As a new Layer-1 generation project, Aptos is increasingly showing its capability to compete with its predecessor L1 generation. This is evident in the uptick in network activity and the growth of its ecosystem. Moreover, Aptos has planned various upgrades to further improve its performance. Find out more information about the development of the Aptos ecosystem and its potential in the following article.

Article Summary

- 🔥 As of 2023, Aptos managed to record an average daily transaction of 483,000 with an average active address count averaging 60,000.

- 🚀 Aptos’ TVL has soared to $220.65 million, marking a substantial increase from $118.22 million at the end of 2023.

- 🏆 The surge in Aptos TVL is attributed to the growth of the ecosystem, featuring promising protocols such as Thala, Amnis Finance, and Aries Market.

- 👁️ Aptos is poised to enhance network performance and quality through upcoming storage sharding updates and the introduction of a new consensus mechanism known as Shoal.

About Aptos

Aptos is a layer-1 blockchain designed with the core principles of scalability, security, reliability, and upgradeability. With these principles, it is a blockchain platform that can fulfill various uses related to crypto and Web3.

Key technologies underpinning Aptos include the AptosBFTv4 consensus mechanism, Quorum Store-pooling protocol, Block-STM parallel execution engine, and the Aptos Move programming language.

Thanks to these technologies, Aptos claims its blockchain can process up to 160,000 transactions per second (TPS). Meanwhile, the Aptos Move programming language is claimed to increase flexibility and security compared to other Web3 programming languages. The Aptos blockchain token is APT.

For a more in-depth explanation of Aptos technology and how it works, you can read the following Pintu Academy article.

Aptos Development

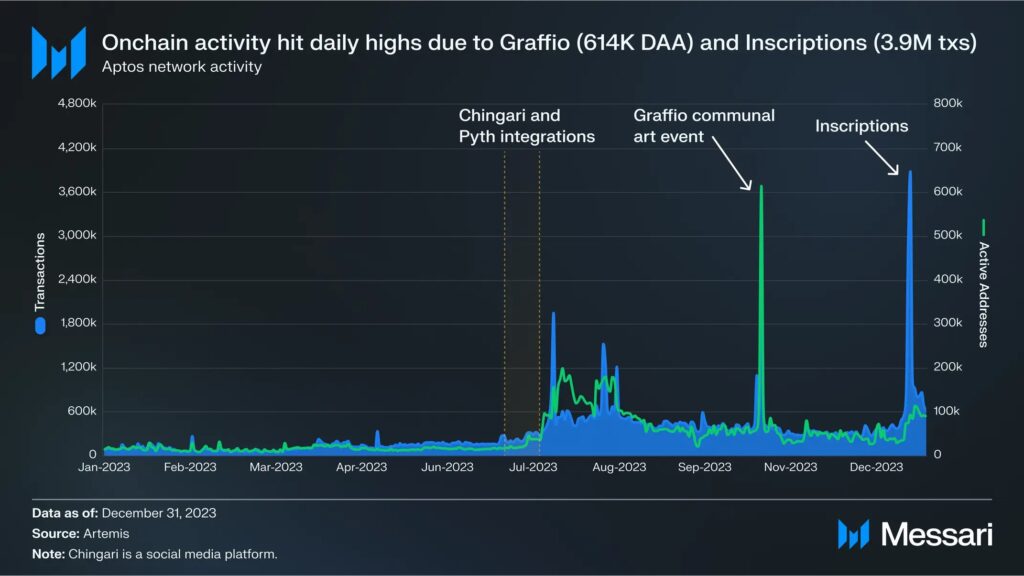

According to research by Messari, Aptos witnessed robust growth in 2023, with an average daily transaction of 483,000 and an an average active address count of 60,000, occasionally experiencing noteworthy surges in these metrics.

For example, in October 2023, the number of Aptos daily transactions passed 1.3 million, with unique addresses reaching 605,000. At that time, the increase was driven by the Graffio communal art creation event. The inscription frenzy also caused Aptos network activity to skyrocket. The launch of APT-20 by BlueMove made Aptos daily transactions reach 6.8 million transactions on December 23 and 24.

In terms of the number of tokens staked, Aptos also recorded an increase. By the end of 2023, 906 million APT tokens had been staked. With this amount, Aptos also makes it into the top 10 largest networks in terms of staked market cap. Active validators on Aptos have also continued to grow since its launch. Currently, there are 126 active validators on Aptos with a total of 511 nodes.

