The crypto market continues to display positive momentum, underscored by a remarkable rise in the popularity of Bitcoin options among crypto enthusiasts. With open interest in Bitcoin options surpassing the futures market at $17.5 billion, this surge is viewed as a sign of growing maturity within the crypto space. However, the question lingers whether this factor alone is enough to propel BTC prices further upward. For a deeper understanding of this phenomenon, explore the market analysis below.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🔄 The Michigan Consumer Sentiment Index fell to 60.4 in November, significantly below the forecast of 63.7 and October’s 63.8.

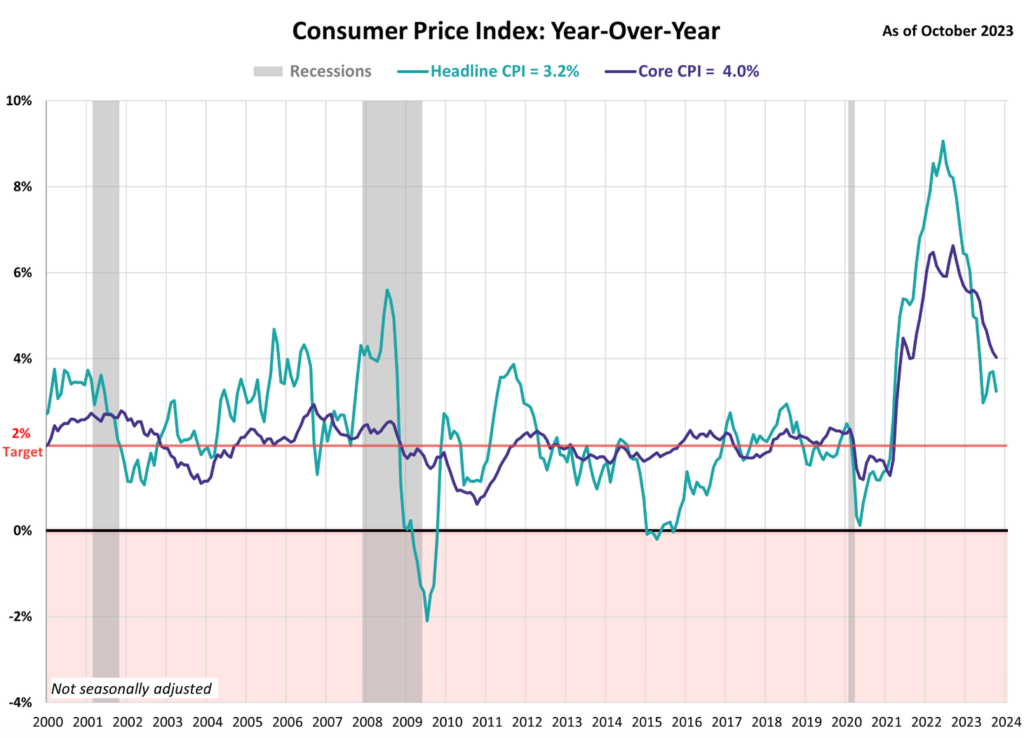

- 📉 The U.S. Consumer Price Index (CPI) remained stable month-over-month in November, signaling a potential easing of high prices. Year-over-year, the CPI rose 3.2%, slightly below the anticipated 3.3%.

- 🚀 Weekly unemployment claims in the U.S. reached a three-month high in the week ending November 11, 2023, with 231,000 new claims.

- 👀 BTC support remains at $36,000. There is optimism in the market that BTC could reach a new all-time high amid prospects of institutional capital flowing into Bitcoin.

- ✍🏻 ETH is showing weaker performance compared to BTC. The resistance for ETH is at the 200-week moving average line.

