Sui’s layer 1 project is going through testing phases on its network. Although it started around the same time as Aptos (a crypto project also from the ex-Diem team), Sui is spending more time on testing and technology development. Sui has just released a permanent testnet that will be the primary testing ground for all aspects of the network. With the clock ticking towards mainnet, many are starting to speculate about Sui. So, what are the tokenomics of SUI? Can SUI be a good investment asset? We will discuss everything below.

Article Summary

- 🌊 Sui is a layer-1 permissionless blockchain created by a team of ex-Meta developers. One of the unique characteristics of Sui is the object-centric processing model that allows parallel transactions.

- ⚙️ SUI is the native asset of the Sui network and has four primary functions: as staking assets, as currency to pay gas fees, as liquid assets in applications, and as a vote in on-chain governance.

- 📱 Currently, DeFi applications dominate the list of applications being built on Sui. In addition, NFT projects and marketplaces have managed to attract the attention of various crypto communities.

- 🧠 The conversation around SUI as an investment asset is purely speculative. Currently, the discussion around Sui is dominated by its potential airdrop. When SUI launches, it will likely be influenced by the general condition of the crypto market and whether or not Sui can get the attention of the crypto community.

Overview of Sui

Sui is a layer-1 permissionless blockchain created by a team of ex-Meta developers. Sui blockchain has smart contract capabilities and is designed to be a platform that can fulfill various needs in one ecosystem. One of the unique characteristics of Sui is the object-centric processing model that allows Sui to process transactions in parallel. This transaction model makes Sui very different from other blockchains.

On March 29, 2023, Sui announced the launch of a permanent testnet. Like the Goeli testnet on Ethereum, this network will be used by Sui’s development team for various technical tests before and after mainnet. In addition, developers on Sui can also use this testnet to evaluate the network and test their application.

This testnet will likely be the last stage before the launch of the main Sui network which will also be done in stages.

This article is the second part about the Sui project, Read the first part of the article in Pintu Academy that explains how Sui works and the advantages of Sui.

Sui Tokenomics

SUI is the native asset on the Sui network. Currently, there is no information about the allocation and distribution of SUI coins. Details on this are likely to be shared closer to the launch of the mainnet. However, the maximum supply amount of SUI is 10 billion SUI. The SUI Whitepaper states that the supply of SUI is constant with no burning mechanism (unless changed through on-chain governance).

According to the Sui document, SUI has four primary functions:

- As a staking asset so users can participate in securing the PoS network.

- SUI is an asset required to pay gas fees for data storage and execute transactions on the Sui platform.

- SUI is a liquid asset for various applications as it can fulfill the standard functions of money (unit of account, medium of exchange, and store of value).

- The asset plays an important role as votes in on-chain governance.

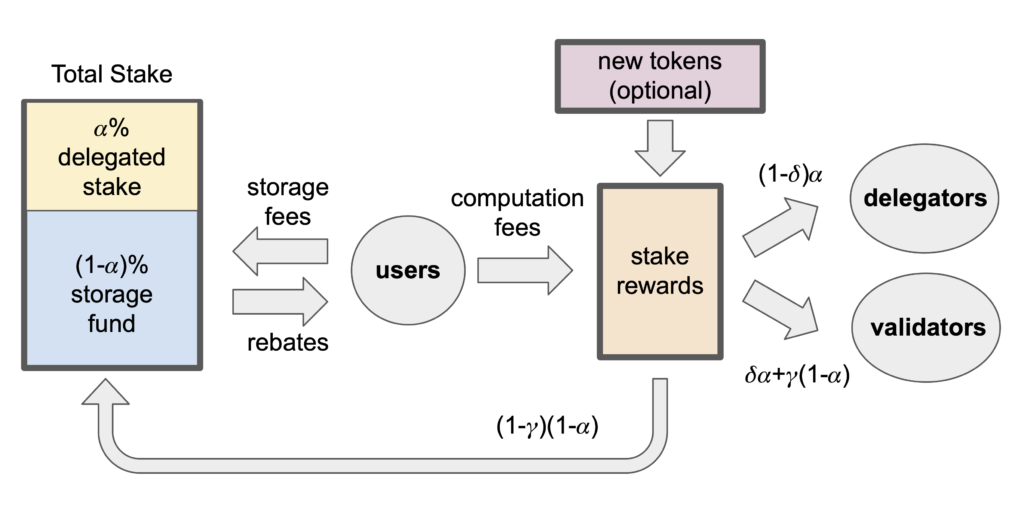

One of the unique mechanisms related to incentivizing validators is the fee for data storage. When you pay a transaction fee using SUI, the fee is split between executing the transaction and storing the transaction data on the Sui network.

