Avalanche stands out with its distinctive architecture, dividing its blockchain into three subnets (P, C, and X Chain). This sets the platform apart as a blockchain capable of fast, almost instantaneous, and cost-effective transaction processing. Notably, numerous blockchain projects opt to develop their applications within the thriving Avalanche ecosystem, particularly in the GameFi, DeFi, and NFT sectors. This article delves into the attention-grabbing Avalanche ecosystem that has captivated the crypto community.

Article Summary

- ⚡ Avalanche is an L1 platform that provides an ecosystem with high interoperability and scalability.

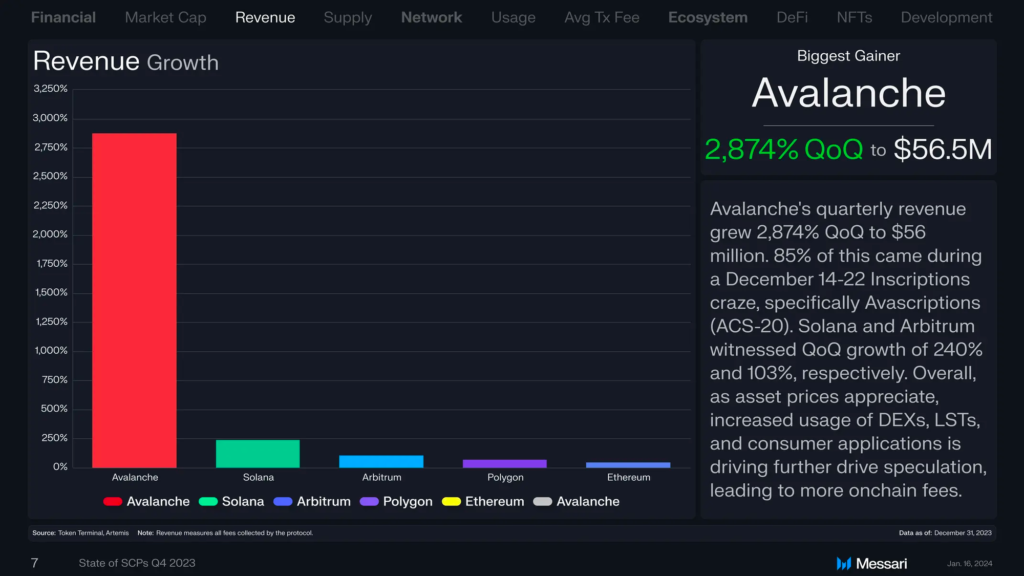

- 🤑 In November, the Avalanche ecosystem witnessed significant growth, with C-Chain registering a total of 6.3 million transactions. The revenue also experienced remarkable quarterly growth, surging by 2,874% and reaching 56 million US dollars in Q4.

- 🏦 Major institutions like JP Morgan and Citi are adopting Avalanche for the tokenization of real-world assets (RWA) projects.

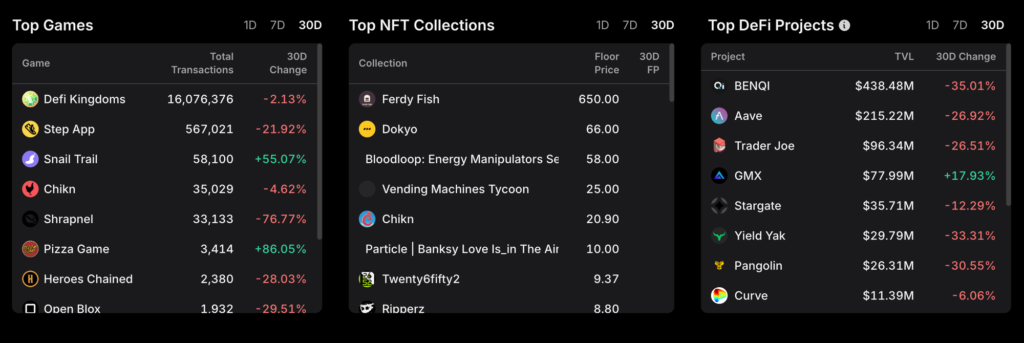

- 🎮 The Gamefi, DeFi, and NFT sectors predominantly shape Avalanche’s ecosystem. Noteworthy projects like DeFi Kingdoms, Shrapnel, and Trader Joe stand out, showcasing play-to-earn innovations, AAA FPS games, and comprehensive DeFi services.

