Crypto has experienced rapid growth in recent years. Crypto users are spread across dozens of countries in the world with users increasing every year. Despite 2022 being a bear market, the adoption of the crypto industry continues to increase, especially in developing countries. Asian countries such as the UAE, Singapore, and Thailand dominate crypto growth statistics. This trend begs the question, will Asia be the next crypto hub? Or will the next bull market start from the Asian crypto market? We will find the answer by looking at various data about the Asian crypto market.

Article Summary

- 🇺🇸 The United States plays an important role in the global crypto industry landscape. It is home to many large projects and has the largest CEX transaction volume in the world. However, in recent years the US government has become increasingly anti-crypto. This negative sentiment is starting to impact the industry.

- 🌐 In various growth metrics, the Asian continent shows positive numbers. By 2023, crypto asset owners in Asia are predicted to double. Nine of the 20 countries with the highest crypto adoption are from Asia.

- 🕋 The Middle East is experiencing considerable crypto adoption growth in 2022. Cities in the UAE, Kuwait, Iran, and Saudi are on the list of crypto hub cities. Meanwhile, crypto adoption in Turkey, Egypt, and Morocco has skyrocketed.

- 💹 Crypto user activity in China remains high despite the ban. On the other hand, Hong Kong has started to reopen its doors to crypto activity. China, Japan, and South Korea have the highest transaction value in the Asian region.

- ⚙️ In Southeast Asia, Vietnam and Thailand have the fastest-growing crypto adoption statistics in the world. NFT and GameFi dominate the crypto activity in Southeast Asian countries. In the region, there are already more than 600 crypto and blockchain companies. The clear and positive regulations of these countries are driving the growth of the crypto industry, dominated by tech-savvy youngsters.

Crypto Global Landscape

2022 was a tough year for the crypto industry. The bear market dropped the price of Bitcoin by more than 50% and did the same to the total market capitalization of the industry. However, various statistics on crypto assets show positive signals.

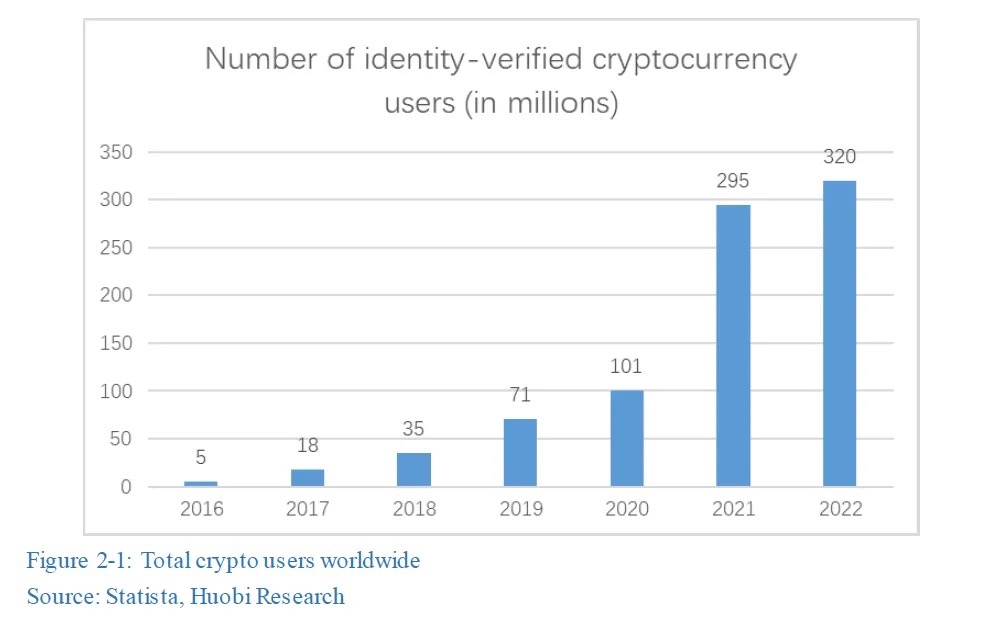

According to Huobi, the number of crypto owners in 2022 is 320 million people. This is a 9% increase compared to the 2021 bull market. So, the crypto industry retains the majority of its users despite weak market conditions in 2022. Of the total number, 40% come from the Asian continent, which is about 120 million people.