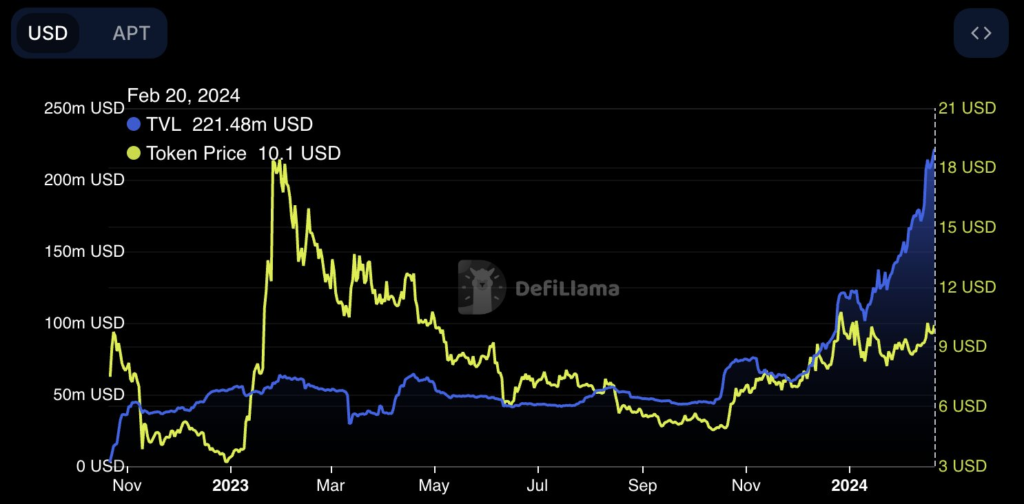

The increase also occurred in Aptos’ total value locked (TVL). Based on data from Defi Llama, Aptos’ TVL currently stands at $220.65 million. At the end of 2023, the amount was only $118.22 million. This shows that there has been significant growth in the Aptos ecosystem in recent times.

Aptos Ecosystem

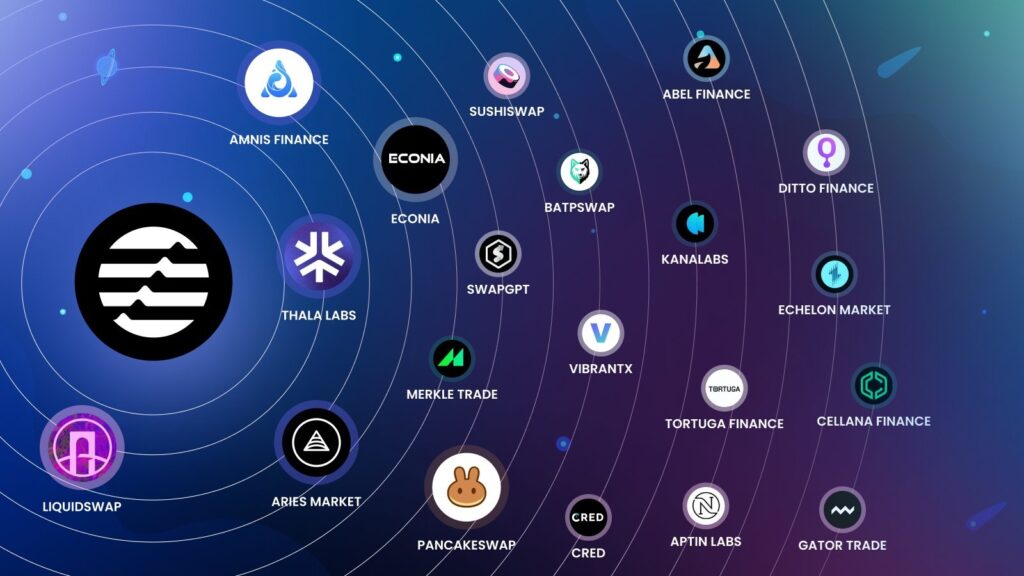

With its advanced technology, Aptos has become a hub for a variety of DeFi protocols. In this section, we will discuss the three protocols with the largest TVLs on the Aptos network:

1. Thala

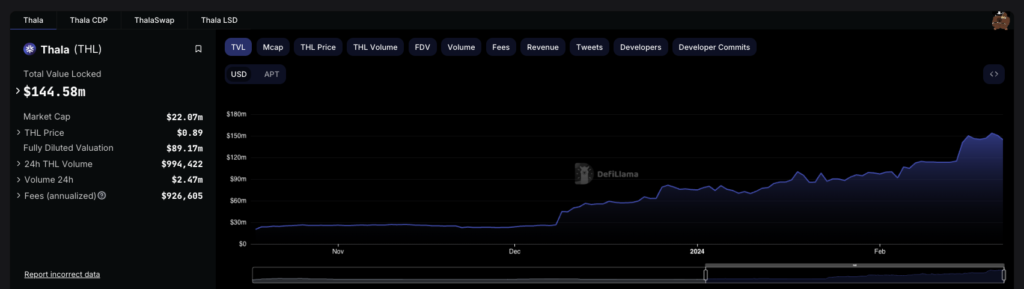

Thala is an all-in-one decentralized finance (DeFi) protocol offering a wide range of products. It serves as a native protocol on the Aptos network and currently holds the title of having the largest TVL. According to DeFi Llama, Thala’s TVL had reached $143.4 million at the time of writing.

