Decentralized exchanges (DEXs) often encounter obstacles around decentralization, scalability, and capital efficiency or liquidity simultaneously. To address these issues, Sei Network has emerged as an innovative solution to address scalability issues in DEXs. Also, Sei seeks to open up opportunities for trading applications to grow effectively while maintaining the crucial principles of decentralization and capital efficiency. So, how does Sei Network address these issues? In this article, we will take a closer look at the Sei Network and how it solves problems in the DeFi world.

Article Summary

- ⛵ Sei is a layer 1 blockchain specifically designed for DeFi infrastructure focusing on order books.

- ⛓️ Operating on the Cosmos SDK and Tendermint Core, Sei’s infrastructure is tailored for trading applications while striking a balance between decentralization, scalability, and capital efficiency.

- 📖 A standout feature of Sei is its self-provided order book, enabling DeFi projects to share a unified order book, fostering substantial liquidity and positioning Sei as the liquidity hub for the next DeFi generation.

- 🪙 SEI, the native token of Sei Network, serves multiple functions within the Sei ecosystem, including asset staking, trading fees, and governance.

What is Sei Network (SEI)?

Sei is a layer 1 blockchain specialized for DeFi infrastructure development focusing on order books. Its design is centered on speed, low fees, and specialized features that support various trading applications.

Sei is built using the Cosmos SDK and utilizes the Tendermint Core consensus mechanism. With the Cosmos SDK and customizations to its technology, Sei can speed up transaction processing, lower latency, and increase throughput in applications built on top of it.

Sei Network’s uniqueness lies in offering a native order book on its blockchain. Within the Sei ecosystem, DeFi projects can collectively utilize a single order book, creating deep liquidity that benefits traders. This positions Sei as both the infrastructure and shared liquidity hub for the upcoming generation of DeFi.

DEXs are facing a tough challenge known as the ‘Trading Trilemma’, where they are trying to balance decentralization, scalability, and capital efficiency simultaneously. Sei directly addresses these issues by designing the first Layer 1 blockchain specifically developed for trading. Every infrastructure component within Sei is optimized to provide the optimal environment for digital asset exchange.

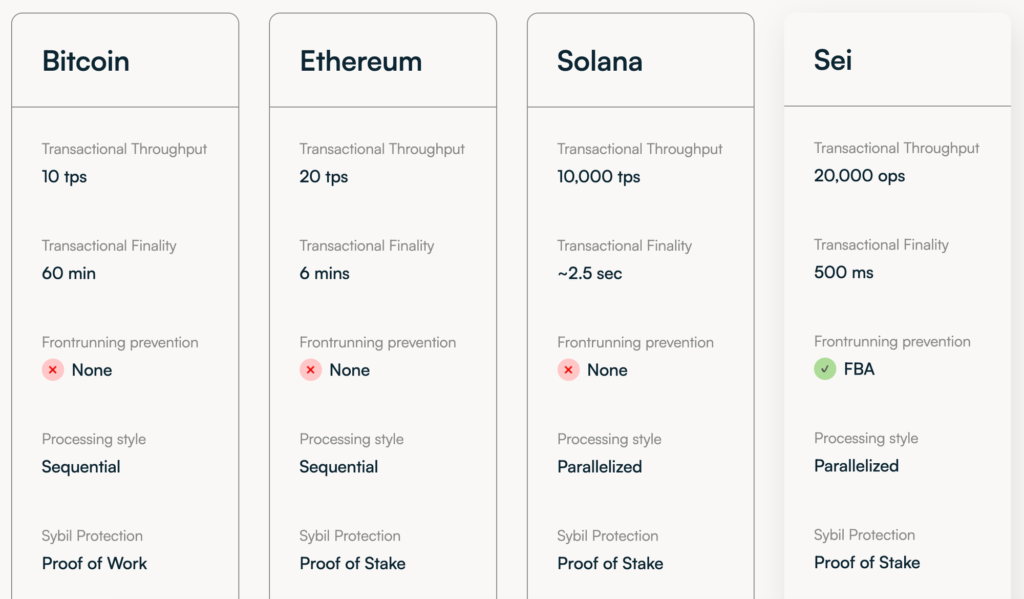

Following the optimization of Sei’s infrastructure, it is anticipated that trading applications, NFT marketplaces, and blockchain-based games will experience enhanced performance on the Sei blockchain. Here’s how Sei compares to other layer 1 blockchains.

For comparison, Bitcoin transaction finalization takes 30 to 60 minutes, Ethereum 6 minutes, while Solana, the fastest blockchain today, finalizes about 2.5 seconds. Sei reports that it currently achieves a transaction finalization time of about 500 ms or 0.5 seconds. It makes Sei the fastest Cosmos SDK chain.

Who Founded Sei Network?

Sei Network was developed by a team with a background in both finance and technology. The individuals behind Sei Network include Jeffrey Feng, Jayendra Jog, and Dan Edlebeck.

