On May 3, the Federal Reserve increased interest rates by 25 basis points. The United States also reported its lowest labor force participation rate since May 2021. Meanwhile, the cryptocurrency market is still maintaining its position above the 100-week Exponential Moving Average (EMA), and must breach its support level to sustain and prolong the positive trend. Read the comprehensive market analysis below.

The Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

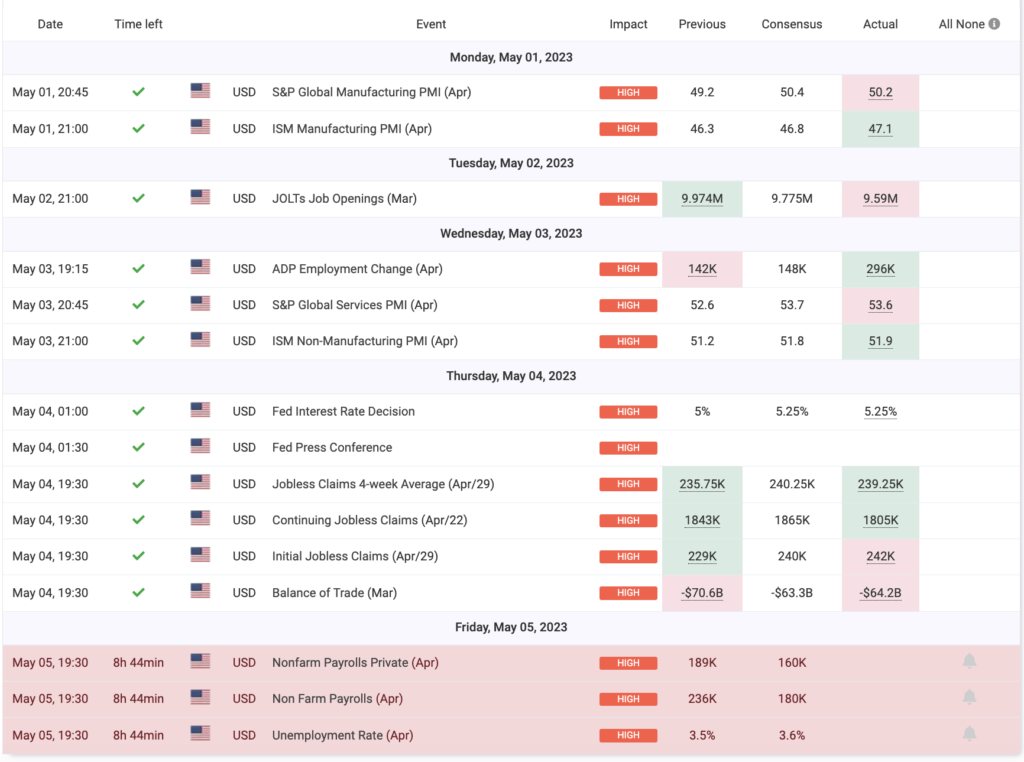

- The Purchasing Manager Index (PMI) for manufacturing and services in the US and globally increased, indicating growth in these sectors, while the US job openings rate reached its lowest point since May 2021.

- Wage growth slowed down in April, but the Federal Reserve still raised the policy interest rate by 25 bps at the Federal Open Market Committee (FOMC) meeting on May 3. Additionally, a recession is predicted to occur this year.