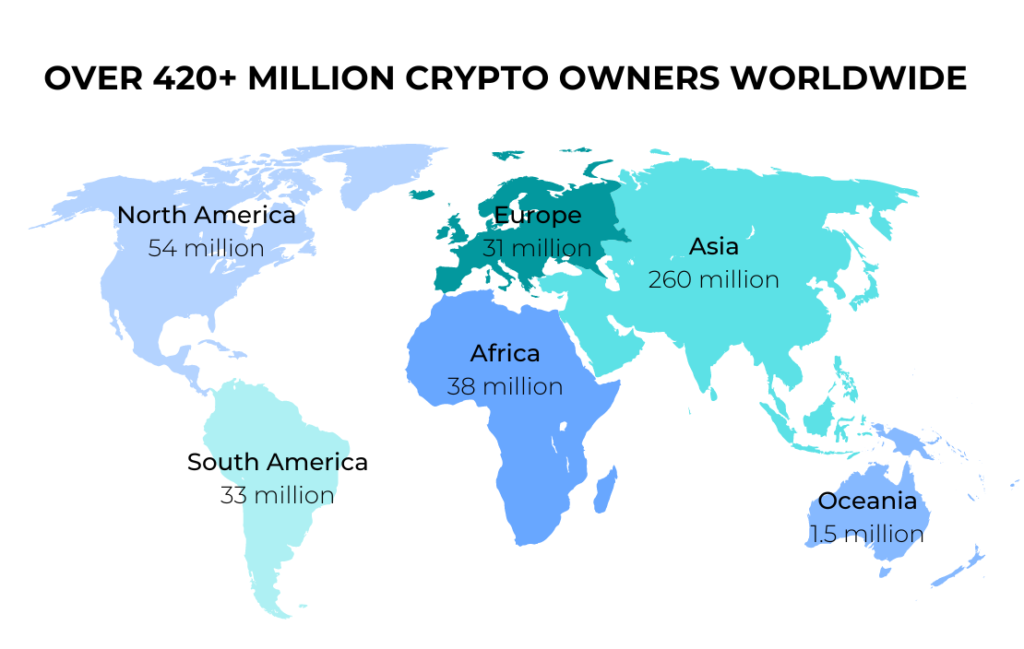

Furthermore, TripleA research estimates that by 2023 there will be more than 420 million crypto users worldwide. TripleA also estimates that Asia will dominate the number of crypto owners with 260 million people, double the 2022 figure. This figure is in line with the population of Asian countries like India, Indonesia, and China. It also shows the strength and potential of the Asian crypto market.

TripleA’s data also shows that North America still contributes heavily to the world’s crypto user numbers. Although the numbers are far from Asia, the US is the center of the world’s most renowned fintech companies, including the crypto industry. So, many crypto projects operate from the US and have large communities there.

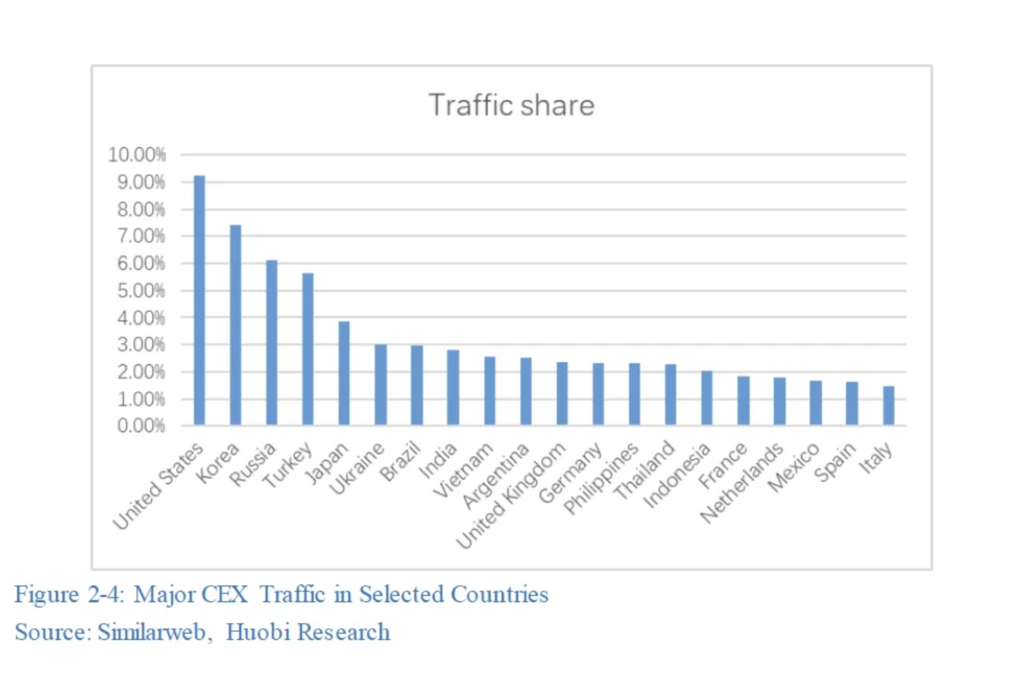

Crypto traffic data paints a different picture. CEX (centralized exchange) activity is dominated by the US which make the largest contribution in 2022. South Korea, Russia, and Turkey follow as they have very active crypto communities. The US also leads in DeFi user numbers with a share of more than 30% of traffic activity. Brazil, the UK, Germany, and France also account for a large share of DeFi activity.

