As a pioneer in cryptocurrency, Bitcoin was designed to prioritize the security of digital asset transfers, in this case Bitcoin (BTC) as a currency. This makes the Bitcoin blockchain not flexible enough to be developed further. Unlike Bitcoin, Ethereum comes with smart contract technology that allows anyone to create applications freely on its blockchain, with ether (ETH) used to pay gas fees. This is what makes many people argue that ETH’s market capitalization will soon surpass BTC’s. This theory is also known as the “Flippening”. So what is Flippening? Let’s find out more in this article.

Article Summary

- 🔠Flippening is the potential shift in market capitalization dominance from Bitcoin to Ethereum, which has been the second largest cryptocurrency based on market capitalization for years.

- 📊 Ethereum has surpassed Bitcoin in several key metrics, such as daily transaction volume. Several successful projects launched on the Ethereum network have contributed significantly to the growth of the number of transactions and transaction volume.

- 🔎 ETH transactions in 2022 were 338% higher than BTC. The number of ETH transactions in 2022 was 408.5 million, while BTC was 93.1 million.

What is Flippening?

Flippening is a term used to describe the potential shift in market capitalization dominance from Bitcoin to Ethereum. Ethereum has been the second largest cryptocurrency based on market capitalization for years, and its market capitalization continues to increase.

The term “flippening” was first used in 2017, when the Ethereum market capitalization grew significantly and almost surpassed the Bitcoin market capitalization with ETH dominance reaching 25.32%. This happened when many altcoins were created using the Ethereum protocol and offered Initial Coin Offerings (ICO). However, with improvements like Taproot upgrade and Bitcoin halving, the Bitcoin market capitalization continues to increase and is still above Ethereum to this day.

Driven by macroeconomic factors and various events such as the collapse of Terra Luna and FTX, Ethereum’s dominance continues to decline. Currently, as of March 2023, Bitcoin has the largest market capitalization among all crypto assets, with $552 billion USD. Meanwhile, Ethereum is in second place with a market capitalization of around $234 billion USD.

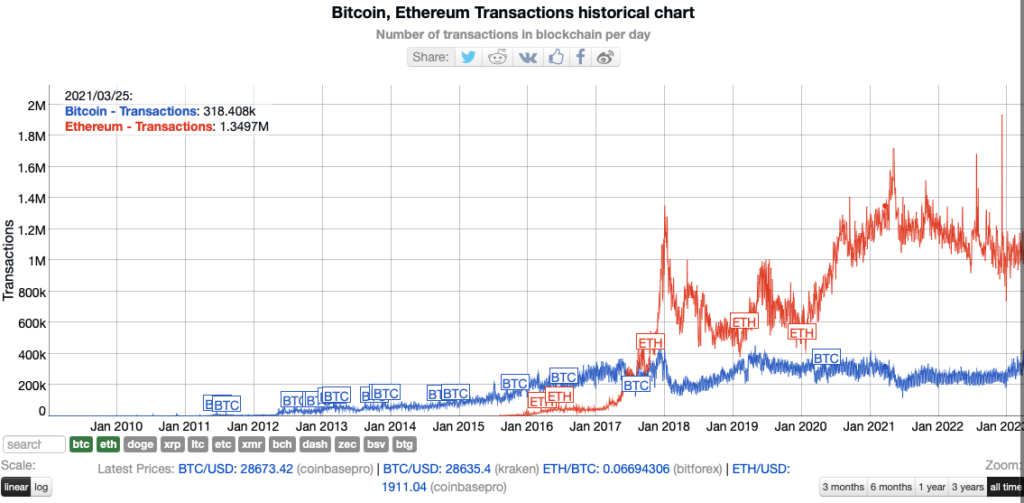

However, there are several metrics that make many people argue that the flippening will occur. One reason behind this argument is the number of ETH transactions that has far surpassed BTC since 2017, as seen in the chart below.

According to data from Nasdaq and Ycharts shared on Reddit on January 2, 2023, ETH transactions in 2022 were 338% higher than BTC. The number of ETH transactions in 2022 was 408.5 million, while BTC was 93.1 million, with an average daily transaction of about 1.1 million for ETH and 255,000 for BTC.

The large number of ETH transactions proves the high utility of the Ethereum blockchain compared to Bitcoin. What makes the number of transactions on Ethereum continue to increase? We will discuss this further below.

Why is Ethereum gained traction?