Performance Growth of the Avalanche Network

By the end of 2023, Avalanche achieved an impressive performance. One of the influencing factors was the significant institutional adoption of Avalanche subnets by large companies such as Citi and JP Morgan. Additionally, the blockchain exhibited ongoing product maturity, experimentation, and the advancement of developer tools.

Institutions like Citi and JPM have large operations with specific and strict requirements that often make them unsuitable for public blockchains. However, Avalanche demonstrated the reliability of its technology to meet the needs of these institutions in real-world asset (RWA) tokenization.

J.P. Morgan’s Onyx and Apollo Global collaborated on proof-of-concept tokenization under the Monetary Authority of Singapore’s (MAS) called Project Guardian. Their goal is to use blockchain technology, smart contracts, and tokenization methods to revolutionize asset management by including alternative assets in portfolios. On the other hand, CitiBank utilized AvaCloud to launch a currency exchange solution that provides secure and real-time price quotes.

Read also What is Avalanche (AVAX)?

In November 2023, Avalanche C-Chain achieved a record-breaking milestone with 6.3 million transactions, where 97% of which originated from Avalanche inscription transactions. Concurrently, on-chain subnet activity witnessed notable growth, primarily driven by Beam, a gaming network created by Merit Circle.

Compared to other blockchains such as Solana, Ehereum, Polygon, and Arbitrum, Avalanche achieved very significant revenue growth. From the figure above, you can see that in Q4, Avalanche’s revenue grew by 2,874% QoQ to reach 56 million US dollars!

85% of the revenue came from the high interest in Avalanche inscriptions or Avascriptions (ACS-20). In December 2023, Avascriptions transactions reached 95 million transactions that flooded the Avalanche C-Chain.

Learn more about blockchain inscriptions in this article.

According to Avalanche, the C-Chain expanded to accommodate rising transaction demands, reaching its peak daily average of 72.59 transactions per second (TPS) on December 19.

Avalanche Ecosystem Development

According to Into The Block’s analysis, Avalanche’s ecosystem shows maturity with a decrease in the concentration of large token holders (whales) from 62% to 43% over the past two years. On the other hand, the number of AVAX token holders increased from 776,000 to 6 million. This change reflects a more decentralized distribution and signifies the growth and maturity of the ecosystem.

Currently, there are 100 subnets, 73 blockchains, and 1,716 validators on the Avalanche main network. The total transactions reached 1.2 billion, with more than 700,000 smart contracts implemented.

Avalanche offers an ecosystem characterized by robust interoperability and scalability, making it a preferred platform for dominant sectors such as Gamefi, DeFi, and NFTs. Notable projects in these sectors on the Avalanche blockchain include Defi Kingdom, Shrapnel, Trader Joe, Benqi, and Dokyo.

1. DeFi Kingdom

DeFi Kingdoms is an RPG game with pixel graphics and a play-to-earn concept. It is built on the robust DeFi protocol with plans to become a full-fledged Web3 game.

As the name suggests, the game combines DeFi and gaming elements by providing features such as DEX, liquidity pool, and NFT marketplace to create a complete online world for gamers.

Within the DeFi Kingdom ecosystem, three key tokens (JEWEL, CRYSTAL, and JADE) serve crucial roles. JEWEL acts as both a gas fee and a governance token, while CRYSTAL and JADE serve as payment methods for various transactions, including NFT purchases, hatching Pets, adding new Heroes, and more.

Since its launch in August 2021, DeFi Kingdom has introduced over 40 features, hosted AMA sessions with 60+ developers, and conducted 15+ governance votes. Moreover, the official website of DeFi Kingdom outlines a comprehensive roadmap, detailing plans for new features, systems, maps, and cross-chain gameplay.

