Many people try their luck at mining for Bitcoin. Bitcoin mining is the process of verifying and adding blocks containing Bitcoin transactions to the blockchain by solving a complex computational math problem.

Unfortunately, making significant earnings from mining is currently fairly challenging due to the size of Bitcoin’s network and intense competition between miners. Not to mention the expensive equipment and other supporting needs. So, given these circumstances, is Bitcoin mining still profitable? Find out the answer in the following article!

Article Summary

- ⚒️ Bitcoin mining is the process of verifying and adding blocks containing Bitcoin transactions to the blockchain by solving mathematical puzzles.

- 🖥️ When a miner wants to start mining Bitcoin, they must have an ASIC (a mining device), prepare electricity bills, and choose the right software for mining activities.

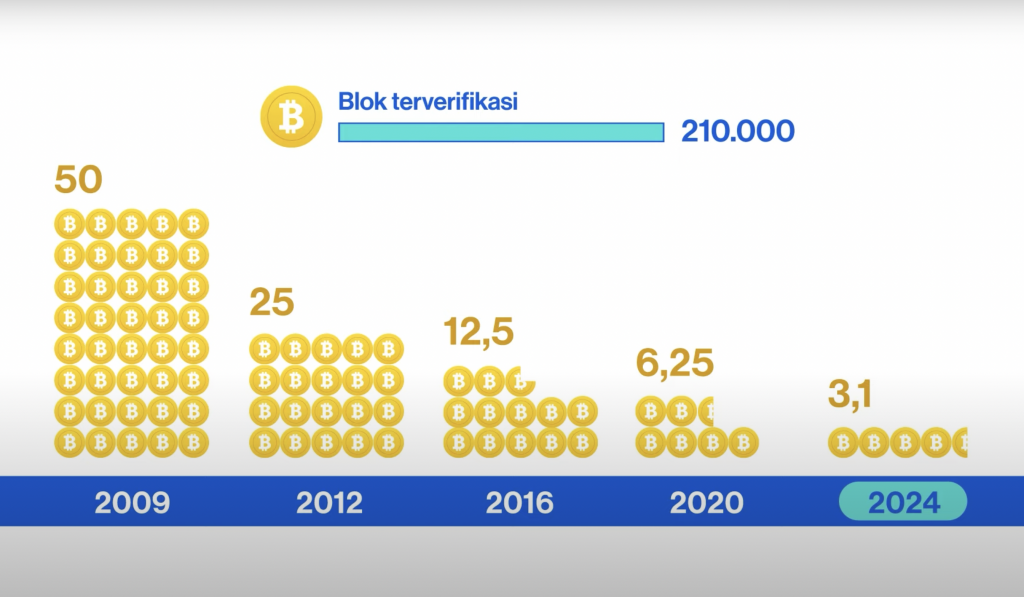

- 🤑 From 2020 until 2023, a miner who mines Bitcoin will get 6.25 BTC as a reward. The amount of this reward decreases every four years or so to keep the value of BTC increasing. This reduction is also known as the Bitcoin Halving.

- 🪙 In addition to Bitcoin, mining is an option for other crypto assets with proof-of-work (PoW) models such as LTC, ETC, DOGE, BCH, DASH, KDA, ZEC.

What is Bitcoin Mining?

Bitcoin Mining is verifying new Bitcoin transactions by solving a complex math puzzle with a sophisticated computer device called an Application-Specific Integrated Circuit (ASIC). It’s called mining because mining creates new blocks that add transaction records to Bitcoin’s public ledger. Just like mining in most commodities, such as gold or coal that requires energy and effort, Bitcoin mining also requires a large amount of computing power.