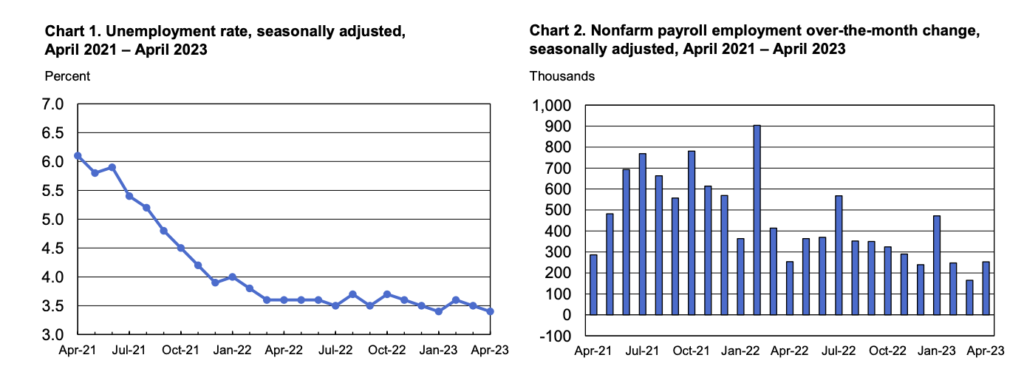

- US employment data showed that initial unemployment claims rose, continuing claims decreased, and Non-Farm Payroll in the US increased in April.

- The crypto market exhibited stability with Bitcoin (BTC) and Ethereum (ETH) holding above the 100-week Exponential Moving Average (EMA), and BTC dominance remaining above the historical support level of 48%.

Macroeconomic Analysis

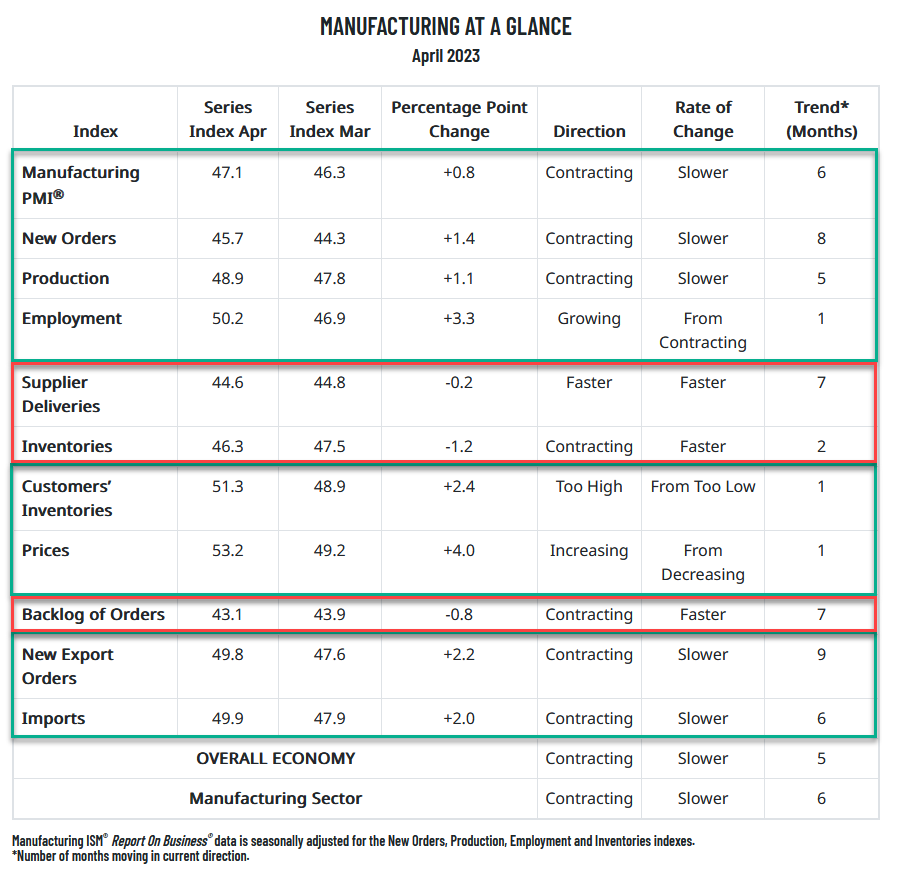

The latest report released by the Institute of Supply Management (ISM) indicates that the ISM Manufacturing PMI rose to 47.1 in April compared to 46.3 in March and a consensus of 46.8. This suggests that the manufacturing sector continued to face contraction in economic activity in April, affirming a sixth consecutive month of decline following a growth period of 28 months. It is important to note that the current PMI value is below 50, indicating contraction.