Thala’s two main products are ThalaSwap and Move Dollars (MOD). ThalaSwap is an Automated Market Maker (AMM) that enables dynamic pool weightings. Meanwhile, MOD is an Aptos-native stablecoin used to transact, facilitate, and interact with various other DeFi protocols in the ecosystem.

Thala’s other products are liquid staking in the form of thAPT and sthAPT tokens. In addition, Thala also features bridges to support asset transfers between Aptos and other chains. To deliver secure and fast bridges, Thala has partnered with LayerZero and Wormhole.

2. Amnis Finance

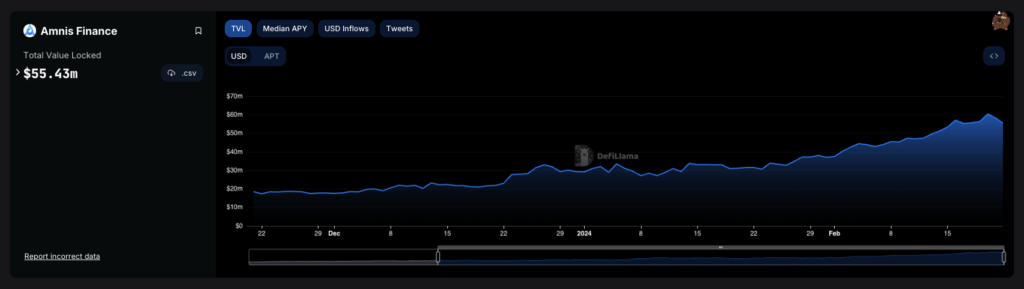

Amnis Finance is the first and largest liquid staking protocol on the Aptos network. It was only launched in October 2023, but it has already shown its potential. One of them is reflected in the growth of its TVL. According to Defi Llama, Amnis Finance’s TVL is now $55 million, the second largest on the Aptos network.

That figure has the potential to continue to grow due to the relatively small portion of liquid staking in the Aptos ecosystem, which currently stands at only 0.66%. As a leader in the sector, Amnis Finance will benefit and play an essential role in the growth of the liquid staking sector in Aptos.

Currently, the number of APT tokens staked on Amnis Finance stands at 5.99 million with 100,690 stakers. Amnis Finance is also now running the Amnis Retroactive Airdrop campaign. By completing various tasks provided, users will earn points that will later be factored into Amnis Finance’s airdrop distribution.

3. Aries Markets

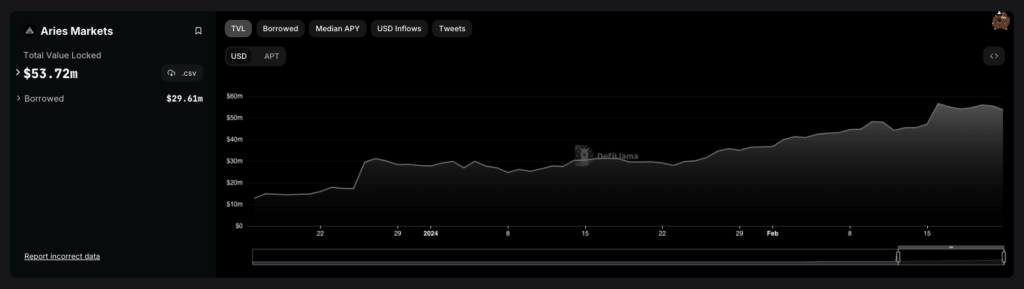

Aries Markets is a decentralized margin trading protocol on the Move Ecosystem. With Aries Markets, users can lend, provide liquidity, and margin trade through a fully on-chain order book at lightning speed.

Aries Markets is the first and largest lending protocol in Aptos. Aries Markets currently has a TVL of $54.14 million, making it the protocol with the third largest TVL in the Aptos ecosystem.

Aries also collaborates with many other protocols to improve its services. Some of the protocols that work with Aries are PancakeSwap, Pyth Network, Pontem Network, Wormhole, and others.

Aptos Potential and Future Roadmap

The potential and development of Aptos will be determined by how much the various protocols grow. In addition, metrics such as the number of users, network activity, and the development of Aptos’ proprietary technology also play an important role. In terms of development, Aptos developers have shown that they are still working on improving their technology.