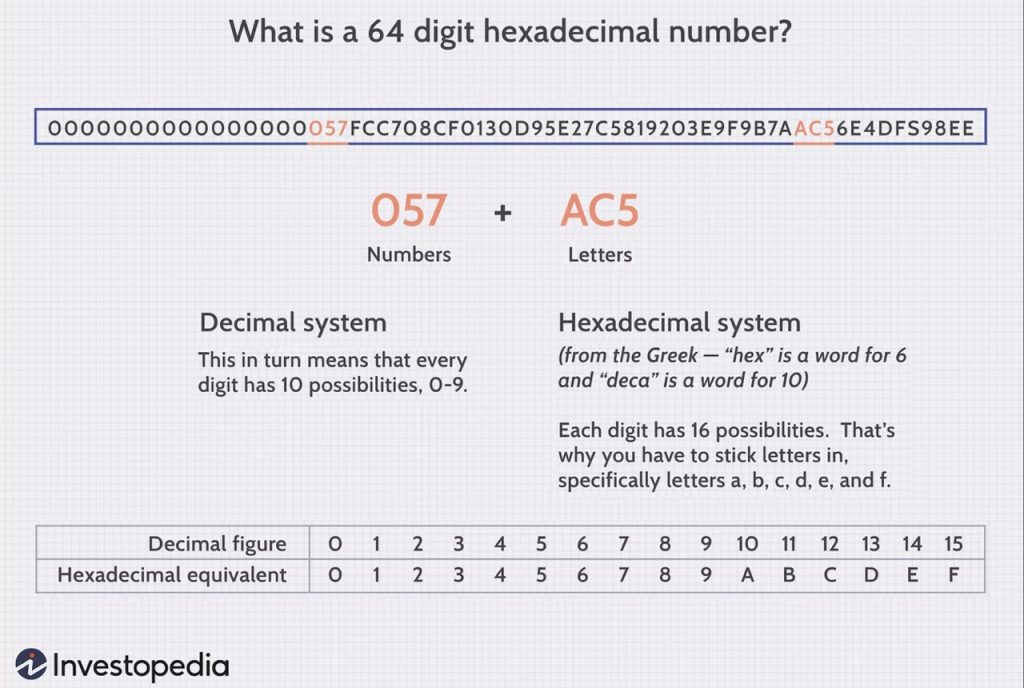

The Bitcoin mining process is not simple. To confirm Bitcoin transactions, a miner has to compete with other miners to solve mathematical puzzles using an ASIC computers that consume enormous amounts of energy. In validating the transaction, miners need to complete a puzzle containing a 64-digit hexadecimal code or referred to as a hash. Here is an example of a hash containing a 64-digit hexadecimal code:

💡 Hexadecimal code refers to 16 bases because “hex” and “deca” is derived from the Greek word for six and ten, respectively. In a hexadecimal system, each digit has 16 possibilities. But, the numeric system only offers ten ways of representing numbers (0-9). That’s why you have to add letters, specifically letters A, B, C, D, E, and F.

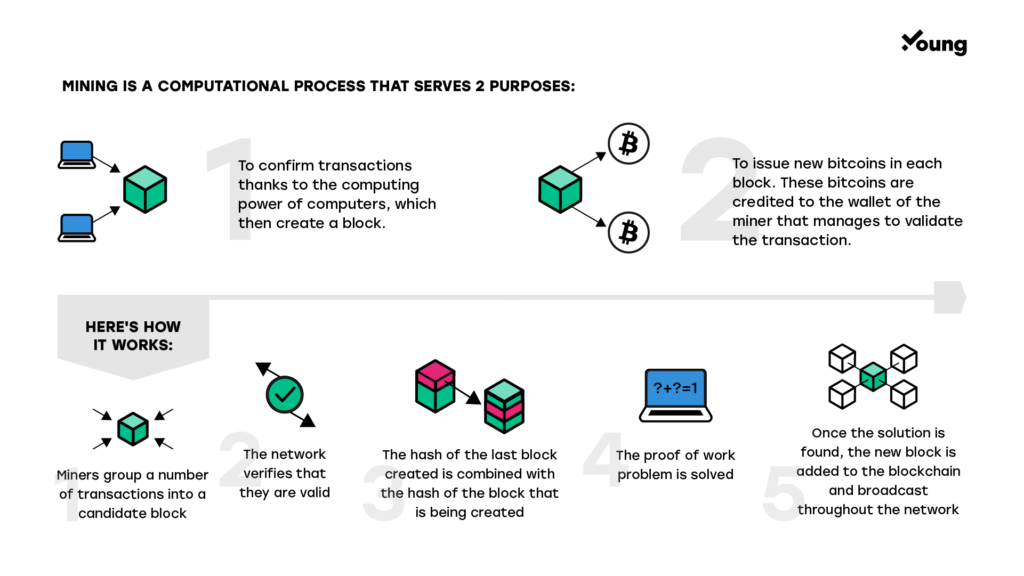

The validating transaction mechanism that requires miners to solve this mathematical puzzle is called proof-of-work (PoW). With the PoW mechanism, miners connect a block containing new Bitcoin transactions with the previous block. Once these blocks are connected, they cannot be changed or altered. This process prevents “double spending”, or the use of the same Bitcoin for multiple transactions.

Don’t forget to read the following article if you want to learn more about Bitcoin and blockchain.