Brazil has one of the most progressive crypto policies. Many government and private institutions in Brazil are already offering crypto products to the general public.

However, 2022 also brings new concerns from the US, regulation. Some major politicians in the US are notorious for their anti-crypto sentiments and the vagueness of crypto regulation in the US is also starting to have a significant impact on the industry.

Anti-Crypto Sentiment and Regulatory Uncertainty in the US

The US Securities and Exchange Commission (SEC) forcibly shut down the staking services provided by Kraken and Gemini. In the aftermath of this incident, Brian Armstrong (Coinbase CEO) explained that regulatory uncertainty and anti-crypto sentiment are beginning to jeopardize the US’ position as a center of crypto development. The SEC considers staking in CEX illegal as it falls under the category of securities. Not only that, Gary Gensler, chairman of the SEC, explained that all crypto assets other than Bitcoin are securities, thus making them illegal. This is the main reason why the SEC is suing crypto projects like Ripple Labs and LBRY.

US regulations have strict rules regarding securities as only certain authorized entities can distribute them. Crypto assets are supposed to fall into the category of commodities. So, many consider that the SEC's actions regarding crypto are politically motivated.

Furthermore, politicians in the US congress also have anti-crypto sentiments. In the US Congress, Senator Elizabeth Warren is at the forefront of the anti-crypto movement. Warren often mentions that crypto assets are tools for terrorists, drug gangs, and countries that want to launder money. She created the “Digital Asset Anti-Money Laundering Act” which basically limits a lot of crypto activity in the US.

Coming back to Brian’s point, the US is a big player in the crypto industry. It is home to many crypto users, talented developers, and various crypto projects. If the US government insists on punishing crypto projects, it could have significant implications on the global crypto industry landscape and potentially shift US market dominance.

The European countries and the EU have taken a different approach. Instead of punishing crypto projects that do not comply with current regulations, the EU wants to create regulations that clarify the operational requirements of crypto assets. The UK and Switzerland are also pursuing the same policy.

Why Asia Could Become a Crypto Hub?

