Cryptocurrencies have been gaining popularity in recent years, but many people still only see them as a new asset class. While it is true that cryptocurrencies can be used to make profits, they have the potential to be much more than that. The view of cryptocurrencies as speculative also creates a negative image of the industry among the general public. In this article, we will explore some of the potential of cryptocurrencies as a global asset.

Article Summary

- ⚖️ Cryptocurrencies were originally created as an alternative means of payment that did not utilize a third party. In the early days of Bitcoin, this was the sole function of cryptocurrencies.

- ⚙️ Today cryptocurrencies have many uses ranging from investment instruments to alternative money. They have the potential to disrupt the financial industry and provide solutions to many of the problems that exist in the current financial system.

- 🛡️ In some cases, cryptocurrencies like Bitcoin are considered as a hedge against inflation, especially in countries with unstable currencies and deteriorating economies.

- 💸 Cryptocurrencies also allow for faster and cheaper cross-border payments and transactions compared to traditional methods such as bank transfers.

- 🏠 One potential trend in the crypto industry is the process of ‘tokenization’, which allows physical assets such as real estate or art to be converted into tradable tokens and recorded on the blockchain.

Cryptocurrency as a Global Asset

Cryptocurrencies are decentralized assets that are fully digital and secured using cryptography. The creator of Bitcoin, Satoshi Nakamoto, had a vision of creating a digital currency that could be used as an alternative to fiat currency. The initial purpose of crypto is as a trustless, decentralized payment system.

Bitcoin was widely utilized as a means of payment in the early era around 2009 to 2015. In this time period, Bitcoin was a digital currency that emphasized privacy and anonymity. Many platforms such as NewEgg and Microsoft provide payment options using BTC.

You can also read the Pintu Academy article Bitcoin Development History.

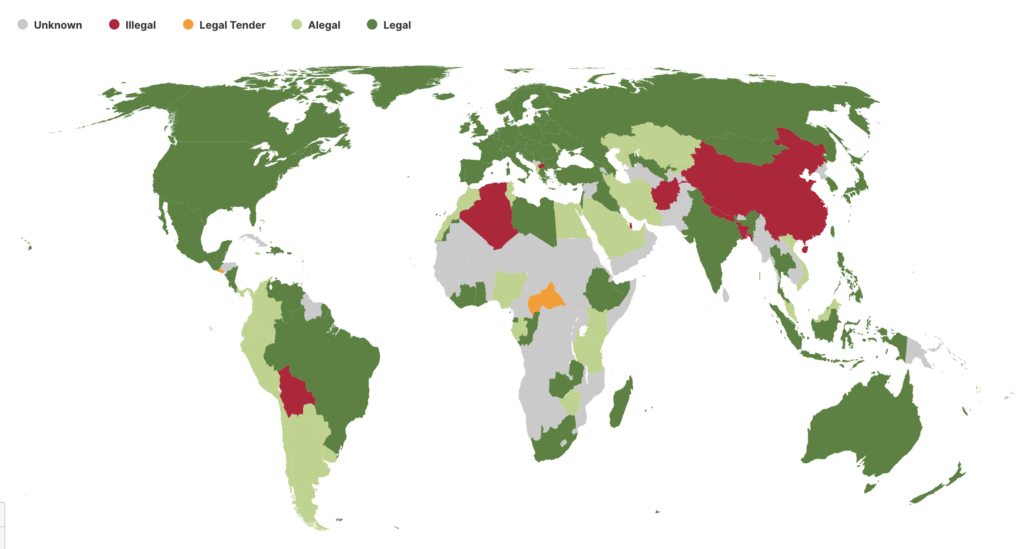

In recent years, views on Bitcoin and the cryptocurrency industry have been very wide-ranging. Investment firms see the cryptocurrency industry as a new asset class. Meanwhile, the development of BTC as a global alternative currency has also been on the rise. El Salvador declares BTC as legal tender in 2021. Various stablecoins also add to the utility of cryptocurrencies as a global means of payment.