Similar to the manufacturing PMI data, the S&P Global Manufacturing PMI also increased, reaching 50.2 compared to the previous month’s consensus of 49.2 and 50.4. This rise marks the first time in six months that manufacturing has experienced growth. This growth occurred despite the fact that factories still reported customers’ hesitancy to place orders due to ongoing economic uncertainty and the shadow of rising prices.

In addition to economic uncertainty and rising prices, revisiting the ISM data reveals that the current PMI figure is below 48.7%, which, if sustained over a prolonged period, could indicate an economic recession. However, the ISM observes that 73% of the manufacturing gross domestic product contracted in April, a higher figure than March’s 70%. The ISM also acknowledges that only a few industries experienced significant declines.

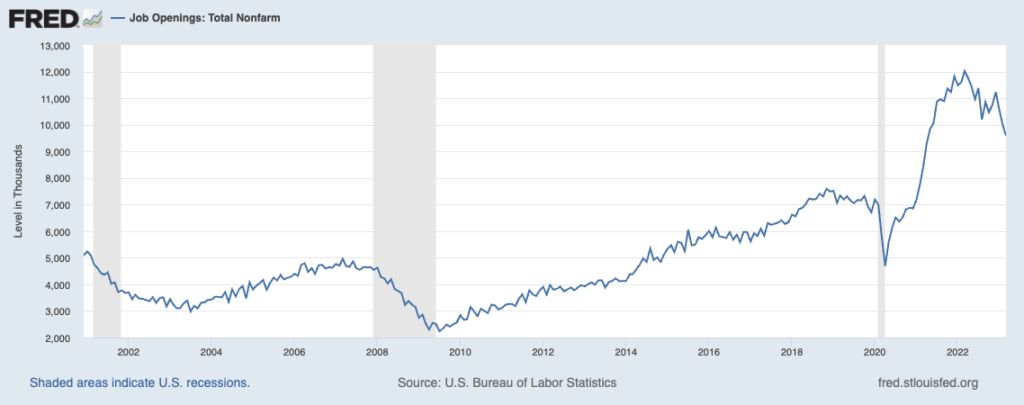

Shifting to the job openings data, the United States experienced the lowest level of job openings in March since May 2021, indicating that the labor market balance has gradually recovered following the Fed’s year-long effort to cool the economy. According to the Bureau of Labor Statistics (BLS), there has been a consecutive three-month decline in job availability in the United States, with job openings in March amounting to 9.59 million, down from the revised figure of 9.974 million in the previous month. The Refinitiv consensus estimate anticipated 9.775 million job openings, but the actual number was lower. Returning to the BLS data, in March, the job openings-to-unemployed individuals ratio decreased to 1.65. This indicates that labor demand is stabilizing, and the labor market is returning to normalcy.