Proof of Work Mechanism

PoW is a consensus mechanism used by Bitcoin. PoW itself is a mechanism that regulates the process of adding blocks of a transaction to the blockchain. As blockchain is decentralized and peer-to-peer by design, it requires some way to achieve both consensus and security.

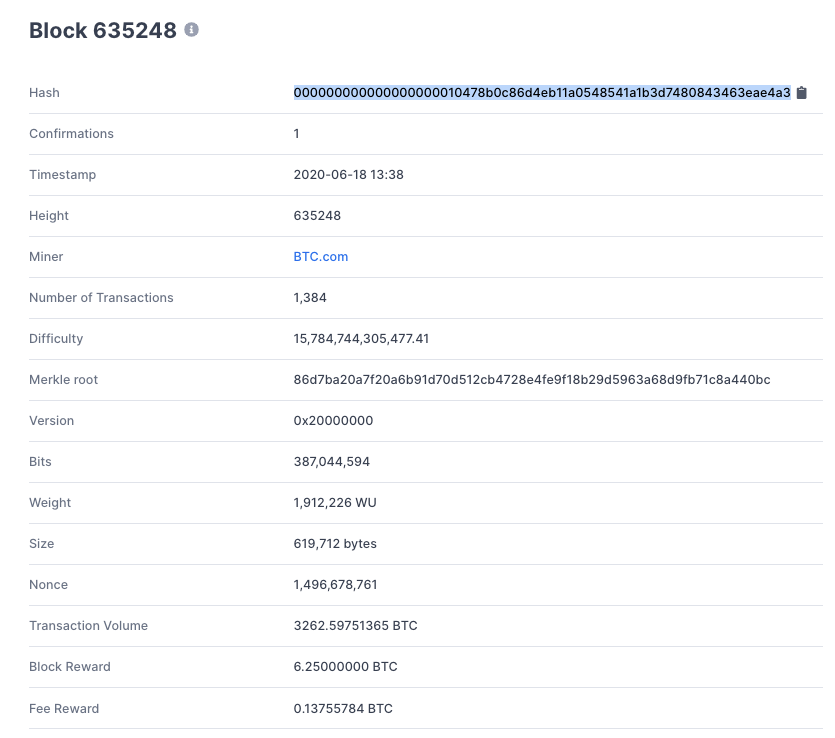

In the PoW system, all transactions are processed and verified by miners. Each miner will compete with each other to solve cryptographic puzzles and upload blocks to the blockchain. For a block to be valid, the SHA-256 hash of that block must be lower than the current difficulty level. Meanwhile, the way to ensure that the hash is lower than the specified target is by adding a nonce (number used for once) to the block.

A new block will be added to the blockchain when a hash is declared valid. Miners who successfully guess the target hash will get a reward in the form of coin base + transaction fees. The whole process of mining one block takes 10 minutes.

💡 Currently, Bitcoin has a difficulty level of 36.95 trillion. Later, the difficulty level will be adjusted every 2016 block. If there is an increase in the number of Bitcoin miners, the difficulty level will also increase. However, the difficulty would also decrease if the number of miners decreased.

