The cryptocurrency market experiences unexpected events on a weekly basis, and one recent development was the surprising resignation of Binance CEO Changpeng Zhao. Although the market initially responded with a 5% dip, conditions rebounded within a day. The question now looms: what other impacts might this have on BTC’s price in the current market landscape? Delve into the comprehensive analysis below for deeper insights.

As usual, the Pintu trading team has gathered critical information and analyzed the general economic situation and the crypto market’s movements over the past week. However, it should be noted that all information in this Market Analysis is intended for educational purposes, not as financial advice.

Market Analysis Summary

- 🚨 Federal Reserve officials have reached a consensus that they will move cautiously in raising interest rates.

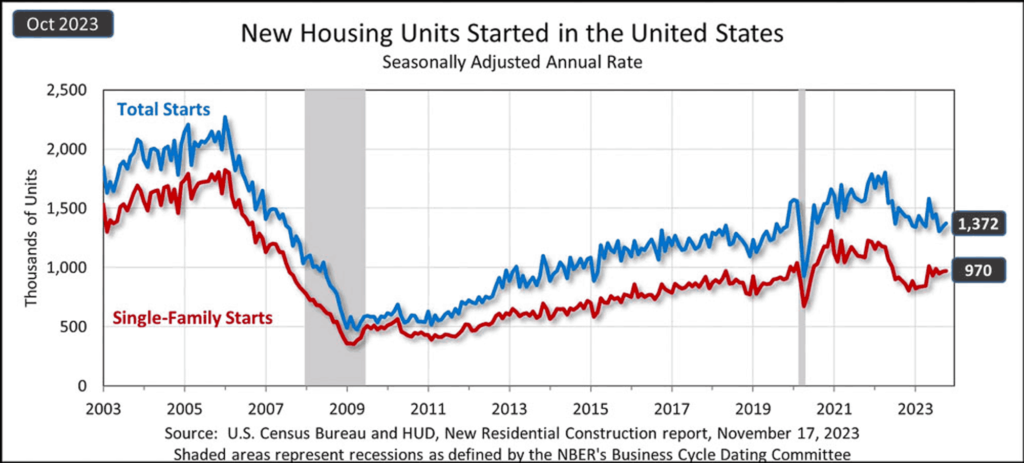

- 🏡 New home construction rose 1.9% to an annual rate of 1.37 million in October, while building permits increased 1.1% to an annual rate of 1.49 million in October.

- 📉 Initial jobless claims dropped by 24,000 to a seasonally adjusted 209,000 for the week ending November 18. Continuing claims decreased by 22,000 to 1.840 million for the week ending November 11.

- ✍🏻 BTC continues to trade sideways between $35,500 and $38,000. Major resistance is at $39,000 and support is at $36,250.

- 👀 ETH has entered a mild bullish trend, with the ETH price reaching $2087. Weekly, ETH is up 4.7%, although trading volume has decreased by 36%.

Macroeconomic Analysis

Housing Starts and Building Permits

In October, new home construction in the U.S. reached 1.37 million units, exceeding expectations and showing a 1.9% increase from September. Building permits also rose to an annual rate of 1.49 million, indicating potential future growth in home construction. While permits for single-family homes increased only slightly by 0.5%, overall construction remains below historical norms due to high mortgage rates.

Despite concerns about the resilience of the consumer sector, recent reports suggest that developers are not anticipating an imminent recession and remain optimistic about the new housing market. Developers are confident in their ability to quickly sell homes without accumulating excess inventory, even in a recession scenario.

Other Economic Indicators

- FOMC Minutes: Federal Reserve officials have agreed to proceed cautiously with future rate hikes. Inflation is showing signs of slowing, and the Fed is shifting toward maintaining the current federal funds rate in the absence of unexpected inflationary developments. In addition, the Fed noted that further policy tightening will be adjusted if incoming information suggests insufficient progress toward the inflation target.

- Existing Home Sales: In October, existing home sales in the U.S. fell 4.1% to an annual rate of 3.79 million, the lowest level in more than 13 years. The decline was largely due to high mortgage rates and a shortage of available homes. At the same time, the median existing home price rose 3.4% to $391,800, a record high for the month. The combination of high prices, rising mortgage rates, and low homeowner move-up rates has resulted in a stagnant market.

- Durable Goods: According to a report from the Census Bureau on Wednesday, U.S. durable goods orders fell 5.4% in October, dropping $16 billion to $279.4 billion. This followed a 4.6% increase in September and was worse than the market’s expectation of a 3.1% decline.

- Initial Jobless Claims: The latest jobless claims data showed a decrease of 24,000 to a seasonally adjusted 209,000 for the week ending November 18th. This decline indicates a gradual slowdown in the labor market, influenced by the current higher interest rates. In addition, continuing claims decreased by 22,000 to 1.840 million for the week ending November 11. These trends point to a resilient labor market, which in turn suggests a reduced likelihood of further Fed rate hikes in the near term. The decline in both initial and continuing claims supports the view of a strong, albeit slowing, labor market.

BTC & ETH Price Analysis

BTC

Binance founder and CEO, Changpeng Zhao, has agreed to plead guilty to money laundering violations and resign from the world’s largest cryptocurrency exchange as part of an extensive settlement with U.S. law enforcement and financial regulators.