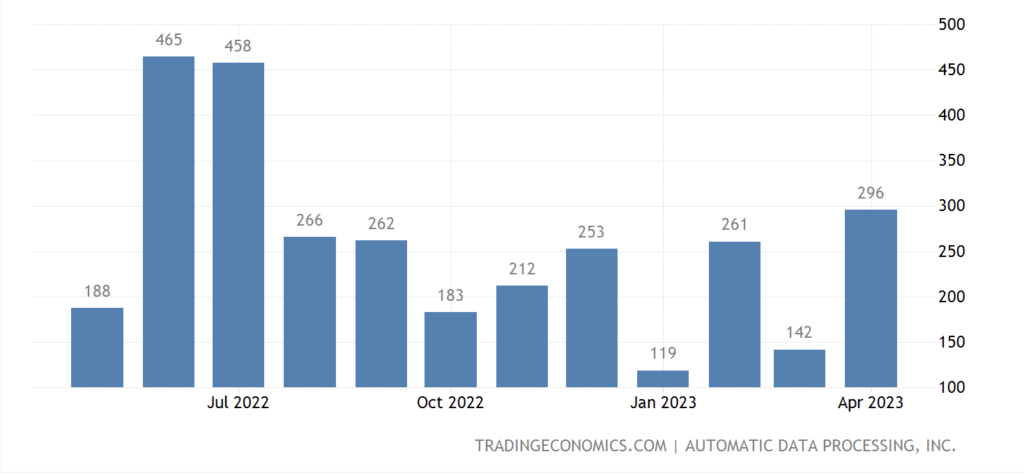

The stabilization of labor demand is consistent with the ADP National Employment Report, which showed a growth of 296,000 private-sector jobs in April. However, this growth is not aligned with wage increases. According to the same data, the annual wage increase was 6.7% compared to the previous year. In fact, the data shows that wage growth slowed rapidly in April, meaning that wage growth is continuing a slowdown that has been ongoing for nearly a year. The decline in workers switching jobs was particularly dramatic, with wage growth slowing from 14.2% to 13.2%, marking the slowest growth rate since November 2021.

“The slowdown in pay growth gives the clearest signal of what’s going on in the labor market right now,” said Nela Richardson, Chief Economist, ADP. “Employers are hiring aggressively while holding pay gains in check as workers come off the sidelines. Our data also shows fewer people are switching jobs.”

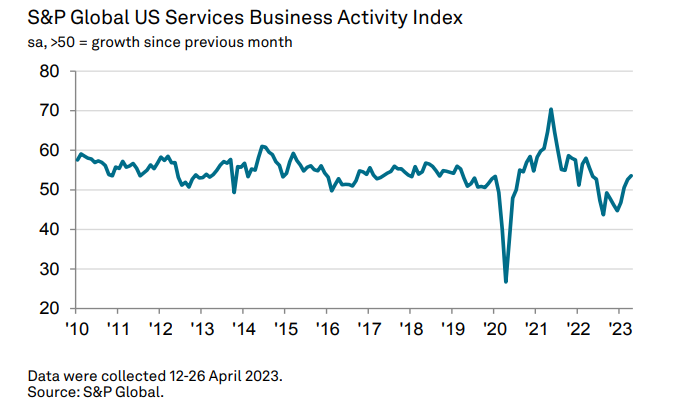

Delving deeper into the data from the S&P Global US Services Purchasing Managers’ Index (PMI) for April, a reading of 53.6 was recorded compared to the previous figure of 52.5 and consensus estimate of 53.7. This suggests that growth in the service sector demonstrated a positive trend in April, along with the potential for a rebound in the manufacturing sector. This serves as a positive indicator for the economy to gain momentum at the beginning of the second quarter.

This positive trend seemingly increased the confidence of companies compared to the previous year, as post-pandemic spending shifted from goods to service-sector businesses, particularly among consumers. However, it is essential to be cautious, as increased demand in the service sector may cause inflationary pressure, especially with service rates having risen sharply over the past eight months, indicating ongoing core inflation issues. Consequently, there are concerns about whether this demand can be sustained, depending on factors such as higher interest rates, increased living costs, and reduced household savings, which may again impede growth in the coming months.

In the previous month, the ISM non-manufacturing PMI increased to 51.9 from 51.2 in March, surpassing the consensus estimate of 51.8, indicating growth in the service sector, which encompasses more than two-thirds of the economy. An increase in figures above 50 signifies expansion. In addition, the US service industry experienced stable growth with a rise in new orders and growing exports. However, companies continued to face increasing input costs, signaling that inflation is likely to persist. Despite the potential economic obstacles due to higher interest rates, a survey from the Institute for Supply Management (ISM) on Wednesday revealed substantial optimism in the service business sector. It is then predicted that a recession may occur this year, albeit milder and shorter in duration.

