The growth of the Injective Protocol ecosystem shows that this protocol has the potential to rival Ethereum as a home for DeFi apps. This growth is due to its scalability, reaching over 10,000 TPS. Recently, Injective Protocol has launched inEVM to enhance its interoperability, scalability, and accessibility. How far has the Injective Protocol ecosystem come? Check out the full review in the following article.

Article Summary

- 🔥 Injective Protocol solidifies its position in the DeFi sector as one of the most affordable L1 networks with its fantastic number of transactions and users.

- 🚀 Injective’s TVL also continues to grow where it currently stands at $92.13 million. At the start of 2023, the figure was only $8.76 million.

- 🏆 TVL Injective Protocol’s growth is attributed to its growing ecosystem. It’s filled with new and potential protocols such as DojoSwap, Hydro Protocol, and Mito.

- 👁️ Injective Protocol has just launched inEVM, a technology that combines the interoperability of Cosmos with the transaction speed of Solana and the ease of developer access of Ethereum.

About Injective Protocol

Injective Protocol is a blockchain created to build dApps, especially for financial products like cross-chain derivatives trading on Layer-1 networks such as Cosmos, Ethereum, and several other blockchains.

The blockchain uses a Tendermint-based consensus mechanism and utilizes the Cosmos-SDK. The main advantage of choosing this Tendermint consensus is that it makes Injective highly scalable (10,000+ TPS).

Injective Protocol offers the benefit of asset trading within its ecosystem without gas fees. Moreover, developers can effortlessly create a variety of dApps, including spot, perpetual, futures, and options, as Injective provides a comprehensive framework. This enables developers to concentrate on the development of their applications.

Learn more about Injective Protocol and how it works in the following article.

Injective Protocol Development

Ethereum is notorious for its scalability issues, but Injective offers a solution. Their impressive metrics showcase their ability to handle high transaction volume, a key factor driving user adoption.

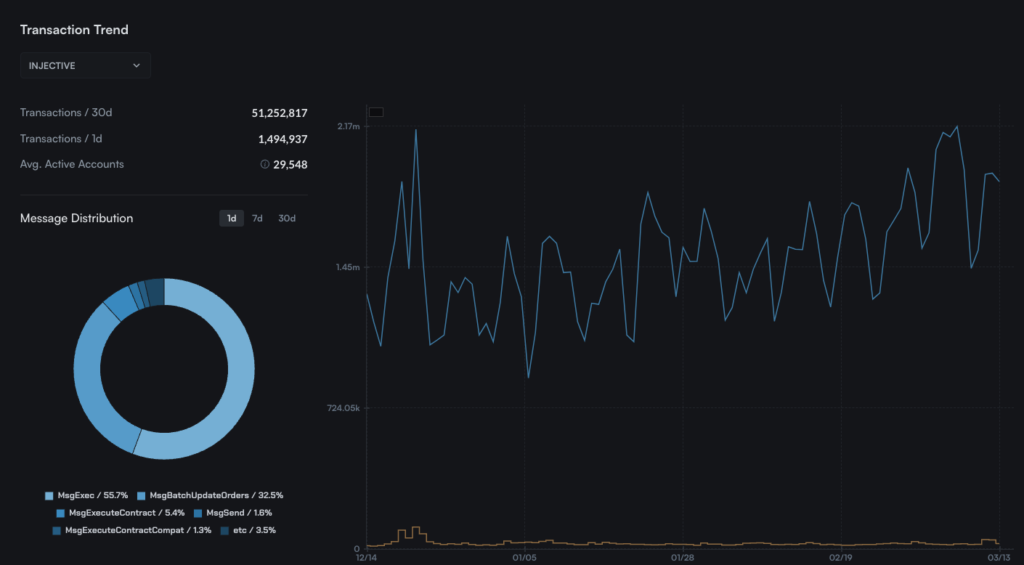

The Mintscan data above shows that Injective has recorded 51.25 million transactions in the last 30 days, with an average active account of 29,548. When compared to other L1 protocols, Injective also has superior performance.