Upon the release of the news, the crypto market experienced an approximately 5% decline, with Binance witnessing an outflow of around 1 billion USD worth of crypto. This amount is relatively modest compared to the outflow seen during the FTX fallout.

Surprisingly, the market rebounded the very next day, reaching a level equivalent to that of Monday. This serves as a true testament to the strength and resilience of the current state of the crypto market.

BTC is still moving sideways at the price range of $35,500 and $38,000 throughout the week. The biggest resistance will be at $39,000. Support is at $36,250. The Bollinger Bands indicate significant volatility in Bitcoin’s price as they are widely spaced. Meanwhile, the RSI is below the average line, signaling bearish activity in the Bitcoin price despite the upward movement.

ETH

ETH has initiated a mild bullish trend, with the ETH price reaching $2087. The weekly rise now stands at 4.7%, although ETH’s trade volume has decreased by 36% during the same period, currently standing at $7.7 billion.

The Bollinger Bands indicate substantial volatility in the ETH price as they are widely spaced. Simultaneously, the RSI is below the average line, suggesting bearish activity in the ETH price despite the upward movement.

On-Chain Analysis

- 📊 Exchange: As the exchange reserve continues to fall, it indicates lower selling pressure. Net deposits on exchanges are high compared to the 7-day average. Higher deposits can be interpreted as higher selling pressure.

- 💻 Miners: Miners’ are selling holdings in a moderate range compared to its one-year average. Miner’s revenue is in a moderate range, compared to its one-year average.

- 🔗 On-Chain: More investors are selling at a profit. In the middle of a bull market, it can indicate a market top. Long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins.

- 🏦 Derivatives: Long position traders are dominant and are willing to pay short traders. Buying sentiment is dominant in the derivatives market. More buy orders are filled by takers. As open interest decreases, it indicates investors are closing futures positions and the possibility of trend reversals. In turn, this might trigger the possibility of long/short-squeeze caused by sudden price movement or vice versa.

- 🔀 Technicals: RSI indicates a neutral condition. Stochastic indicates a neutral condition where the current price is in a moderate location between the highest-lowest range of the last 2 weeks.

News About Altcoins

- BLUR Token Skyrockets 22% Following Binance Listing and Blast Protocol Optimism. The native token of non-fungible token (NFT) platform Blur, BLUR, experienced a significant 22% spike to as high as $0.64 after being listed on Binance’s Convert feature. This feature, designed to simplify transactions for Binance’s retail customers, allows for easier buying and selling of assets without the need for a traditional order book. The increase in BLUR’s value has increased interest and confidence in the NFT platform and its digital assets within the broader cryptocurrency market.

- Layer 2 Blast Successfully Gathers Over $500 Million. The recent launch of Blast, an Ethereum layer-2 network, has amassed over $535 million in total value locked (TVL), as users enthusiastically lock in funds to earn potential yields and rewards.

News from the Crypto World in the Past Week

- Bitcoin ETFs Set to Revolutionize Crypto Investing on Wall Street with $100 Billion Potential. Bitcoin ETFs on Wall Street are expected to receive approval from the U.S. Securities and Exchange Commission. This approval will significantly expand cryptocurrency investing to a wider audience, including institutional and retail investors. According to Bloomberg Intelligence, this development has the potential to grow the spot bitcoin ETF market into a $100 billion sector. The introduction of these ETFs is also expected to transform the cryptocurrency market by offering a more direct and efficient investment method compared to existing options.

- KyberSwap DEX Hit by $48 Million Hack, Attacker Signals Negotiation. KyberSwap, a decentralized exchange (DEX), has suffered a significant hack resulting in nearly $50 million in losses. The platform, which had over $80 million in total value locked (TVL) before the incident, witnessed the theft of funds primarily in Ether, wrapped ether (wETH), and USDC across various chains, including $20 million from Arbitrum, $15 million from Optimism, and $7 million from Ethereum. The attacker has indicated a willingness to negotiate, stating they will start discussions after resting, accompanied by a comment about the weather in Ontario

Cryptocurrencies Market Price Over the Past Week

Cryptocurrencies With the Best Performance

- Blur (BLUR) +97,35%

- Sei (SEI) +69,03%

- The Graph (GRT) +27,66%

- Sui (SUI) +24,98%

Cryptocurrencies With the Worst Performance

- Celestia (TIA) -19,58%

- Ordinals (ORDI) -17,99%

- THORChain (RUNE) -12,54%

- Dogecoin (DOGE) -7,50%

References

- Oliver Knight, NFT Platform Blur’s Token Jumps 22% Amid Binance Listing and Blast Optimism, Coindesk, accessed on 25 November 2023.

- Vildana Hajric, Bitcoin ETF Hype Has Wall Street Eyeing $100 Billion Crypto Potential, Bnnbloomberg, accessed on 25 November 2023.

- Andrew Hayward, Paradigm Says Ethereum Layer-2 Blast Launch ‘Crossed Lines’ as Users Lock Up $535 Million, Decrypt, accessed on 27 November 2023.

- Sam Reynolds, KyberSwap DEX Hacked for $48 Million, Attacker Teases Negotiations, Coindesk, accessed on 25 November 2023.