As previously explained, Ethereum has become one of the most popular cryptocurrencies in the world and consistently ranks second to Bitcoin in terms of market capitalization. Here are some factors that contribute to Ethereum’s consistent adoption and growth:

- Utility: Ethereum offers a much wider range of utility compared to Bitcoin. Its smart contract technology enables the building of various decentralized applications (dApps), ranging from decentralized finance (DeFi), decentralized exchanges (DEX) to various NFT projects. These various utilities attract many users and investors, making it the second largest cryptocurrency asset by market capitalization after Bitcoin.

- Scalability and Ethereum blockchain upgrades: The success of The Merge Ethereum, as well as the upcoming Shapella Upgrade, supported by the growth of DeFi and NFT ecosystems on the Ethereum network, can lead to increased adoption of Ethereum, which in turn can increase market capitalization.

- Developer community: Ethereum has a large and active developer community, which contributes to the growth and improvement of its ecosystem. The increasing number of projects built on Ethereum can cause demand for ETH to increase and ultimately increase its market capitalization.

- Institutional interest: Institutional investors have shown increasing interest in crypto technology other than Bitcoin, with Ethereum often being the choice. JPMorgan has invested in ConsenSys, a blockchain software company focused on Ethereum. Microsoft has worked on several blockchain initiatives, including the use of Ethereum-based smart contracts on its Azure cloud platform. Meanwhile, Intel has explored the use of Ethereum for various applications, including supply chain management and decentralized identity systems. As more institutions adopt Ethereum technology, its market capitalization can continue to increase.

What Metrics are Used to Measure Flippening?

As seen above, as of March 2023, Bitcoin still has the largest market capitalization among all cryptocurrencies, with Ethereum as the second largest cryptocurrency. However, Ethereum’s market capitalization has been consistently increasing over the years and has surpassed Bitcoin in several key metrics, such as daily transaction volume and transaction fees. Below are some metrics used as measures of flippening as quoted from blockchaincenter.net.

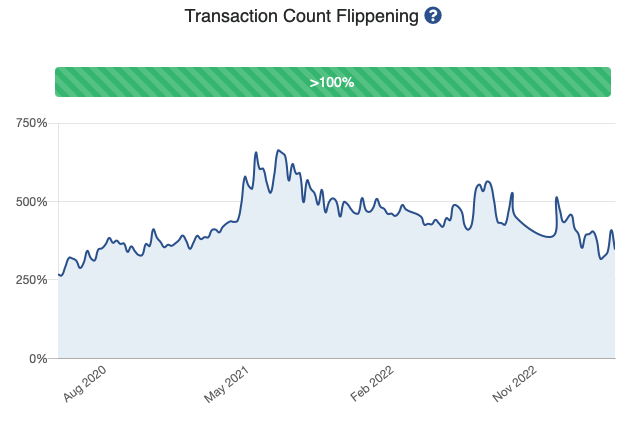

1. Transaction Count ✅

Transaction count is the total on-chain transactions that occur on the network. As previously mentioned, Ethereum has 100% surpassed Bitcoin in terms of transaction count, with an average daily transaction of around 1.1 million for ETH and 255,000 for BTC.

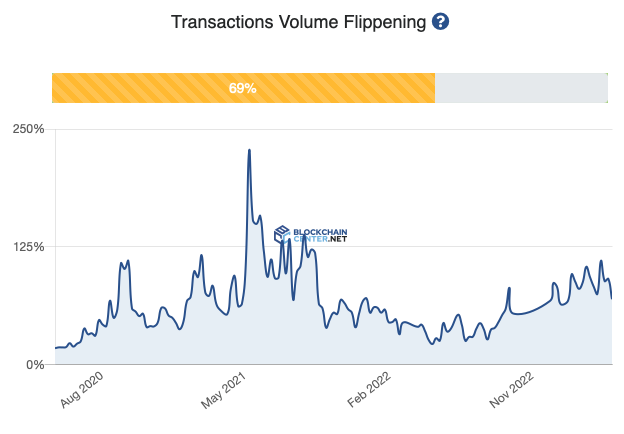

2. Transactions Volume ❌

Transaction volume essentially counts the total USD sent through the network. In this case, Ethereum is still far below Bitcoin.

However, it should be noted that this metric only compares ETH and BTC. If the number is combined with the number of token transfers on the Ethereum blockchain and also stablecoins, then Ethereum is far above Bitcoin in terms of transaction volume.