Jeffrey Feng brings investment expertise from his time at Goldman Sachs. On the other hand, before co-founding Sei, Jayendra Jog was a software engineer at Robinhood. Meanwhile, Dan Edlebeck was the former CEO at Exidio, a decentralized VPN application within the Cosmos ecosystem.

In April 2023, Sei successfully raised US$30 million in two strategic funding rounds. The investment came from leading investors such as Jump Crypto, Distributed Global, Multicoin, Asymmetric, Flow Traders, Hypersphere, and Bixin Ventures.

How Does Sei Network Work?

As mentioned, Sei is built utilizing the Cosmos SDK and Tendermint Core. With the Cosmos SDK, Sei can utilize its built-in technologies to become a high-performance DeFi hub in the Cosmos ecosystem.

Intelligent Block Propagation and Optimistic Block Processing

Intelligent Block Propagation speeds up transaction processing time by providing all relevant transaction hashes to the validator. Meanwhile, Optimistic Block Processing can reduce latency and increase throughput. Thus, with a 1-second block time, there will be a 30% decrease in latency and a 43% increase in throughput.

Native Order Matching Engine

Unlike the Automated Market Maker (AMM) system commonly used in DeFi applications today, Sei uses its on-chain order book to match buy and sell orders at specific prices. DeFi application developers can utilize Sei’s native central limit order book (CLOB) to access deep liquidity.

The order book feature on the Solana network is powered by Serum DEX, while the Sei Network provides the order book on its blockchain. All dApps on Cosmos can access Sei's order book and liquidity.

Frequent Batch Auctioning (FBA)

Sei also implements Frequent Batch Auctioning (FBA) to prevent front-running and MEV. FBA combines transactions into groups within each block, and orders are executed simultaneously at a uniform clearing price. It ensures that orders in batches do not affect the price.

Oracle Module

Sei provides an Oracle module to determine the price of the asset exchange rate. Validators participate by voting on the token price when committing a block during the consensus process. They can only create the block if the token price input is executed.

Advantages of Sei Network

- A trading-specific blockchain: Unlike other layer 1 blockchain with multiple use cases, Sei is specifically designed to facilitate high-activity decentralized trading.

- High speed: Sei has a high transaction speed. It is measured by Time to Finality (TFF), where Sei is 2x faster than Sui and about 1.5x faster than Aptos.

- Transaction throughput: Transaction throughput is the rate at which valid transactions are approved to enter the blockchain within a given period. For comparison, Solana can process 10,000 transactions per second (TPS). In contrast, Sei can process 20,000 orders per second (OPS).

- High security: Sei Network uses the Tendermint Core consensus mechanism and focuses on avoiding MEV risk through Frequent Batch Auctioning (FBA). Sei is creating a new standard in the DeFi ecosystem by prioritizing security, bandwidth, and reliability. Sei’s Native Order Matching Engine enables users to specify the price, size, and direction of their trades while providing protection against potential MEV risks.

Read more about MEV in the article What is MEV (Maximal Extractable Value)?

- Parallel Order Execution: In blockchain, orders are typically executed sequentially. However, Sei has adopted a parallel order-matching system, allowing the order-matching process for different markets (trading pairs) to run simultaneously.

SEI Token

SEI is the native token of Sei Network which has important functions in the Sei ecosystem. Quoted from the official SEI blog, here are some SEI functions:

- Network Fees: Pay for transaction fees on the Sei blockchain.

- DPoS Validator Staking: SEI holders have the option to delegate their holdings with validators or stake SEI to run their own validator to secure the network.

- Governance: SEI holders can engage in future governance of the protocol.

- Native Collateral: SEI can be used as native asset liquidity or collateral to applications built on the Sei blockchain.

- Fee markets: Users can pay a tip to validators to get their transactions prioritized, which can be shared with users that are delegating to that validator.

- Trading Fees: SEI can be used as fees for exchanges built on Sei blockchain.