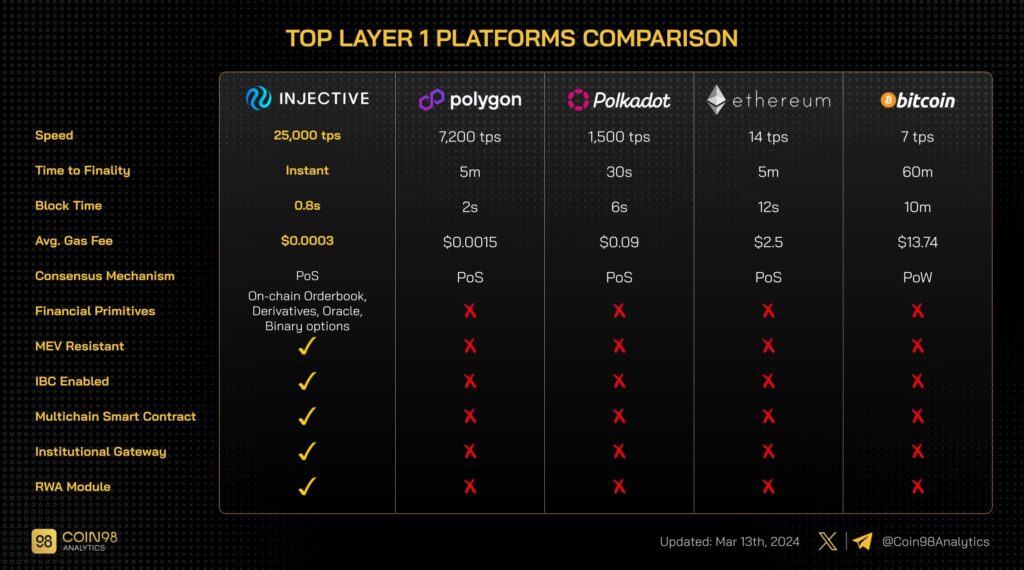

For example, Injective can process as many as 25,000 transactions per second. Then, the Injective recorded 0.8 seconds for block time with an average gas fee of only 0.0003$. Here is a comparison of Injective’s performance with other L1 protocols:

In addition, Injective’s Total Value Locked (TVL) and INJ’s token price witnessed significant growth. At the start of 2023, Injective’s TVL was only $8.76 million, and INJ’s worth was $1.8. However, when this article was written, its TVL had grown to $92.13 million, with INJ prices at $48.3.