This data storage fee is collected into the storage fund as part of the staking rewards for validators in the next epoch. So, transaction fees from previous users are used to pay validators who process subsequent transactions. Why? As data storage on the network increase, the burden on validators will scale linearly. The network creates this system so validators have a sustainable business model.

Sui Ecosystem

Currently, DeFi applications dominate the list of application types being built in Sui. MovEX, Ocean DEX, Araya Finance, and Suiswap are some of the DEX applications in Sui. MovEX is unique in that it also collaborates with the Sui Foundation to build liquidity protocols for various DeFi applications in Sui. Additionally, MovEX has a decentralized order book and implements various features from Uniswap V3 such as Concentrated Liquidity AMM.

In addition, some DEX applications such as Palladium also support Aptos. Several DeFi applications are designed to integrate with move-based blockchains (currently Aptos and Sui).

Several digital wallets have also been integrated into Sui. Currently, you can only use devnet and testnet using a special SUI token. Suiet and Sui Wallet are the two most popular digital wallets at the moment. You can try using both wallets to interact with some applications such as NFT marketplace and DEX.

Finally, one of the fastest-growing sectors in Sui is the NFT ecosystem. One of Sui’s most popular digital marketplaces is BlueMove, created for Aptos and Sui. Currently, several NFT projects in Sui have managed to gain attention from the NFT community. Some of these projects include Sui G00dies, SNSstork, SuiGatorz, and Funnybuns.

SUI as an Investment Asset

Currently, the conversation about SUI as an investment asset is purely speculative. Discussions about Sui are all based on the potential that Sui can achieve through its technological advantages. However, Sui’s technological advantages have no influence on the price movements of its asset. How investors view Sui’s asset price will depend on whether or not Sui can attract the attention of the crypto community. In addition, Sui needs to have one application that successfully attracts many users.

If we want to look at Sui’s potential as an investment asset, we can compare it to two recent crypto projects, Aptos and Arbitrum. Both managed to gain the crypto community’s attention at the time of their token launch. However, Aptos’ APT lost momentum due to the FTX incident in November 2022. It has recovered and has risen by more than 200%. So, the price movement of SUI at launch will largely depend on the state of the crypto market and whether we’ve entered a bull market or not.

With the crypto market on the mend, it is not unlikely that Sui managed to take center stage in the crypto community at its launch. Following ARB and APT’s airdrops, many people on Twitter are now looking for ways to get SUI airdrops. Airdrops like this are usually given to community members who actively use the network and various applications on it. This can positively bring many new users to Sui.

You can read the article about airdrop on Pintu Academy to find out how to participate!

Conclusion

Sui is a layer 1 blockchain that has unique and cutting-edge technology. SUI assets themselves have various functions that make them an important part of the Sui ecosystem. One of the unique features of SUI’s tokenomics design is the data storage fees collected by the network. These data storage funds are then used to pay validators who process subsequent transactions. This is done because the burden borne by validators will increase in line with the size of the on-chain data. The Sui ecosystem is currently dominated by DeFi applications as well as the NFT platform.

As an investment asset, the potential of SUI is still difficult to predict. SUI’s price movement at launch depends on several things such as crypto market conditions, Sui’s popularity, and also whether or not Sui can attract many new users.

How to Buy SUI at Pintu

Sui has yet to unveil the details regarding the launch of the SUI coin. However, you can invest in other cryptocurrencies such as BTC, BNB, ETH, and others through Pintu safely and easily. The Pintu app is compatible with various popular digital wallets like Metamask to make your transactions easier.

Download the Pintu cryptocurrency app on the Play Store and App Store now!

Aside from transactions, you can also learn crypto through various Pintu Academy articles updated weekly! All Pintu Academy articles are for educational purposes and not financial advice.

References

- Testnet Wave 2 Recap – The Tokenomics Suinami, accessed on 3 April 2023.

- Learning Sui Tokenomics | Sui Docs, accessed on 3 April 2023.

- Sui’s Storage Fund | Sui Docs, accessed on 3 April 2023.

- Sui Station (@Sui_Station), Twitter, accessed on 4 April 2023.

- MovEx : First DEX on Sui, accessed on 4 April 2023.