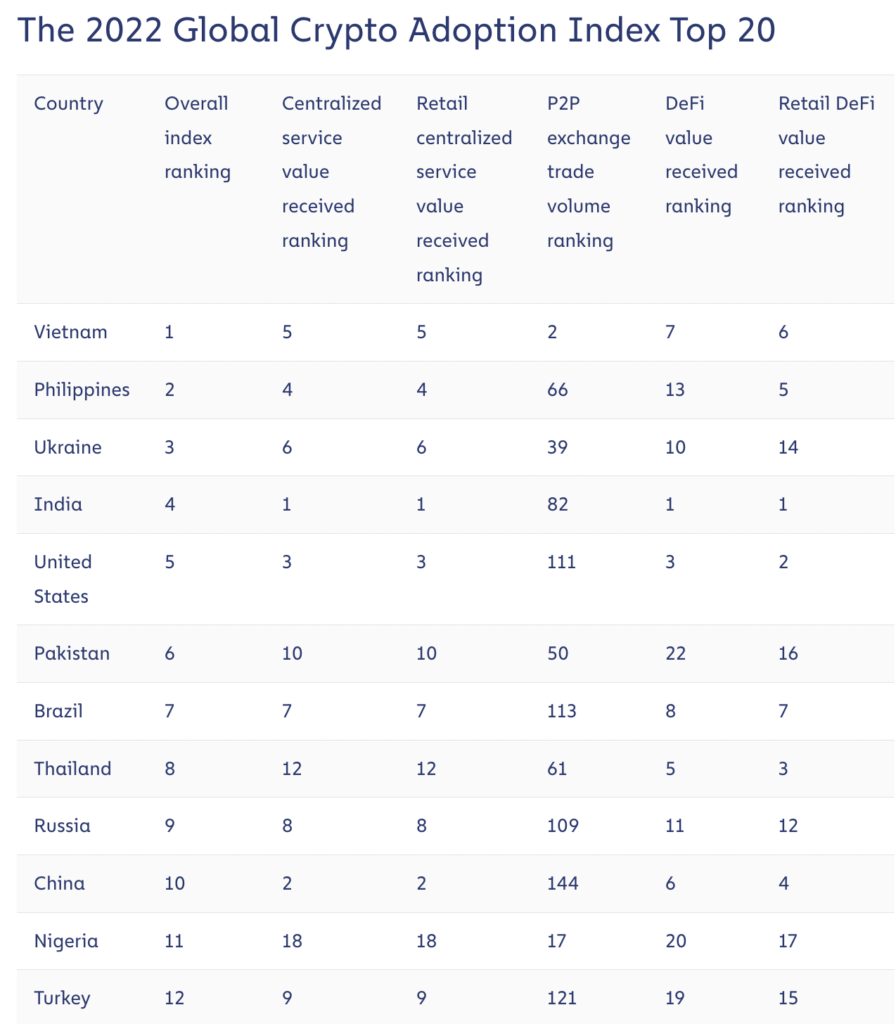

9 out of 20 countries in the 2022 crypto adoption index are from Asia. Chainalysis calculates the activity of retail individuals who use crypto, be it CEX or DeFi. In addition, there are six Asian countries in the top 10 positions. This is the second year Vietnam has been at the top of the list. The US and the UK are the only representatives of developed countries that made it to this list. Besides that, China has finally returned to the top 10.

Chainalysis shows interesting data related to adoption rates and country economies. The crypto adoption list is dominated by developing countries, especially lower-middle countries. Here is the classification:

- Lower-middle income countries: Vietnam, Philippines, Ukraine, India, Pakistan, Nigeria, Morocco, Nepal, Kenya, and Indonesia.

- Upper-middle income countries: Brazil, Thailand, Russia, China, Turkey, Argentina, Colombia, and Ecuador.

- High-income countries: United States and United Kingdom.

Data from Chainalysis and other research shows one thing: the Asian crypto market has huge potential. The crypto adoption rate, number of users, and user activity levels in Asia support the argument that the Asian market has the potential to dominate the global crypto market. Here are some reasons why Asia could become the center of the world’s crypto industry.

Cameron Winklevoss, Gemini CEO, said that: "My working thesis at the moment is that the next bull run is going to start in the East. It will be a humbling reminder that crypto is a global asset class and that the West, really the US, always only ever had two options: embrace it or be left behind."

1. The Middle East is opening up to the crypto industry

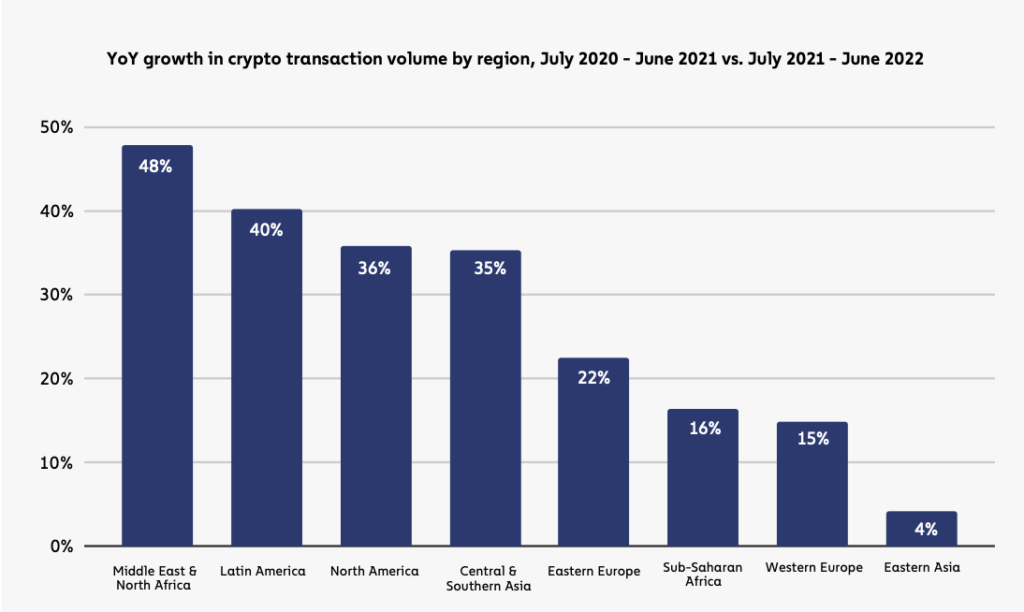

By 2022, the Middle East and North Africa (MENA) region accounted for only 9% of global crypto transaction volume. However, the Middle East market has the biggest transaction growth in comparison to other regions at 48%. Turkey (12), Morocco (14), and Egypt (24) also made it to Chainalysis’ crypto adoption list.