Injective EVM (inEVM) Launch

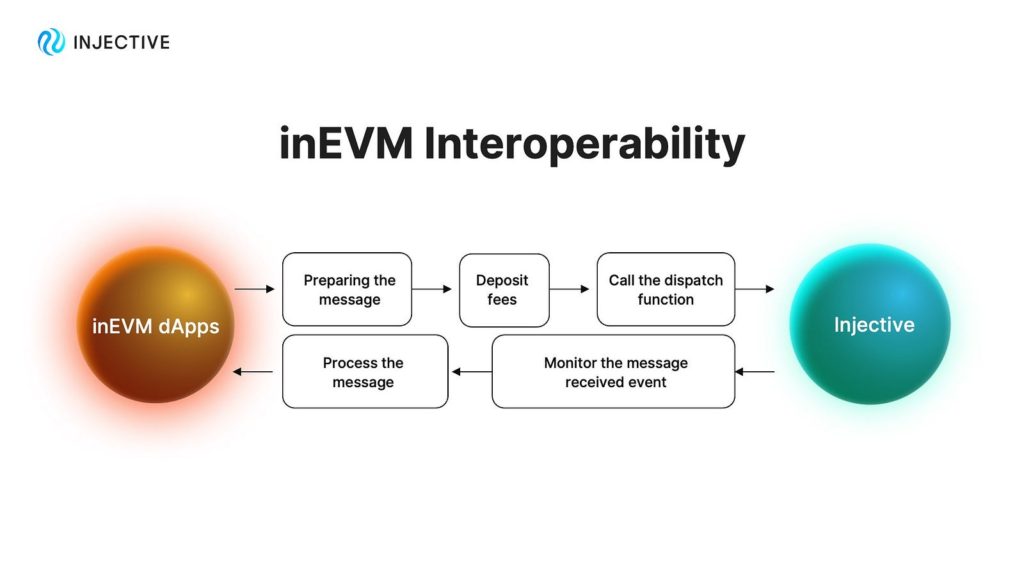

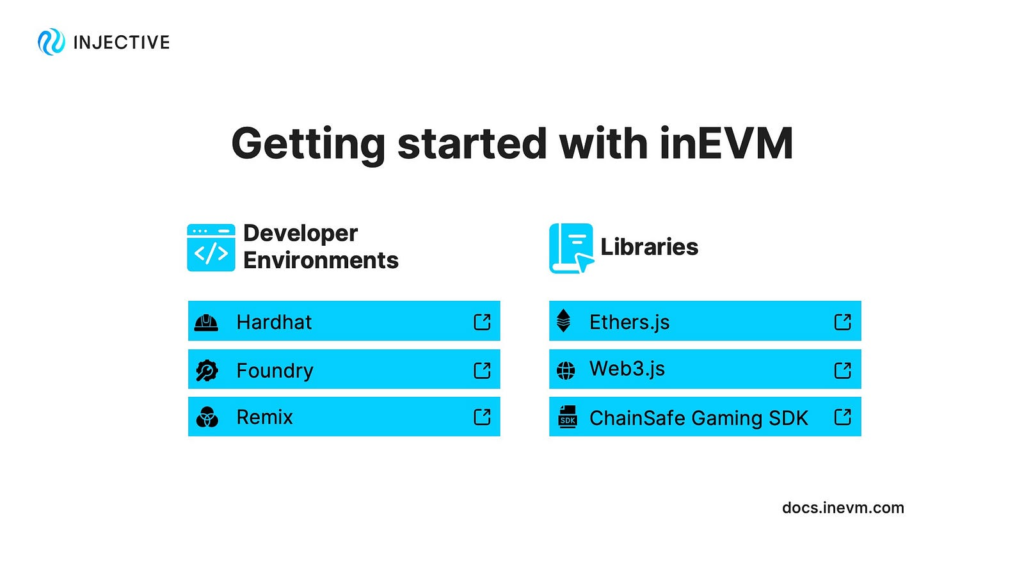

Injective has just launched Injective EVM (inEVM) on their mainnet. inEVM is the first Ethereum ever Ethereum aligned rollup designed to supercharge concurrent VM development.

Injective’s inEVM enables Ethereum developers to build applications that can uniquely leverage Injective’s blazing fast speeds and near zero fees while simultaneously achieving composability across the WASM and EVM world.

