The Litecoin halving is an anticipated event in the Litecoin ecosystem, as it significantly impacts LTC tokenomics. Through halving, Litecoin mining rewards are reduced to half of what they were before, controlling new supply coming into the market. It affects mining incentives and can create a balance between supply and demand, potentially affecting Litecoin’s price. In this article, we will explore LTC tokenomics and its implications with halving, and LTC’s potential as an investment asset.

Article Summary

- 🪙 Litecoin (LTC) is one of the oldest crypto assets in the crypto market. Litecoin aims to facilitate secure, fast, and low-cost payments to improve the Bitcoin system, which has some limitations.

- 🔨 The creation of new LTC coins depends entirely on mining activities. No new tokens are awarded through liquidity incentives or airdrops.

- ⚖️ Miners have successfully mined approximately 86.9% of the total Litecoin supply. The total supply of LTC is 84 million LTC or four times more than the maximum supply of Bitcoin.

- 🛡️ Litecoin has undergone two halvings to date, and the upcoming halving, scheduled for August 2023, will reduce the LTC mining reward rate to 6.25 LTC.

Overview of Litecoin

Litecoin (LTC) is one of the earliest crypto assets in the crypto market. It was created in 2011 by a computer scientist and Bitcoin enthusiast, Charlie Lee. Litecoin aims to facilitate secure, fast, and low-cost payments to improve the Bitcoin system, which has some limitations.

LTC is touted as ‘digital silver’ by the crypto community as it has similarities to Bitcoin being ‘digital gold.’ However, some differences include the consensus algorithm, blocking time, and maximum coin supply.

Read more about what Litecoin (LTC) is here.

Litecoin (LTC) Tokenomics

Litecoin implements the proof-of-work (PoW) distribution method, similar to Bitcoin, where creating new coins relies solely on mining activities. No new tokens are awarded through liquidity incentives or airdrops, and neither the development team nor the founders receive any tokens.

Currently, there are 72.9 million LTC in the market. The maximum supply of Litecoin tokens is 84 million LTC, which is four times that of Bitcoin. Miners have successfully mined approximately 86.9% of the total Litecoin supply. During Litecoin’s halving, the mining reward rate for new coins is halved every four years.

Litecoin undergoes a halving process, which occurs approximately every 840,000 blocks or four years. When a halving occurs, the mining difficulty increases, and the block reward is halved. Litecoin has experienced two halvings so far. The next halving is scheduled for August 3, 2023, when the LTC mining reward rate will decrease to 6.25 LTC.

Overall, Litecoin halving has an essential impact on LTC tokenomics. It affects the supply, inflation, and value of LTC. LTC halving creates conditions where the new supply of Litecoin decreases while demand remains or increases, potentially increasing the price of the LTC asset. In addition, halving also plays a role in controlling LTC inflation.

Litecoin (LTC) as An Investment

As of May 25, 2023, the price of LTC stood at 84.5 US dollars, with a trading volume of over 772 million US dollars in 24 hours. As one of the oldest altcoins, LTC still consistently ranks 13th by market capitalization value in the crypto market. Currently, Litecoin has a market cap of more than 6 billion US dollars.

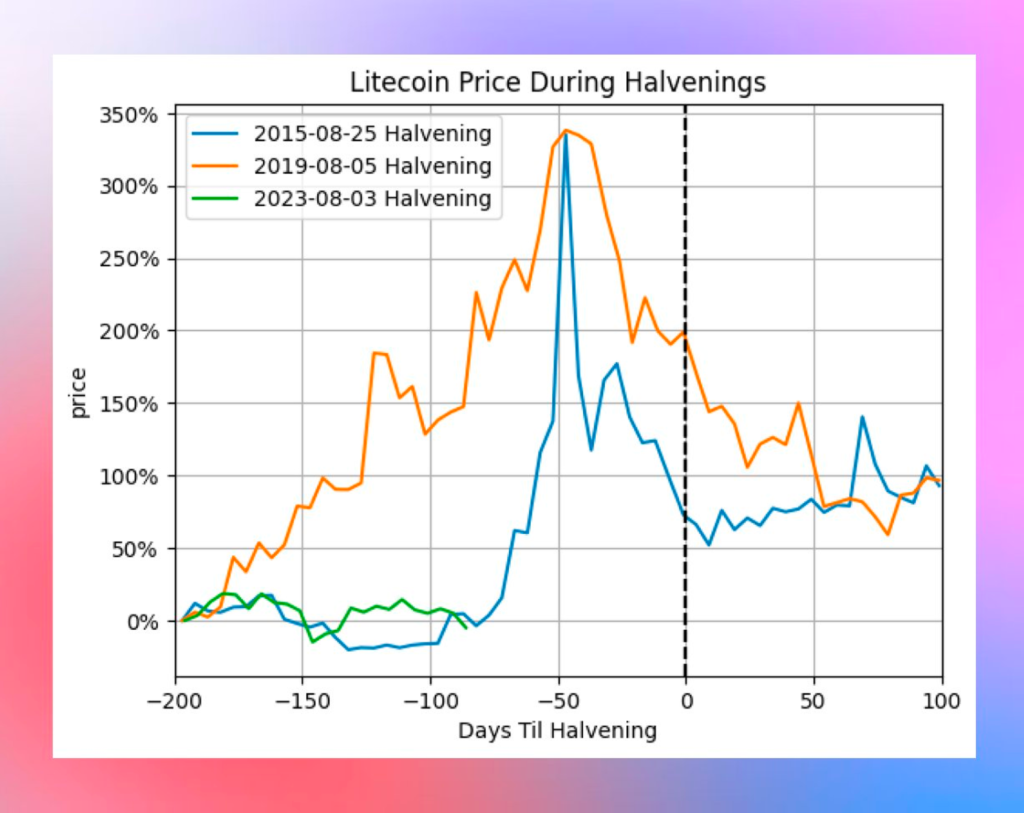

From the Litecoin price chart data above, you can see that the Litecoin price experienced a significant increase before the halving. This pattern can be seen in the 2015 and 2019 halving, where LTC peaked about 50 days before the halving.

While there are similarities in Litecoin price movements leading up to the 2015 and 2023 halvings, it’s important to remember that past performance is no guarantee of future price increases. Various factors, including global market conditions and investor sentiment, influence Litecoin’s price. Therefore, it is necessary to do a comprehensive analysis and consider other factors before making investment decisions related to LTC or other crypto assets.

Litecoin’s Existence in the Crypto World

The Litecoin team continues to develop its system to stay in competition with other crypto assets, including by launching OmniLite in 2021. OmniLite allows Litecoin users to create Non-Fungible Tokens (NFTs) on the Litecoin network.

The OmniLite development team, consisting of Omni and Litecoin developers, developed OmniLite based on the Omni protocol, which serves as the L2 blockchain for Bitcoin. The first launch of Tether (USDT) tokens took place on Omni in October 2014 before transitioning to ERC-20 tokens on Ethereum in November 2017.

In addition, Litecoin also implemented Segregated Witness, Lightning Network, and MimbleWimble technologies. These significantly improve the scalability, speed, efficiency, cost, and privacy of transactions on the Litecoin network.

Since the beginning of 2023, LTC price has increased by almost 400%. One of the things that influenced this was the introduction of the LTC-20 by the Litecoin community on May 1, 2023. LTC-20 is an experimental token that allows users to create meme tokens and NFTs on top of the Litecoin Ordinals network. This token is also a response to the emergence of the BRC-20 token.

Interestingly, the appearance of LTC-20 was enthusiastically received by the global Litecoin community. The graph above shows the high number of new Litecoin wallet addresses since May 1, 2023.

Learn more about Ordinals in this article.

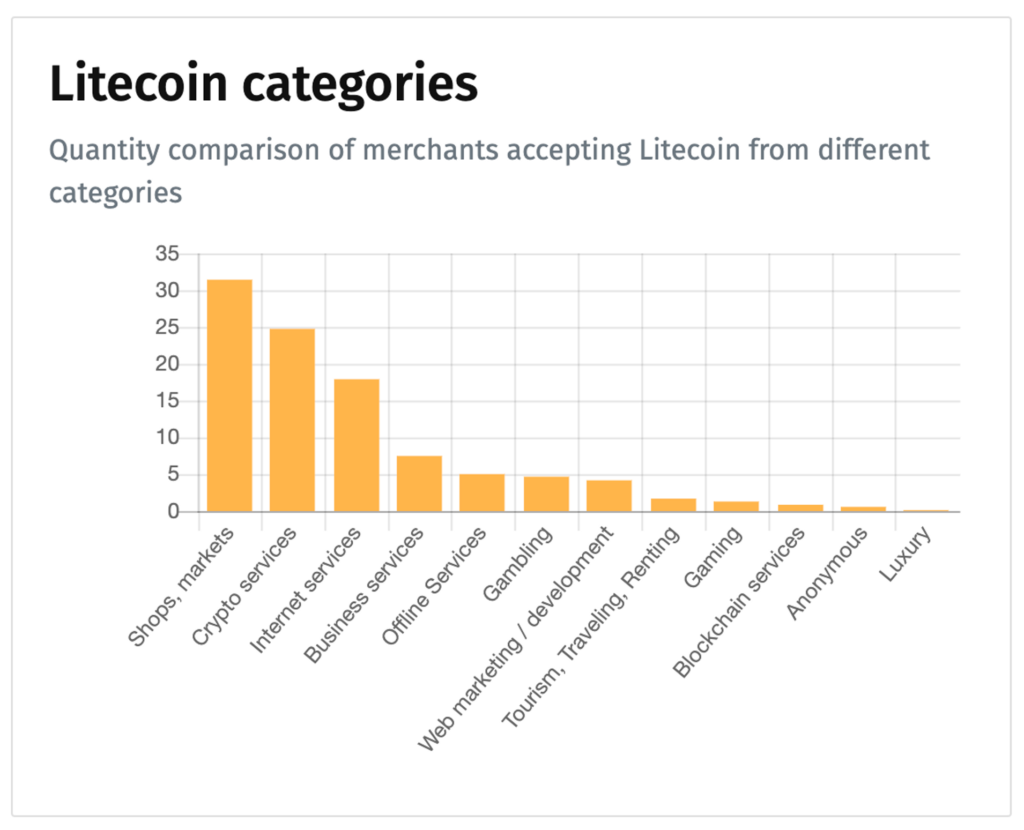

Litecoin has collaborated with 3,376 merchants and 119 payment gateways as a digital payment instrument. It shows the broad adoption of LTC in various sectors of the economy. In addition, the variety of payment gateways available provides many options for users to use Litecoin as a payment instrument in various online and offline transactions.

Litecoin’s partnerships with merchants and payment gateways show Litecoin’s efforts to increase its adoption and use cases as a digital payment instrument. Companies with LTC partnerships include Mastercard, MATH, AlphaPays, Polden, bit4win, SimpleFX, ServerWhere.com, Impreza Host, and others.

Conclusion

Since its launch in 2011, Litecoin has introduced features such as Segregated Witness (SegWit), Lightning Network, and MimbleWimble to improve scalability, transaction efficiency, and transaction privacy on the Litecoin network. In addition, Litecoin also worked with various partners and merchants to increase its adoption as a digital payment instrument.

The Litecoin halving in 2023 is a much-anticipated event in the LTC tokenomics. Litecoin’s previous halving history shows that Litecoin price increases often follow halving events, but it should be noted that past performance does not guarantee future performance.

Therefore, before investing, do your own research, consider risk factors, and consult a financial advisor if necessary.

How to Buy LTC Token on Pintu?

You can start investing in LTC by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for LTC.

- Click buy and fill in the amount you want.

- Now you have ID as an asset!

In addition, Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- AI, The Case for Litecoin, Medium, accessed 25 Mei 2023.

- Ibrahim Ajibade, [LTC-20 Launch Boosts Litecoin (LTC) Price: Will It Hit $120?](https://beincrypto.com/ltc-20-litecoin-price-is-120-next/#:~:text=On May 1%2C Litecoin debuted,to the Bitcoin base chain.) Beincrypto, accessed 25 Mei 2023.

- Marko Mihajlović, Litecoin Tokenomics Explained, Shrimpy, accessed 25 Mei 2023.

- Christie Harkin, Litecoin Enthusiasts Can Now Create NFTs, Tokens With OmniLite, Coindesk, accessed 25 Mei 2023.

- Lawrence Mike Woriji, Why Are Litecoin Ordinals Trending? Altcoin Buzz, accessed 25 Mei 2023.