Of the three countries, Egypt has a 221% increase in transaction volume from 2021 to 2022. Meanwhile, Morocco has just provided a clear regulation of its crypto industry and it is driving significant growth in 2022.

The rapid growth of Egypt's crypto industry is closely related to the activity of the remittance sector. The Central Bank of Egypt is building plans for the integration of crypto in sending and receiving remittances.

A report by Recap on the crypto hub cities measures a city’s friendliness towards crypto communities and activities. UAE business city Dubai took the second spot in the crypto hub index. Kuwait’s capital city, Kuwait City also made it to the list, followed by Tehran at 17 (Iran) alongside Riyadh and Jeddah (Saudi Arabia) at 22 and 25. Dubai is already a destination for many large CEXs looking to enter the Middle East region. To date, Binance, Huobi, Coinbase, and Kraken have been licensed to operate in Dubai.

Countries like Saudi and UAE are already the economic centers in the Middle East. With positive crypto policies, the future of the crypto industry in Middle Eastern countries looks promising.

2. Steady Crypto Activity in China Despite the Ban

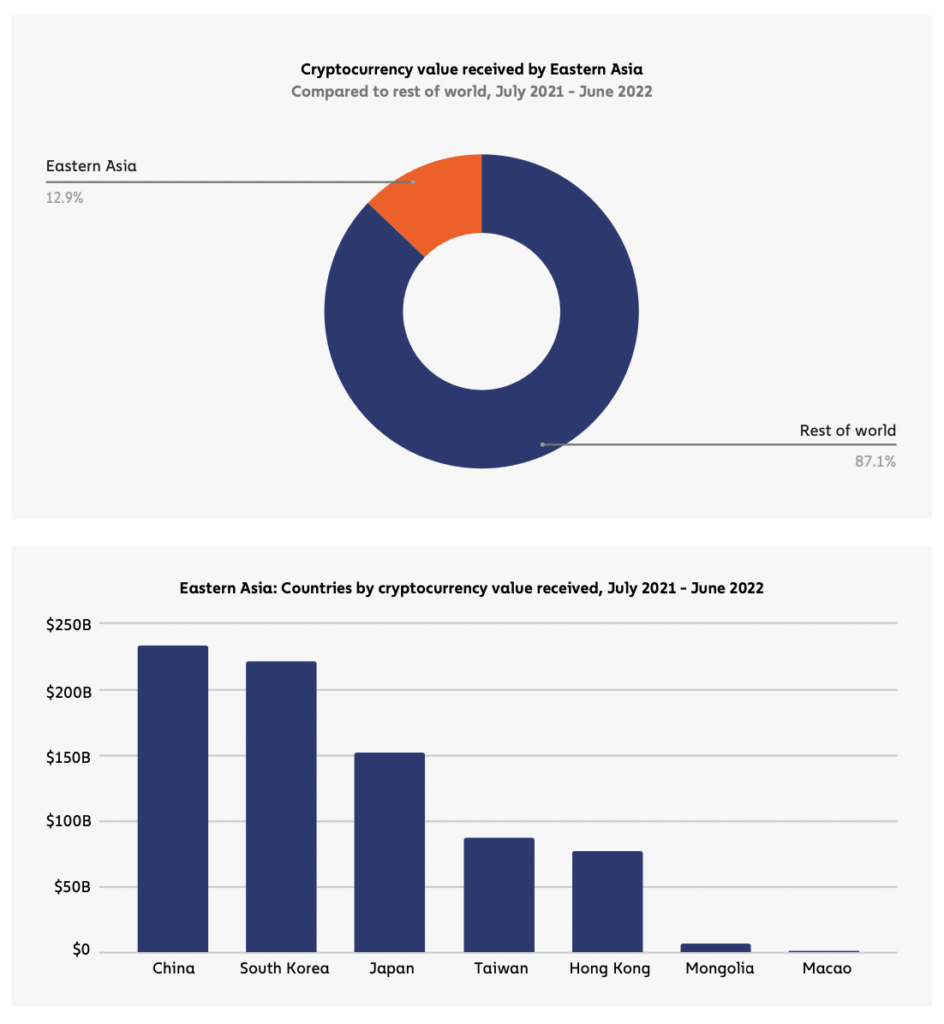

At the end of September 2021, the Chinese government bans all crypto transactions. The 2022 crypto adoption index puts China in 10th place. So, even though the government ban all crypto activities, many people still use it. In the East Asia region, which accounts for 12.9% of global crypto transactions, China still tops the transaction volume.

