The crypto market euphoria surrounding the spot Ethereum ETF has dried up this week. Now, BTC and ETH are seen back to a sideways phase. BTC is below the $70,000 threshold, while ETH is below $4,000 with decreasing trading volumes.

At the start of this week, BTC and the overall crypto market are still following a sideways trend. Currently, the total crypto market capitalization remains at around $2.5 trillion.

This week, it’s crucial to watch BTC’s $69,000 level. If BTC can turn this resistance level into a support level, the trend will likely become bullish. However, if it fails to break the resistance level, BTC will continue consolidating at the current price area.

The Pintu Academy team has compiled valuable insights from several crypto projects. We analyze that information to determine its potential impact on various asset prices. Will these be bullish or bearish catalysts? Find out in the following article.

It should be noted that all information in this Market Signal is intended for educational purposes, not as financial advice. Do your own research before making any financial decisions!

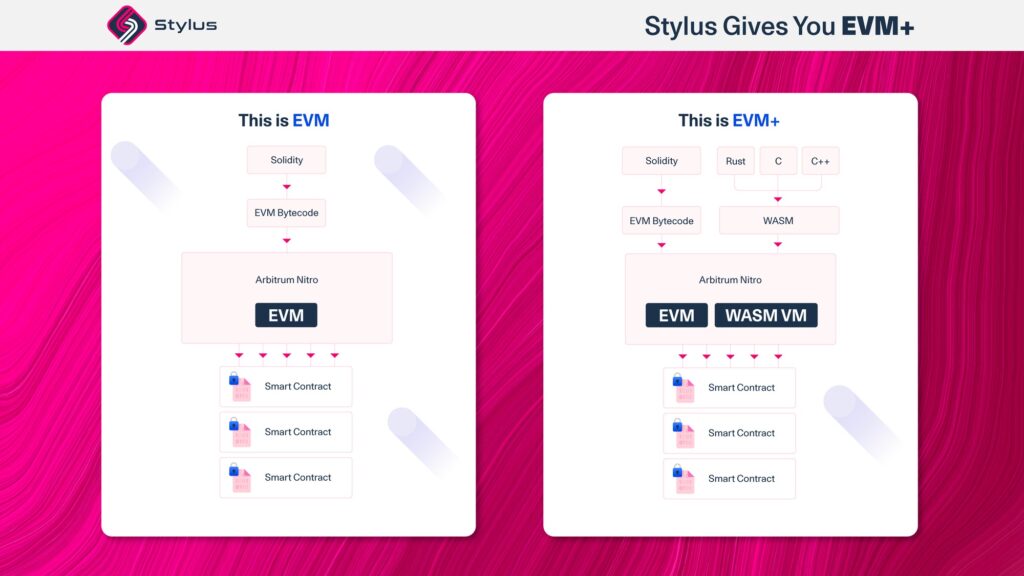

Arbitrum (ARB) ➡️ Bullish 🚀

Arbitrum just started voting on the Stylus renewal proposal on May 31, 2024, which runs until June 7, 2024. When this article was written, 98% of Arbitrum DAO members had approved the proposal.

With the Stylus upgrade, the smart contract creation process in Arbitrum will become more efficient and Multi-Virtual Machine. The development team will be able to create smart contracts using the Rust programming language, which is much more efficient than Solidity. In addition, as a multi-VM, smart contracts on Stylus become fully interoperable with EVM smart contracts.

It is reported that many developer teams have built their dApps on the Stylus testnet in recent months. If this upgrade is successfully implemented, Stylus is believed to attract many new developer teams from various alternative VM ecosystems. Furthermore, Stylus also brings new use cases that may not have been tapped in EVM-based chains.

An upgrade that improves fundamentals and expands the Arbitrum ecosystem has the potential to be a positive catalyst that can lift ARB prices in the short term. As for now, ARB is currently trading in the area of IDR 18,415.

Pendle Finance (PENDLE) ➡️ Bullish 🚀

Pendle Finance (PENDLE) is another token that could be in a bullish trend this week. One of the main driving factors is PENDLE’s success in achieving Total Value Locked (TVL) growth.

Defi Llama data shows that PENDLE’s TVL has reached a new all-time high of $6.68 billion. At the beginning of this year, it was only $295.5 million. In other words, the TVL has increased by more than 2,000% in the past five months!

The TVL represents the overall value of assets locked in a DeFi protocol. A growing TVL is a positive indicator of increasing interest and participation in the protocol.

The main factor that boosts PENDLE’s TVL is the growth of its users. Understandably, Pendle has been collaborating with other protocols such as Ether.Fi, Renzo, and most recently, Ethena. Notably, the PENDLE smart contract is in the top three holdings of eETH (LST EtherFi), ezETH (LST Renzo), and USDe (Ethena synthetic dollar). In addition, the recent ETH price increase has also helped PENDLE’s TVL.