“The last 6 to 9 months we’ve had a huge number amount of different institutions and financial managers talking about the fact that crypto assets, especially BTC and ETH, are becoming extremely important parts of a diversified asset pick”

Danielle Szetho, Head of Digital Asset Portfolio & Governance Standard Chartered

Currently, the cryptocurrency industry has many potential uses but none that can attract mass adoption. Despite this, Bitcoin and other cryptocurrencies are starting to gain attention as global assets. The digital and borderless nature of cryptocurrencies creates many use cases that fiat currencies lack.

The Unique Use Cases of Cryptocurrencies in Developing Countries

In many developing countries, cryptocurrencies have a fairly unique function as an asset to hedge against inflation. This is especially true in countries with high rates of inflation and devaluation of national currencies such as Turkey, Egypt, and Argentina. Argentina and Venezuela are even experiencing inflation above 100%. These inflation rates encourage people to utilize crypto such as BTC and stablecoins to maintain the value of their assets.

In the case of Argentina, the country also has a pro-Bitcoin presidential candidate, Javier Milei. Javier Milei just won in the first stage of elections (primaries) in Argentina and the next stage will be determined in October 2023. If Javier wins, this could have a huge influence on Argentina’s crypto policy.

Read also: Why Asia Could Become the Center of the World’s Crypto Industry.

In developing countries, more and more people are looking at cryptocurrencies as a way to escape the country’s poor economic conditions. In the 2022 crypto adoption list, 17 of the 20 countries with the highest crypto adoption fall into the developing countries category. People from these countries also consider crypto an attractive investment asset amid economic conditions where job opportunities are hard to come by.

Cryptocurrency Disruption to Traditional Financial Sector

1. Remittance Sector

The remittance sector is experiencing surprisingly high adoption of cryptocurrencies, especially in developing countries. The use of cryptocurrencies as remittance is prevalent in countries such as Nigeria, the Philippines, and Mexico.

Bitso, one of the largest cryptocurrency exchanges in Mexico, explains that Bitso processes approximately $3.3 billion dollars of remittances from the US to Mexico by 2022. Companies like Coinbase have also opened asset withdrawal services in Mexico to tap into the remittance market.

In addition to Mexico, African countries such as Nigeria, South Africa, and Kenya are also beginning to utilize crypto-based remittance withdrawals. Bitpesa, Paxful, and LocalBitcoins are some of the platforms used for remittance transactions by many people. Crypto is seen as preferable to send remittances because of its fast settlement and cheap transaction cost. This strengthens the idea that crypto is a global asset.