Before the crypto ban, China has the 2nd largest bitcoin mining industry in the world because of its cheap electricity.

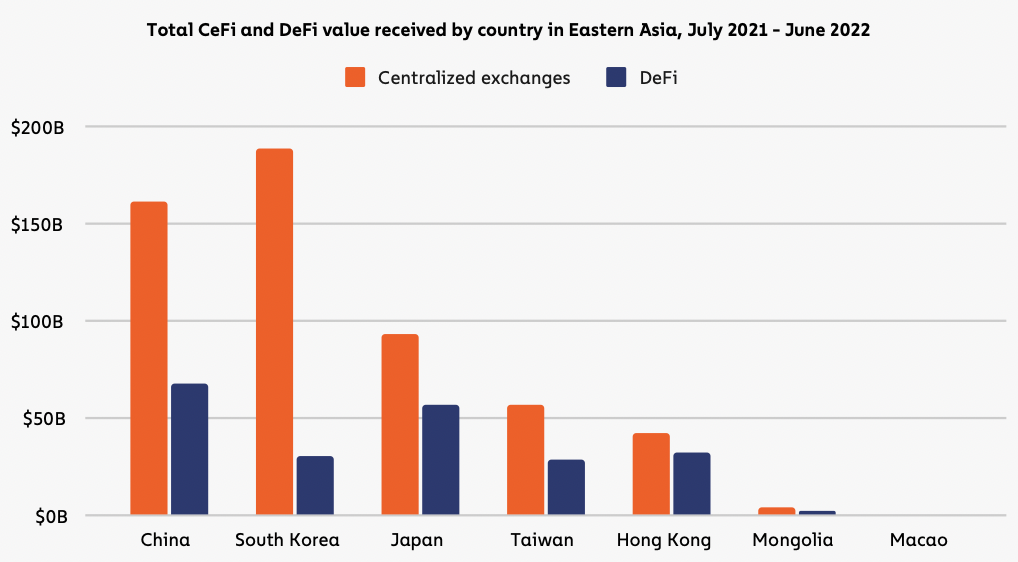

Cryptocurrency transaction volume in China stands at over $200 billion dollars. This exceeds the crypto activity figures in South Korea and Japan, which officially allow the trading of crypto assets. This indicates that either the government’s restrictions are ineffective or the government is not enforcing its regulations. However, crypto activity in China is still down 31% compared to 2020-2021 before the ban.

With Hong Kong about to open up, there will come a time when China will have to rethink whether to close or start reopening its crypto industry.

3. Hong Kong Regulatory Clarity and Japan-South Korea Situation

In late December 2022, Hong Kong formalize its license regulations for virtual asset service providers (such as CEX). Hong Kong has also listed Bitcoin and Ethereum in an Exchange-Traded Fund (ETF). Furthermore, the government mentioned that other major crypto assets will be able to be traded by retail on licensed CEXs. The Hong Kong government is also drafting regulations on crypto assets and is open to consultations until March 31, 2023. The new rules will be officially implemented in Hong Kong on June 1, 2023.

South Korea accounts for the most CEX activity in the East Asia region. On social media like Twitter, many crypto accounts from South Korea are very active. Japan on the other hand accounts for considerable DeFi activity, almost doubles that of South Korea. This activity comes from Japanese people who often use DEXs like Uniswap. In addition, many people in Japan are fans of NFTs. Data on crypto hub cities also put Sapporo and Osaka in 13th and 19th place in the world.

Some reports mentioned that the increasingly expensive property rate and the unemployment rate have led many young people to choose crypto as an alternative investment asset. Data from Huobi also shows that 1 in 5 young people in South Korea invest in Bitcoin. In addition, the data above shows that Japan and South Korea have a strong retail investor base.

4. Singapore as Southeast Asia’s Crypto Hub

Since the last few years, Singapore’s government has always made it clear that Singapore wants to become a crypto hub in Southeast Asia. The government wants to attract projects and developers that can drive innovation. The country is focused on exploring the potential uses of blockchain and crypto, especially for the traditional finance sector. On the other hand, the Singapore government does not favor crypto as a trading and speculative asset. This stance comes after the Terra and FTX incidents that devastated many retail investors.