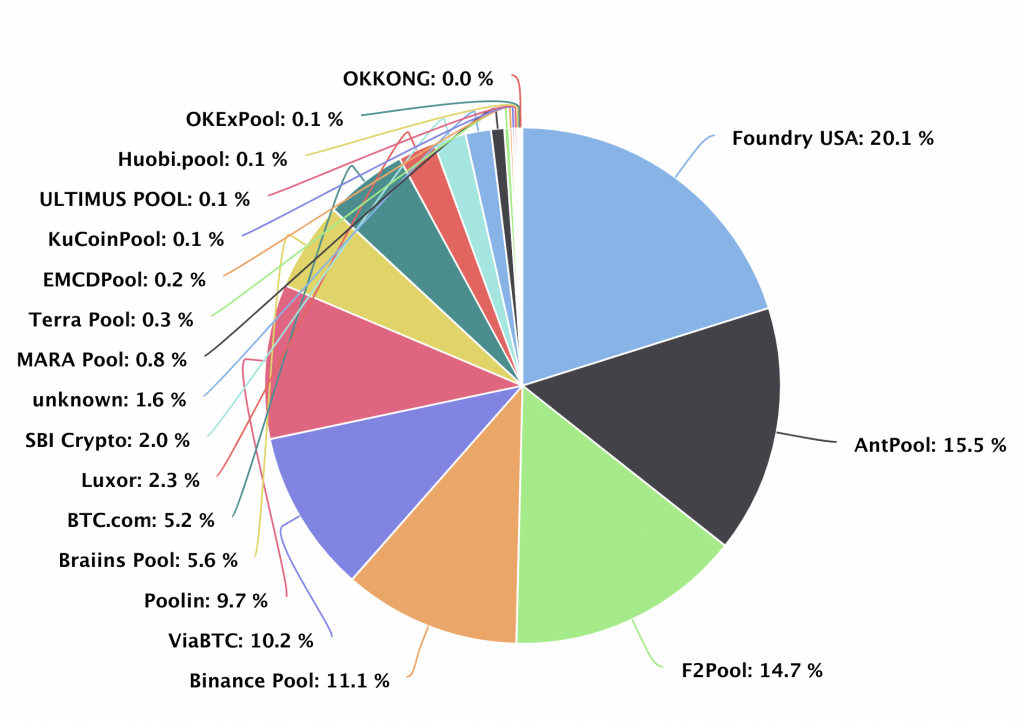

The PoW mechanism is known to have very good security and is the most decentralized among other consensus mechanisms. It is because, to be able to hack blockchain, the hacker must control 51% of the total hashing power. This is very difficult because of the computing power needed to control such an extensive network. However, on the one hand, PoW requires a massive amount of energy, so many consider this mechanism not environmentally friendly.

The following article explains the more environmentally friendly Proof-of-Stake (PoS) consensus mechanism.

Bitcoin Mining Process

The Bitcoin mining process starts when a transaction that needs to be validated occurs. As mentioned earlier, the validation process will generate a new block that goes into the Bitcoin blockchain. When each new block is mined, a new hash sequence will appear, ofter referred to as the target hash.

To guess the hash target, miners must have an ASIC device that will perform the computation process and generate a row of numbers according to the hash target. Next, the miners will compete to be the first to get the correct or at least the closest to the sequence of numbers on the target hash.

Unfortunately, guessing the hash is not an easy matter. Moreover, with the increasing number of miners participating in Bitcoin mining. It will lead to an increase in mining difficulty. Thus, miners need a sophisticated device such as ASIC with a high “hash rate”. Because the higher the hash rate, the greater the chance of success in guessing the hash target.

Get to know more about the hash rate and its function in Bitcoin mining in this article.

When a miner successfully guesses the hash target and completes a new block of Bitcoin, they will immediately get a reward of 6.25 BTC Bitcoin. The price of Bitcoin is 19,350 US dollars at the time this article was written, so the reward is 120,938 US dollars (6.25 x 19,350) or around 1.88 billion rupiah. With these astounding numbers, it is not surprising that many people try their luck by mining a Bitcoin.

With the halving system, the reward from Bitcoin mining will be reduced in half every four years. When Bitcoin was first launched in 2009, the reward for mining Bitcoin was 50 BTC. Then, after the first halving in 2012, the incentive was cut to 25. Then in 2016, it was 12.5, and in 2020 it was reduced to 6.25. On the upcoming halving in 2024, the reward for mining Bitcoin will be 3,125. This halving process will continue until 2140, or until all 21 million coins in the Bitcoin supply have been issued.

Watch the following video to find out more about the Bitcoin mining and halving process:

Then, what happens if all Bitcoins are already in circulation? Read the explanation in the article “What Happens When Bitcoin Runs Out?”.

What Happens When All 21 Million Bitcoin are Mined?