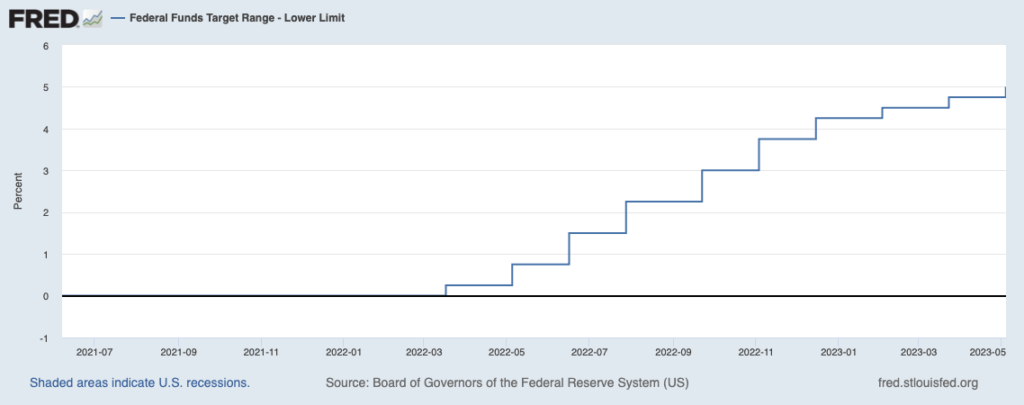

In an effort to mitigate the recession, The Fed once again raised its policy interest rate by 25 basis points at the FOMC meeting on May 3. Many believe that this interest rate hike might be the last in the current cycle, based on several reasons:

- The policy interest rate has finally reached a level consistent with the guidelines provided by The Fed. The 25 basis point increase at the May FOMC meeting resulted in the current policy interest rate range of 5.00-5.25%, aligning with the median “dot plot” for 2023 in the FOMC’s most recent Summary of Economic Projections.

- Pressure on the banking system has prompted tighter financial conditions. Consequently, stricter bank lending standards have the potential to reduce the need for further policy interest rate increases.

- Current macroeconomic indicators and data signify a deceleration in the pace of economic expansion and more moderate inflation. Although price pressures have not subsided sufficiently for interest rate reductions, it appears inappropriate to continue raising interest rates at the current level.

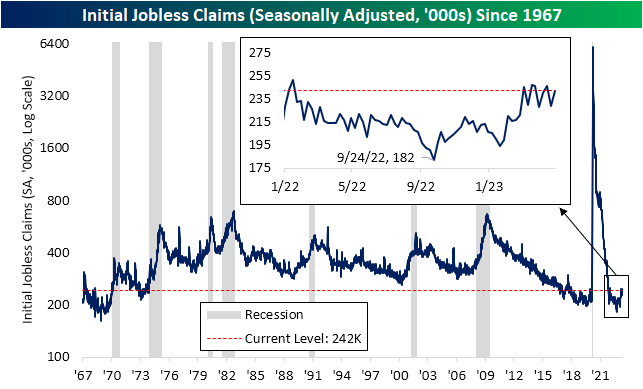

Last week, the number of individuals in the United States filing new claims for unemployment benefits increased, reflecting a gradual slowdown in the labor market due to higher interest rates, which reduced demand in the economy. Initial state-level unemployment claims rose by 13,000 to a seasonally adjusted 242,000 for the week ending April 29, compared to 229,000 in the previous month and a consensus of 240,000.