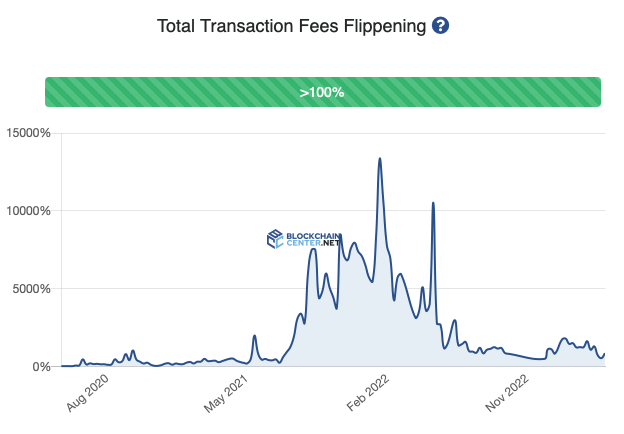

4. Transaction Fees ✅

Transaction fees are the total cost paid to make a transaction on the network calculated in US dollars. (100% means Ethereum has surpassed Bitcoin in this metric)

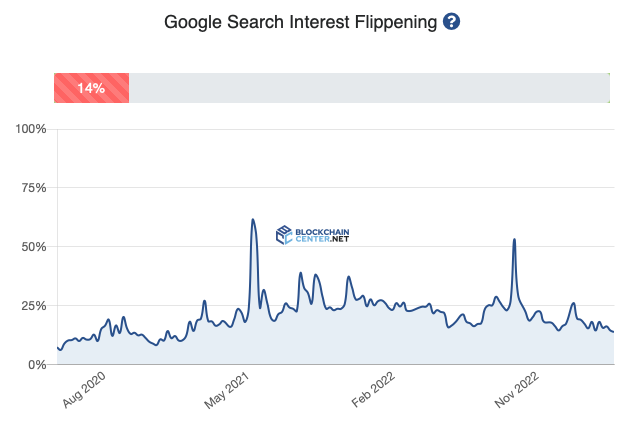

5. Google Search Interest ❌

This metric measures how much interest there is in Bitcoin and Ethereum based on the number of searches on Google. To date, Bitcoin remains the most searched cryptocurrency.

According to the newsletter “In Bitcoin We Trust:”BTC still records the most searched keyword in 2022 with 28.4 million searches per month on Google. Meanwhile, Ethereum is in fourth place with 3.8 million searches per month, after Shiba Inu and Dogecoin.

Will Flippening Happen?

Ethereum maxis are optimistic about the “Flippening” – Ethereum overtaking Bitcoin in market capitalization. They believe Ethereum’s utility, triple halving, and adherence to ESG guidelines make it a strong investment choice for institutions. Regardless of the outcome, Bitcoin’s security and decentralization are likely to ensure that it remains a major asset in the crypto landscape.

In the end, Ethereum and Bitcoin have fundamentally different goals. Ethereum aims to be a network that supports a wide range of tokens and applications beyond just currency. Its smart contract technology enables the creation of decentralized applications for DeFi, DEXs, and NFTs, among other use cases, making it a more versatile platform than Bitcoin.

On the other hand, Bitcoin’s key feature is its capped supply of 21 million coins, which makes it a reliable store of value and a hedge against inflation. While it can also be used as a medium of exchange, Bitcoin’s primary objective is to maintain its scarcity and value over time.

Given their divergent objectives, there is little reason to compare Bitcoin and Ethereum as direct competitors. Instead, they occupy different niches within the broader cryptocurrency ecosystem, with Bitcoin serving as a digital gold and Ethereum as a decentralized platform for innovation and experimentation.

References

- Ryan Watkins, The Flippening of ETH: The Rise of Stablecoins on Ethereum, Messari, accessed on March 29, 2023

- The Flippening (Ethereum vs. Bitcoin), accessed on March 29, 2023

- Will Ethereum ever surpass Bitcoin? Crypto community answers , Cointelegraph, accessed on March 29, 2023

- Martin Young, Ethereum transactions 338% higher in 2022 but Bitcoin remains most popular, Cointelegraph, accessed on March 29, 2023

- Kunal Goel, State of Ethereum Q4 2022, Messari, accessed on April 5, 2023

- Ben Strack, Ethereum Now Deflationary for 2 Months Straight, Blockworks, accessed on April 5, 2023