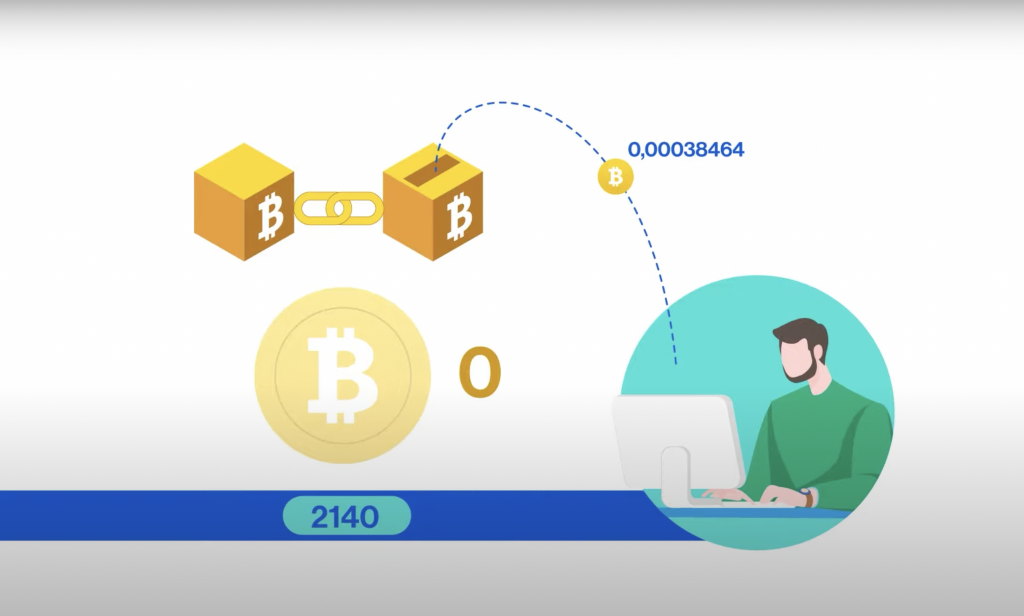

As we all know, Bitcoin is designed on the principle of controlled supply, with a maximum of 21 million coins that can be mined and circulated on the market. With that in mind, this Bitcoin mining process will continue more or less until 2140 or until all 21 million coins are in circulation. So, what would happen then when all Bitcoins are mined in 2140?

Satoshi Nakamoto predicted this and wrote in the Bitcoin Whitepaper that once a predetermined number of coins have been issued, the incentive can switch to transaction fees.

There are two kinds of rewards from the Bitcoin mining process. First, the transaction fees that are paid by Bitcoin owners who make transactions and have their transactions validated by the miners. Second, new Bitcoins to reward miners for validating the transactions. It means after the 64th halving day in 2140 when all the Bitcoin supply is already in circulation, there will be no more rewards in the form of new Bitcoins.

In the end, the role of miners is only limited to being a transaction validator. Thus, the rewards will only be in the form of transaction fees paid by the Bitcoin owners who make transactions.

So, is mining Bitcoin still profitable? This is quite difficult to answer, especially since 2140 is still so far away that it is impossible to predict what developments will take in the future. But, one thing is for sure, we know that when the price of Bitcoin goes up, transaction fees also go up.

Preparation for Crypto Mining

Before begin mining, there are several things that miners must prepare.

1. Preparing the Hardware

In the early stages of crypto asset development, you can use a standard laptop or PC device to do mining. However, with the development of the crypto assets ecosystem and the blockchain network, miners can no longer use common computer devices. Currently, to mine Bitcoin and other crypto assets, you must have at least an Application-Specific Integrated Circuit (ASIC).

ASIC is a superior tool for crypto mining because it can generate more than one trillion random codes per second, i.e., an exponentially higher number of guesses than any standard laptop or PC can make every second. Thus, using ASICs will increase the chances of guessing the correct target hash.

Unfortunately, an ASIC device costs a lot. Based on ASIC Miner Value, the most profitable ASIC device, the Antminer KA3, is sold at 12,000 US dollars. So, for those who want to do Bitcoin mining, get ready to spend a lot of money.