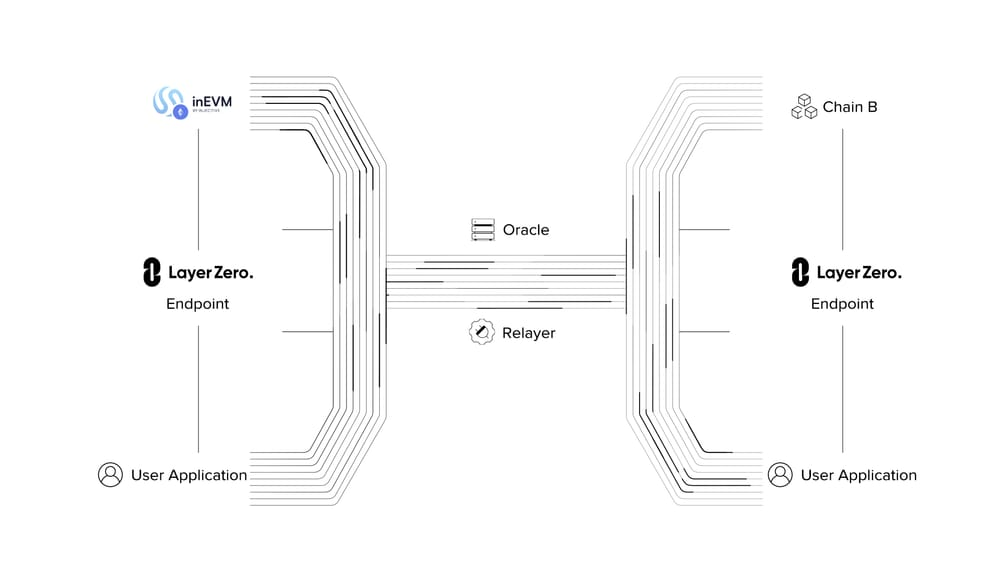

Injective utilizes Hyperlane technology to improve the interoperability of inEVM. With Hyperlane, users can build interchain applications that abstract the complexities of the multichain world away from users. Regarding composability, inEVM is integrated with LayerZero to facilitate the creation of omnichain apps which can interact not just within the Injective’s ecosystem but across all connected networks.

Meanwhile, to increase its scalability, inEVM uses Celestia’s data availability. Celestia’s modular infrastructure will serve as the data availability layer for inEVM, providing a mechanism for the inEVM execution and settlement layers to monitor in a trust-minimized manner whether transaction data is indeed available.

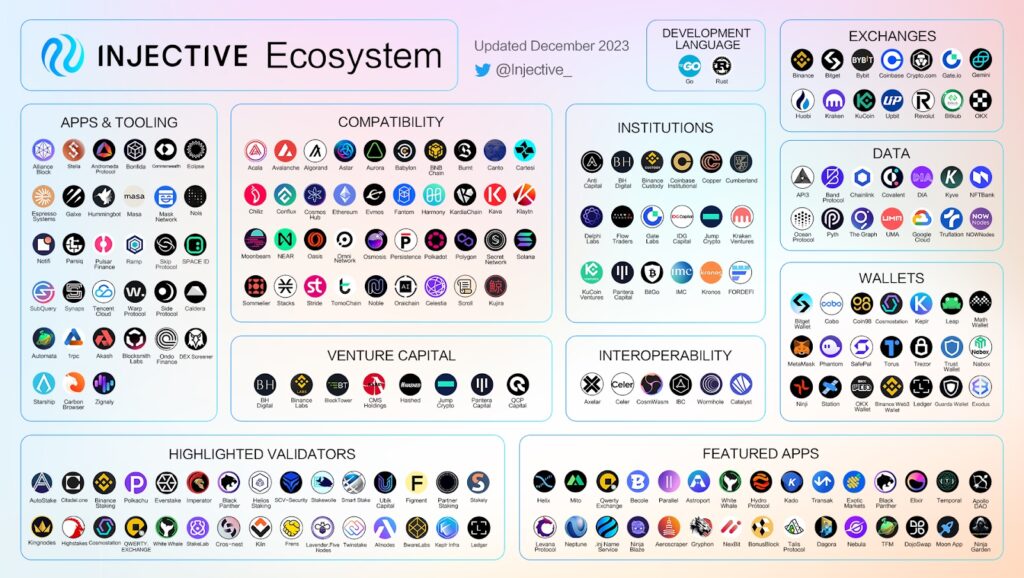

Injective Protocol Ecosystem

Various protocols that have caught the attention of the crypto space are starting to emerge in the Injective Protocol ecosystem. Here are three potential protocols on the Injective network:

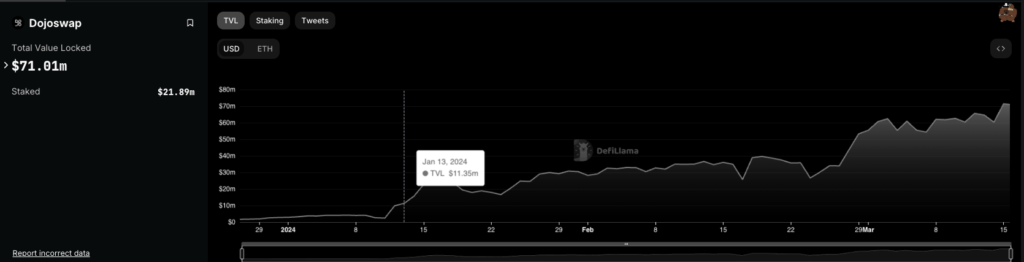

1. DojoSwap

DojoSwap is a native Automated Market Maker (AMM) protocol on the Injective network. As a decentralized on-chain exchange, it allows users to swap various tokens in the Injective ecosystem.

