The Bitcoin Halving is the biggest and most anticipated event in crypto. This once-every-four-years event is part of the system Satoshi Nakamoto designed for Bitcoin. Now, the Bitcoin Halving is the biggest catalyst that triggers significant price appreciation for all crypto assets. So, how does the halving affect the price movement of BTC and altcoins? What happened before and after the halving? This article will discuss the movement of BTC and altcoins at the time of halving.

Article Summary

- ⛏️ Bitcoin halving is a cut in rewards for Bitcoin miners that occurs once every four years to limit the supply of BTC.

- 📈 Historically, halvings have always been a positive catalyst for Bitcoin price, but are followed by a short-term correction pattern before and after the event.

- ⚖️ Bitcoin’s post-halving historical price movement suggests two possible scenarios: a major correction before an uptrend like in 2016, or a consolidation/sideways before a parabolic move similar to 2020.

- ⚠️ The altcoin market also performed well after the Bitcoin halving. However, altcoins performed worse than Bitcoin during the halving correction, with drawdowns that can reach 30-50% in a short period.

What is Bitcoin Halving?

Bitcoin halving is the cutting of BTC block rewards for Bitcoin miners by half. Currently, the BTC reward for miners is 6.25 BTC. The reward will be cut to 3.125 BTC in the April 2024 halving. Halving events occur every 210,000 blocks or around every four years.

Historically, Bitcoin halving has always been a positive catalyst for the price of BTC. A parabolic move of Bitcoin always occurs after a halving. So far, the halving has occurred three times since 2009 and the last one occurred on May 11, 2020. The 2024 Bitcoin halving will occur around April 19, 2024. You can track the Bitcoin halving countdown on this website.

Why is Halving Always a Big Catalyst for Bitcoin?

Halving aims to limit supply and slow down the speed at which new Bitcoins enter the market (thus reducing the inflation of BTC). Satoshi Nakamoto designed BTC as a scarce currency with an ever-decreasing inflation rate. In the next halving, BTC entering the market will decrease from 900 to 450 BTC per day.

Following the principles of economics, the scarcer an item, the more valuable it becomes, especially if the demand remains high. This concept of scarcity is one of the reasons Satoshi implemented halving. In addition, BTC is in a crucial position as ETFs unlock massive demand on the part of institutional investors.

Right now (April 14), we have 5 days before the next halving. As in the image above, Bitcoin has been in an uptrend since the ETF announcement in January 2024. However, the past few days show a possible market structure break because of its significant correction. Just a few days before halving, Bitcoin corrects around 15% from its ATH.

Bitcoin Price Movement Towards Halving

Bitcoin price movement after halving (red zone on the left). Source: @rektcapital.

The Bitcoin halving has always been seen as the most bullish event in crypto that impacted the entire industry. The halving created the 4-year cycle we now know. On the other hand, history shows that halving has also been a sell-the-news event in the short term. In 2016 and 2020, Bitcoin corrected about a month before the halving.

As in the chart (from @rektcapital), BTC corrected by about -20% in the 2020 halving and -40% in 2016. BTC is currently experiencing a 15% correction (April 14) from the highest price after reversing from a -20% correction on April 13, 2024.

With the halving just 5 days away, are we in for a short correction like in 2020 or a deeper and longer correction like in 2016? The interim situation suggests the BTC correction is more similar to the conditions before the 2020 halving. Moreover, the flow of funds from BTC ETFs should create a more stable buying demand for BTC.

Post Halving Price Movement of BTC

The price movements of BTC in the 2016 and 2020 halvings paint a picture of two possible scenarios. In 2016, BTC experienced a deep correction of up to -30% which occurred a month after the halving. However, after that Bitcoin experienced a significant parabolic movement from $600 to $20,000 by the end of 2017. The BTC halving in 2020 told a different story as BTC went sideways for 2.5 months before starting its parabolic movement in 2021.