Macroeconomic Analysis

Consumer Price Index (CPI)

This week’s macroeconomic analysis begins with a positive sign: the U.S. Consumer Price Index (CPI) for October remained stable month-over-month. This suggests that high prices may start to decline. Year-over-year, the CPI rose by 3.2%, slightly below the projected 3.3%. The core CPI, excluding food and energy, increased by 0.2% month-over-month and 4% year-over-year. This is the lowest annual rate in the last two years, but it is still above the Fed’s 2% target. Following the CPI announcement, the Dow Jones surged nearly 500 points, as traders downplayed the likelihood of imminent Fed rate hikes. For context, the Fed has raised interest rates 11 times since March 2022, totaling a 5.25 percentage point increase.

Other Economic Indicators

- Michigan Consumer Sentiment: Concerns over high interest rates have dampened consumer sentiment, causing the Michigan Consumer Sentiment Index to plummet to 60.4, a significant drop from the expected 63.7 and October’s 63.8. The long-term economic outlook has also deteriorated, with a 12% decline, with lower-income and younger consumers experiencing the sharpest drop in sentiment. This downturn aligns with statements from the Federal Reserve Chair regarding the potential for further interest rate hikes. Currently, interest rates stand at a 22-year high of 5.25-5.5%, while mortgage rates hover around 7.9%.

- Retail Sales: U.S. retail sales experienced a slight decline of 0.1% in October 2023, bringing an end to a six-month period of consecutive increases. This decrease can be partially attributed to a drop in gasoline and car prices. When excluding these factors, sales marginally increased by 0.1%. The upward revision of September’s sales figures from 0.7% to 0.9% further highlights the recent slowdown in consumer spending. These figures collectively indicate a slight moderation in consumer spending amid ongoing market fluctuations.

- Producer Price Index (PPI): PPI for final demand exhibited a notable decline of 0.5% in October 2023, defying economists’ expectations of a 0.1% increase. This marked the largest monthly decrease since April 2020 and signaled a significant slowdown in producer price inflation. Over the 12 months through October, PPI increased by a mere 1.3%, down from the 2.2% rise in September. This moderation in PPI suggests a potential easing of inflationary pressures at the producer level.

- New York State Manufacturing Index: The New York State Manufacturing Index experienced a sharp surge to 9.1 in November 2023, surpassing expectations of -2.8. This robust increase signals a notable rebound in business conditions within the state, following a decline of -4.6 in October. The index’s positive trajectory is further supported by an upward trend in the inventories index, indicating rising inventory levels for the first time in several months. However, despite these encouraging signs, the outlook for the next six months remains somewhat subdued, with firms expressing less optimism about future economic conditions.

- Weekly Unemployment Claims: Weekly unemployment claims in the United States reached a three-month high for the week ending November 11, 2023, with 231,000 new claims filed. This increase suggests a moderation in the labor market, which could potentially aid the Federal Reserve’s efforts to curb inflation. Additionally, continuing claims rose to 1.865 million, the highest level since November 2021. This development aligns with a broader economic slowdown and increased demand restraint stemming from higher interest rates.

BTC & ETH Price Analysis

Bitcoin

The options market for Bitcoin has surged in popularity within the crypto community, surpassing its futures counterpart with a remarkable open interest of $17.5 billion, a substantial lead over the $15.84 billion observed in the futures market. This transition not only indicates a more mature market but also suggests that knowledgeable traders are gaining increased influence in the crypto space.

The increase in Bitcoin’s value this year has reignited interest in the crypto market. This upswing is driven by a combination of factors, including an increased demand for safe-haven assets, anticipation surrounding spot ETFs in the United States, and positive expectations linked to the Fed.

While the initial focus was on Bitcoin’s spot and futures markets, there is now a shift towards options as they offer a cost-effective means for speculating on price movements.

Amidst this favorable momentum, BTC is currently priced at $36,000 – 37,000, demonstrating a notable rebound from last year’s 65% decline and an impressive surge of 122% this year. The prospect of institutional capital flowing into Bitcoin is considered a potential game-changer, with the potential to propel its value beyond the previous all-time high of $69,000, possibly reaching the coveted milestone of $100,000 or even higher. Current support at $36,000.

Ethereum

ETH has shown weaker performance compared to BTC, experiencing a -1.5% loss against BTC over the week. Currently, it is encountering resistance at the 200-week moving average line. This trend is expected to persist until the resistance line is successfully breached.