Thanks to various updates, it has now become an all-in-one DeFi platform. In addition to making swaps, users can become liquidity providers, staking, farming, and joining the launchpad. It also has a dedicated airdrop page where users can see the latest airdrop updates in the Injective ecosystem.

DojoSwap is currently the protocol with the largest TVL in the Injective ecosystem, at $71.01 million. Since its launch in late 2023, DojoSwap has recorded over $250 million in trading volume from over 24,000 traders. At the time of writing, there are already 24 tokens that can be traded on DojoSwap.

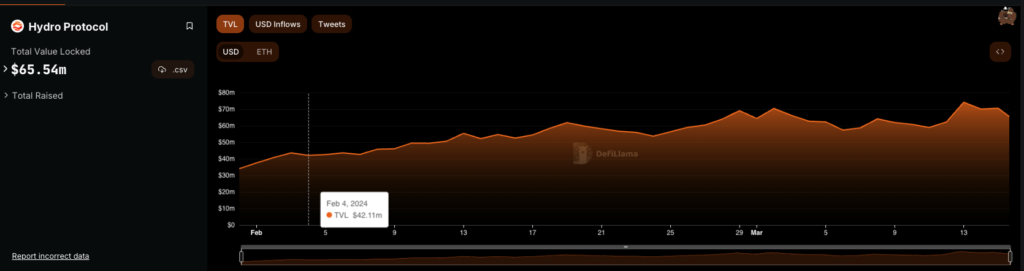

2. Hydro Protocol

Hydro Protocol is a protocol that combines the Liquid Staking Derivatives (LSD) products and Real World Assets (RWA) to offer a specialized LSDFi product suite. It is the protocol with the second largest TVL in Injective, at US$ 65.54 million. Remarkably, Hydro Protocol’s mainnet was only launched in February.

As an LSD protocol, users can stake their INJ tokens and get hINJ in return. The hINJ tokens can be used for trading, lending, and farming to earn additional rewards.

Hydro Protocol has a unique product called Real Yielding Assets (RYA). It allows users to execute various yield optimization strategies. Hydro RYA is an index of multiple yields from the crypto industry that have been rigorously selected.

Hydro Protocol has just airdropped its tokens for INJ stakers as well as their testnet participants. You can visit the following page to check your $HDRO token airdrop eligibility.

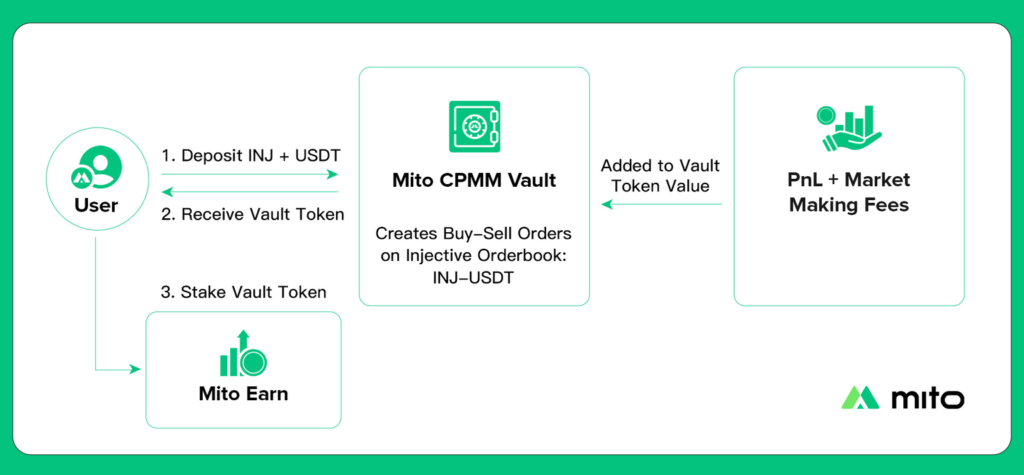

3. Mito

Mito is a Web3 protocol that aims to revolutionize the way trading is done with automated vaults. It contains smart contracts designed to execute trading strategies on the Injective order book. So far, nine automatic vaults are available on Mito, and the HDRO/INJ pairing has the largest TVL at $5 million.

