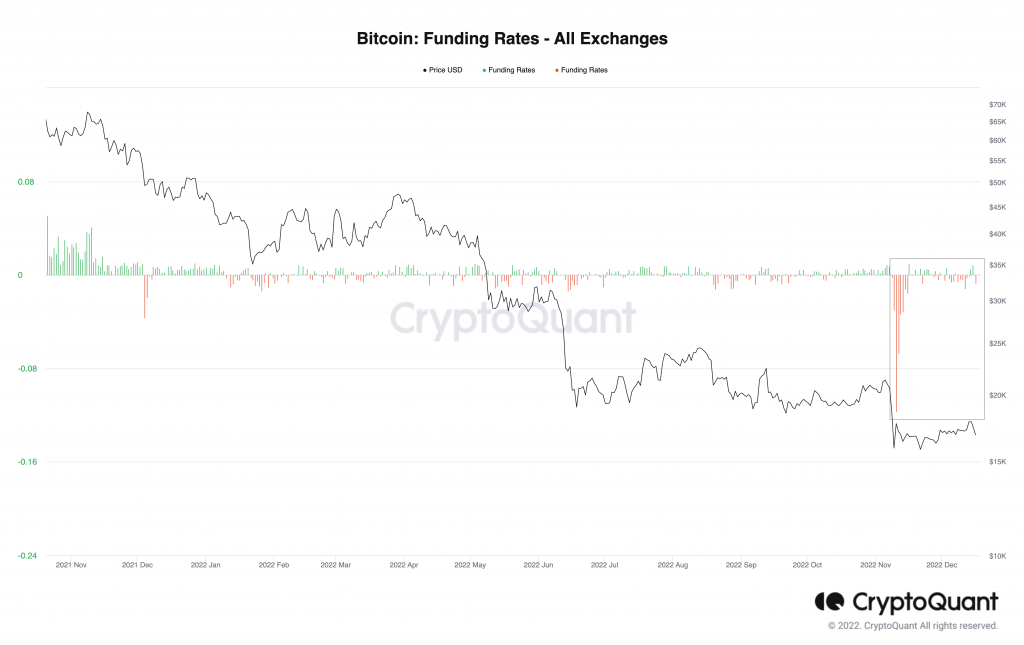

Negative funding in the futures market indicates bearish sentiment among traders. Market is not as fearful as it was back in Mid-November. If we take a look at the past 1-2 weeks, we can see that we briefly turned positive before going negative again, the market sentiment is still bearish.

On-chain Analysis:

📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

💻 Miners: Miners are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

🔗 On-Chain: More investors are selling at a loss. In the middle of a bear market, it can indicate a market bottom. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in a capitulation phase where they are currently facing unrealized losses. It indicates the decreasing motive to realize loss which leads to a decrease in sell pressure.

🏦 Derivatives: Short position traders are dominant and are willing to pay long traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

Altcoins News

- ⚠️ Tether (USDT) to reduce secured loans to zero in 2023. Previously, Tether was hit by FUD concerning its secured loans amidst of FTX turmoil. However, Tether ensure that its secured loans are over-collateralized and covered by liquid assets. Also, they will reduce their secured loans in Tether’s reserves to zero throughout 2023.

- 🏦 Algorand (ALGO) has been chosen as the public blockchain to support an innovative digital guarantees platform in Italy. The Algorand-supported platform which used by banking and insurance is expected to launch in early 2023. The blockchain technology was suited for the “digital sureties” platform because of its fast, efficient, low-cost and scalable data transactions, as well as its ability to provide protection against fraud.

More News from Crypto World in the Last Week

- 🚨 The authorities finally arrested SBF. In the aftermath of the FTX turmoil, FTX founder Sam Bankman-Fried (SBF) was arrested by the Bahamas authorities. SBF arrest was followed by formal requests from the US administration, which had filed criminal charges against the SBF. The criminal charges against SBF included wire fraud, wire fraud conspiracy, securities fraud, securities fraud conspiracy, and money laundering

- 💰 MetaMask Launches PayPal Integration For ETH Purchases. On December 14th, MetaMask integrated its payment system with PayPal. Select U.S. users can now purchase Ether from within the MetaMask app by tapping its “buy” button and logging into their PayPal accounts. The service will be made available to all eligible U.S. users in a matter of weeks. This is the first time a web3 wallet has rolled out a direct PayPal integration

- 🔗 Solana DeFi Exchange Raydium Hacked. On the Friday (16/2), Solana DeFi protocol Raydium announced that a hacker had managed to overtake the organization’s “owner authority,” and used that access to begin draining Raydium’s liquidity. Within hours, a hacker stole over $2.2 million worth of digital assets from such a pool on Raydium, including $1.6 million worth of SOL, according to analysis from blockchain analytics firm Nansen.

Cryptocurrencies Market Price Over the Past Week

Top Gainers

- Pax Gold (PAXG) +0.05%

- Tether (USDT) + 0.01%

Top Losers

- Filecoin (FILE) -28.78%

- Flow (FLOW) -24.53%

- Chiliz (CHZ) -20.83%

- Kava IKAVA) -20.53%

Referensi

- David Yaffe-Bellany, FTX’s Sam Bankman-Fried Is Arrested in the Bahamas, The New York Times, accessed on 17 December 2022.

- Samuel Haig, MetaMask Launches PayPal Integration For ETH Purchases, The Defiant, accessed on 17 December 2022.

- Justin Bannermanquist, Algorand to support bank and insurance guarantees platform in Italy, Coin Telegraph, accessed on 17 December 2022.

- Sander Lutz, Solana DeFi Exchange Raydium Hacked for Over $2 Million, Decrypt, accessed on 18 December 2022.

- Martin Young, Tether to reduce secured loans to zero in 2023 amid battle against FUD, Coin Telegraph, accessed on 18 December 2022.