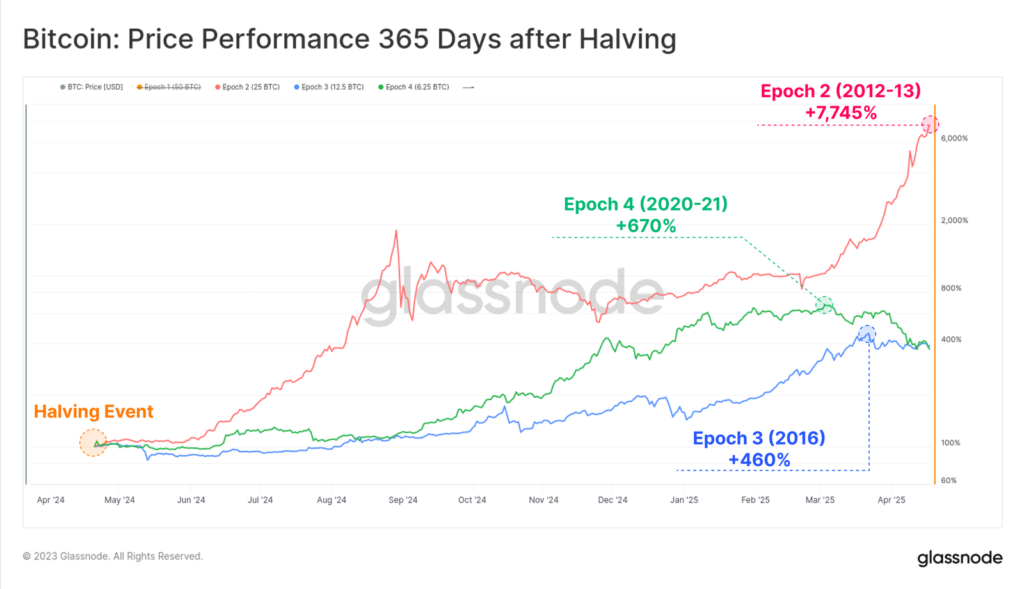

As in the image above, Bitcoin’s biggest gains occurred post-halving. The average timeframe for Bitcoin to reach a bull market cycle high is 1.5 years. The image above also shows that any post-halving correction is temporary and a buy-the-dip strategy seems ideal before 2025.

Therefore, 2025 is crucial. Many analysts such as @rektcapital argue that this bull market cycle will be shorter than the previous one and the peak price of BTC will be reached in under 1 year after the halving.

Altcoin Market Movement Post Halving

Like Bitcoin, the altcoin market also experienced its best price performance after halving. Altseason occurred while Bitcoin was experiencing a correction amidst parabolic price movements.

In 2020, the altcoin market immediately experienced a significant price increase since the halving and did not stop until BTC stagnated at its peak. This situation is different from 2016 when the altcoin market experienced accumulation and moved sideways for several months.

Then, what about 2024? We can look at Bitcoin’s movement as a reference. Currently (April 14), the movements and corrections experienced by BTC are very similar to 2020. Furthermore, BTC has already broken the previous ATH ($69,000) which shows that the bull market cycle has started. So, in theory, the movement of altcoins will be more similar to what happened in 2020.

You should note that the altcoin market correction will always be sharper than BTC. Over the past week (April 7-14, 2024), Bitcoin experienced a correction of about 10% but many altcoins fell by 30-50%. Some altcoins like AVAX, APT, and INJ are already below their January 2024 prices.

Conclusion

The Bitcoin Halving event was a huge catalyst for the crypto market as a whole. Halving aims to reduce supply and slow down the rate at which new Bitcoins enter the market, in line with the concept of scarcity. While a parabolic move has historically followed the halving, there has been a pattern of short-term corrections before and after the event. Previous post-halving price movements have shown two different scenarios. In 2016, there was a correction before a significant increase while 2020 saw a period of consolidation before starting a price surge. Meanwhile, altcoins will experience a sharper correction than BTC but experience significant price appreciation after halving.

References

- Marcin Miłosierny, “Introduction to Bitcoin Halving for Directional Traders”, Glassnode, accessed on 2 April 2024.

- @rektcapital, “#BTC 4 Phases of The Bitcoin Halving 1. Pre-Halving Rally Approximately 30 days remain until the Bitcoin Halving in April 2024”, X, accessed on 3 April 2024.

- @rektcapital, “#BTC The Bitcoin Pre-Halving Retrace Bitcoin is officially in the “Danger Zone” (orange) where historical Pre-Halving Retraces”, X, accessed on 3 April 2024.

- @cryptogirlnova, “1/18 What happens to altcoins after the Bitcoin halving takes place? A thread”, X, accessed on 4 April 2024.