2. Preparing the Energy Source

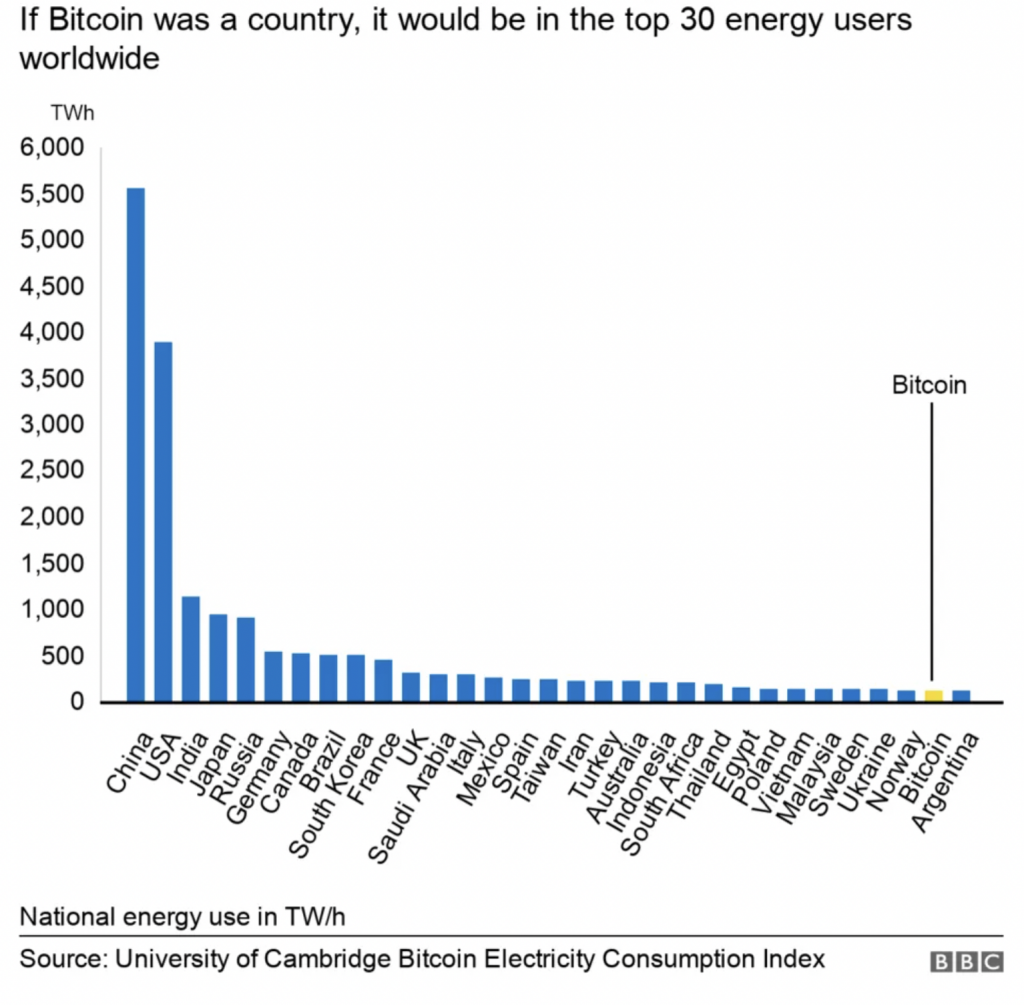

In addition to expensive ASIC devices, Bitcoin mining activities also require a large amount of electrical power, as ASIC device requires a lot of computing power. Not to mention that the devices need to operate all the time to mine Bitcoin.

For example, the monthly electricity cost for one Antminer KA3 device is at least US$272. To increase the chances of successful Bitcoin mining, more ASIC devices are needed. This means that the monthly electricity bill will also increase.

Therefore, many miners or mining pools are located in countries with relatively cheap electricity costs. This is done to reduce Bitcoin mining operational costs. Renewable energy sources such as solar energy are also carried out. This is also an effort to make Bitcoin mining activities more environmentally friendly.

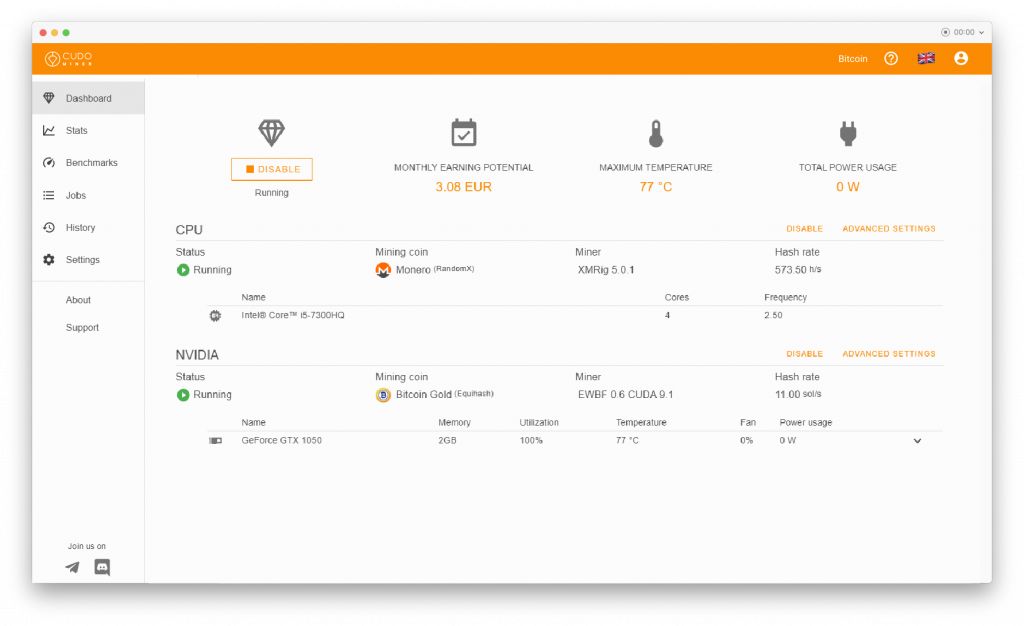

3. Choosing the Software

After setting up the hardware device, the next step is to prepare the software that allows you to mine. This software’s primary function is to connect your devices with the blockchain network. This way, it can help you track and control the devices. This software also help to collect the results and then distribute it throughout the Bitcoin network.

Each software has its characteristics, advantages, and disadvantages. This makes the selection of mining software should be based on the needs of each user. For example, there is software that is suitable for beginners because of its user-friendly appearance. Still, there is also one that displays various features, so it is ideal for those who are experts.

Unlike hardware devices that need a large amount of money, you can get mining software for free. However, Do Your Own Research (DYOR) before choosing a software tool for Bitcoin mining. Here are lists of popular mining software commonly used: CGMiner, ECOS, EasyMiner, Kryptex Miner, Awesome Miner, Pionex, BFGminer, Multi Miner, and so on.

How To Mine Bitcoin

In Bitcoin mining and other crypto assets, there are various methods that you can choose, namely:

1. Solo Mining

As the name implies, if you do mining individually, then it is called solo mining. In other words, you must buy the ASIC devices, join the blockchain network, using the necessary software, and try mining Bitcoin by yourself.

With the current state of the crypto asset ecosystem, the solo mining method is almost impossible. Moreover, the current difficulty level of Bitcoin or the chance of being a winner in guessing the hash is one in 10 trillion. Even with a superior ASIC device, the chances of successfully doing solo mining methods are very small.

2. Pooled Mining

If solo mining proves challenging, you can team up with other miners to increase your chances of success. This is what mining pools offer. A mining pool is a large group of miners who combine their computational power to increase the possibility of completing new blocks.

So, when one of the pool mining members completes a new block, the reward will be distributed to all members. However, the number of rewards will be adjusted to each member’s hash power contribution. A good mining pool will make your Bitcoin mining more profitable, even though the ASIC device you have is not the best one.

The results of mining pools are relatively smaller than solo mining. Even so, mining pools can be much more profitable. Because the possibility of completing a new block is greater than solo mining. In addition, pool mining also offers a more consistent chance of winning than solo mining.

3. Cloud Mining

Cloud mining is a method of mining by renting high computing power from cloud mining companies. With cloud mining, you don’t need to buy expensive ASIC devices and pay a monthly electricity bill.

Cloud mining companies will charge you monthly or yearly fees so you can borrow their device. Later, the mining company will do the mining, and you only need to sit back. Those rewards will be directly distributed to the users if they complete a new block.

💡 The higher the rental fee, the higher the power hash you can rent. Thus, the more significant the part of the rewards you will get later.

This mining model does sound too good to be true. However, some companies are doing scams on behalf of the cloud mining platform. Thus, make sure to do some research about the fees, company background, and other vital details. Genesis and Bit Deer are some of the largest cloud mining services for retail consumers.

Does Bitcoin Mining Still Profitable?