The development team is actively working on long-term features like In-game Chat, Golden Egg Hatching, Guilds, Dungeons, and Large-scale PvP. Additionally, upcoming releases include features such as Expeditions, Traveling System, PvP Combat, and Level 10 Mining Quests, among others.

DeFi Kingdom is the most popular game on the Avalanche network. In the last 30 days, it has a total of 16 million transactions with 315,923 wallets.

2. Shrapnel (SHRAP)

Shrapnel is the first Web3 first-person shooter (FPS) game operating on the Avalanche network. This shooting game is said to be a 3D AAA-quality FPS game with an impressive gameplay experience.

Originally scheduled for a 2024 release, the game has been postponed to 2025. Early access is available through the acquisition of Extraction Packs, with prices starting at 19.99 US dollars.

To evaluate specific features of the game, the Shrapnel team conducted the Shrapnel STX Operators Only Playtest on January 25, 2024.

The SHRAP token was introduced in November 2023. The token recorded an impressive achievement by reaching a trading volume of over 18 million US dollars on November 15, 2023. SHRAP made it into the top five tokens in the GameFi category on the Avalanche network.

The game has become one of the most anticipated due to its high quality and AAA-class gaming experience. Additionally, through its play-to-earn mechanism, Shrapnel empowers players to earn SHRAP tokens while engaging in gameplay and crafting their own NFT content.

Find out more about Shrapnel in What is Shrapnel (SHRAP)? A Web3 AAA First-Person Shooter (FPS) Game.

3. Trader Joe (JOE)

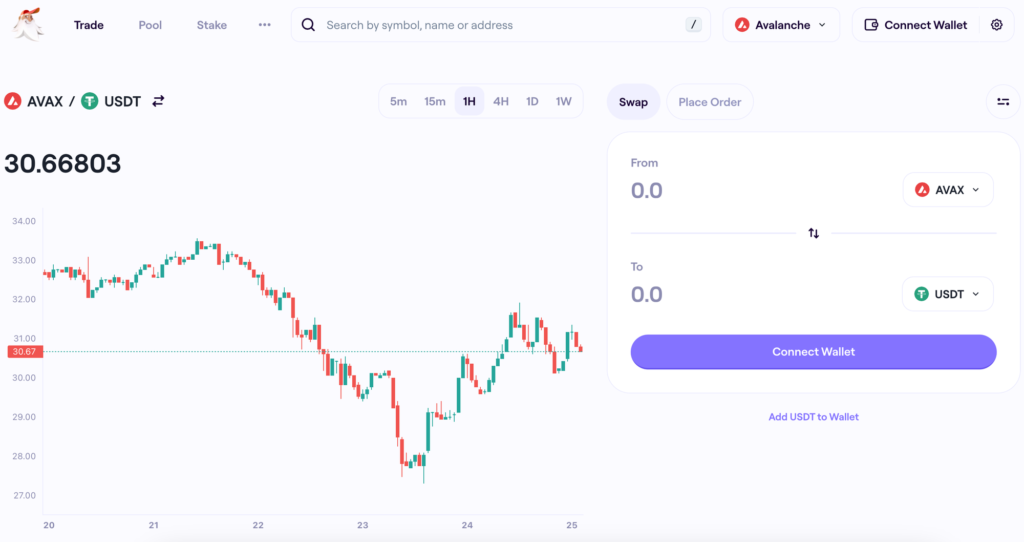

Trader Joe is a multi-chain decentralized exchange (DEX) built on the Avalanche network. According to Token Terminal, Trader Joe was founded in 2021 by an anonymous team and was a fork of Sushiswap.

Trader Joe provides a range of NFT and DeFi services, including swapping, staking, yield farming, lending, and token bridging. Alongside its comprehensive services, Trader Joe boasts a user-friendly interface, multi-blockchain support, and a fast, cost-effective transaction process. These features contribute to Trader Joe’s status as one of the most popular decentralized exchanges (DEXs) today.