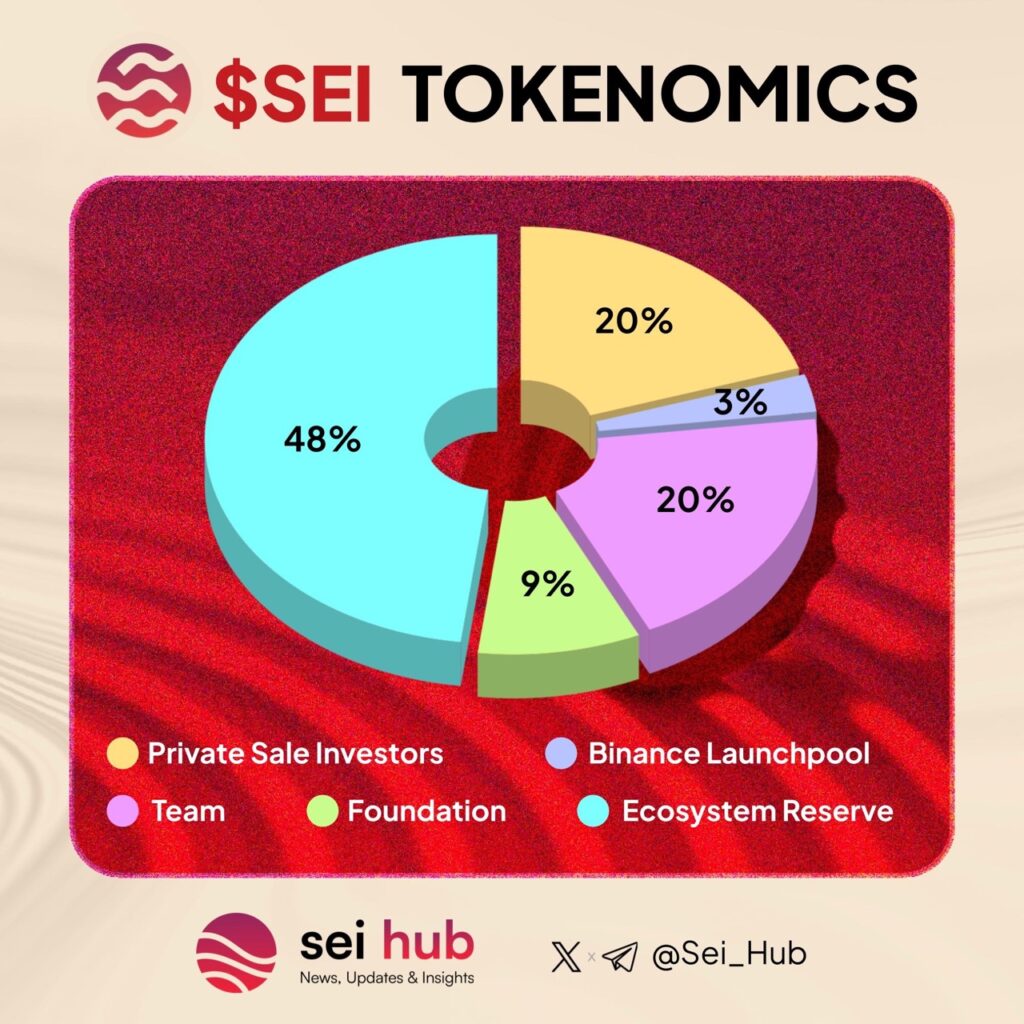

SEI possesses a total token supply of 10 billion, with 51% allocated to the Sei community. Within this, 48% serves as ecosystem reserves, rewarding stakers and contributors, validators, and developers. Another 3%, or 300 million SEI, is designated for Season 1 of an airdrop, while the remaining portion is assigned to private sale investors, foundations, and the Sei team.

Following its launch on August 15, 2023, SEI experienced a surge to 0.47 US dollars but swiftly declined to 0.14 US dollars within two days. As of November 16, 2013, the SEI price stands at 0.16 US dollars.

Conclusion

Traditional DEX protocols often have their downsides, and Sei Network seeks to overcome these obstacles by presenting a solution that optimizes its network performance.

Sei Network, a decentralized blockchain based on the Cosmos SDK, presents an alternative to Layer 1 blockchains. Sei introduces a distinct approach compared to existing order book-based decentralized DEX protocols like Serum, dYdX, and Injective.

By providing a specialized order book and Native Order Matching Engine, Sei Network aims to provide deep liquidity while achieving high throughput and low latency through innovative features such as Intelligent Block Propagation, Optimistic Block Processing, and Parallel Order Execution.

How to Buy SEI Token on Pintu?

You can start investing in SEI by buying it on Pintu app. Here is how to buy crypto on Pintu application:

- Create a Pintu account and follow the process of verifying your identity to start trading.

- On the homepage, click the deposit button and top up the Pintu balance using your preferred payment method.

- Go to the market page and look for SEI.

- Click buy and fill in the amount you want.

- Now you have SEI as an asset!

In addition, Pintu application is compatible with various popular digital wallets such as Metamask to facilitate your transactions. Go and download the Pintu cryptocurrency app on Play Store and App Store! Pintu is regulated and supervised by Bappebti and Kominfo.

You can also learn more crypto through the various Pintu Academy articles which are updated every week! All Pintu Academy articles are for educational purposes, not financial advice.

References

- Sei Network, The Layer 1 for Trading, Docs, accessed 15 November 2023.

- Hamtrade, Exploring #Sei: The Fastest Layer 1 Blockchain Built for Trading, Medium, accessed 15 November 2023.

- 1007, [Research] Sei Network, the DeFi Hub of the Future? Medium, accessed 15 November 2023.

- Jimmy Aki, SEI (Layer 1 Blockchain), Techopedia, accessed 15 November 2023.