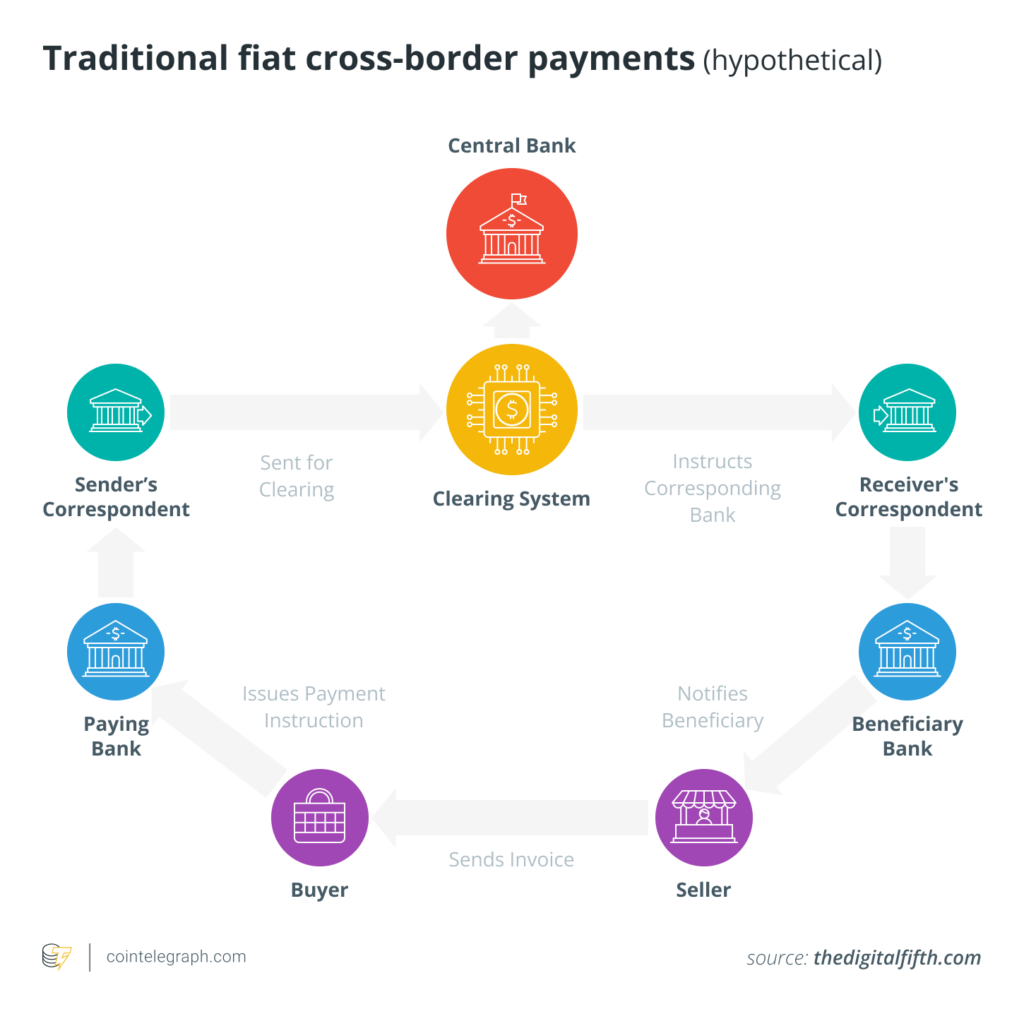

2. Cryptocurrency for Cross-Border Payment

Blockchain technology and cryptocurrencies as payment have great potential. Cryptocurrency is ideal for cross-border transactions because it does not need to go through complicated administrative processes and has no additional fees. Crypto transactions do not require cooperation between countries and banks, do not need to go through the conversion process, and have the same transaction fees all across the globe.

Transnational payments using cryptocurrencies can be completed quickly in minutes. In addition, transaction data can also be checked immediately because users can see it on the blockchain. The transaction fees paid by users can also be reduced and become very cheap (using blockchains with small gas fees such as L2 or Solana).

Currently, several large companies are already utilizing cryptocurrency payments. One of the largest credit card companies in the world, Visa, started processing payments using USDC on Ethereum in 2021. Visa also recently opened USDC payments on the Solana blockchain which is known to be faster and cheaper than Ethereum.

Besides Visa, another massive payment company that has started using cryptocurrencies is PayPal. Instead of just opening up payments through cryptocurrencies like Visa, PayPal went ahead and created its own stablecoin, PYUSD. PayPal’s PYUSD will be fully collateralized by the US Dollar and issued through Paxos Trust.