The growth of these metrics could be a positive catalyst for PENDLE prices as they attempt to surpass their all-time high. Currently, PENDLE is at IDR 103,128, while its all-time high is IDR 113,092.

FET, AGIX, OCEAN ➡️ Uncertain⚖️

Fetch Ai (FET), SingularityNET (AGIX), and Ocean Protocol (OCEAN) will merge into one entity under the new name Artificial Superintelligence Alliance (ASI). $ASI will be the ticker representing open-source protocols focused on decentralized networks in the Artificial Intelligence (AI) industry.

On June 11, $FET token holders can swap to $ASI via a token migration contract. Meanwhile, the swap of AGIX and OCEAN tokens can only be done on June 13, simultaneously with the completion of the merger process.

FET holders will receive 1 ASI token for every 1 FET token. Meanwhile, AGIX owners will get 0.433350 ASI tokens for every 1 AGIX token. Then OCEAN owners will get 0.433226 ASI tokens for every 1 OCEAN token.

With the execution approaching, it is difficult to see its impact on price movements. Moreover, there has never been a merger process involving three protocols in the crypto industry.

Selling pressure can trigger a correction if the merger moment is used to “sell the news” event. However, if the merger triggers buying due to ASI’s potential as a new giant in the AI sector, the price of ASI tokens may skyrocket. Therefore, all three token prices are categorized as uncertain in the short term.

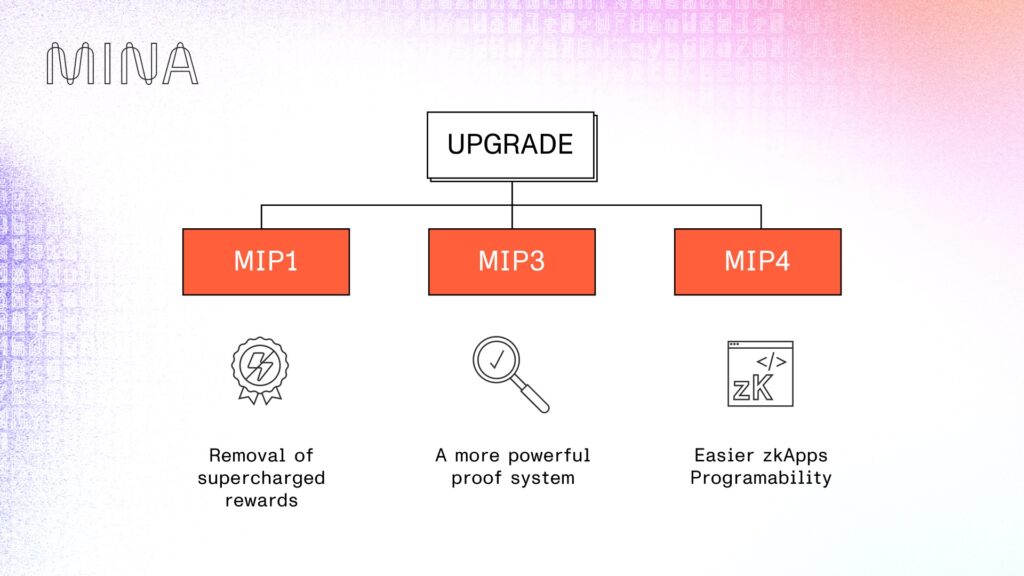

Mina Protocol (MINA) ➡️ Uncertain⚖️

The next token in the watchlist is the Mina Protocol (MINA). On June 4, it is scheduled to launch the Berkeley upgrade. This major upgrade allows MINA to create Zero Knowledge (ZK) based smart contracts. With ZK technology, MINA will also support zkApps, Layer-2 solutions, and bridges after the upgrade.

Another important feature introduced by MINA in the Berkeley upgrade is Kimchi, a proof system mechanism that improves security and supports new program additions.

However, the scenario for MINA is not very different from that of FETCH. If the Berkeley update is followed by “sell the news,” increased selling pressure will trigger a correction. However, it is possible that this update will bolster MINA’s fundamentals and could boost its prospects.

Currently, the MINA token is trading at IDR 14,025. It has gained 20.42% from its lowest level of IDR 11,646 on May 17, 2024.

Crypto Performance Over the Past Week

Here are the best and worst performing cryptos on Pintu:

Cryptocurrencies With the Best Performance

- My Neighbor Alice (ALICE): 🔼97,90% (Rp 41,298)

- Entangle (NGL): 🔼78,85% (Rp 13.357)

- Foxy (FOXY): 🔼68,60% (Rp 390)

Cryptocurrencies With the Worst Performance

- OMG Network (OMG): 🔽30,76% (Rp 8.198)

- Waves (WAVES): 🔽29,79% (Rp 27.616)

- SubQuery Network (SQT): 🔽25,06% (Rp 280)

Last Week’s Crypto News

Here are some important cryptocurrency news from last week: