Coinciding with the Chinese New Year 2024 celebrations, Bitcoin (BTC) surged to $48,000 once again. Some speculate that this rise is linked to the Ethereum Spot ETF option. However, despite this bullish momentum, crypto investors should exercise caution and closely monitor Bitcoin’s future price movements.

As usual, Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- ✍🏻 BTC is facing resistance at the lower boundary of the Fibonacci retracement, which, if successfully breached, could see prices surpass the $45,000 to $45,100 range and potentially continue to rise.

- 💼 The latest U.S. employment report revealed an addition of 353,000 jobs in January, while the unemployment rate in the U.S. remained relatively stagnant at 3.7%.

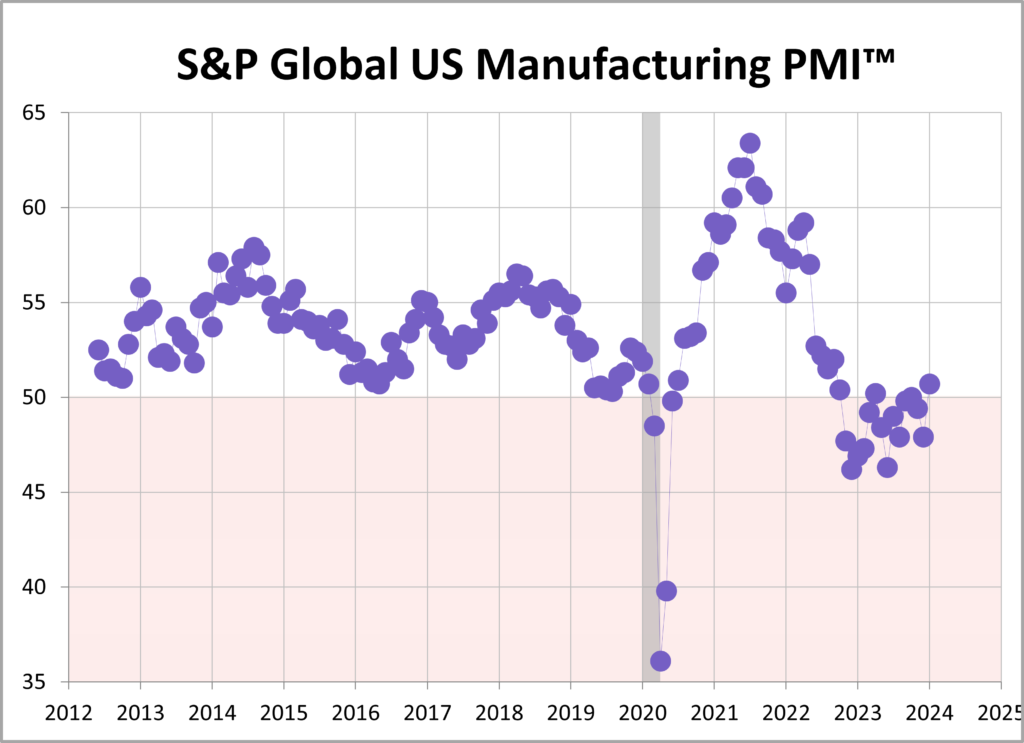

- 🏭 The Global S&P Manufacturing PMI for January exceeded expectations, reaching 50.7, while the ISM version hit 49.1, above expectations but indicating slight contraction. In the services sector, the S&P PMI reached 52.5, and the ISM PMI was at 53.4, both indicating sector growth and surpassing predictions.

Macroeconomic Analysis

Manufacturing Index

A recent S&P Global report highlighted a significant improvement in the US Manufacturing Purchasing Managers’ Index (PMI) that reached 50.7 in January, up from 47.9 in December. This marks the highest increase in operating conditions since September 2022. The 2.8-point increase surpassed the forecast of 50.3, indicating an expansion of the manufacturing sector for the first time ending two consecutive months of decline.

Meanwhile, data from the Institute for Supply Management (ISM) reported that the January PMI rose from 47.1 in December to 49.1. However, the increase hasn’t been able to break above 50, which means it still shows a contraction that has been a trend for 15 consecutive months.

Other Economic Indicators

- Services Index: In January, the U.S. S&P Global Services Purchasing Managers’ Index (PMI) reached 52.5, marking it the strongest performance of this sector in the last seven months, despite a slight decrease from the preliminary estimate of 52.9. This increase was fueled by a significant rise in new orders and the largest export of goods since August, along with an optimistic production outlook for the next twelve months. Furthermore, employment also increased for the first time in seven months in response to a rise in backlogs. Meanwhile, the Institute of Supply Management (ISM) reported a services PMI of 53.4, above the forecast of 52.0, indicating expansion for 13 consecutive months. This growth was driven by increases in new orders, employment, and supplier deliveries amid stable business conditions and cautious optimism due to concerns about inflation and geopolitical issues.

- Unemployment Rate & Nonfarm Payrolls: The latest employment report showed a significant surge in job creation, with 353,000 jobs added in January, far exceeding the expected 187,000. The unemployment rate remained steady at 3.7%, contrary to predictions of a slight increase from the April low of 3.4%. This stability is partly due to the influx of new entrants into the workforce. Predictions for the first half of 2024 indicate that the unemployment rate will range between 3.4% and 4.0%, consistent with trends observed over the past two years. In the second half of 2024, job additions are expected to fall short of keeping pace with population growth, leading to a slight increase in the unemployment rate.

- Michigan Consumer Sentiment: For two consecutive months, there has been a significant increase in U.S. consumer sentiment, unprecedented in the last three decades. According to the University of Michigan’s Consumer Survey released last Friday, consumer sentiment in January rose by 13%, reaching its highest level since July 2021. This increase, along with a 14% rise in December, marks the largest two-month increase since 1991, coinciding with the end of the Gulf War and America’s emergence from a recession. The boost in consumer confidence is attributed to improved inflation prospects and personal income. Moreover, this surge represents an almost 60% increase from the all-time low recorded in June 2022 and is now 7% below the historical average since 1978.

BTC Price Analysis

In the midst of the current bullish momentum sweeping through the cryptocurrency market, the price of Bitcoin has surpassed $44,000. This milestone, achieved for the first time this month, signals a potential recovery in the market.

The recent upswing has generated a notably positive sentiment across the entire cryptocurrency landscape. Speculation suggests that the surge could be attributed to the anticipation surrounding Ethereum Spot ETFs and BTC ETF options. However, it’s essential to note that trend levels, while on the rise, remain relatively lower compared to last month, emphasizing the need for vigilance.

Analyzing the chart provided, it’s evident that the price movement is encountering resistance at the lower boundary of the Fibonacci retracement. If we manage to surpass the price range of 45,000-45,100, anticipate additional upward price movement.

The overall cryptocurrency market is facing resistance at the lower limit of the Fibonacci retracement. If we successfully surpass the price resistance of 1.68 trillion USD, anticipate additional upward movement.

💡 According to Coinmarketcap.com, the price of Bitcoin (BTC) attained a peak of $48,707 on February 12, 2024, at precisely 07:30 AM.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long-term holders’ movement in the last 7 days was higher than the average. If they were moved for selling, it may have a negative impact. Investors are in an anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long-position traders are dominant and are willing to pay short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest increases, it indicates more liquidity, volatility, and attention are coming into the derivative market. The increasing trend in open interest could support the current ongoing price trend.

- 🔀 Technicals: RSI indicates an overbought condition where 76.00% of price movement in the last 2 weeks has been up and a trend reversal can occur. It indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- ERC-404 First Token Soars 12,000%. Pandora, the first token based on ERC-404, saw its price increase by 12,000% within a week to trade at $32,000 and signalled a new sub-asset class in the crypto market. Developers working on an Ethereum Improvement Proposal (EIP) to gain official recognition of ERC-404 highlighted its potential to revolutionise the ownership and use of NFTs. ERC-404 itself is an unofficial and experimental Ethereum token standard developed by pseudonymous creators “ctrl” and “Acme” that aims to combine the characteristics of fungible ERC-20 tokens and non-fungible ERC-721 tokens into a new class of commensurate semi-digital assets. ERC-404 It facilitates the native fractionalisation of NFTs through a minting and burning mechanism that enables fractional transfers and trading.

News from the Crypto World in the Past Week

- The Securities and Exchange Commission (SEC) has adopted new rules, requiring market participants who act as significant liquidity providers, including those in the cryptocurrency and decentralized finance (DeFi) sectors, to comply with federal securities laws. Despite resistance from the crypto industry, which argued that the rules are impractical for DeFi products due to their decentralized nature, the SEC regulations now mandate market participants involved in trading crypto asset securities as part of a regular business to register with the SEC as broker-dealers or alternative trading systems. Industry leaders criticized the regulations as “misguided and difficult to enforce,” while highlighting the challenges of applying traditional regulatory frameworks to DeFi and automated market makers.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Dymension (DYM) +85,14%

- Immutable (IMX) +27,87%

- Beam (BEAM) 25,87%

- Ethereum Name Service (ENS) 23,98%

Cryptocurrencies With the Worst Performance

- Ronin (RON) -15,75%

- Jupiter (JUP) -12,39%

- Frax Share (FXS) -10,40%

- Wemix (WEMIX) -7,49%

References

- Sarah Wynn, SEC adopts rule to have stricter oversight over dealers, looping in crypto and DeFi, theblock, accessed on 10 February 2024.

- Shaurya Malwa, What Is ERC-404? The Experimental Standard Whose First Token Has Rocketed 12,000% in One Week, coindesk, accessed on 10 February 2024.