By using the automatic vault, traders no longer need to bother trading. Everything will be executed on autopilot using Avellaneda-Stoikov Market Making (ASMM) or Constant Product Marketing Making (CPMM) strategies. Users can choose the spectrum of each strategy and tailor it to their needs and target returns.

Another feature that Mito has is the Mito Launchpad. Unlike other launchpads with specific criteria, Mito Launchpad encourages developer teams to set token launch criteria according to their needs. This inclusive approach ensures small and large projects can utilize Launchpad for their funding. With Mito Launchpad, the ICO process is no longer limited to private sales but is open to everyone.

Compared to the previous two protocols, Mito is the most recent protocol to launch its mainnet. Currently, its TVL is still relatively small, only $6.5 million. However, with its potential, this figure will likely continue to grow. Especially when Mito launches its token.

Injective Potential in The Future

inEVM could be a game changer for Injective’s future development. This is because the technology makes Injective the only L1 blockchain capable of unifying the interoperability of Cosmos with the speed of Solana and the developer access of Ethereum.

With these updates, Injective can become the developers’s choice to develop Web3 and DeFi applications. Later, applications created using inEVM will get the best performance potential and connect with the IBC and Solana ecosystems.

Furthermore, Injective, along with big names such as Pantera Capital, Kucoin Ventures, IDG Capital, etc., has launched the Injective Ecosystem Group. Injective has prepared US$ 150 million through this venture group to incentivise developers to develop dApps on the Injective network.

The presence of inEVM technology as a breakthrough and the incentives can be factors that encourage the massive adoption of Injective. With more and more apps being developed in the Injective ecosystem, it can be a positive catalyst for creating the Injective ecosystem in the future.

Conclusion

Injective Protocol, one of the new L1 generation projects, is progressively showing its potential to compete with its predecessors. Thanks to its high scalability, its ecosystem is growing. From DojoSwap, an all-in-one DeFi protocol, Hydro Protocol, which offers liquid staking services to maximize yield, to Mito, which provides automated trading and inclusive launchpad services.

Entering 2024, the Injective Protocol development team continues to improve their performance. Most recently, they launched inEVM, combining Cosmos interoperability with Solana transaction speed and Ethereum-style developer accessibility. It will be interesting to see what Injective Protocol does in the future with the increasing competition in the L1 sector and the presence of various L2 projects.

How to Buy INJ Token on Pintu

You can start investing in INJ by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for INJ.

- Click buy and fill in the amount you want.

- Now you have INJ!

In addition to INJ, you can safely and conveniently purchase a wide range of cryptocurrencies such as BTC, ETH, SOL, and others safely and easily on Pintu. Pintu diligently evaluates all its crypto assets, highlighting the significance of being cautious.

Pintu is also compatible with popular wallets such as Metamask to facilitate your transactions. Download Pintu app on Play Store and App Store! Your security is guaranteed because Pintu is regulated and supervised by Bappebti and Kominfo.

Aside from buying and trading crypto assets, you can expand your knowledge about cryptocurrencies through various Pintu Academy articles. Updated weekly, all Pintu Academy articles are made for knowledge and educational purposes, not as financial advice.

References

- Injective Labs, Injective Launches inEVM on Mainnet: The First Rollup to Hyperscale Concurrent VM Development, Injective Blog, accessed on 14 March 2024.

- Injective Labs, A Year in Review: 2023, Injective Blog, accessed on 14 March 2024.

- Coin 98 Analytics, Injective Overview, X. accessed on 14 March 2024.

- SwapDojo Docs, About DojoSwap, accessed on 15 March 2024.

- Hydro Finance, Introduction to Hydro Protocol, Medium, accessed on 15 March 2024.

- Mito Docs, About Mito, accessed on 15 March 2024