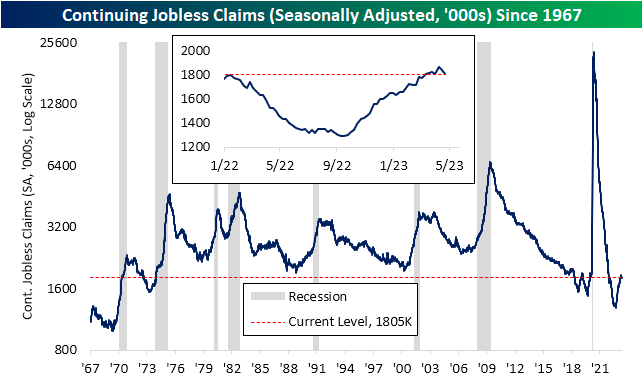

In contrast to the increased new unemployment claims, the number of continuing claims declined to 1.805 million, a decrease of 38,000 individuals receiving benefits after the first week of assistance. This reduction represents the largest decline in continuing claims since the previous July, indicating that a portion of workers who recently lost their jobs swiftly found new employment.

In April, the U.S. Non-Farm Payroll increased by 253,000, exceeding the 180,000 estimate projected by economists, signifying a better-than-expected performance. This demonstrates that the Federal Reserve’s interest rate hikes did not decelerate the labor market as much as the Fed had anticipated.

Here is the economic calendar for the month of May:

BTC & ETH Price Analysis

BTC has successfully maintained its position above the 100-week Exponential Moving Average (EMA) as support for seven consecutive weeks. This marks the second week BTC remains above the 0.236 Fibonacci retracement line. BTC’s strength in sustaining its position above the 100-week EMA for multiple periods indicates solid support for its future movement toward the 200-week Moving Average (MA) at 26,000. It is crucial to underline whether BTC can breach and establish support at the psychological price point of 30,000.

Not far behind BTC, ETH has also held its position above the 100-week EMA but for the fourth week and has formed a strong support line. Resistance can be observed at the 0.382 retracement line at the price point of 1,917. Support at the 200-week MA, which coincides with the 0.236 Fibonacci retracement line, is at the psychological price of 1,500.

BTC dominance remains above its historical support of 48.5%, although a slight decline is still visible this week.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling more holdings compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days were lower than the average. They have a motive to hold their coins. Investors are in an anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦Derivatives: Long position traders are dominant and are willing to pay to short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Optimism employs Ethereum attestation service to boost user trust. Optimism, an Ethereum-based layer 2 solution, is reported to be utilizing the Ethereum Attestation Service (EAS), an on-chain attestation protocol that allows users to assess the reliability of platform users and verify whether an event actually occurred on the blockchain. This implementation could promote a fairer distribution of OP tokens and community voting systems within Optimism.

- Polkadot’s KILT Protocol partners with Deloitte to enhance identity protocol. Polkadot announced a collaboration with Deloitte, the world’s largest accounting firm, which will use Polkadot’s KILT Protocol parachain to improve its identity protocol. Deloitte will leverage KILT’s reusable digital identity credentials to support Know Your Customer / Know Your Business (KYC / KYB) processes.

News from the Crypto World in the Past Week

- Bhutan plans to allocate $500 million for crypto mining in the Himalayas. Bhutan’s investment department, a small South Asian country with a population of 770,000, plans to seek investors alongside Bitdeer to raise $500 million with the goal of harnessing Bhutan’s hydroelectric power for carbon-neutral Bitcoin mining.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Rocket Pool (RPL) +4,30%

- Stacks (STX) +4,00%

- WOO Network (WOO) +3,09%

- Pax Gold (PAXG) +1,77%

Cryptocurrencies With the Worst Performance

- Pancake Swap (CAKE) -25,65%

- Immutable X (IMX) -18,49%

- Optimism (OP) -15,82%

- Lido DAO (LDO) -14,77%

References

- Polkadot, Deloitte partners with Polkadot’s KILT Protocol to to enhance its identity protocol, Twitter, accessed 8 May 2023.

- Elizabeth Napolitano, Layer 2 Network Optimism to Use Ethereum Attestation Service to Promote User Trust, Coindesk.com, accessed 8 May 2023.

- Sidharta Shukla, Bhutan Plans a $500 Million Fund for Crypto Mining in the Himalayas, Bloomberg.com, accessed 8 May 2023.