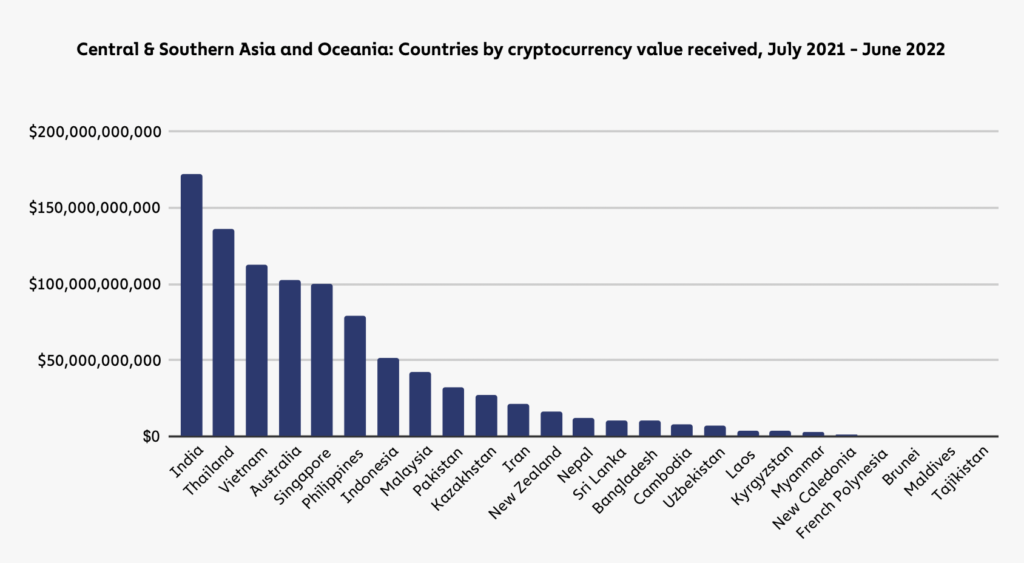

Despite the restrictions put in place, Singapore is the 4th crypto hub city in the world. Singapore also become the 5th leading country in transaction volume in the Southeast Asia and Oceania region.

With positive government policies and an already strong hub for crypto projects, Singapore will be a major player in the Southeast Asia region.

5. Southeast Asian Countries Lead in Crypto Adoption

Southeast Asia manages to dominate various crypto data. Four countries from Southeast Asia made it into the top 20 of the global crypto adoption index. Vietnam and Thailand even managed to take 1st and 2nd place on the index. Furthermore, the existence of these four countries from Southeast Asia is not a coincidence. Based on TripleA research, Vietnam, the Philippines, Indonesia, and Thailand are also among the top 10 countries with the highest crypto ownership in the world. Additionally, White Star Capital’s 2022 report shows that there are more than 600 blockchain and crypto company offices in Southeast Asia.

With a demographic consisting of 34% young people, Southeast Asia is a suitable place for the crypto industry to flourish. Although crypto and blockchain infrastructure is still centered around Europe and the US, Southeast Asia has a generation of young people who are well-versed in technology, thus the financial aspect of crypto is very attractive.