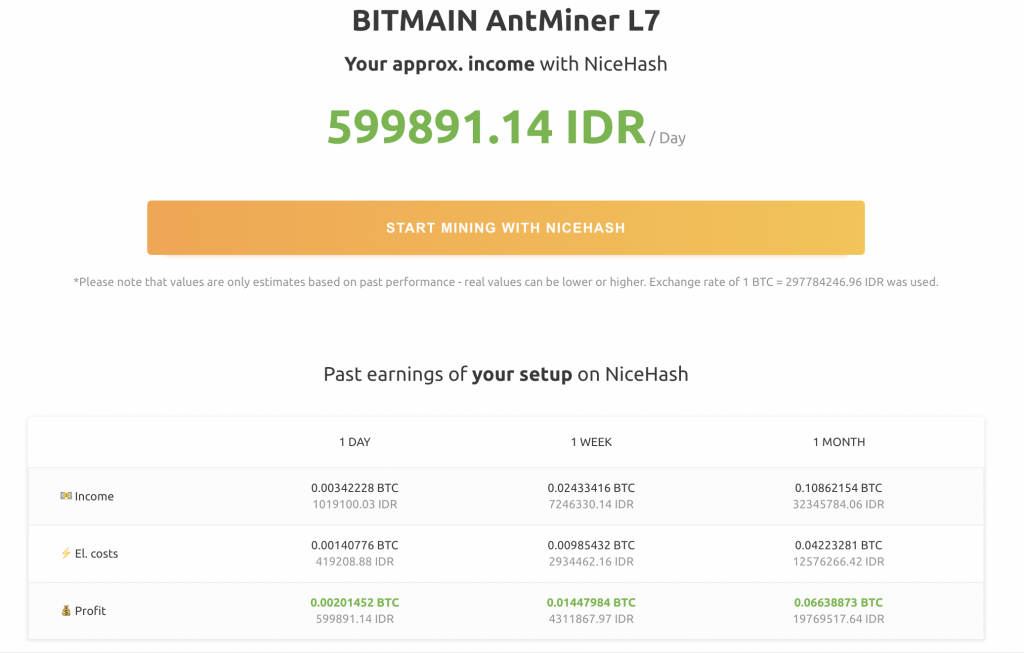

With the big amount of money required to buy ASIC devices and pay electricity bills, and the intense competition with other miners, does Bitcoin mining still profitable? Profitability calculators, such as Nicehash, can help aspiring miners determine whether mining Bitcoin is profitable or not.

For example, a miner uses three units of AntMiner L7 as the ASIC devices. Then, the electricity bill for a power limit of 6,600 VA is 1,700 rupiah per kWh. Based on Nicehash’s calculations, miners can earn a daily profit of around 599.891 rupiahs. This figure uses the Bitcoin price of 19,156 US dollars as an assumption.

But, the initial capital required to own one unit of AntMiner L7 is US$15,000 or around Rp233 million. Thus, you must have Rp700 million to have three units of AntMiner L7**. Assuming the daily profit is Rp600,000, at least miners will need 1,167 days or about three years to get the break-even point.**

Keep in mind that miners’ profit is very influenced by the movement of the Bitcoin price itself. When the crypto market is in a bearish trend, miners’ profitability may decline. Because the electricity bill will remain while the Bitcoin exchange rate has fallen. Not to mention, there is no guarantee that you are part of a winning group in the mining competition every day.

As crypto assets have high volatility, it is pretty tricky to calculate how much profit miners can get from Bitcoin mining. Given the high uncertainty, expensive equipment, and high electricity costs in Bitcoin mining. As a result, there is no guarantee that the miners will be able to get their return on investment quickly.

If you want to learn more about mining difficulty, don’t forget to read the following article.

Other Crypto Assets Can Be Mined

Currently, Bitcoin is the most popular crypto asset to mine. However, with the current level of difficulty and tight competition, some miners are looking for other crypto assets to mine. Back then, Ethereum is also a popular crypto asset with PoW mechanism. But, recently, Ethereum has switched from a PoW to a proof-of-stake (PoS) mechanism. As a result, ETH can no longer be mined.

Some small tokens -which tend to be less competitive with other miners – can be an option. But, these small tokens are more volatile, so the profits are more difficult to estimate. In addition, the profits from small token mining are much smaller than Bitcoin mining.

Based on WhatToMine, it is mentioned that some small tokens can provide a gain of 2-3 US dollars per day. If you look at this number, maybe it’s not much, but at least you can get tokens for “free.” Not to mention, there is a possibility that the value of these tokens will increase in the future. Mining small tokens also do not need a very sophisticated computer device.

For those of you who want to choose tokens to mine, you should consider the following factors:

- The number of crypto exchanges that trade the crypto asset

- Ensuring the legitimacy and quality of the crypto assets to be mined

- Evaluating the long-term durability of mining equipment

- Possibility of withdrawing these crypto assets in fiat currency

💡 Apart from Bitcoin, some other popular crypto assets that can be mined are LiteCoin (LTC), Ethereum Classic (ETC), Dogecoin (DOGE), Bitcoin Cash (BCH), Dash (DASH), Kadena (KDA), ZCash (ZEC).

Start Your Crypto Investment at Pintu

Mining is indeed one of the options for obtaining crypto assets. However, buying crypto assets directly through crypto exchanges like Pintu is an easier way to accumulating crypto assets. Through Pintu, you can invest in various crypto assets such as BTC, BNB, ETH, and others safely and easily.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download the Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Besides making transactions, in the Pintu Apps, you can also learn more about crypto through various Pintu Academy articles that are updated weekly! All Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

Reference

Euny Hong, How Does Bitcoin Mining Work? Investopedia, accessed on 21 October 2022.

Bybit Learn. What Is Crypto Mining and How Does It Work? Bybit, accessed on 21 October 2022.

Andrey Sergeenkov. How to Set Up a Bitcoin Miner. Coindesk, accessed on 21 October 2022.

Cristina Criddle. Bitcoin consumes ‘more electricity than Argentina’. BBC, accessed on 21 October 2022.

Michael Kurko. Best Bitcoin Mining Software. Investopedia, accessed on 21 October 2022.

Coin Telegraph. How to mine Bitcoin: A beginner’s guide to mine BTC. Coin Telegraph, accessed on 21 October 2022