Recently, Aptos launched Previewnet, a test ecosystem designed to mirror the Aptos mainnet. Through Previewnet, the Aptos development team can test various upgrades that are being prepared.

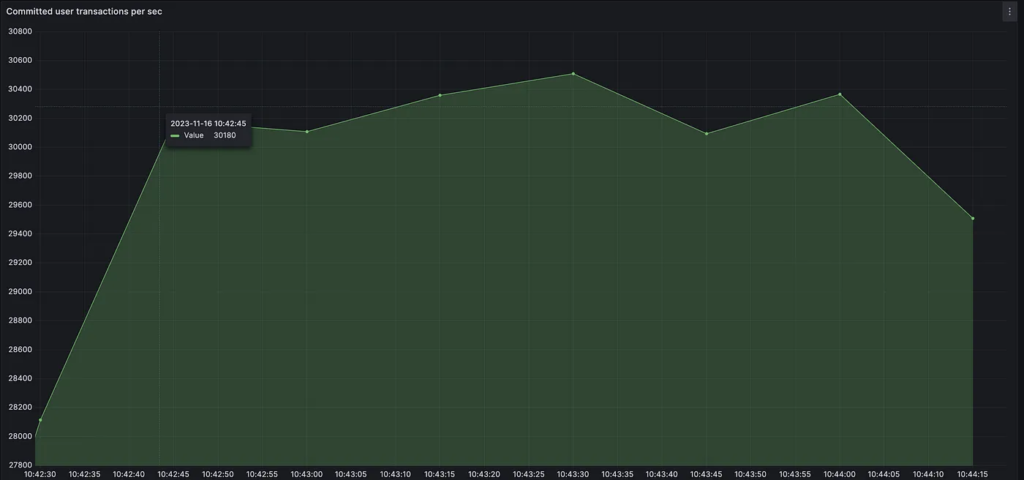

On November 6-21, 2023, Previewnet ran a test. As a result, they recorded more than 9 billion transactions of which 2 billion occurred within 24 hours. In addition, P2P transactions reached 30,000 TPS, and more than 1 million NFT collections were minted in 90 seconds

The high performance is due to an upgrade called storage sharding. It works by dividing the storage state into RocksDB. The plan is to implement storage sharding technology in the Aptos mainnet this year. If the upgrade enables the Aptos mainnet to record Previewnet-like performance, it will certainly have a big impact.

Furthermore, the Aptos development team is also preparing a new consensus mechanism called Shoal. The technology will combine DAG with BFT qualities, thus reducing latency and increasing throughput. With these updates, Aptos Labs expects Aptos to process up to 100,000 TPS transactions this year.

There are also indications that Aptos will enter the RWA space. This is indicated by @neilhar_’s post which mentions that he and Aptos CEO Mo Shaikh recently met with three investment managers. During the meeting, they discussed RWA and the growth of the crypto ecosystem in Asia.

https://x.com/neilhar_/status/1758156693332996608?s=20

If Aptos does indeed enter the RWA space, this could be a positive thing. Moreover, RWA is predicted to be the main narrative in the upcoming bull market and the gateway for institutional investors to enter the crypto industry.

Conclusion

Aptos, as a new L1 generation project, continues to show its potential to rival its predecessors. Not only is the technology advanced and innovative, but the Aptos ecosystem is also growing. Starting from Thala, a one-stop DeFi protocol, then Amnis Finance, which offers liquid staking services to maximize yield, to Aries Markets as a lending and margin trading protocol.

Entering 2024, the Aptos development team continues to strive to improve the quality and performance of Aptos. Most recently, they are preparing storage sharding upgrades and a new consensus mechanism called Shoal. It will be interesting to see what Aptos does in the future with the increasing competition in the L1 sector and the presence of various L2 projects.

How to Buy Token APT on Pintu

You can start investing in APT by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for APT.

- Click buy and fill in the amount you want.

- Now you have APT!

In addition to APT, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Peter Horton, State of Aptos Q4 2023, Messari, accessed on 20 February 2024.

- VibrantXFinance, Let’s dive into Aptos Network Ecosystem, X, accessed on 20 February 2024.

- Aptos Network, Aptos = THE chain-of-choice for DeFi innovation as evidenced by the growing ecosystem, X, accessed on 20 February 2024.

- Thala Docs, Thala Protocol, accessed on 21 February 2024.

- Amnis Finance Docs, What is AMNIS? accessed on 21 February 2024.

- Aries Markets Docs, Aries Markets Overview, accessed on 21 February 2024.