According to Coinmarketcap, Trader Joe is developing uses for the JOE token, for example, by making JOE as collateral to borrow other assets. In addition, Trader Joe also plans to facilitate limit orders, options, and futures services on its platform.

In early December 2023, Trader Joe introduced Merchant Moe (MOE), a DEX built to expand liquidity on the Mantle Network. Users can stake JOE to earn MOE token rewards and get MOE airdrops in the next 12 months.

With technological innovation and strong branding, this DEX is backed by big names such as Three Arrows Capital, DeFiance Capital, GBV Capital, Mechanism Capital, and others.

Trader Joe is the third biggest DeFi app in the Avalanche ecosystem with a TVL of 96 US dollars and over 32 million transactions in the last three months. At the time of writing, the JOE token price is at 0.4 US dollars.

4. BenQi (QI)

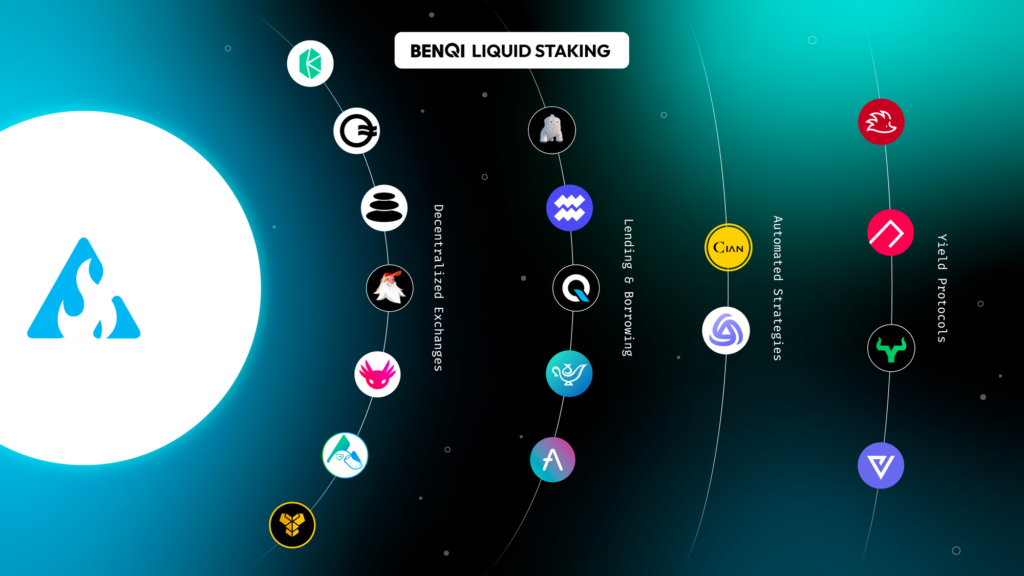

BenQi is a liquid staking protocol that runs on the Avalanche blockchain. Launched in 2021 by Rome Blockchain Labs, BenQi is one of the pioneers of DeFi lending services on Avalanche.

BenQi offers users fast and cost-effective entry to decentralized financial services. Simultaneously, developers can leverage BENQI to design financial products by utilizing governance protocols and tokens.

BenQi has become the leading liquid staking protocol in Avalanche with a remarkable growth of +131.4% in Total Value Locked (TVL). This growth is partially attributed to a +75.1% AVAX tokens during the same period, primarily driven by Avalanche supporting this. However, BenQi’s TVL has been declining ever since.

BenQi is actively broadening its ecosystem through collaborations with various Web3 projects, including NodeKit, Zeeve, FWX Finance, ChainStack, EMDX, and more. The recent update to the BenQi portfolio is Ignite, a platform presenting an alternative method for launching Avalanche validators. Users can opt for the Pay As You Go (PAYG) service, allowing them to become a validators for a weekly rental fee of 4 AVAX. This service proves to be a cost-effective alternative compared to the conventional approach of becoming an Avalanche validator, which necessitates a capital investment of 2,000 AVAX.