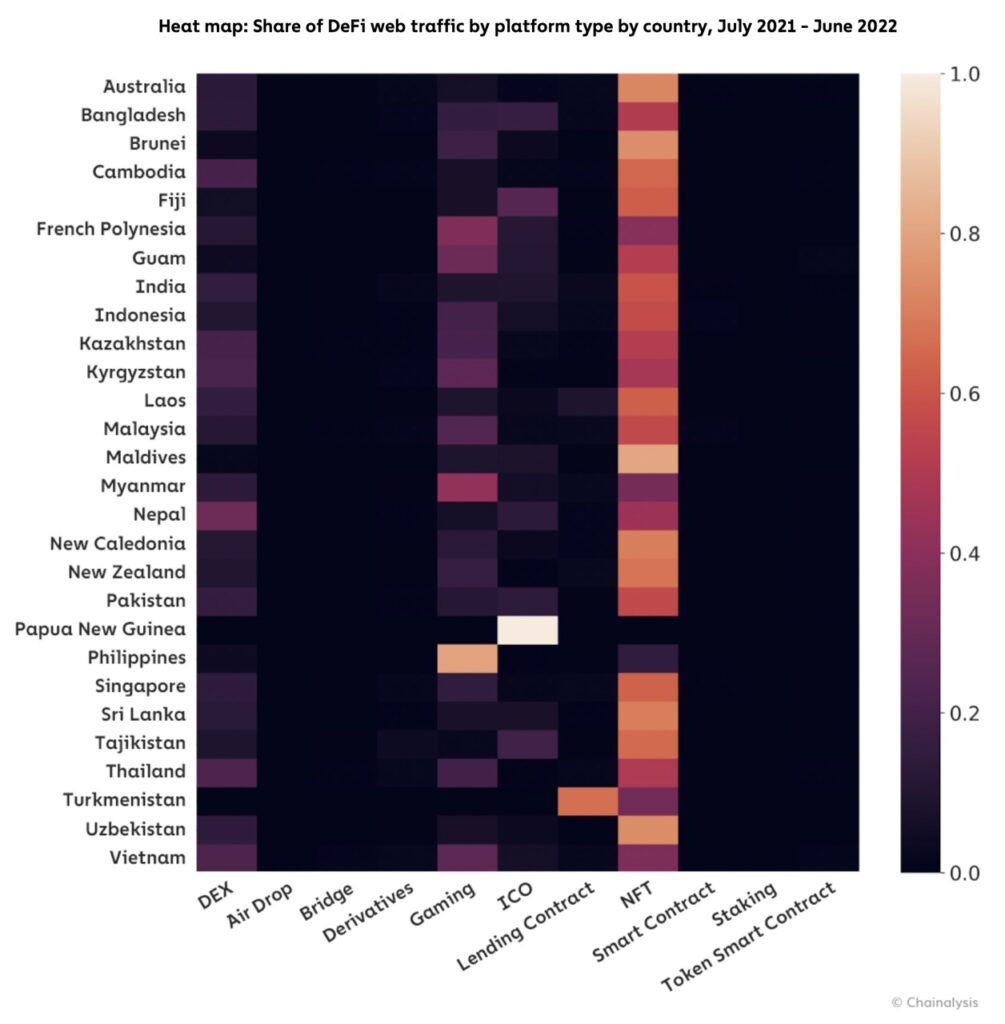

Another interesting data of Southeast Asia is the dominance of NFT and GameFi sectors. 58% of internet traffic in crypto among Southeast Asian users is related to NFTs. Meanwhile, another 21% is related to play-to-earn game sites. The two sectors are interlinked as games like Axie Infinity and STEPN are both GameFi and NFTs. The activities of countries like Thailand, Vietnam, and the Philippines are most likely related to games like Axie Infinity.

In Indonesia, there are 16.55 million crypto asset owners in 2022, up 48.7% from 2021. Similar to the Philippines and Thailand, the majority of crypto internet activity in Indonesia is also related to NFTs. Additionally, the Indonesian government is also starting to take the crypto industry seriously and has clear regulations. Currently, there are 28 CEXs with official licenses to operate in Indonesia. Education about crypto is also quite prominent in order to protect retail investors.

Southeast Asia is one of the regions with the highest growth potential compared to other regions. As shown in the figure above, countries in Southeast Asia are also generally supportive of the development of the crypto industry. With a 15.8% contribution to the global crypto transaction volume and a large number of young investors, the region has abundant potential.

Several Crypto Projects Based in Asia

- Polygon (MATIC): Polygon is a layer-2 Ethereum project created in 2017 by a group of developers from India. MATIC has a market capitalization of $9.2 billion.

- Axie Infinity (AXS): Axie Infinity is a GameFi crypto project created in 2018 and based in Vietnam. AXS has a market capitalization of $854 million.

- TRON (TRX): Tron is a layer-1 project created in 2017 and based in Singapore. TRX has a market capitalization of $5.2 billion.

- Sandbox (SAND): Sandbox is a crypto metaverse project based in Hong Kong. SAND has a market capitalization of $815 million.

How to Buy Crypto at Pintu

You can start investing in crypto by buying them in the Pintu App. Here’s how to buy crypto on the Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite token.

- Click buy and fill in the amount you want.

- Now you have crypto as an asset!

You can also invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily through Pintu.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to executing transactions in the Pintu Apps, you can also learn crypto through various Pintu Academy articles which are updated every week! All Pintu Academy articles are made for educational purposes, not financial advice.

References

- Chainalysis, 2022 Global Cryptocurrency Adoption Index, Chainalysis, accessed on 8 March 2023.

- TripleA, Global Cryptocurrency Ownership Data 2023, TripleA, accessed on 8 March 2023.

- Huobi Research, Global Crypto Industry Overview and Trends[2022–2023 Annual Report](First Part), Huobi, accessed on 9 March 2023.

- Dan Howitt, The Rise of Crypto Hubs: Which Cities are Leading the way in Cryptocurrency Adoption?, Recap, accessed on 10 March 2023.

- Rita Lao, In Southeast Asia, a booming crypto scene, Tech Crunch, accessed on 10 March 2023.