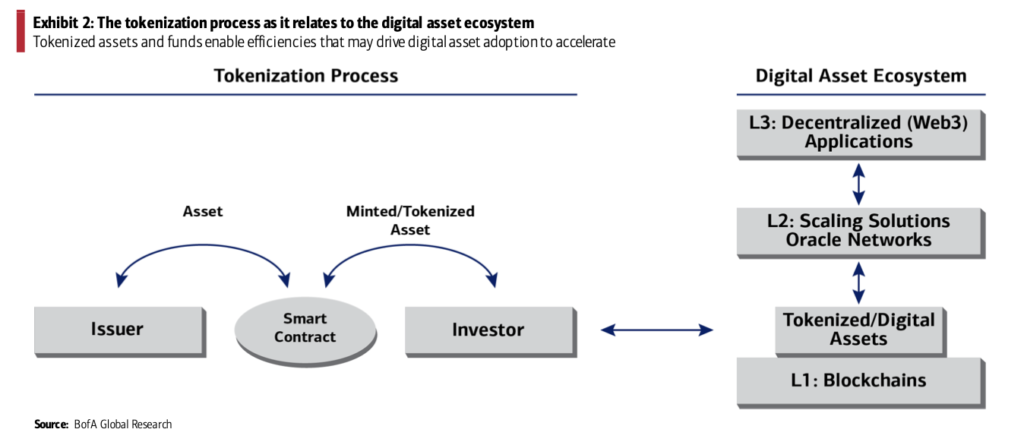

3. Tokenization of Physical Assets into Blockchain

The tokenization of physical assets (Real-World-Asset or RWA) onto the blockchain has been much talked about recently. RWA is a way of bringing real-world goods onto the blockchain ecosystem. Currently, RWA tokenization is mostly done on property, securities, and US government bonds. BlackRock CEO Larry Fink even explained that securities tokenization will be the future of the securities market.

Read also: What is Real-World-Asset (RWA) in the crypto industry?

RWA tokenization has great potential to be disruptive to the traditional financial sector. Tokenized physical assets will eliminate the role of third parties while making transactions transparent and faster. Moreover, RWA tokenization can open up many incentive schemes that utilize smart contract technology. RWA tokenization also opens up access to various businesses and assets that usually have complicated entry processes.

Professor Jason Potts of Australia’s RMIT University explains that blockchain technology and cryptocurrencies enable “programmable commerce”, creating a digital economic ecosystem that utilizes protocols and algorithms. RWA has the potential to realize a blockchain-based Web3 economy.

Currently, there are many projects and companies that utilize RWA tokenization. One of the largest crypto projects utilizing RWA tokenization is MakerDAO. The total value of RWA in MakerDAO’s portfolio reaches $2.3 billion DAI which consists of various types of assets ranging from ETF products, bonds, to real estate.

Conclusion

Cryptocurrency has far more potential than just being a new investment asset class. Originally created as an alternative means of payment, cryptocurrencies have evolved to offer solutions to a variety of financial problems, especially in developing countries struggling with inflation and currency devaluation. Moreover, cryptocurrencies have also played a role in disrupting traditional financial sectors, including remittances, cross-border payments, and tokenization of physical assets.

The industry has yet to achieve mass adoption, but its rapid development has attracted attention from investment firms in countries around the world. Its potential as an asset that is not restricted by geographical borders offers a range of uses that fiat currencies do not have, making it valuable not only as an investment instrument but also as an instrument that could redefine how the global economy operates.

How to Buy Cryptocurrency on the Pintu App

You can start investing in cryptocurrencies by buying them on the Pintu app. Here is how to buy crypto on Pintu:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for your favorite asset.

- Click buy and fill in the amount you want.

- Now you are a crypto investor!

In addition, the Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on the Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice

References

- “The 2022 Geography of Cryptocurrency Report”, Chainalysis, accessed on 4 September 2023.

- “A Look at Crypto Adoption in Latin America”, Bitfinex Blog, accessed on 4 September 2023.

- Tobias Adrian and Tommaso Mancini-Griffoli, “Technology Behind Crypto Can Also Improve Payments, Providing a Public Good”, IMF, accessed on 5 September 2023.

- Shailey Singh, “What are cross-border payments, and how do they work?”, Coin Telegraph, accessed on 5 September 2023.

- Justin Bannon, “The Trillion Dollar Crypto Opportunity: Real World Asset (RWA) Tokenization”, CoinDesk, accessed on 6 September 2023.

- Anutosh Banerjee and Ian De Bode, “Tokenization: A digital-asset déjà vu”, McKinsey, accessed on 6 September 2023.