The growth of the TVL liquid staking token (LST) has outpaced the rise of the AVAX token. It shows a particular interest in this sector. In addition, the platform is also backed by Ascensive Assets, Dragonfly Capital, Mechanism Capital, Arrington XRP Capital, Spartan Group, and other major companies.

5. Dokyo

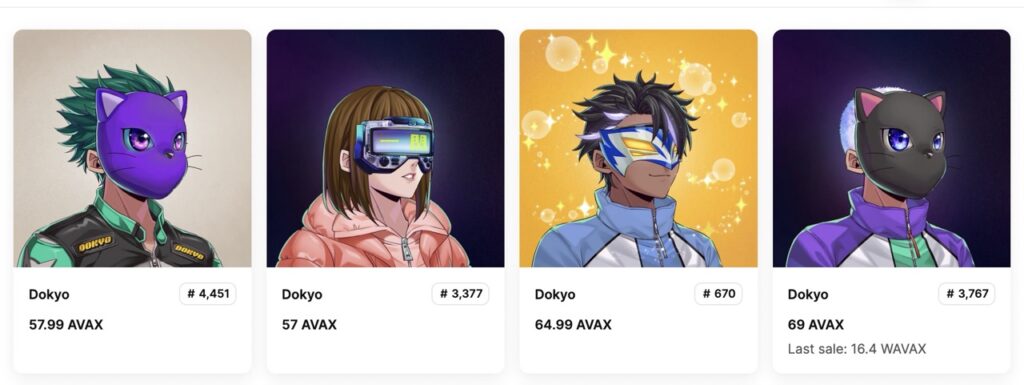

Dokyo is a PFP collection consisting of 5,555 NFTs. Since its introduction in October, this NFT collection has experienced the highest trading volume demand. In Japanese, “Dokyo” means courage and grit, particularly in a leadership context.

Dokyo has effectively asserted its leadership, emerging as the most traded NFT on January 15, 2023, with total sales reaching 2 million US dollars. This surpassed the sales of other well-known NFTs like Azuki, Bored Ape Yacht Club, and Cryptopunks. Presently, Dokyo holds a floor price of 57 AVAX or 1,767 US dollars, boasting a total of 935 NFT owners.

Dokyo’s artwork takes inspiration from projects in Japan. The humanoid figures are presented in an anime style, complete with various masks and detailed clothing. The creators of the artwork are from Murasaki Creative Studio, a team that is a collaboration between Japanese creators and international business teams.

Conclusion

Avalanche achieved remarkable accomplishments by the end of 2023, driven by institutional adoption and steady ecosystem growth. Large institutions such as Citi and JP Morgan adopted Avalanche subnets, demonstrating the reliability of its technology in tokenizing real-world assets.

The Gamefi, DeFi, and NFT sectors dominate the Avalanche ecosystem. Numerous blockchain projects are progressively embracing Avalanche subnets, contributing to its continued growth and adoption. With this rapid expansion, Avalanche is emerging as one of the intriguing Layer 1 (L1) blockchains to keep a close eye on.

Buy AVAX on the Pintu App

You can buy AVAX tokens and other assets such as JOE, SHRAP and others without worrying about fraud on Pintu. In addition, all crypto assets on Pintu have passed a rigorous assessment process and prioritize the principle of prudence.

The Pintu application is compatible with various popular digital wallets, such as Metamask, to facilitate transactions. Download the Pintu app on the Play Store and App Store! Your safety is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

In addition to making transactions on the Pintu app, you can learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are created for educational and knowledge purposes, not as financial advice.

References

- Messari Team, Ecosystem Brief: Avalanche Institutional Adoption, Messari, accessed 22 January 2024.

- Peter Horton, State of Smart Contract Platforms Q4 2023, Messari, accessed 22 January 2024.

- Avalanche Team, Avalanche Watch: December Edition, Avalanche, accessed 22 January 2024.

- Pedro M. Negron, Analyzing Avalanche’s Ecosystem Growth, accessed 23 January 2024.