The overall crypto market is facing resistance at the 150-week moving average, positioned at the 1.425 trillion mark. Anticipate a period of range-bound movement in the crypto market unless we successfully surpass this resistance line.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to rise, it indicates higher selling pressure. Net deposits on exchanges are low compared to the 7-day average. Lower deposits can be interpreted as lower selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long term holders’ movement in the last 7days was lower than the average. They have a motive to hold their coins. Investors are in an Anxiety phase where they are currently in a state of moderate unrealized profits.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay to short traders. Selling sentiment is dominant in the derivatives market. More sell orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- Sam Altman has been fired from his position as CEO of OpenAI. Following Sam Altman’s resignation, the value of Worldcoin’s token (WLD) experienced a significant decline of over 13%, dropping to $1.91, according to CoinMarketCap data. Worldcoin has not yet commented on Altman’s departure or the project’s future. As of March 2023, Altman is a member of Worldcoin’s board but is not involved in its day-to-day operations.

- Mark your calendars for the upcoming Chainlink Staking v0.2 launch! The Priority Migration Period starts from November 28 to December 6, 2023, offering an exclusive opportunity for v0.1 stakers to migrate their stakes and rewards to Staking v0.2, with guaranteed access for all eligible stakers during this nine-day period. Then, the Early Access Phase runs from December 7-10, 2023, where community members on the Early Access Eligibility List can stake LINK four days before it opens to the public. Finally, beginning December 11, 2023, the General Access Phase allows open staking for all LINK holders, within the pool’s capacity and with a maximum limit per wallet. Don’t miss this exciting chance to be part of Chainlink’s decentralized staking ecosystem!

- A groundbreaking Proof-of-Concept (PoC) developed by Onyx by J.P. Morgan and Apollo Global under Singapore’s Project Guardian highlights the transformative potential of blockchain technology in asset and wealth management. Utilizing Onyx Digital Assets, the project automates portfolio management and integrates alternative assets with liquid assets, while also exploring multi-chain interoperability. This collaboration underscores the growing adoption of blockchain technology to enhance capital market infrastructures and institutional processes.

News from the Crypto World in the Past Week

- BlackRock’s active pursuit of a spot ether ETF is evident in their filings with Nasdaq (19b-4) and the SEC (S-1). This ETF aims to track the price movements of ether. This move aligns with BlackRock’s previous endeavors in a spot bitcoin ETF. While the ETF was listed on the Depository Trust and Clearing Corporation (DTCC) website in October, the DTCC clarified that this listing does not imply SEC approval.

- Inflation in the United States is exhibiting signs of moderation, reflecting the impact of the Federal Reserve’s interest rate hikes. According to the U.S. Department of Labor, overall inflation held steady from September to October, buoyed by a decline in fuel prices. This represents a deceleration from the 0.4% increase recorded in the previous month. Year-over-year, consumer prices rose by 3.2% in October, down from 3.7% in September.

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Celestia (TIA) +95,75%

- THORChain (RUNE) +48,48%

- Avalance (AVAX) +47,93%

- ORDI (ORDI) +43,69%

Cryptocurrencies With the Worst Performance

- Neo (NEO) -16,27%

- Rocket Pool (RPL) -13,70%

- Theta Network (THETA) -12,41%

- Kava (KAVA) -12,29%

References

- Jacquelyn Melinek, Worldcoin token’s value drops nearly 10% after Sam Altman removed as OpenAI CEO, Techcrunch, accessed on 18 November 2023.

- Katherine Ross, BlackRock submits S-1 SEC filing for spot ether ETF, Blockworks, accessed on 18 November 2023.

- The Associated Press, U.S. inflation rate eases to 3.2%, lower than anticipated, Cbc, accessed on 18 November 2023.

- Chainlink, Staking v0.2 is launching this year, X, accessed on 18 November 2023.

- Avalance, Onyx by J.P. Morgan Leverages Avalanche To Explore a New Paradigm for Portfolio Management, avax.network, accessed on 18 November 2023.